December 1, 2025

It's Finally Happening: The Great Migration to Digital Money

At Rhino.fi, we believe the next billion users won't come for memecoin trading. They'll come because real businesses (payments, games, neobanks) are moving onto digital rails. That migration is happening now.

I. On the Verge of Revolution

Stablecoins are growing enormously and represent the biggest financial innovation in two decades…We all know this. What's less obvious is just how big the surface area of change really is.

The endgame here is every business in the world operating on digital-native stablecoin rails. All payments. All finance. Rebuilt with greater transparency, lower costs, less friction. The global payments market alone is $2.2 trillion annually. Cross-border remittances hit $860 billion in 2024. Stablecoin transaction volume exceeded $27 trillion in 2024, up from $11 trillion the year before. This isn't theoretical anymore.

For a while, those of us in DeFi believed we'd build an alternative financial system that would make legacy finance obsolete. That's not happening. Legacy systems are slow, but they know how to adopt new technologies. Stripe's acquisitions of Bridge and Privy are the clearest signal yet: the most innovative parts of modern finance are integrating the best of crypto, not competing with it. DeFi paved the way. Now it's colliding with fintech.

But here's what hasn't been said enough: whilst legacy finance and modern fintechs will now supercharge adoption, what will really drive the next phase will be the same frontier cryptography and DeFi innovation that created stablecoins in the first place.

First, emerging markets will outpace everyone. These regions never got modern financial infrastructure. Switching to stablecoin rails isn't an upgrade. It's a leap from broken systems to something far better. Neobanks built on stablecoins are scaling fast across Africa and South America, offering stable savings, instant global transfers, and programmable finance. In Nigeria, stablecoin transaction volume grew 9x year-over-year in 2024. Kenya saw 400% growth. The adoption curve is steep.

Second, real innovation still lives on the frontier. Even as fintech embraces stablecoins, the most advanced ideas remain on-chain. Zero knowledge systems. Account abstraction. Intent-based execution. Protocol-level liquidity. This is years ahead of anything in the legacy stack. Builders can lift the best of DeFi and apply it directly to fintech, creating products incumbents can't match.

The result will be a hybrid system where fintech controls distribution and frontier cryptography supplies breakthrough technology. The teams that understand both will define the next decade.

II. Expanding Our Wedge: From DeFi to the Real Economy

We first grew by serving DeFi users. Our application helped people bridge funds between chains instantly. It felt like product-market fit, as if we'd ‘stepped on a landmine’. Over 2023 and 2024, we helped 2M+ users onboard to new chains, hitting 100k+ weekly active users. We processed $5B+ in volume, mostly ETH and stablecoins.

At peak, rhino.fi generated $2M in monthly revenue. But by mid-2024, we asked ourselves: where does the next 10x come from?

Being brutally honest with ourselves, a large proportion of bridging to new rollups was driven by airdrop hunting on those chains. We knew that wasn't sustainable and that margins would compress. Bridging would and should eventually become invisible, bundled into other flows. It wouldn't exist as a standalone consumer action.

We needed to make three changes:

Focus on stablecoins. The long-term opportunity wasn't ETH. It was growing volumes of stablecoin movement.

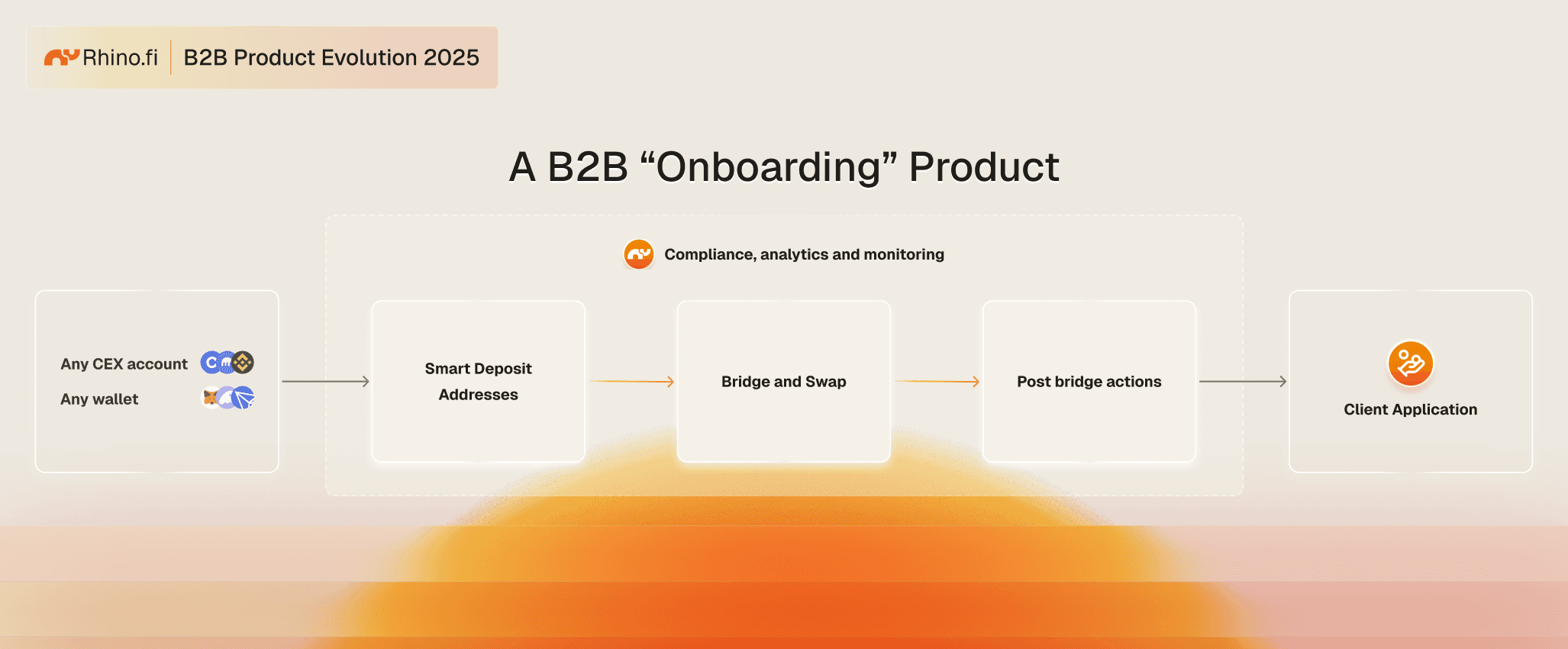

Focus on B2B. Consumers wouldn't bridge. Apps would bundle it into their user journeys. This meant rewriting our core architecture for reliability and enterprise-grade expectations.

