December 10, 2025

Wirex Partners with Rhino.fi to Deliver Multichain Stablecoin Orchestration Across 20+ Networks with Guaranteed 1:1 Fiat Parity

Wirex is building what the crypto payments space has needed for years: a genuinely usable onchain payment stack. Whilst Wirex predominantly build inhouse, where necessary they partner with specialists to execute more efficiently and go to market faster.

For cross-chain stablecoin infrastructure, they chose Rhino.fi.

The problem: fragmented liquidity, broken UX

Wirex's users (both retail and enterprise) hold stablecoins across dozens of chains. They're on Tron for cheap transfers, Base for DeFi yields, Ethereum for security, Polygon for speed. But when it's time to actually use those funds for payments, they hit a wall.

Traditional bridging means:

Manually selecting the right bridge for each chain

Paying gas fees on both sides

Waiting for confirmations across multiple steps

Managing wrapped tokens and denomination mismatches

Running compliance checks separately

For an enterprise treasury manager moving €50k in EURC from Polygon, or a user converting $200 USDT from Tron to pay a bill, this friction kills the experience, and the ultimate assertion that stablecoin rails will power payments.

The technical solution

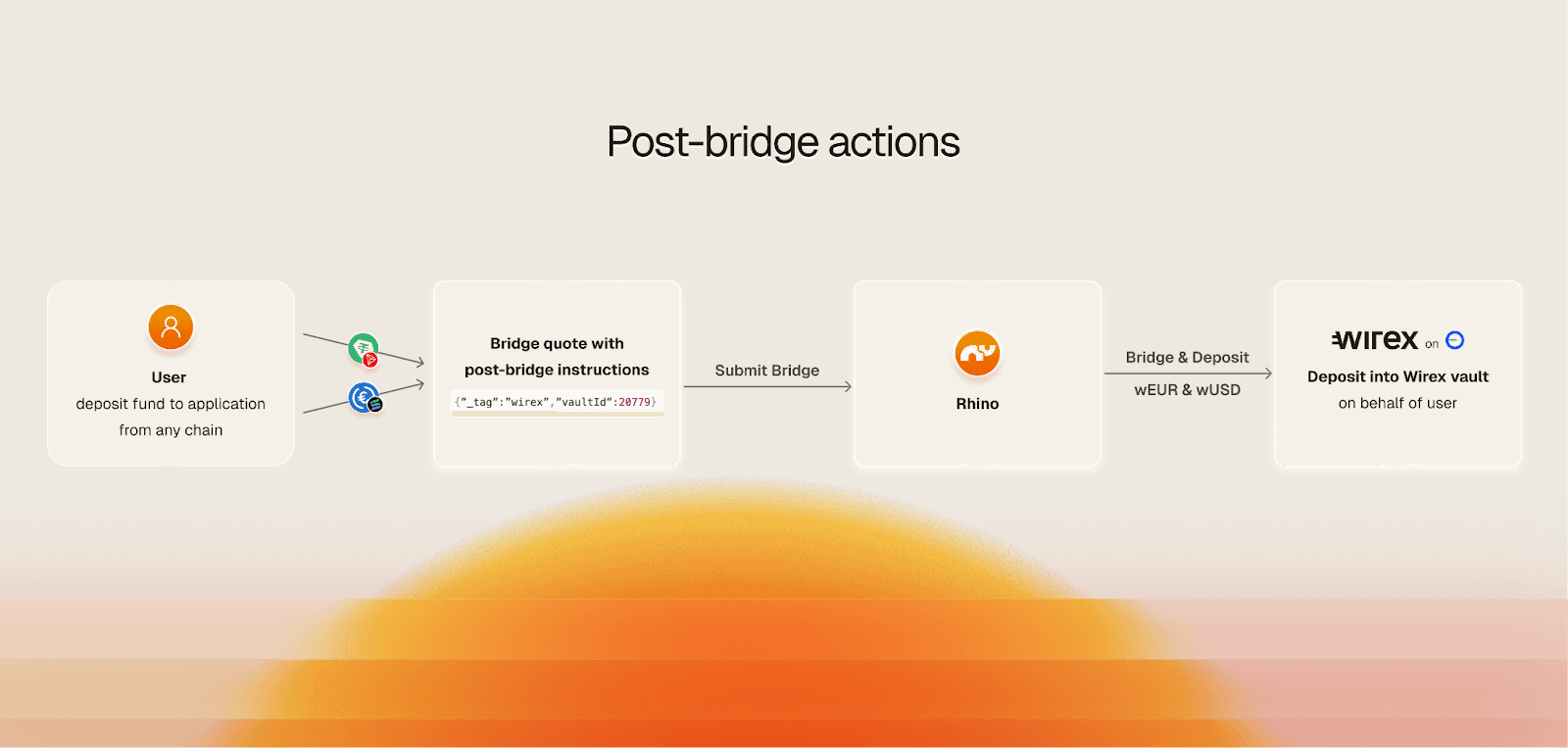

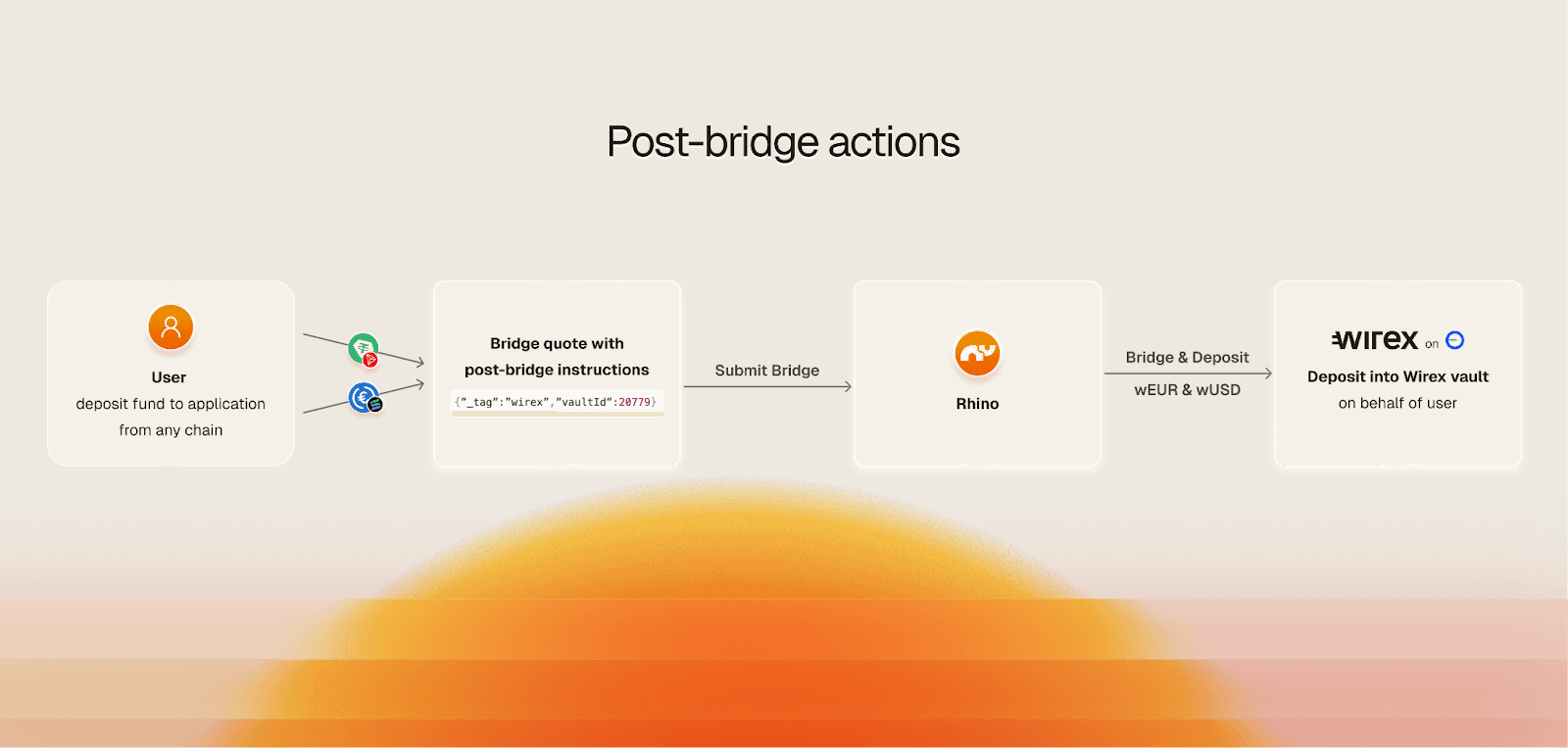

We built Smart Deposit Addresses (SDAs) combined with Post Bridge Actions (PBAs) specifically to solve this.

Here's how it works under the hood:

Each onchain Wirex user gets a unique deposit address that's chain-agnostic. When funds arrive, say, USDC on Base,our system:

Detects the deposit across 20+ chains in real-time (including Tron, which processes 75% of all global USDT transfers and handles over 4.5 million stablecoin transactions daily)

