Welcome to our October performance report.

With an aim to provide Nectar (NEC) token holders with a clearer view of the inner-workings of the exchange, we publish monthly reports reflecting the trends and financial results of each 30-day period.

Ethfinex Governance Summit

The first Ethfinex Governance Summit was held in Switzerland earlier this month. The Ethfinex team worked incredibly hard to make sure the event went as smoothly as possible and we were overwhelmed by the quality of delegates that attended.

Pictures from the event are now on the summit web page and the individual presentations are available on our Youtube channel.

Highlights of the first two days included two interactive and thought provoking panel discussions, including a passionate debate between Phil Lucsok from Parity, Vlad Zamfir from Ethereum, Nicolas Bacca from Ledger and Igor Barinov from POA about on-chain and off-chain governance. There were also a range of fascinating presentations and demonstrations about progressing towards decentralised governance, including Giveth, Kleros, Democracy 21, Colony, DAOStack, Melonport, Aragon, Procivis, POA, Consensus Clubs, The Human Rights Foundation and Bitfinex.

On the final day Ethfinex held the first ever token holder un-board meeting for the Nectar token (NEC) community members. Led by Ross Middleton, Ethfinex’s Commercial Director and Will Harborne, Ethfinex’s Director of Operations, we gained valuable feedback and ideas from the discussions between our major NEC holders, the Ethfinex team and many of the other guests and speakers who decided to stay to watch as spectators. We are now working towards turning these inputs into concrete proposals over the next few weeks.

The feedback from the Ethfinex Governance Summit confirmed to us that we will be running another governance summit next year, so stay tuned for 2019.

Executive Summary

This following report breaks down monthly trading revenues, volume and user growth, and will continue to provide more detailed statistics each period.

The performance period covered in this report is 11th September 2018 – 11th October 2018.