Add more value beyond moving between chains. Nobody wants to bridge for its own sake. It's an intermediate step to get from one app to another. We needed to own more of that journey.

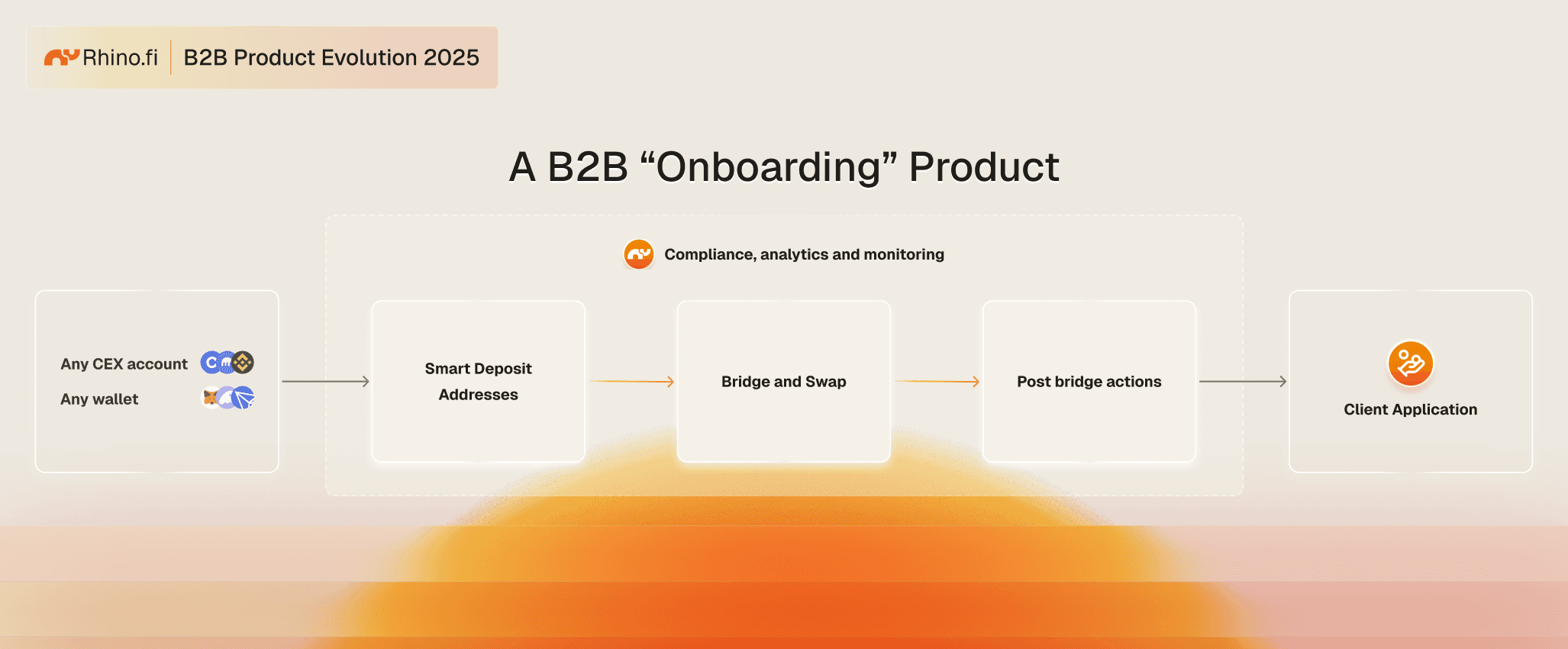

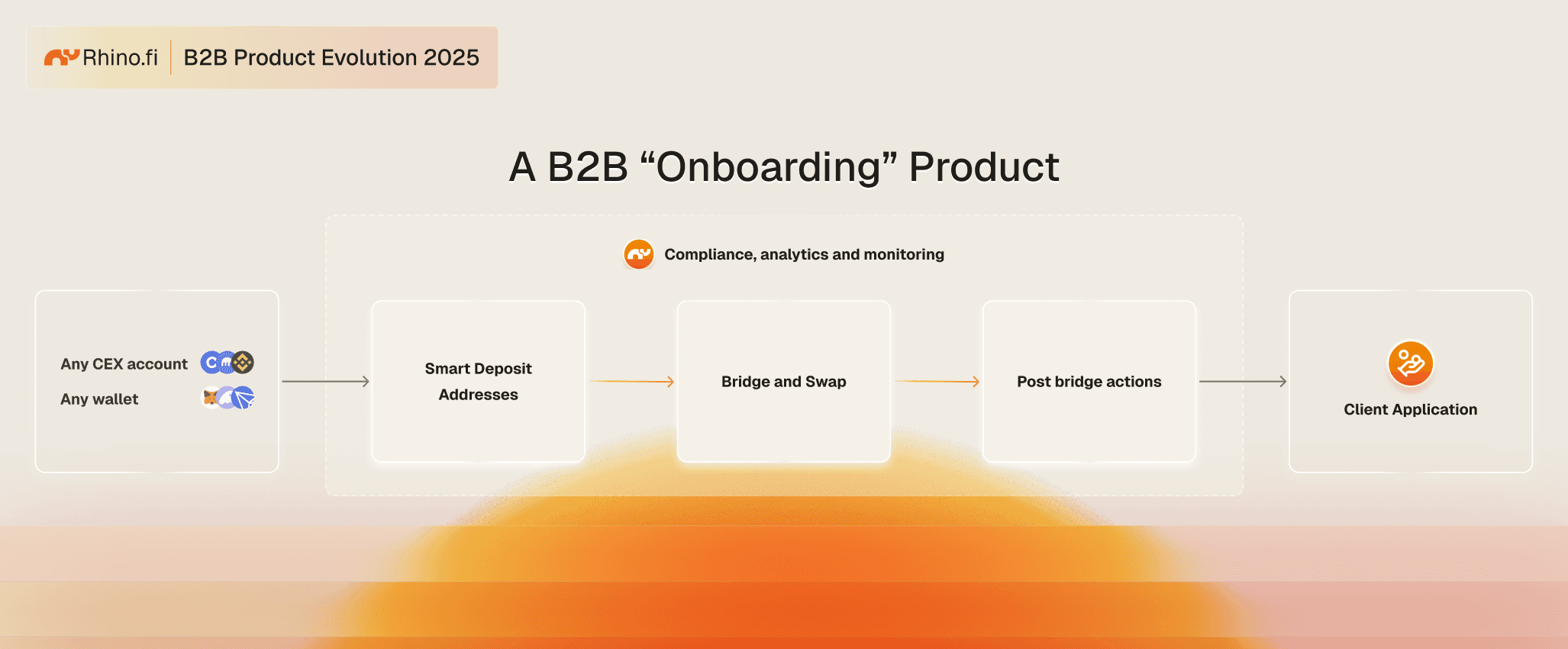

Our hypothesis: we could build a compelling B2B offering. We had ideas about ideal customers, but as we worked with clients, one use case kept coming up: onboarding.

First, we built the value-add components:

Smart Deposit Addresses (SDA): Generatable addresses which accept any stablecoin on any chain, and automatically swap and forward it to a specified chain. Abstract the routing away from users and optimize multiple steps into one. No wallet connection required. Deterministic amounts. Your app receives the right asset on the right chain. Users just make the simplest possible transaction: send.

Post-Bridge Actions (PBA): Programmable actions on arrival. Auto-swap. Vault deposit into yield. Credit a sub-account. Settle an invoice. Mint an on-app balance. Money arrival equals immediate product activation.

By summer 2025, we'd completed our B2B shift and were acquiring larger clients. Our infrastructure was hardened; reliable, secure, handling the transaction sizes and throughput businesses needed.

We'd transitioned from serving DeFi explorers to serving the real economy:

Payments clients in Latam

Neobanks in Africa

Perps exchanges building to compete with major centralized venues

[CASE STUDY 1: Monetic] Monetic, an African fintech platform, integrated Rhino's infrastructure to enable instant cross-border payments without traditional banking rails. Users in Nigeria, Kenya, and Ghana can now receive remittances in stablecoins and convert them instantly to local currency or keep them earning yield—all within the Monetic app. Settlement time dropped from 3-5 days to under 2 minutes. Transaction costs fell by 70%.