Routes through Rhino.fi optimised liquidity pools to convert USDC/USDT/EURC into WirexPay's unified settlement tokens (wUSD/wEUR) with 0 slippage.

Executes KYT screening using integrated compliance tooling before any funds are credited

Sponsors destination gas fees so users never touch native tokens

Credits the Wirex onchain balance in a single atomic operation

From the user's perspective: they send USDT from their Tron wallet, and seconds later their WirexPay wUSD balance updates. One click. No bridges, no swaps, no gas.

"Wirex selected Rhinofi for its industry-leading cross-chain liquidity infrastructure, which enables seamless, cost-efficient movement of stablecoins across over 20+ blockchain networks with a single integration. This partnership enhances Wirex’s ability to offer scalable multi-chain stablecoin payments to our customers globally." said Pavel Matveev (Co-Founder at Wirex)

Why this matters for payments

Wirex is building stablecoin backed infrastructure for the future,. that serves users across all across the globe. That means handling real-world flows like:

Payroll deposits from DAOs

Merchant settlements in EUR from customers paying in various stablecoins

Card top-ups from wherever users keep their funds

Our integration gives them:

Multi-chain acceptance by default: Users on any of 20+ chains can deposit without Wirex maintaining separate integrations for each

Unified balances:Deposit or pay via banking rails - it’s always 1:1 between stablecoin and fiat. No hidden FX or transfer fees.

Gasless UX: Essential when onboarding non-crypto-native users who don't hold ETH or POL