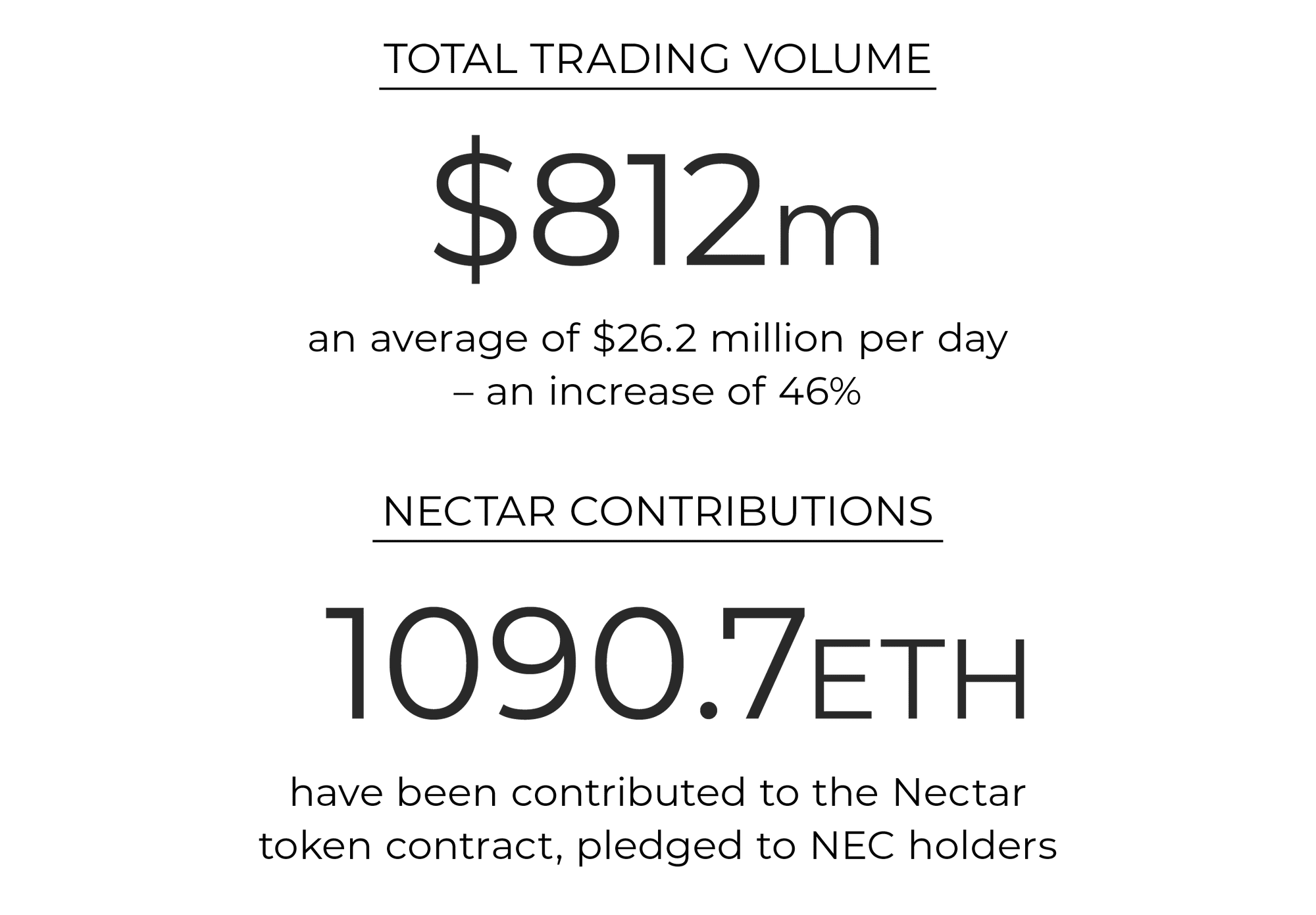

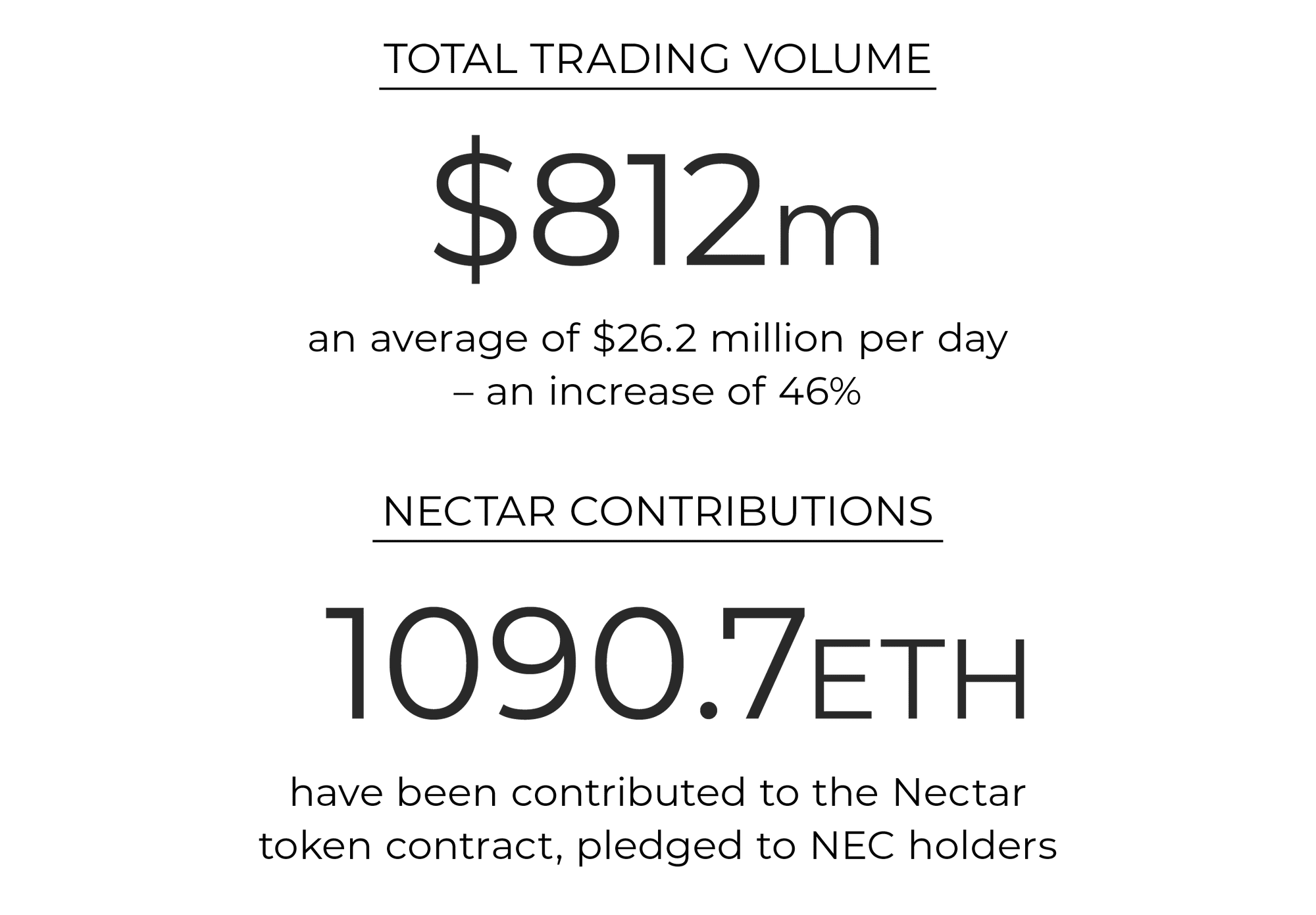

- Total trading volume for the period equalled $812m, a simple average of $26.2 million per day, an increase of 46% from the previous period.

- Ethfinex Trustless has been used by 209 traders over the past 30 days, with 903 individual transactions totalling 571 ETH of volume.

- Total trading fees of ~$492,146 (depending on price feeds) were collected through trading and other fees in the 30-day period, an increase of 20% from the previous round.

- In line with this, 1090.7 ETH have been contributed to the Nectar token contract, pledged to NEC holders.

- 1,069,298 NEC tokens were distributed to reward market marking active on Ethfinex in the past month, an increase of 70% from the previous round. Statistics can now be viewed on Nectar.community.