[CASE STUDY 2: Extended] : Extended is a perpetual futures exchange growing extremely fast. We supercharged their onboarding journey allowing clients to deposit from 10+ chains instantly in a single step with >$325M in client deposits processed so far. Read more on the full case study: https://rhino.fi/blog/single-click-onboarding-at-scale-the-extended-case-study

Across every vertical, we kept seeing the same pain: onboarding, onboarding, onboarding.

That made us wonder: what if we tripled down on this? What if we got maximally ambitious and optimized entirely around solving stablecoin onboarding through 2026?

III. Rhino Endgame: Full-Stack Digital Native Onboarding

The Rhino Thesis:

Every business and consumer app will shift to digital-native stablecoins. This affects in-app purchases, payments, trading, gaming, shopping, every use case where money moves inside an app. Gaming alone is a $200 billion market. In-app purchases hit $170 billion in 2024. All of it will eventually flow through stablecoin rails. The shift requires embedded wallets and stablecoin onboarding inside every product.

The gap is enormous. Players see the opportunity, but no complete, production-ready solution exists at global scale. This is the first chance in a generation for new entrants to challenge Visa, Mastercard, and a handful of entrenched processors.

Rhino already built a B2B product that solves stablecoin onboarding. Clients accept any supported stablecoin from any chain and convert it into the correct asset on the correct chain. Funds arrive inside the embedded wallet or smart contract, ready to use. Apps stop thinking about chains. They focus on their product.

