Sonic Points Guide

Use our guide to maximise your returns AND your potential airdrop.

What are Sonic Points?

Sonic Points make up the user-focused airdrop program for Sonic with the main aim of boosting liquidity on-chain. With around 200 million $S tokens marked for their airdorp, there’s plenty of reasons to engage with Sonic. The first season started at mainnet launch and will run until June 2025.

Users can earn Sonic Points in a few different ways. And remember, there are multipliers for different assets so choose the right ones!

Passive Points

Earned by holding whitelisted assets in a Web3 wallet like Rabby or MetaMask.

Activity Points

Earned by deploying whitelisted assets as liquidity on various dApps.

App Points (gems)

These are for builders. Gems are earned as users interact with their apps which can then be redeemed for $S.

The best way to earn Sonic Points

Bridge funds to Sonic

Stablecoins, ETH and S tokens all provide the best multiplier returns so move those funds over to Sonic first.

rhino.fi allows you to bridge stables and ETH from over 30 chains to Sonic and you can add S tokens while you bridge using our Gas Boost feature.

Get whitelisted assets to earn Passive Points

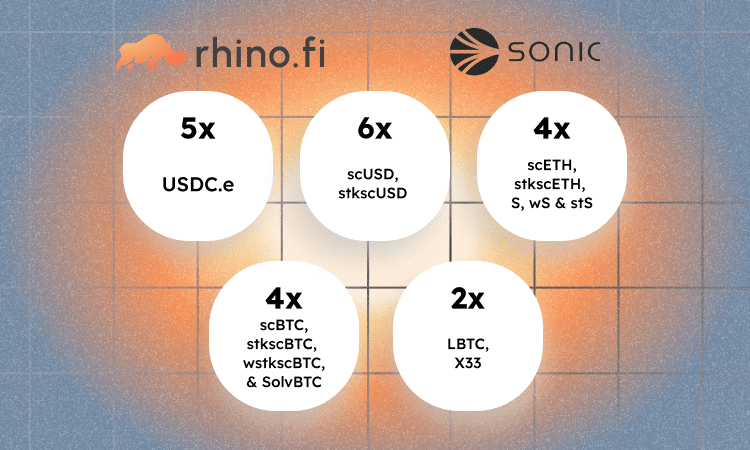

You can mint or swap directly into assets that earn you Passive Points just for holding them. The assets below provide the best multiplier bonuses.

There are a variety of ways to get these assets but two of the most popular dApps are Rings for staking and Odos for swapping.

Deploy assets to earn Activity Points

There are a lot of excellent apps being built on Sonic. We’ve list a few below to get your started but as always, make sure to DYOR before engaging any of your funds.

Go here for a full list of apps that provide Activity Points on Sonic.

Make sure to toggle “AP Points” on the top right to ensure you only see apps that generate Activity Points.

DEXs

SwapX

V4 DEX with concentrated liquidity and active management, powered by Algebra.

SpookySwap

Portal to DeFi built on Uni v3 — launch, trade, farm, stake, and earn rewards.

Equalizer

DEX that uses a vote-escrowed model to drive liquidity to the highest-volume pairs.

Yield

ICHI

Liquidity management protocols turning single-token deposits into optimized yields.

Rings

Scalable yield-bearing stablecoin inspired by Solidly, powered by Veda strategies.

Beefy Finance

Decentralized, multi-chain yield optimizer allowing users to earn compound interest.

Lending

Eggs Finance

DeFi platform offering yield and lending products through a deflationary token model—secured by S.

ZeroLend

Lending market with a focus on LRTs, governance, RWAs, and account abstraction.