All Blog Posts

March 5, 2026

The infrastructure risk behind stablecoin adoption

Read Article

Read Article

March 5, 2026

The infrastructure risk behind stablecoin adoption

Read Article

Read Article

March 2, 2026

How Shift Protocol uses Rhino.fi to enable cross chain perpetual strategies

Read Article

Read Article

March 2, 2026

How Shift Protocol uses Rhino.fi to enable cross chain perpetual strategies

Read Article

Read Article

February 27, 2026

Zabio integrates Rhino.fi to power real-world stablecoin payments in Latin America

Read Article

Read Article

February 27, 2026

Zabio integrates Rhino.fi to power real-world stablecoin payments in Latin America

Read Article

Read Article

January 29, 2026

Polar integrates Rhino.fi to power seamless cross-chain onboarding and payments

Read Article

Read Article

January 29, 2026

Polar integrates Rhino.fi to power seamless cross-chain onboarding and payments

Read Article

Read Article

January 27, 2026

How CPAY built flexible crypto wallet infrastructure with Rhino.fi

Read Article

Read Article

January 27, 2026

How CPAY built flexible crypto wallet infrastructure with Rhino.fi

Read Article

Read Article

January 19, 2026

Scaling stablecoin payment routes with confidence: Reveel x Rhino.fi

Read Article

Read Article

January 19, 2026

Scaling stablecoin payment routes with confidence: Reveel x Rhino.fi

Read Article

Read Article

December 30, 2025

Synthesis launches a new prediction market terminal with seamless onboarding powered by Rhino.fi Smart Deposit Addresses

Read Article

Read Article

December 30, 2025

Synthesis launches a new prediction market terminal with seamless onboarding powered by Rhino.fi Smart Deposit Addresses