Month in Review — October

Revenue & Activity Reports

1. Trading fee revenues

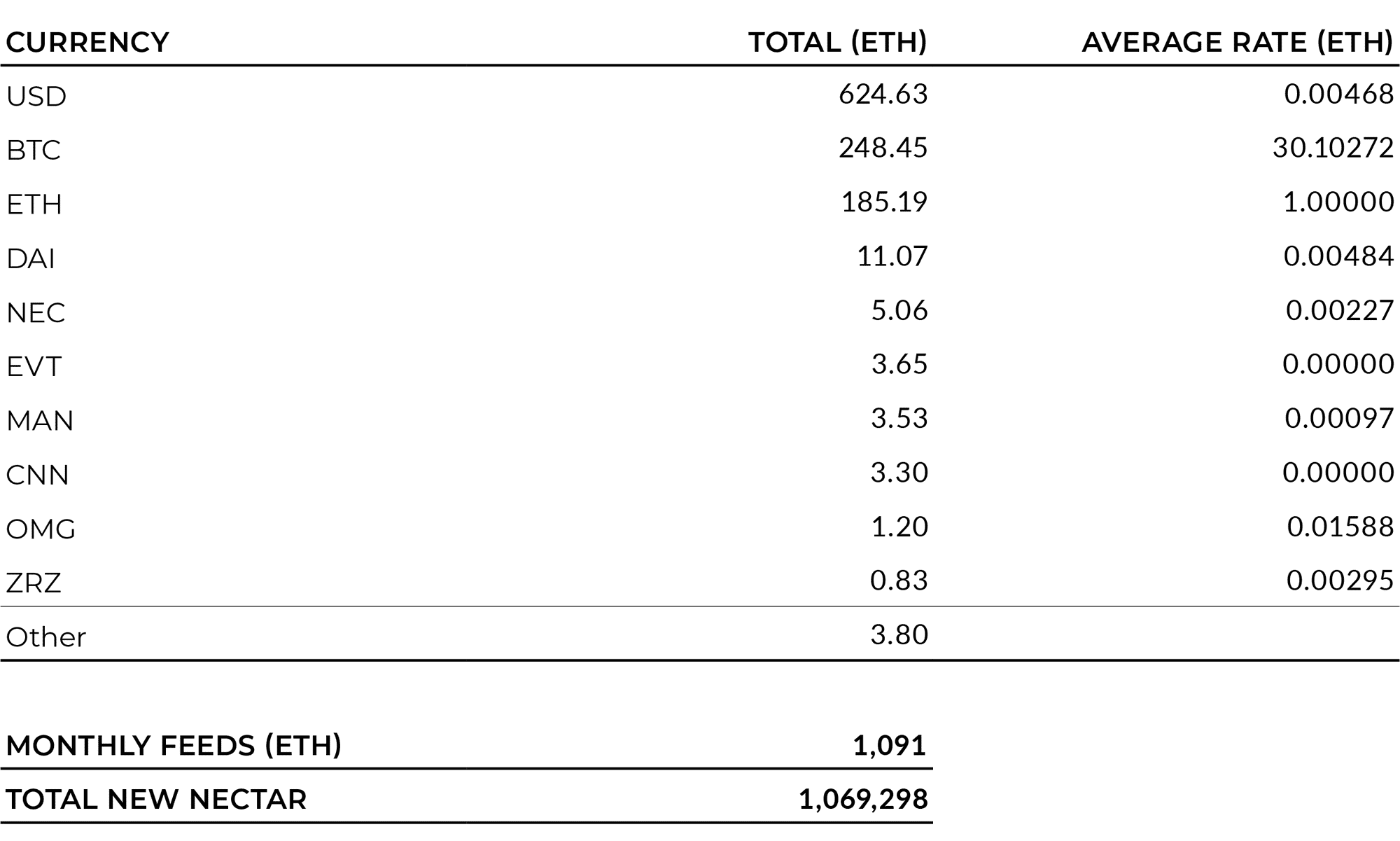

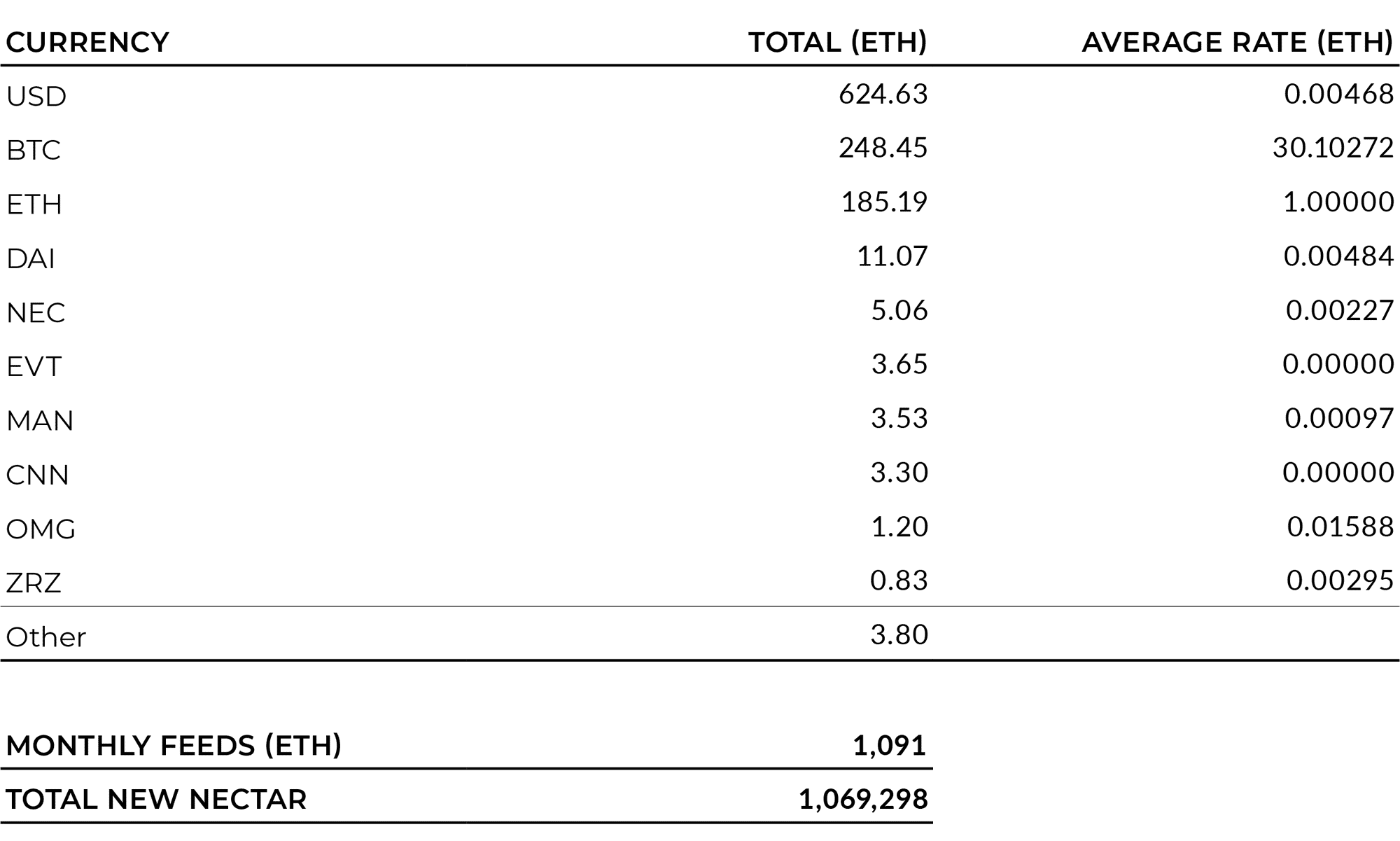

All fees were converted as they were collected into ETH to provide an averaged conversion cost across the month and average out the effects of price volatility during the period.

Fee currencies in the table are ranked in order of most collected. Quick note — fees cannot be extrapolated directly to trading volume as users can set their preferred fee currency (hence the popularity of USDT and BTC).

The above chart shows 50% of fees in all currencies collected. 1,091.7 ETH were collected during the month and pledged to NEC token holders. NEC, MAN, EVT and DAI again all performed relatively well.

Due strong community demand, we plan to add DAI pairs to Ethfinex Trustless very soon.