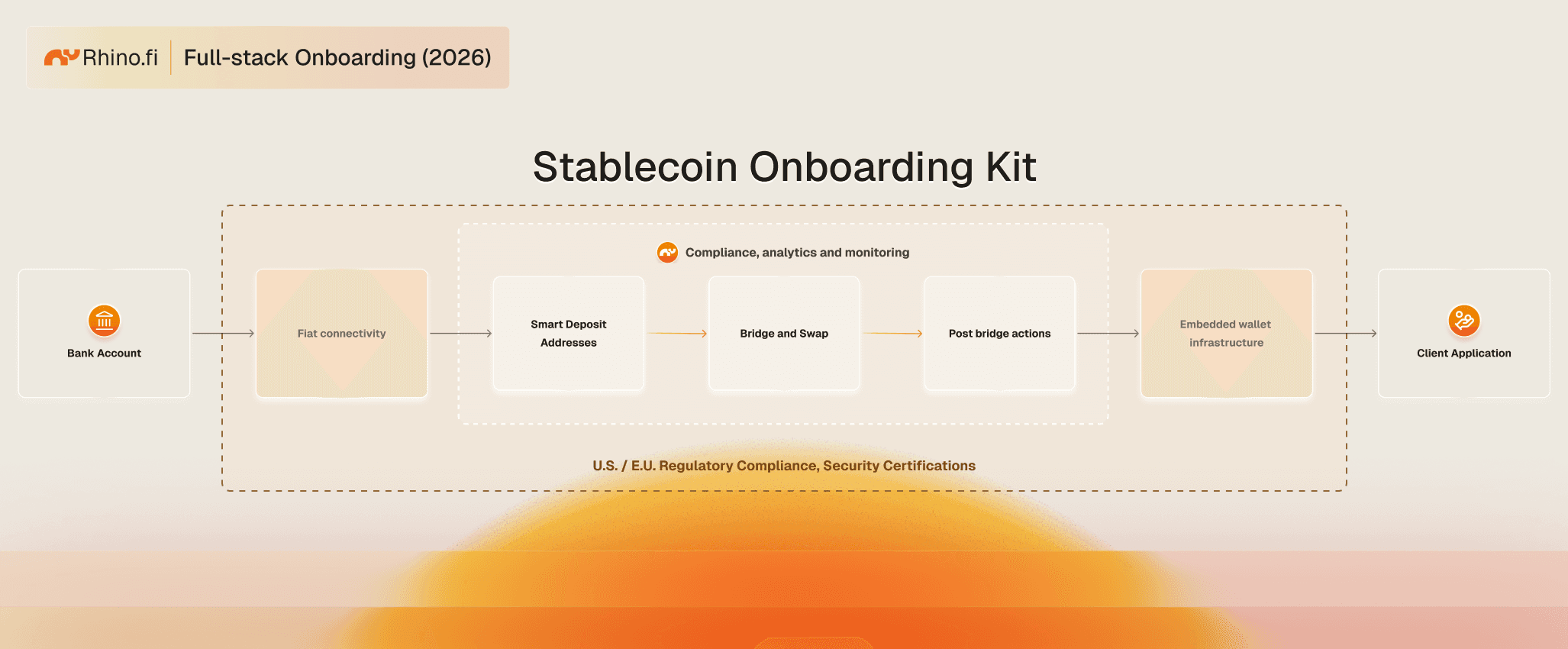

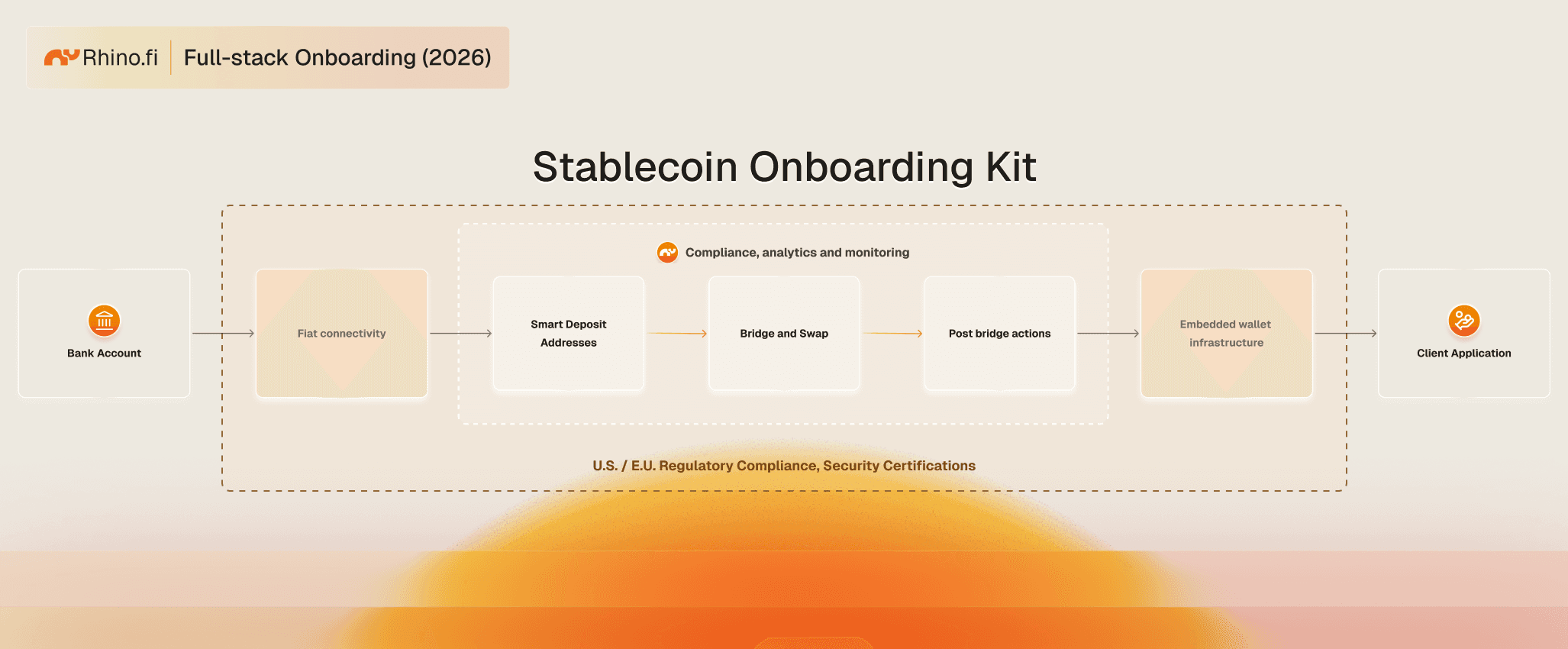

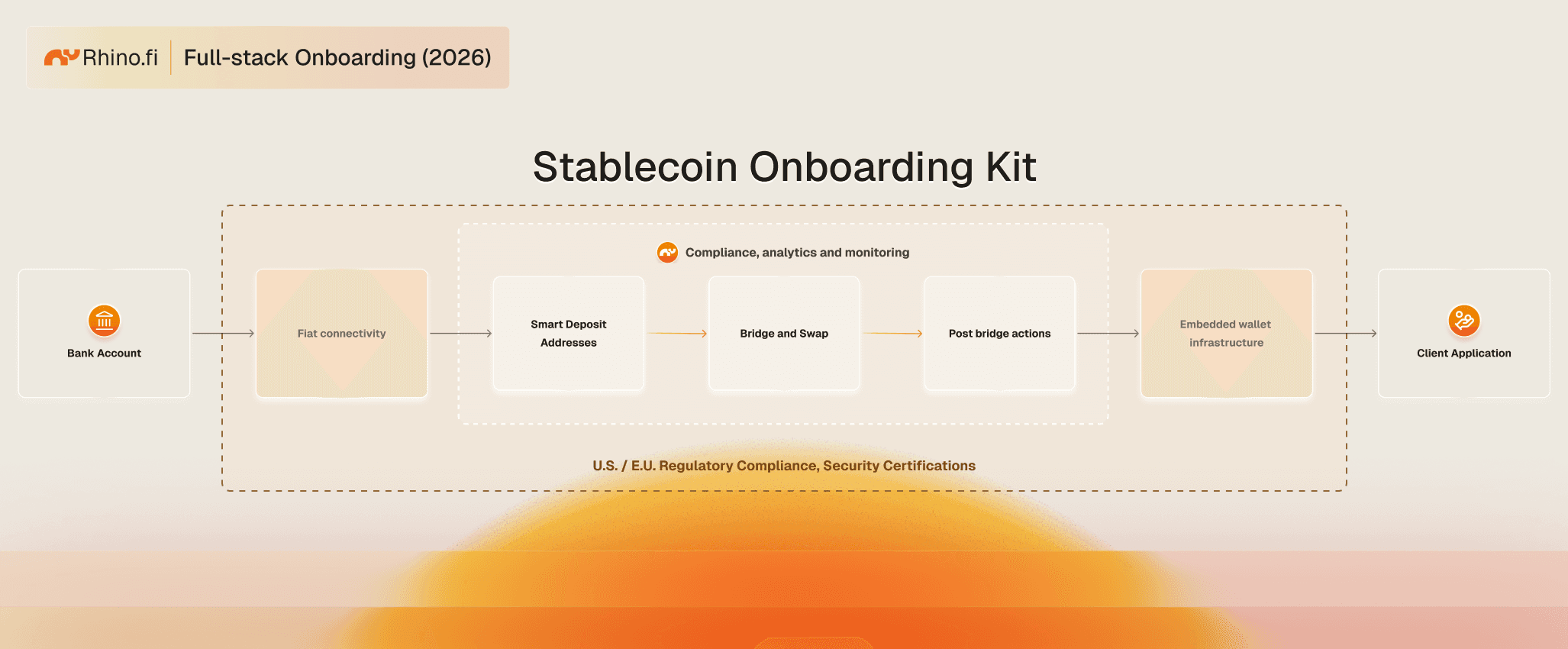

Our next step adds fiat rails and embedded wallet tools. This lets us serve the entire flow, from first deposit to live in-app balance, through one partner, one integration.

Our crypto expertise is our edge. We integrate deeper into chains, with custom smart-contract actions, and leveraging the latest DeFi innovations. We deliver more control, more customization to clients who care about UX. We'll lead in rapidly growing emerging markets. We'll be a fast follower in the EU and US, winning customers with our additional customisability.

Delivering on our thesis requires us to build the full onboarding stack:

Fiat integrations in multiple phases, starting with partners and working closely with stablecoin issuers.

Regulatory licenses in all relevant jurisdictions to support enterprise clients. KYT tooling, AML automation, travel rule compliance, so we can be the single onboarding supplier our clients need.

Embedded wallet and transaction orchestration, moving toward deeper native capability to abstract transaction logic from clients.

But the center of the stack is our specialty. Wide chain support, complex routing, post-bridge actions, yield flows, custom execution paths. Deep integrations with the latest DeFi innovations offering account and fee abstraction. This provides flexibility no simple on-ramp or bridge can match and differentiates us from fintech companies moving into crypto.

Our goal: the most comprehensive, configurable onboarding kit in the market. Any application can adopt it, adjust it for their ideal UX, create a tailored onboarding flow without additional partners.

Want fiat? ✓

Want to convert all incoming stablecoins into yield automatically? ✓

Want AML and travel rule handled automatically? ✓

We are fully aware that major players exist and have set their sights on this market:

Stripe (Bridge + Privy)

MoonPay (Iron + m0)

CrossMint and specialized providers