Embedded compliance: Every cross-chain deposit is screened before crediting

Instant finality: Our Post Bridge Actions mean funds are usable immediately, not locked in pending states

The architecture

In their stack, we function as the stability and settlement rail. We don't hold funds long-term, issue cards, or manage user identity. We do one thing: move stablecoins cleanly across chains and deliver them in the format Wirex's payment layer needs.

That specialization matters. Cross-chain onboarding has failure modes most teams don't think about until they're underwater: MEV attacks, slippage on low-liquidity pairs, failed transactions that lock funds, compliance gaps when tokens move between jurisdictions. We've handled these edge cases because it's our core business. With Tron alone handling approximately $25 billion in daily USDT volume, supporting this chain properly, alongside 20+ others, requires infrastructure built specifically for high-throughput stablecoin movement.

The result?

A single, unified, multi-chain onboarding experience for payments.

“Wirex is building the kind of real-world payment experience the ecosystem has been waiting for,” said Lexi Short, Chief Growth Officer at Rhino.fi.“We’re thrilled to power their stablecoin infrastructure and grow together in 2026.”

Rhino.fi is the stablecoin rail behind the next generation of onchain payments, treasury flows, and global fintech apps.

If you want to add multi-chain stablecoin acceptance to your product, we’d love to work with you.

Wirex is building what the crypto payments space has needed for years: a genuinely usable onchain payment stack. Whilst Wirex predominantly build inhouse, where necessary they partner with specialists to execute more efficiently and go to market faster.

