In 1903, when the first motorcar was fresh off the production line, a prominent U.S. banker told Henry Ford “the automobile is a fad, but horses are here to stay.”

If you think that prediction’s aged badly, how about the boss of Intel saying, as recently as 1992, that pocket computers were a pipe-dream? Or Microsoft’s Steve Ballmer saying that the iPhone would never take off? Or early YouTube being written off as an unviable proposition… by the person who was running YouTube?

The history of technology is a graveyard littered with freezing-cold takes, often given by people at the heart of the action who should know better.

And so it was when Ethereum released the Shappella upgrade (a combination of the Shanghai and Cappella upgrades), which meant that stakers, the people who lock their tokens to secure the Ethereum network, could finally withdraw their funds from the Beacon chain.

Shappella, we were told by the experts, was going to open the gates to an avalanche of destaking, and topple Ethereum’s price. After more than two years of being unable to unstake their funds, users were finally free to trade, swap and invest their precious ETH again.

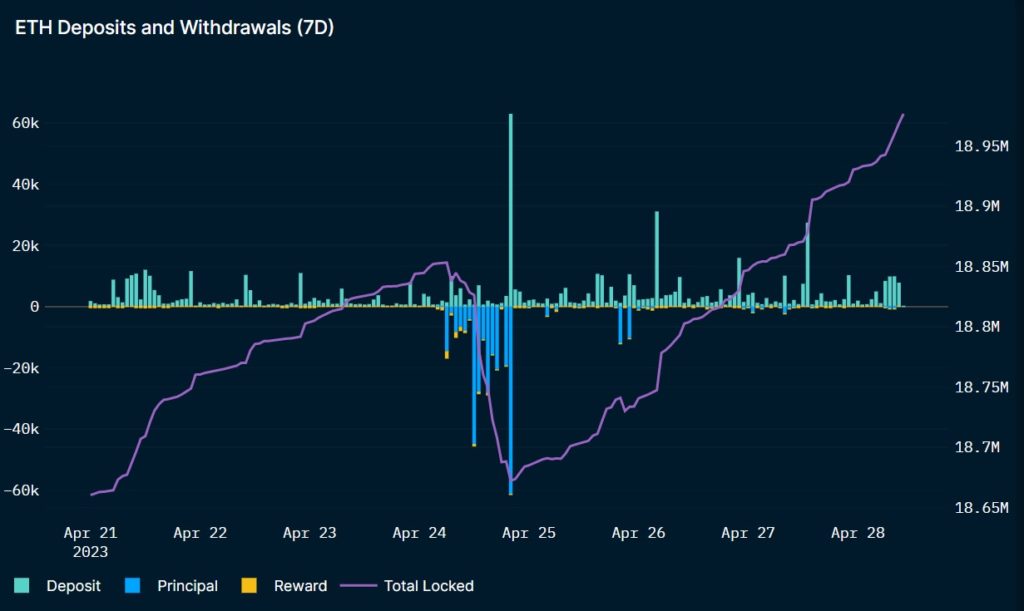

But what happened? Well, take a look at this 7-day chart from Nansen.

After an initial flurry of unstaking, deposits consistently outstripped withdrawals in the first few days following the upgrade and Ethereum’s total value locked (TVL) soared.

On April 25, Coindesk revealed that Ethereum had recorded a weekly inflow of 572,000, worth more than $1 billion, the highest inflow in the history of staking. What’s more, the price of ETH briefly broke the $2,000 barrier, its highest level since the crypto bear market began last spring.

And there’s little sign of stakers changing their mind any time soon. In fact, judging by this chart which shows the ETH that is scheduled for withdrawal right now, nearly all stakers are in it for the long haul.

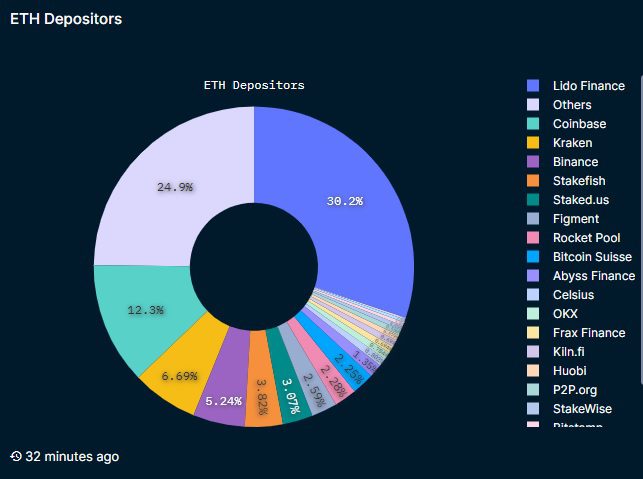

What’s even more interesting than that, though, is the breakdown of people staking.

As well as big investors using institutionally focused platforms such as Figment and Bitcoin Suisse, a vast number of smaller holders are depositing into staking pools, which, as the name suggests, allow you to pool your investment with others.

Nearly a third of depositors are currently staking via Lido, one of the most influential staking-pool service in crypto right now (we provide our own Lido opportunity on Rhino, more of which below).

Why is this?

Because the removal of the lock has significantly reduced the risk of staking Ethereum.

Previously, stakers had to lock their funds for the long term and hope that Ethereum, and crypto as a whole, would hold its value; if the price tanked, there’d be no way to release their funds in time to offload the asset. Their rewards were locked, too, so there was no immediate gain to be made from trusting the project.

So stakers tended to be people who were in it for the tech, and the chance to support the evolution of Ethereum, rather than financial gain. Or they were big institutional investors who could afford the financial hit if the markets took a dive.

Now, however, stakers know they can free their funds in periods of volatility, which means they can secure Ethereum’s future without risking their own.

This will have (and is having) knock-on effects too. Liquid staking, whereby users receive a tradeable derivative token when locking in their asset, is gaining a boost, too. Now traders are able to move their assets between various liquid staking platforms which will, in turn, be forced to make their tokens ever more liquid to compete with one another.

And all of this is creating a virtuous circle. As the ratio of staked ETH to overall supply increases, this means more validators, more liquidity and more long-term security, which will (or should) improve price stability and make staking even more reliable.

What’s next for Ethereum?

Now that the true impact of Shappella has become clear, commentators are talking about Ethereum leading the charge into the new bull market, even breaking the $5k barrier.

We’re not in the business of giving predictions at rhino.fi, but we can say with confidence that Ethereum is going to keep evolving.

Following Shappella, we’re going to see Danksharding, which will more effectively distribute the responsibility of managing the data created by rollups like rhino.fi. And we’re going to see Proto-Danksharding, which could increase the size of each block created on Ethereum to 2MB, further reducing gas fees for users.

As history has shown time and again, technology can make fools of us all. But whatever happens to Ethereum over the next few months, we’ll be watching closely. And we’ll bring you our (hopefully hot) take when the next big thing happens.

And, just finally… we’ve got our own staking opportunity on rhino.fi via Lido. It returns 4.92% APY and provides wrapped staked ETH, a liquid staking token. You can explore the opportunity by clicking below.