Most focus on the US and Europe. They work top-down from fintech into crypto.

Rhino approaches from the opposite direction. We come from DeFi and were shaped by it. We understand composability, routing, smart contracts. We know how to design UX for users who already live on digital rails.

Our advantages:

Small and agile. We follow demand into emerging markets where larger players move slowly.

Experience in Africa and Latam where stablecoin adoption is accelerating fastest.

Deep crypto engineering that fintech-native competitors lack.

High customizability for clients needing more than generic on-ramps.

Stablecoin-first for three years. We've been here. We know this territory.

We're securing licenses for global operations. Completing SOC 2 security certifications. Matching enterprise expectations for security and process. Building a track record with major clients who demand reliability, auditability, high throughput.

The message is straightforward: Rhino is enterprise-ready. Clients can trust our stability. Now is the time to migrate onto crypto rails.

Our Mission

Migrate every application onto digital native rails.

We focus on one thing with absolute intensity: onboarding. Onboarding users. Onboarding funds. Onboarding the world.

If you're building anything that touches money online, the next decade is yours. Our job is to make sure your users' money moves anywhere you need it, and that once it lands, it activates real value inside your product.

We're raising our ambition significantly and expanding the team. If you want to build the financial backbone of the internet, explore our open roles here: https://rhino.fi/careers

At Rhino.fi, we believe the next billion users won't come for memecoin trading. They'll come because real businesses (payments, games, neobanks) are moving onto digital rails. That migration is happening now.

I. On the Verge of Revolution

Stablecoins are growing enormously and represent the biggest financial innovation in two decades…We all know this. What's less obvious is just how big the surface area of change really is.