For cross-chain stablecoin infrastructure, they chose Rhino.fi.

The problem: fragmented liquidity, broken UX

Wirex's users (both retail and enterprise) hold stablecoins across dozens of chains. They're on Tron for cheap transfers, Base for DeFi yields, Ethereum for security, Polygon for speed. But when it's time to actually use those funds for payments, they hit a wall.

Traditional bridging means:

Manually selecting the right bridge for each chain

Paying gas fees on both sides

Waiting for confirmations across multiple steps

Managing wrapped tokens and denomination mismatches

Running compliance checks separately

For an enterprise treasury manager moving €50k in EURC from Polygon, or a user converting $200 USDT from Tron to pay a bill, this friction kills the experience, and the ultimate assertion that stablecoin rails will power payments.

The technical solution

We built Smart Deposit Addresses (SDAs) combined with Post Bridge Actions (PBAs) specifically to solve this.

Here's how it works under the hood:

Each onchain Wirex user gets a unique deposit address that's chain-agnostic. When funds arrive, say, USDC on Base,our system:

Detects the deposit across 20+ chains in real-time (including Tron, which processes 75% of all global USDT transfers and handles over 4.5 million stablecoin transactions daily)

Routes through Rhino.fi optimised liquidity pools to convert USDC/USDT/EURC into WirexPay's unified settlement tokens (wUSD/wEUR) with 0 slippage.

Executes KYT screening using integrated compliance tooling before any funds are credited

Sponsors destination gas fees so users never touch native tokens

Credits the Wirex onchain balance in a single atomic operation

From the user's perspective: they send USDT from their Tron wallet, and seconds later their WirexPay wUSD balance updates. One click. No bridges, no swaps, no gas.

"Wirex selected Rhinofi for its industry-leading cross-chain liquidity infrastructure, which enables seamless, cost-efficient movement of stablecoins across over 20+ blockchain networks with a single integration. This partnership enhances Wirex’s ability to offer scalable multi-chain stablecoin payments to our customers globally." said Pavel Matveev (Co-Founder at Wirex)

Why this matters for payments

Wirex is building stablecoin backed infrastructure for the future,. that serves users across all across the globe. That means handling real-world flows like:

Payroll deposits from DAOs

Merchant settlements in EUR from customers paying in various stablecoins

Card top-ups from wherever users keep their funds

Our integration gives them:

Multi-chain acceptance by default: Users on any of 20+ chains can deposit without Wirex maintaining separate integrations for each

Unified balances:Deposit or pay via banking rails - it’s always 1:1 between stablecoin and fiat. No hidden FX or transfer fees.

Gasless UX: Essential when onboarding non-crypto-native users who don't hold ETH or POL

Embedded compliance: Every cross-chain deposit is screened before crediting

Instant finality: Our Post Bridge Actions mean funds are usable immediately, not locked in pending states

The architecture

In their stack, we function as the stability and settlement rail. We don't hold funds long-term, issue cards, or manage user identity. We do one thing: move stablecoins cleanly across chains and deliver them in the format Wirex's payment layer needs.

That specialization matters. Cross-chain onboarding has failure modes most teams don't think about until they're underwater: MEV attacks, slippage on low-liquidity pairs, failed transactions that lock funds, compliance gaps when tokens move between jurisdictions. We've handled these edge cases because it's our core business. With Tron alone handling approximately $25 billion in daily USDT volume, supporting this chain properly, alongside 20+ others, requires infrastructure built specifically for high-throughput stablecoin movement.

The result?

A single, unified, multi-chain onboarding experience for payments.

“Wirex is building the kind of real-world payment experience the ecosystem has been waiting for,” said Lexi Short, Chief Growth Officer at Rhino.fi.“We’re thrilled to power their stablecoin infrastructure and grow together in 2026.”

Rhino.fi is the stablecoin rail behind the next generation of onchain payments, treasury flows, and global fintech apps.

If you want to add multi-chain stablecoin acceptance to your product, we’d love to work with you.