Read Article

Read Article

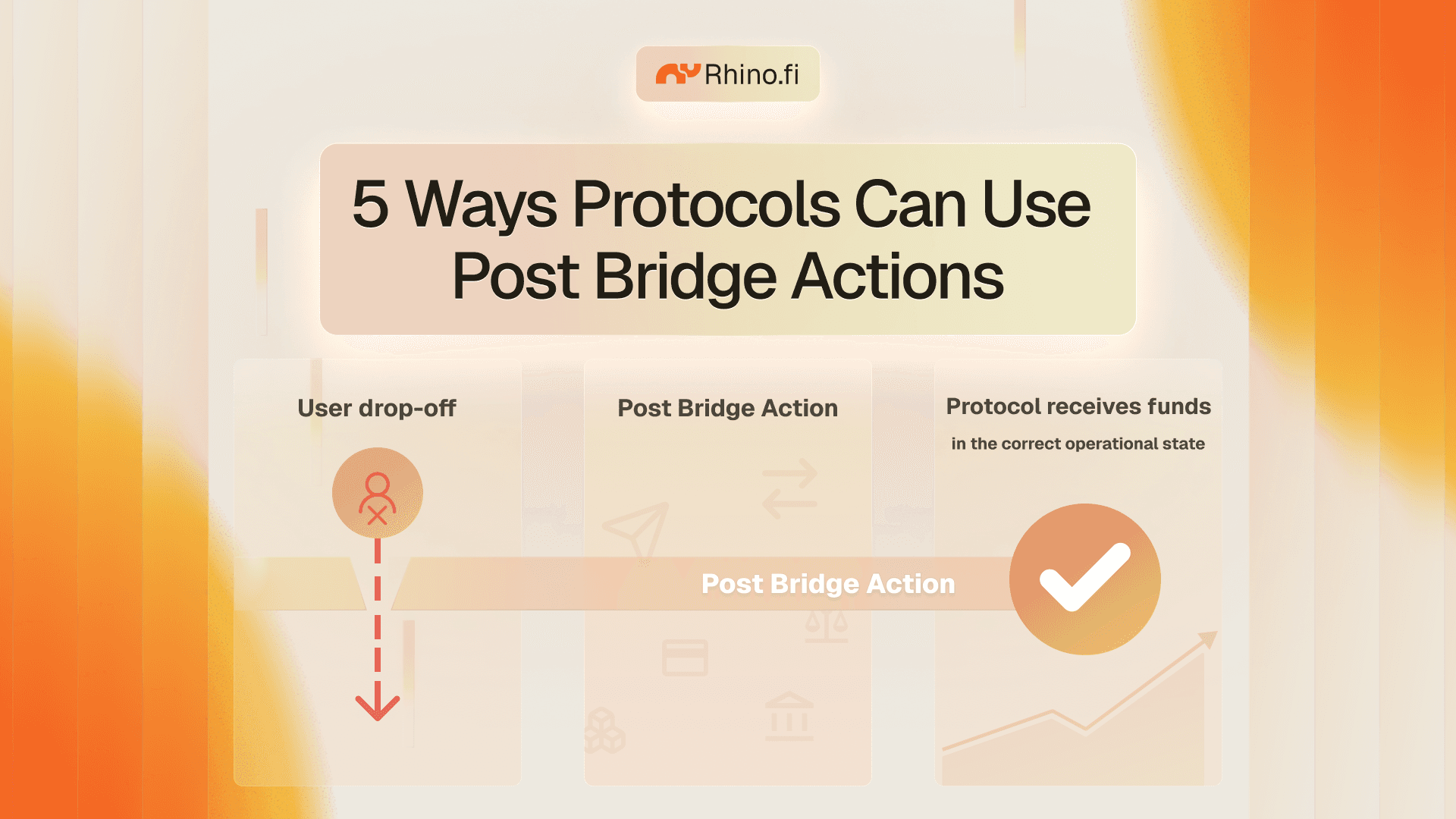

December 12, 2025

5 Ways Protocols Can Use Post Bridge Actions

Read Article

Read Article

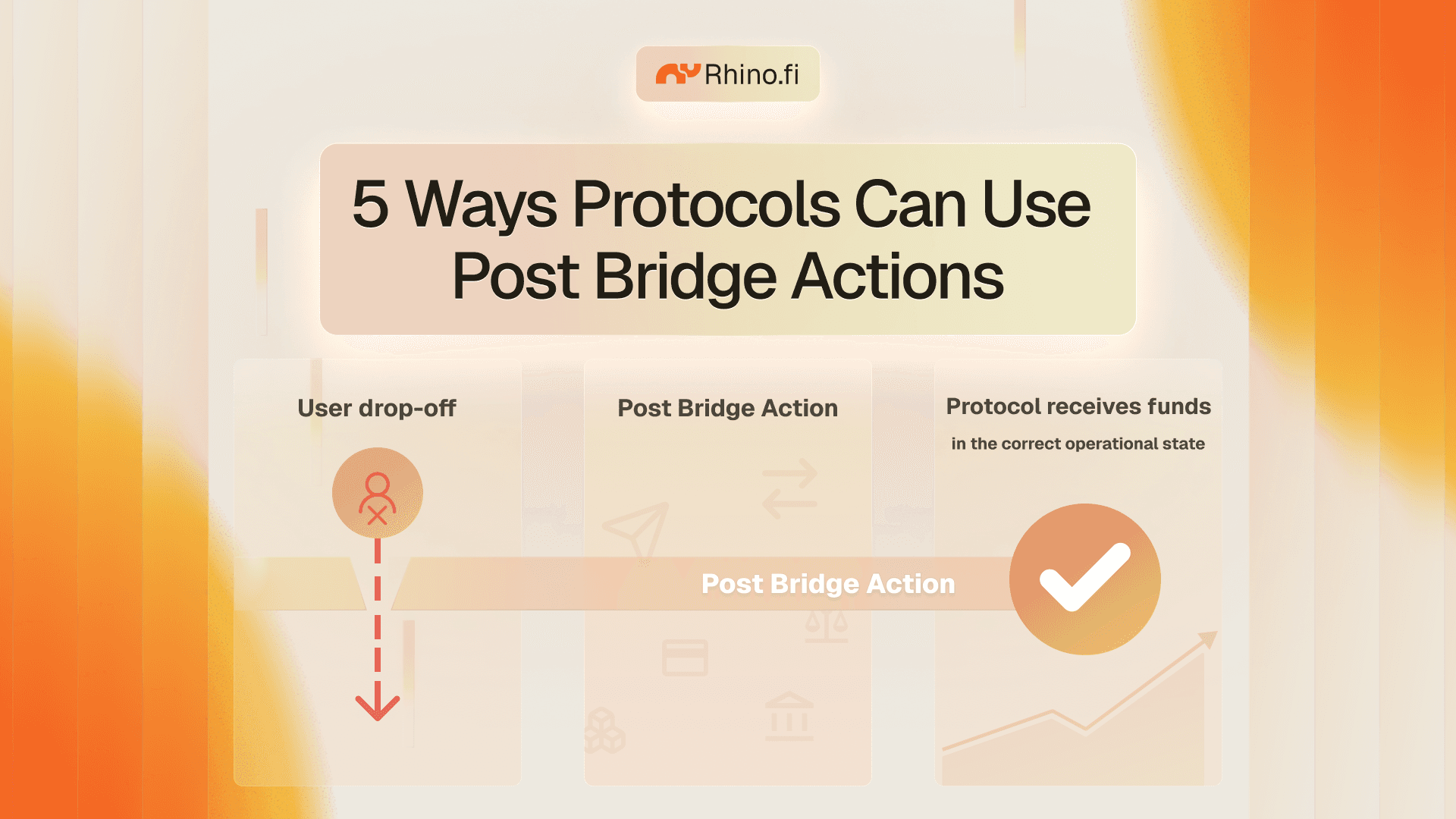

December 12, 2025

5 Ways Protocols Can Use Post Bridge Actions

Read Article

Read Article

December 10, 2025

Wirex Partners with Rhino.fi to Deliver Multichain Stablecoin Orchestration Across 20+ Networks with Guaranteed 1:1 Fiat Parity

Read Article

Read Article

December 10, 2025

Wirex Partners with Rhino.fi to Deliver Multichain Stablecoin Orchestration Across 20+ Networks with Guaranteed 1:1 Fiat Parity

Read Article

Read Article

December 1, 2025

It's Finally Happening: The Great Migration to Digital Money

Read Article

Read Article

December 1, 2025

It's Finally Happening: The Great Migration to Digital Money

Read Article

Read Article

December 1, 2025

What are Post Bridge Actions and How Do They Work?

Read Article

Read Article

December 1, 2025

What are Post Bridge Actions and How Do They Work?

Read Article

Read Article

November 28, 2025

Case Study: How Blockradar is scaling stablecoin deposits with Rhino.fi

Read Article

Read Article

November 28, 2025

Case Study: How Blockradar is scaling stablecoin deposits with Rhino.fi

Read Article

Read Article

November 25, 2025