The endgame here is every business in the world operating on digital-native stablecoin rails. All payments. All finance. Rebuilt with greater transparency, lower costs, less friction. The global payments market alone is $2.2 trillion annually. Cross-border remittances hit $860 billion in 2024. Stablecoin transaction volume exceeded $27 trillion in 2024, up from $11 trillion the year before. This isn't theoretical anymore.

For a while, those of us in DeFi believed we'd build an alternative financial system that would make legacy finance obsolete. That's not happening. Legacy systems are slow, but they know how to adopt new technologies. Stripe's acquisitions of Bridge and Privy are the clearest signal yet: the most innovative parts of modern finance are integrating the best of crypto, not competing with it. DeFi paved the way. Now it's colliding with fintech.

But here's what hasn't been said enough: whilst legacy finance and modern fintechs will now supercharge adoption, what will really drive the next phase will be the same frontier cryptography and DeFi innovation that created stablecoins in the first place.

First, emerging markets will outpace everyone. These regions never got modern financial infrastructure. Switching to stablecoin rails isn't an upgrade. It's a leap from broken systems to something far better. Neobanks built on stablecoins are scaling fast across Africa and South America, offering stable savings, instant global transfers, and programmable finance. In Nigeria, stablecoin transaction volume grew 9x year-over-year in 2024. Kenya saw 400% growth. The adoption curve is steep.

Second, real innovation still lives on the frontier. Even as fintech embraces stablecoins, the most advanced ideas remain on-chain. Zero knowledge systems. Account abstraction. Intent-based execution. Protocol-level liquidity. This is years ahead of anything in the legacy stack. Builders can lift the best of DeFi and apply it directly to fintech, creating products incumbents can't match.

The result will be a hybrid system where fintech controls distribution and frontier cryptography supplies breakthrough technology. The teams that understand both will define the next decade.

II. Expanding Our Wedge: From DeFi to the Real Economy

We first grew by serving DeFi users. Our application helped people bridge funds between chains instantly. It felt like product-market fit, as if we'd ‘stepped on a landmine’. Over 2023 and 2024, we helped 2M+ users onboard to new chains, hitting 100k+ weekly active users. We processed $5B+ in volume, mostly ETH and stablecoins.

At peak, rhino.fi generated $2M in monthly revenue. But by mid-2024, we asked ourselves: where does the next 10x come from?

Being brutally honest with ourselves, a large proportion of bridging to new rollups was driven by airdrop hunting on those chains. We knew that wasn't sustainable and that margins would compress. Bridging would and should eventually become invisible, bundled into other flows. It wouldn't exist as a standalone consumer action.

We needed to make three changes:

Focus on stablecoins. The long-term opportunity wasn't ETH. It was growing volumes of stablecoin movement.

Focus on B2B. Consumers wouldn't bridge. Apps would bundle it into their user journeys. This meant rewriting our core architecture for reliability and enterprise-grade expectations.

Add more value beyond moving between chains. Nobody wants to bridge for its own sake. It's an intermediate step to get from one app to another. We needed to own more of that journey.

Our hypothesis: we could build a compelling B2B offering. We had ideas about ideal customers, but as we worked with clients, one use case kept coming up: onboarding.

First, we built the value-add components:

Smart Deposit Addresses (SDA): Generatable addresses which accept any stablecoin on any chain, and automatically swap and forward it to a specified chain. Abstract the routing away from users and optimize multiple steps into one. No wallet connection required. Deterministic amounts. Your app receives the right asset on the right chain. Users just make the simplest possible transaction: send.

Post-Bridge Actions (PBA): Programmable actions on arrival. Auto-swap. Vault deposit into yield. Credit a sub-account. Settle an invoice. Mint an on-app balance. Money arrival equals immediate product activation.

By summer 2025, we'd completed our B2B shift and were acquiring larger clients. Our infrastructure was hardened; reliable, secure, handling the transaction sizes and throughput businesses needed.

We'd transitioned from serving DeFi explorers to serving the real economy:

Payments clients in Latam

Neobanks in Africa

Perps exchanges building to compete with major centralized venues

[CASE STUDY 1: Monetic] Monetic, an African fintech platform, integrated Rhino's infrastructure to enable instant cross-border payments without traditional banking rails. Users in Nigeria, Kenya, and Ghana can now receive remittances in stablecoins and convert them instantly to local currency or keep them earning yield—all within the Monetic app. Settlement time dropped from 3-5 days to under 2 minutes. Transaction costs fell by 70%.

[CASE STUDY 2: Extended] : Extended is a perpetual futures exchange growing extremely fast. We supercharged their onboarding journey allowing clients to deposit from 10+ chains instantly in a single step with >$325M in client deposits processed so far. Read more on the full case study: https://rhino.fi/blog/single-click-onboarding-at-scale-the-extended-case-study

Across every vertical, we kept seeing the same pain: onboarding, onboarding, onboarding.

That made us wonder: what if we tripled down on this? What if we got maximally ambitious and optimized entirely around solving stablecoin onboarding through 2026?

III. Rhino Endgame: Full-Stack Digital Native Onboarding

The Rhino Thesis:

Every business and consumer app will shift to digital-native stablecoins. This affects in-app purchases, payments, trading, gaming, shopping, every use case where money moves inside an app. Gaming alone is a $200 billion market. In-app purchases hit $170 billion in 2024. All of it will eventually flow through stablecoin rails. The shift requires embedded wallets and stablecoin onboarding inside every product.

The gap is enormous. Players see the opportunity, but no complete, production-ready solution exists at global scale. This is the first chance in a generation for new entrants to challenge Visa, Mastercard, and a handful of entrenched processors.

Rhino already built a B2B product that solves stablecoin onboarding. Clients accept any supported stablecoin from any chain and convert it into the correct asset on the correct chain. Funds arrive inside the embedded wallet or smart contract, ready to use. Apps stop thinking about chains. They focus on their product.

Our next step adds fiat rails and embedded wallet tools. This lets us serve the entire flow, from first deposit to live in-app balance, through one partner, one integration.