2. Trading Volume

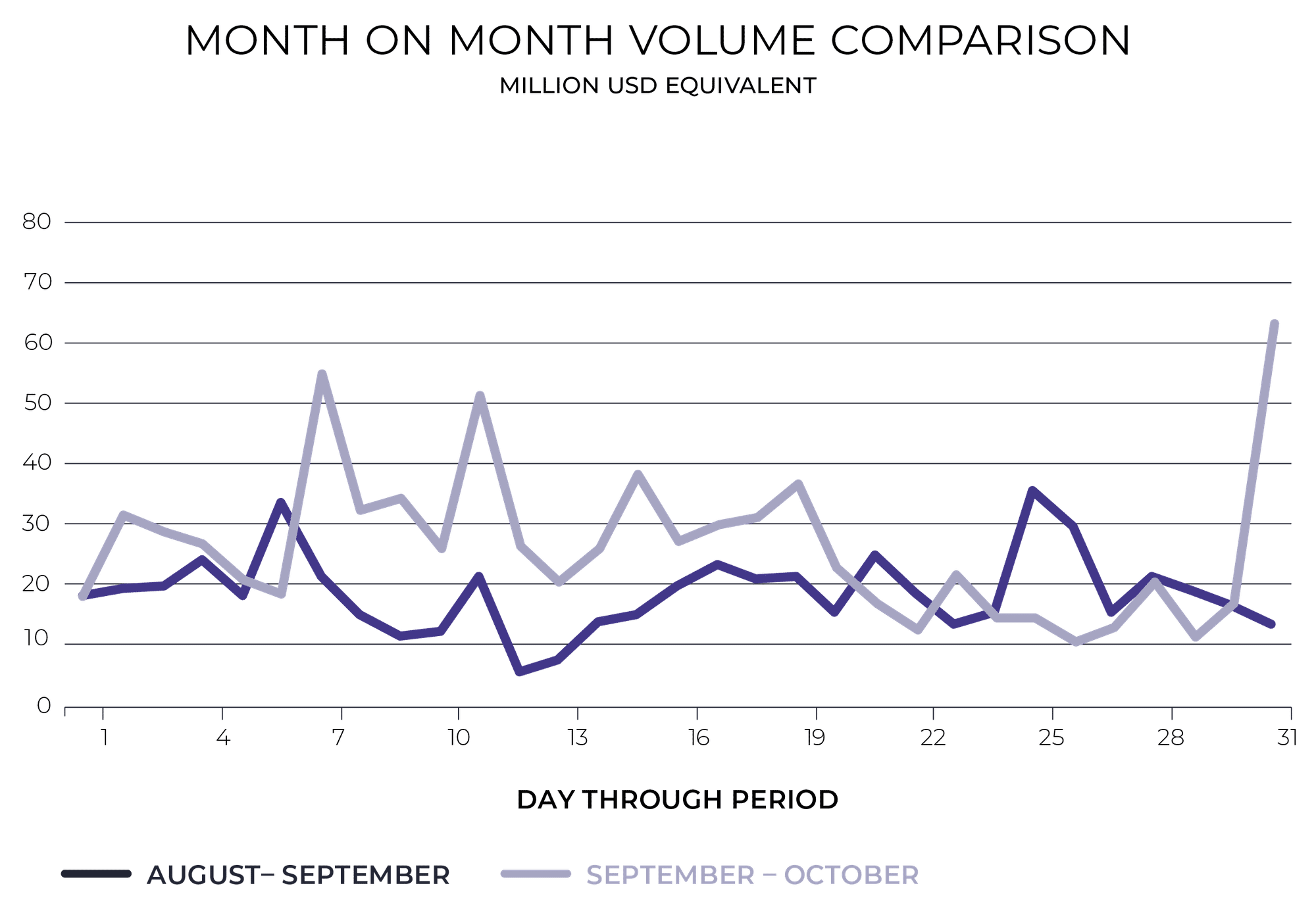

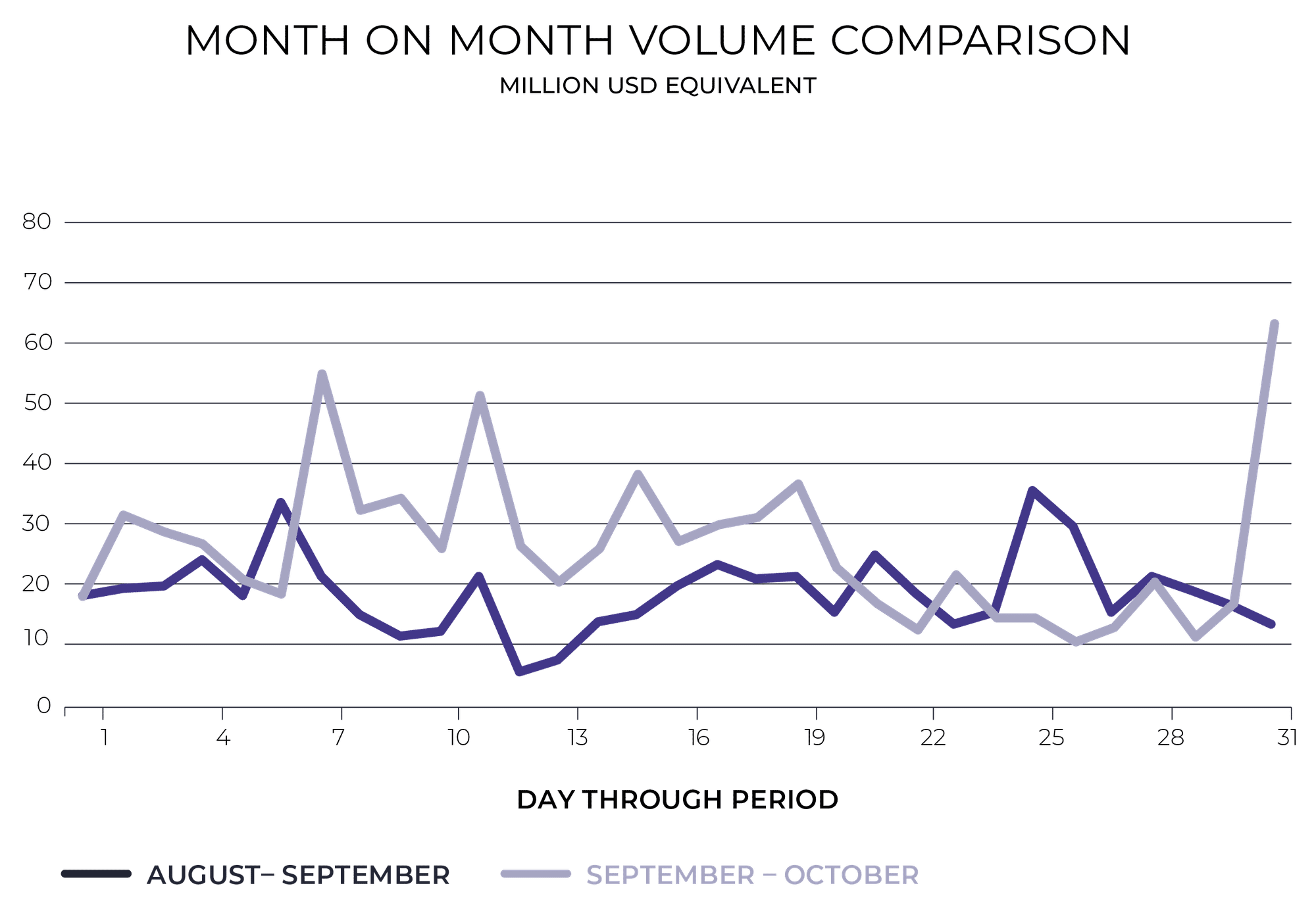

Ethfinex total 30-day trading volume increased 46% from the previous period to $812m.

Interestingly, volatility wasn’t the main driver of the increase in volume, with ETH/USD daily volatility across the month dropping 62% (as measured by standard deviation across the month) as price was relatively static around the average monthly price. This volatility was in stark contrast to to the previous month’s large absolute price decline. Intraday volatility (as measured by the intraday range as a percentage of the open price) also dropped 5%.

Instead the increase in trading volume was driven partly by an increase in ETH/USD and ETH/BTC volume across the board on all exchanges (+14% month on month) and Ethfinex capturing a higher percentage share of ETH/USD and ETH/BTC volumes from other exchanges.

Trading volumes varied greatly across the period, with the first half of September and the 11th October containing the lion’s share of the volume for the whole period. The first half of October was relatively quiet as the market looked for direction.