Introducing Post Bridge Actions

Read Article

Read Article

November 25, 2025

Introducing Post Bridge Actions

Read Article

Read Article

November 18, 2025

Single-Click Onboarding at Scale: The Extended Case Study

Read Article

Read Article

November 18, 2025

Single-Click Onboarding at Scale: The Extended Case Study

Read Article

Read Article

November 4, 2025

Smart Deposit Addresses now support deposits from Solana

Read Article

Read Article

November 4, 2025

Smart Deposit Addresses now support deposits from Solana

Read Article

Read Article

October 21, 2025

Smart Deposit Addresses now support 0 zero slippage stablecoin swaps

Read Article

Read Article

October 21, 2025

Smart Deposit Addresses now support 0 zero slippage stablecoin swaps

Read Article

Read Article

October 10, 2025

Monetic x Rhino.fi: powering instant bankless payments across borders

Read Article

Read Article

October 10, 2025

Monetic x Rhino.fi: powering instant bankless payments across borders

Read Article

Read Article

October 2, 2025

BTCfi is live on Starknet: Unlock BTC yield with Rhino.fi

Read Article

Read Article

October 2, 2025

BTCfi is live on Starknet: Unlock BTC yield with Rhino.fi

Read Article

Read Article

September 25, 2025

Plasma, the first stablecoin native chain, is live, and Rhino.fi powers day one access