Our crypto expertise is our edge. We integrate deeper into chains, with custom smart-contract actions, and leveraging the latest DeFi innovations. We deliver more control, more customization to clients who care about UX. We'll lead in rapidly growing emerging markets. We'll be a fast follower in the EU and US, winning customers with our additional customisability.

Delivering on our thesis requires us to build the full onboarding stack:

Fiat integrations in multiple phases, starting with partners and working closely with stablecoin issuers.

Regulatory licenses in all relevant jurisdictions to support enterprise clients. KYT tooling, AML automation, travel rule compliance, so we can be the single onboarding supplier our clients need.

Embedded wallet and transaction orchestration, moving toward deeper native capability to abstract transaction logic from clients.

But the center of the stack is our specialty. Wide chain support, complex routing, post-bridge actions, yield flows, custom execution paths. Deep integrations with the latest DeFi innovations offering account and fee abstraction. This provides flexibility no simple on-ramp or bridge can match and differentiates us from fintech companies moving into crypto.

Our goal: the most comprehensive, configurable onboarding kit in the market. Any application can adopt it, adjust it for their ideal UX, create a tailored onboarding flow without additional partners.

Want fiat? ✓

Want to convert all incoming stablecoins into yield automatically? ✓

Want AML and travel rule handled automatically? ✓

We are fully aware that major players exist and have set their sights on this market:

Stripe (Bridge + Privy)

MoonPay (Iron + m0)

CrossMint and specialized providers

Most focus on the US and Europe. They work top-down from fintech into crypto.

Rhino approaches from the opposite direction. We come from DeFi and were shaped by it. We understand composability, routing, smart contracts. We know how to design UX for users who already live on digital rails.

Our advantages:

Small and agile. We follow demand into emerging markets where larger players move slowly.

Experience in Africa and Latam where stablecoin adoption is accelerating fastest.

Deep crypto engineering that fintech-native competitors lack.

High customizability for clients needing more than generic on-ramps.

Stablecoin-first for three years. We've been here. We know this territory.

We're securing licenses for global operations. Completing SOC 2 security certifications. Matching enterprise expectations for security and process. Building a track record with major clients who demand reliability, auditability, high throughput.

The message is straightforward: Rhino is enterprise-ready. Clients can trust our stability. Now is the time to migrate onto crypto rails.

Our Mission

Migrate every application onto digital native rails.

We focus on one thing with absolute intensity: onboarding. Onboarding users. Onboarding funds. Onboarding the world.

If you're building anything that touches money online, the next decade is yours. Our job is to make sure your users' money moves anywhere you need it, and that once it lands, it activates real value inside your product.

We're raising our ambition significantly and expanding the team. If you want to build the financial backbone of the internet, explore our open roles here: https://rhino.fi/careers

At Rhino.fi, we believe the next billion users won't come for memecoin trading. They'll come because real businesses (payments, games, neobanks) are moving onto digital rails. That migration is happening now.

I. On the Verge of Revolution

Stablecoins are growing enormously and represent the biggest financial innovation in two decades…We all know this. What's less obvious is just how big the surface area of change really is.

The endgame here is every business in the world operating on digital-native stablecoin rails. All payments. All finance. Rebuilt with greater transparency, lower costs, less friction. The global payments market alone is $2.2 trillion annually. Cross-border remittances hit $860 billion in 2024. Stablecoin transaction volume exceeded $27 trillion in 2024, up from $11 trillion the year before. This isn't theoretical anymore.

For a while, those of us in DeFi believed we'd build an alternative financial system that would make legacy finance obsolete. That's not happening. Legacy systems are slow, but they know how to adopt new technologies. Stripe's acquisitions of Bridge and Privy are the clearest signal yet: the most innovative parts of modern finance are integrating the best of crypto, not competing with it. DeFi paved the way. Now it's colliding with fintech.

But here's what hasn't been said enough: whilst legacy finance and modern fintechs will now supercharge adoption, what will really drive the next phase will be the same frontier cryptography and DeFi innovation that created stablecoins in the first place.

First, emerging markets will outpace everyone. These regions never got modern financial infrastructure. Switching to stablecoin rails isn't an upgrade. It's a leap from broken systems to something far better. Neobanks built on stablecoins are scaling fast across Africa and South America, offering stable savings, instant global transfers, and programmable finance. In Nigeria, stablecoin transaction volume grew 9x year-over-year in 2024. Kenya saw 400% growth. The adoption curve is steep.

Second, real innovation still lives on the frontier. Even as fintech embraces stablecoins, the most advanced ideas remain on-chain. Zero knowledge systems. Account abstraction. Intent-based execution. Protocol-level liquidity. This is years ahead of anything in the legacy stack. Builders can lift the best of DeFi and apply it directly to fintech, creating products incumbents can't match.

The result will be a hybrid system where fintech controls distribution and frontier cryptography supplies breakthrough technology. The teams that understand both will define the next decade.

II. Expanding Our Wedge: From DeFi to the Real Economy

We first grew by serving DeFi users. Our application helped people bridge funds between chains instantly. It felt like product-market fit, as if we'd ‘stepped on a landmine’. Over 2023 and 2024, we helped 2M+ users onboard to new chains, hitting 100k+ weekly active users. We processed $5B+ in volume, mostly ETH and stablecoins.

At peak, rhino.fi generated $2M in monthly revenue. But by mid-2024, we asked ourselves: where does the next 10x come from?

Being brutally honest with ourselves, a large proportion of bridging to new rollups was driven by airdrop hunting on those chains. We knew that wasn't sustainable and that margins would compress. Bridging would and should eventually become invisible, bundled into other flows. It wouldn't exist as a standalone consumer action.

We needed to make three changes:

Focus on stablecoins. The long-term opportunity wasn't ETH. It was growing volumes of stablecoin movement.

Focus on B2B. Consumers wouldn't bridge. Apps would bundle it into their user journeys. This meant rewriting our core architecture for reliability and enterprise-grade expectations.