User numbers, page visits, and conversions have all been broadly similar to last month. We still see significant increases during periods of volatility and when new pairs are added to the exchange at the end of the community vote. Sunday’s are the quietest days in terms of user numbers – proving that even crypto traders have a break sometimes!

Peak daily trading volume was 67.5m, an increase of 82% compared to the peak trading day in the previous period.

The Month Ahead – November

TLDR – it is going to be a very busy month.

1. The Ethfinex ‘Un-board’ meeting

The priority for the immediate weeks following the first Ethfinex Governance summit has been to take all the amazing ideas and feedback from the NEC token holder meetings on the third day of the summit, and to turn them into a set of concrete policies that can then be presented to all NEC holders for voting. Some of the policies that were discussed needed additional research to make sure that they were technically, financially and legally possible, as well as actually achieving their desired outcomes without any unintentional negative consequences.

We are now nearing the point when we will be able to present a set of preferred policies to the wider NEC community. The last few kinks are being ironed out by a technical council of NEC holders (of which we will also give more details on over the coming few weeks) so please stay tuned for what we think are some very exciting and positive developments for the Ethfinex community.

2. Ethfinex Community Meetup No.3

On the 23rd October we will be hosting our third Ethfinex Meetup event in Shoreditch, London.

We will give a quick run through of some of the new features we are working on at Ethfinex. There will also be special guests from Melonport and Rigoblock who will be demonstrating their decentralised asset platforms and taking questions.

There will also be plenty of time to meet the Ethfinex team, the speakers and network with other attendees. We would love to see as many people there as possible so please do register your interest as places are on a first come first served basis. Also, there will be a limited free bar at the venue.

3. Ethfinex Token Sales

We have been busy working behind the scenes with some very interesting new token projects and will be announcing the first token sale on Ethfinex very soon.

The Ethfinex token sale platform is designed to improve the overall user experience of token sales. Instead of a ‘fastest finger first’ race on a dodgy unknown ICO website, out contribution process will be in the form of a random ballot. We think that this is one the fairest mechanism to allocate a scarce amount of tokens as it avoids many of the problem that sours some token sales. The advantages of contributing to a token sale on Ethfinex rather than an unknown ICO website is that is minimises the risks associated with protection of personal data, phishing, miss-typings and gas price errors. More details coming very soon.

4. Trustless Portal Expansion

Ethfinex Trustless launched two weeks ago, allowing users to trade against the centralised liquid order books of Ethfinex and Bitfinex, from the security and privacy of a private wallet. Over the past 30 days, 209 traders have made 903 individual transactions totalling 271 ETH of volume.

On Tuesday 16th October, Trustless had its largest trading volume day to date, with over $100k traded through the portal.

After the limited initial launch last month, the portal is now fully open for business and we are slowly adding new pairs and functionality.

The key next steps for us are to upgrade to 0x version two and to add more DAI pairs as well as improving the UI. We are also seeking feedback from users on how we can make improvements, so please get in touch on our telegram group if you have any ideas.

5. Business Development

Business development continues to be incredibly busy as we build relationships with partners across a wide variety of project areas, including (but not limited to) Ethfinex token sales, Ethfinex Trustless, new products, on-boarding large traders and gearing up for international expansion. With the launch of a colocation offering over the next few weeks we are also speaking with some initial traders who may be interested in this service.

6. New Hires

Ethfinex is actively hiring in key areas as we look to aggressively grow our product offering. We are a small, dynamic and close-knit team, working to expand across a wide range of functions. Despite key hires to help us with legal, marketing & content, business development, product management and technical development, we are always on the lookout for more.

If you are looking to make the leap into the digital asset space then we would love to hear from you.

Trading is now live on Ethfinex — get started here.

Sign up to our weekly newsletter and stop by our Telegram to learn more about the vision for Ethfinex.

Visit our Twitter to stay up to date with announcements, token additions and more.