Read Article

Read Article

September 25, 2025

Plasma, the first stablecoin native chain, is live, and Rhino.fi powers day one access

Read Article

Read Article

September 22, 2025

5 Ways to Use Smart Deposit Addresses

Read Article

Read Article

September 22, 2025

5 Ways to Use Smart Deposit Addresses

Read Article

Read Article

August 22, 2025

Bridge as a Service

Read Article

Read Article

August 22, 2025

Bridge as a Service

Read Article

Read Article

August 18, 2025

Choosing the Right Cross-Chain Bridge: Canonical, Messaging, or Liquidity/Intent?

Read Article

Read Article

August 18, 2025

Choosing the Right Cross-Chain Bridge: Canonical, Messaging, or Liquidity/Intent?

Read Article

Read Article

August 8, 2025

Smart Deposit Addresses: Accept stablecoins from any chain, no wallet connection required

Read Article

Read Article

August 8, 2025

Smart Deposit Addresses: Accept stablecoins from any chain, no wallet connection required

Read Article

Read Article

July 28, 2025

Bridge to Morph with Rhino.fi

Read Article

Read Article

July 28, 2025

Bridge to Morph with Rhino.fi

Read Article

Read Article

June 30, 2025

Introducing Katana: The Yield-Focused L2 on Polygon

Read Article

Read Article

June 30, 2025

Introducing Katana: The Yield-Focused L2 on Polygon

Read Article

Read Article

June 26, 2025

Introducing Rhino.fi 2025: Unifying Stablecoin Liquidity

Read Article

Read Article

June 26, 2025

Introducing Rhino.fi 2025: Unifying Stablecoin Liquidity

Read Article

Read Article

June 19, 2025

GRVT integrates with rhino.fi to unlock seamless multichain onboarding

Read Article

Read Article

June 19, 2025

GRVT integrates with rhino.fi to unlock seamless multichain onboarding

Read Article

Read Article

June 5, 2025

Bridge to Plume – Fee Free for One Week

Read Article

Read Article

June 5, 2025

Bridge to Plume – Fee Free for One Week

Read Article

Read Article

May 1, 2025

Go anywhere in DeFi in one click

Read Article

Read Article

May 1, 2025

Go anywhere in DeFi in one click

Read Article

Read Article

April 25, 2025

Unlock the Full Potential of Paradex: Everything You Need to Know About Vaults

Read Article

Read Article

April 25, 2025

Unlock the Full Potential of Paradex: Everything You Need to Know About Vaults

Read Article

Read Article

April 25, 2025

How Paradex Enabled Seamless Crosschain Access With a Custom Bridge by Rhino.fi

Read Article

Read Article

April 25, 2025

How Paradex Enabled Seamless Crosschain Access With a Custom Bridge by Rhino.fi

Read Article

Read Article

April 14, 2025

How to Bridge to Paradex with rhino.fi: A Step-by-Step Guide

Read Article

Read Article

April 14, 2025

How to Bridge to Paradex with rhino.fi: A Step-by-Step Guide

Read Article

Read Article

April 7, 2025

What is Paradex? Discover the Future of Decentralized Perpetual Trading

Read Article

Read Article

April 7, 2025

What is Paradex? Discover the Future of Decentralized Perpetual Trading

Read Article

Read Article

April 2, 2025

Celo L2 Just Launched. Bridge There First with rhino.fi

Read Article

Read Article

April 2, 2025

Celo L2 Just Launched. Bridge There First with rhino.fi

Read Article

Read Article

February 24, 2025

How to Get the Sonic Airdrop: A Complete Guide to Sonic Points

Read Article

Read Article

February 24, 2025

How to Get the Sonic Airdrop: A Complete Guide to Sonic Points

Read Article

Read Article

February 18, 2025

Sonic Points Guide

Read Article

Read Article

February 18, 2025

Sonic Points Guide

Read Article

Read Article

February 14, 2025

Bridge to Soneium: For Less Than $1!