Add more value beyond moving between chains. Nobody wants to bridge for its own sake. It's an intermediate step to get from one app to another. We needed to own more of that journey.

Our hypothesis: we could build a compelling B2B offering. We had ideas about ideal customers, but as we worked with clients, one use case kept coming up: onboarding.

First, we built the value-add components:

Smart Deposit Addresses (SDA): Generatable addresses which accept any stablecoin on any chain, and automatically swap and forward it to a specified chain. Abstract the routing away from users and optimize multiple steps into one. No wallet connection required. Deterministic amounts. Your app receives the right asset on the right chain. Users just make the simplest possible transaction: send.

Post-Bridge Actions (PBA): Programmable actions on arrival. Auto-swap. Vault deposit into yield. Credit a sub-account. Settle an invoice. Mint an on-app balance. Money arrival equals immediate product activation.

By summer 2025, we'd completed our B2B shift and were acquiring larger clients. Our infrastructure was hardened; reliable, secure, handling the transaction sizes and throughput businesses needed.

We'd transitioned from serving DeFi explorers to serving the real economy:

Payments clients in Latam

Neobanks in Africa

Perps exchanges building to compete with major centralized venues

[CASE STUDY 1: Monetic] Monetic, an African fintech platform, integrated Rhino's infrastructure to enable instant cross-border payments without traditional banking rails. Users in Nigeria, Kenya, and Ghana can now receive remittances in stablecoins and convert them instantly to local currency or keep them earning yield—all within the Monetic app. Settlement time dropped from 3-5 days to under 2 minutes. Transaction costs fell by 70%.

[CASE STUDY 2: Extended] : Extended is a perpetual futures exchange growing extremely fast. We supercharged their onboarding journey allowing clients to deposit from 10+ chains instantly in a single step with >$325M in client deposits processed so far. Read more on the full case study: https://rhino.fi/blog/single-click-onboarding-at-scale-the-extended-case-study

Across every vertical, we kept seeing the same pain: onboarding, onboarding, onboarding.

That made us wonder: what if we tripled down on this? What if we got maximally ambitious and optimized entirely around solving stablecoin onboarding through 2026?

III. Rhino Endgame: Full-Stack Digital Native Onboarding

The Rhino Thesis:

Every business and consumer app will shift to digital-native stablecoins. This affects in-app purchases, payments, trading, gaming, shopping, every use case where money moves inside an app. Gaming alone is a $200 billion market. In-app purchases hit $170 billion in 2024. All of it will eventually flow through stablecoin rails. The shift requires embedded wallets and stablecoin onboarding inside every product.

The gap is enormous. Players see the opportunity, but no complete, production-ready solution exists at global scale. This is the first chance in a generation for new entrants to challenge Visa, Mastercard, and a handful of entrenched processors.

Rhino already built a B2B product that solves stablecoin onboarding. Clients accept any supported stablecoin from any chain and convert it into the correct asset on the correct chain. Funds arrive inside the embedded wallet or smart contract, ready to use. Apps stop thinking about chains. They focus on their product.

Our next step adds fiat rails and embedded wallet tools. This lets us serve the entire flow, from first deposit to live in-app balance, through one partner, one integration.

Our crypto expertise is our edge. We integrate deeper into chains, with custom smart-contract actions, and leveraging the latest DeFi innovations. We deliver more control, more customization to clients who care about UX. We'll lead in rapidly growing emerging markets. We'll be a fast follower in the EU and US, winning customers with our additional customisability.

Delivering on our thesis requires us to build the full onboarding stack:

Fiat integrations in multiple phases, starting with partners and working closely with stablecoin issuers.

Regulatory licenses in all relevant jurisdictions to support enterprise clients. KYT tooling, AML automation, travel rule compliance, so we can be the single onboarding supplier our clients need.

Embedded wallet and transaction orchestration, moving toward deeper native capability to abstract transaction logic from clients.

But the center of the stack is our specialty. Wide chain support, complex routing, post-bridge actions, yield flows, custom execution paths. Deep integrations with the latest DeFi innovations offering account and fee abstraction. This provides flexibility no simple on-ramp or bridge can match and differentiates us from fintech companies moving into crypto.

Our goal: the most comprehensive, configurable onboarding kit in the market. Any application can adopt it, adjust it for their ideal UX, create a tailored onboarding flow without additional partners.

Want fiat? ✓

Want to convert all incoming stablecoins into yield automatically? ✓

Want AML and travel rule handled automatically? ✓

We are fully aware that major players exist and have set their sights on this market:

Stripe (Bridge + Privy)

MoonPay (Iron + m0)

CrossMint and specialized providers

Most focus on the US and Europe. They work top-down from fintech into crypto.

Rhino approaches from the opposite direction. We come from DeFi and were shaped by it. We understand composability, routing, smart contracts. We know how to design UX for users who already live on digital rails.

Our advantages:

Small and agile. We follow demand into emerging markets where larger players move slowly.

Experience in Africa and Latam where stablecoin adoption is accelerating fastest.

Deep crypto engineering that fintech-native competitors lack.

High customizability for clients needing more than generic on-ramps.

Stablecoin-first for three years. We've been here. We know this territory.

We're securing licenses for global operations. Completing SOC 2 security certifications. Matching enterprise expectations for security and process. Building a track record with major clients who demand reliability, auditability, high throughput.

The message is straightforward: Rhino is enterprise-ready. Clients can trust our stability. Now is the time to migrate onto crypto rails.

Our Mission

Migrate every application onto digital native rails.

We focus on one thing with absolute intensity: onboarding. Onboarding users. Onboarding funds. Onboarding the world.

If you're building anything that touches money online, the next decade is yours. Our job is to make sure your users' money moves anywhere you need it, and that once it lands, it activates real value inside your product.

We're raising our ambition significantly and expanding the team. If you want to build the financial backbone of the internet, explore our open roles here: https://rhino.fi/careers