Read Article

Read Article

February 14, 2025

Bridge to Soneium: For Less Than $1!

Read Article

Read Article

January 6, 2025

Bounty for Phishing Recovery

Read Article

Read Article

January 6, 2025

Bounty for Phishing Recovery

Read Article

Read Article

October 31, 2024

Bridge to ApeChain with Rhino! ApeChain Now Available on rhino.fi

Read Article

Read Article

October 31, 2024

Bridge to ApeChain with Rhino! ApeChain Now Available on rhino.fi

Read Article

Read Article

October 10, 2024

Taiko Safari – Bridge to Taiko, Earn Extra Rewards

Read Article

Read Article

October 10, 2024

Taiko Safari – Bridge to Taiko, Earn Extra Rewards

Read Article

Read Article

October 9, 2024

Fast Road to TGE – bridge to Scroll, increase your Airdrop

Read Article

Read Article

October 9, 2024

Fast Road to TGE – bridge to Scroll, increase your Airdrop

Read Article

Read Article

September 25, 2024

Bridge to TON – fee free for 2 weeks!

Read Article

Read Article

September 25, 2024

Bridge to TON – fee free for 2 weeks!

Read Article

Read Article

September 9, 2024

Rhino Nation: Your key to Exclusive Rewards and Benefits

Read Article

Read Article

September 9, 2024

Rhino Nation: Your key to Exclusive Rewards and Benefits

Read Article

Read Article

September 3, 2024

Rhino.fi and Across integration

Read Article

Read Article

September 3, 2024

Rhino.fi and Across integration

Read Article

Read Article

August 7, 2024

Plan for DVF purchase

Read Article

Read Article

August 7, 2024

Plan for DVF purchase

Read Article

Read Article

June 20, 2024

Rhino Alpha Key: Unlocking ultra low-cost bridging

Read Article

Read Article

June 20, 2024

Rhino Alpha Key: Unlocking ultra low-cost bridging

Read Article

Read Article

May 27, 2024

Bridge to Taiko – free on rhino.fi

Read Article

Read Article

May 27, 2024

Bridge to Taiko – free on rhino.fi

Read Article

Read Article

May 9, 2024

New Bridge to Solana: Instant $WIF Rewards!

Read Article

Read Article

May 9, 2024

New Bridge to Solana: Instant $WIF Rewards!

Read Article

Read Article

April 16, 2024

X Layer – bridge fee free for 2 weeks

Read Article

Read Article

April 16, 2024

X Layer – bridge fee free for 2 weeks

Read Article

Read Article

April 1, 2024

Memecoin madness: 2,000,000 $TOSHI up for grabs

Read Article

Read Article

April 1, 2024

Memecoin madness: 2,000,000 $TOSHI up for grabs

Read Article

Read Article

February 29, 2024

Bridge to Blast – fee free for 4 weeks

Read Article

Read Article

February 29, 2024

Bridge to Blast – fee free for 4 weeks

Read Article

Read Article

February 20, 2024

Blast – Explore New Projects

Read Article

Read Article

February 20, 2024

Blast – Explore New Projects

Read Article

Read Article

February 14, 2024

Starknet Provisions Program airdrop eligibility

Read Article

Read Article

February 14, 2024

Starknet Provisions Program airdrop eligibility

Read Article

Read Article

February 1, 2024

New bridge announcement: ZetaChain

Read Article

Read Article

February 1, 2024

New bridge announcement: ZetaChain

Read Article

Read Article

January 25, 2024

New bridge announcement: Tron

Read Article

Read Article

January 25, 2024

New bridge announcement: Tron

Read Article

Read Article

January 20, 2024

The Rhino Run: Layer 2 Stampede

Read Article

Read Article

January 20, 2024

The Rhino Run: Layer 2 Stampede

Read Article

Read Article

January 16, 2024

Tether and rhino.fi Forge Strategic Alliance to Enhance USDT Utility Within DeFi Prioritizing User Experience

Read Article

Read Article

January 16, 2024

Tether and rhino.fi Forge Strategic Alliance to Enhance USDT Utility Within DeFi Prioritizing User Experience

Read Article

Read Article

January 15, 2024

New Bridge to Avalanche: No platform fees for 2 weeks!

Read Article

Read Article

January 15, 2024

New Bridge to Avalanche: No platform fees for 2 weeks!

Read Article

Read Article

December 5, 2023

zkSync Holiday Takeover – Bridge for free

Read Article

Read Article

December 5, 2023

zkSync Holiday Takeover – Bridge for free

Read Article

Read Article

November 29, 2023

Next steps for our Token: the future of DVF

Read Article

Read Article

November 29, 2023

Next steps for our Token: the future of DVF

Read Article

Read Article

November 9, 2023

A Vision for DVF

Read Article

Read Article

November 9, 2023

A Vision for DVF

Read Article

Read Article

November 9, 2023

Bridge to Starknet – No bridge fees for 2 weeks

Read Article

Read Article

November 9, 2023

Bridge to Starknet – No bridge fees for 2 weeks

Read Article

Read Article

October 19, 2023

rhino.fi: Fast, Fresh, and Unstoppable!

Read Article

Read Article

October 19, 2023

rhino.fi: Fast, Fresh, and Unstoppable!

Read Article

Read Article

October 17, 2023

Bridge to Scroll – No bridge fees for a month

Read Article

Read Article

October 17, 2023

Bridge to Scroll – No bridge fees for a month

Read Article

Read Article

October 12, 2023

Rhino.fi and Caldera Bring Frictionless Bridging To Layer 2 Rollups

Read Article

Read Article

October 12, 2023

Rhino.fi and Caldera Bring Frictionless Bridging To Layer 2 Rollups

Read Article

Read Article

October 12, 2023

Masters of Manta quest

Read Article

Read Article

October 12, 2023

Masters of Manta quest

Read Article

Read Article

September 28, 2023

Safari Bounty Quest: Explore Arbitrum and WIN $ARB

Read Article

Read Article

September 28, 2023

Safari Bounty Quest: Explore Arbitrum and WIN $ARB

Read Article

Read Article

September 25, 2023

Base Activity Tracker

Read Article

Read Article

September 25, 2023

Base Activity Tracker

Read Article

Read Article

September 22, 2023

zkSync Bridge Bonanza

Read Article

Read Article

September 22, 2023

zkSync Bridge Bonanza

Read Article

Read Article

September 20, 2023

Unlocking the Future with Starknet: Our Journey to Bridging Beyond the EVM

Read Article

Read Article

September 20, 2023

Unlocking the Future with Starknet: Our Journey to Bridging Beyond the EVM

Read Article

Read Article

September 20, 2023

Understanding Cross-Chain Bridging with Rhino.fi

Read Article

Read Article

September 20, 2023

Understanding Cross-Chain Bridging with Rhino.fi

Read Article

Read Article

September 19, 2023

Bridge to Arbitrum Nova – fee free for 48 hours

Read Article

Read Article

September 19, 2023

Bridge to Arbitrum Nova – fee free for 48 hours

Read Article

Read Article

September 12, 2023

Bridge to Manta Pacific fee free

Read Article

Read Article

September 12, 2023

Bridge to Manta Pacific fee free

Read Article

Read Article