Welcome to your weekly newsletter, delivering top stories, must-reads, expert analyses and guest contributions from leading figures in the blockchain landscape… Enter the ether below and let your friends know where they can subscribe.

“In the mathematical realm you cannot threaten an algorithm with a gun.”– Luis Cuende, CEO Aragon

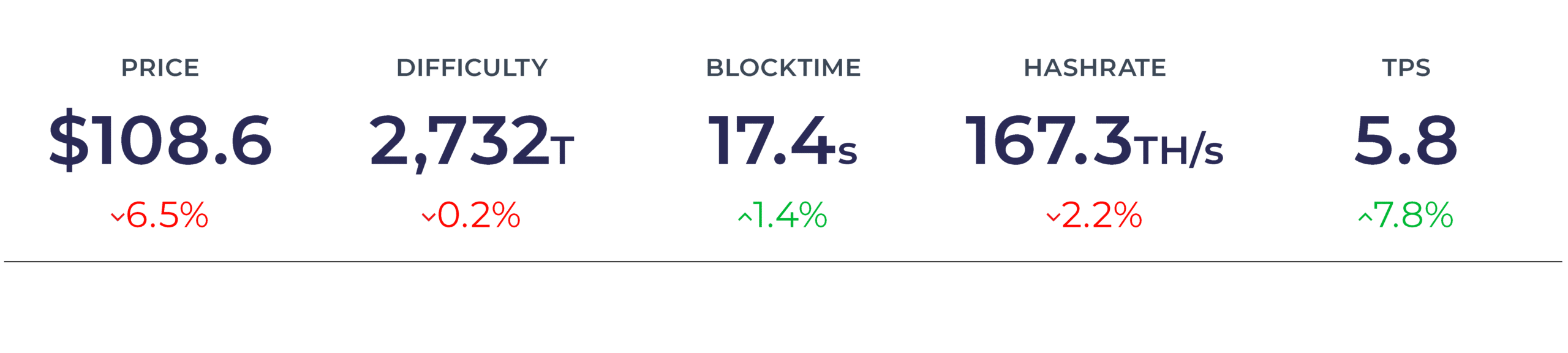

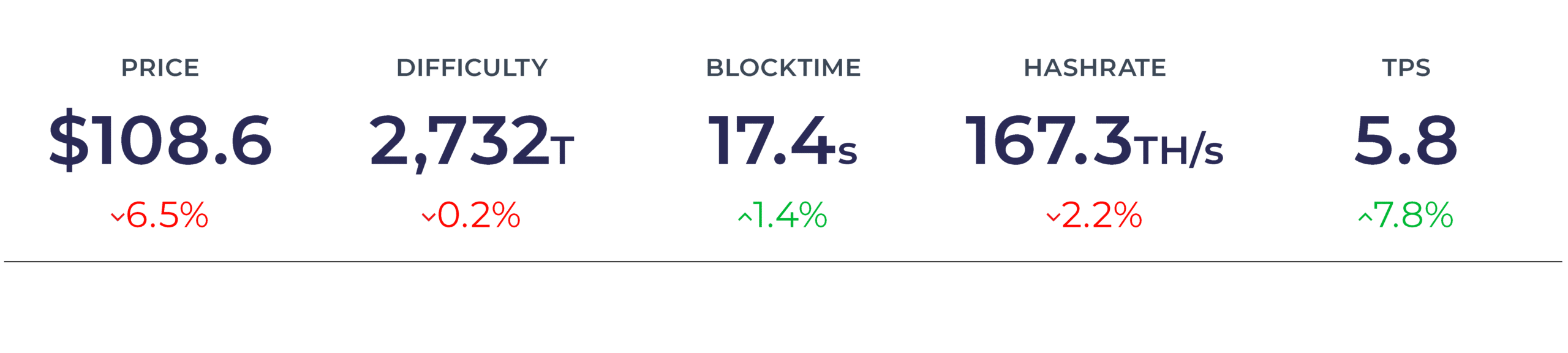

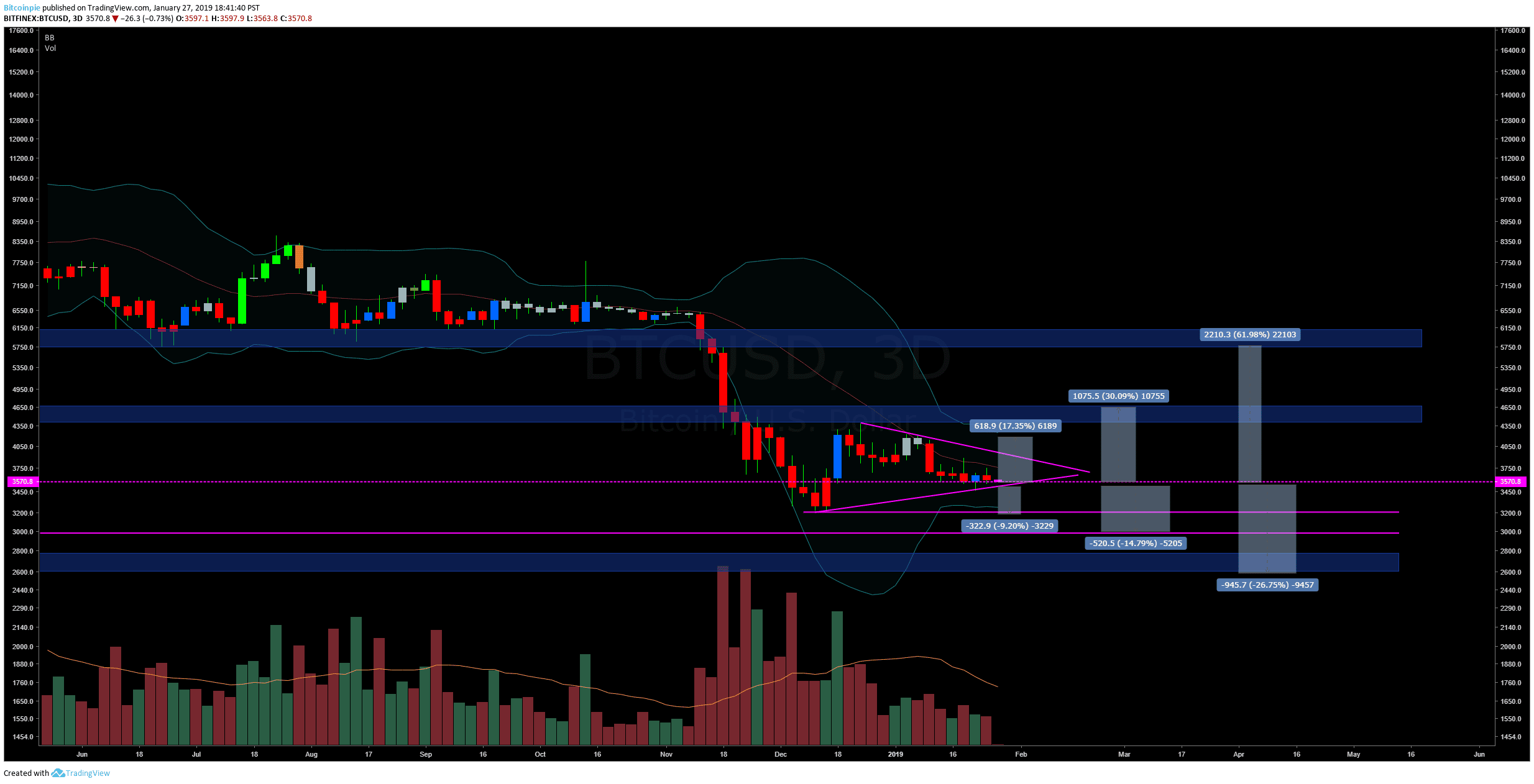

Macro: The trend continues to remain bearish, with no clear reversal for an extended rally under the major 2018 level which we broke down from at $5,700. We’ve been in this weekly range for the past 3 months and with volume declining, I’d expect a move out of this range within the next few weeks.

Support = $3,200, $3,000, $2,650

Resistance = $4,150 $4,400, $5,700

Intraday: Gap moves in the ‘bart’ formation continue to be the norm, which is typical of the low volume we have seen. A lot of the smaller caps have benefited from this, as it takes less capital to move markets, but the risk is increased for traders trying to chase the low liquidity pumps, as the spreads are often poor, and exiting / entering without slippage can prove difficult, depending on your position sizing.

Regarding bitcoin, with contracting volatility and range, I repeat my strategy of sticking with the daily levels if you’re going to place a trade in this mess, which has just been mainly stop run hunts. Execute discipline and patience when volatility is low, and the range is tight in order to preserve your capital for when the expansion occurs, and a swing trade presents itself. Near term support rests around $3,400 with $3,750 serving as a strong resistance. I have a bearish bias on price action, and would look to continue to fade any pop below $3,750, with a target of $3,400, and if broken, a move back down to the weekly support at $3,200.

Newsamentals: The announcement of CBOE’s decision to withdraw their request for a rule change, regarding the Vaneck backed bitcoin ETF was a relatively mute event. I don’t believe there was any expectation that the ETF would see approval, considering the U.S. government shut down, and the effects that had on Bakkt’s pending approval of their futures product. Assuming the U.S. government gets back on track, 2019 is shaping up to be a great year for institutional development and investment into infrastructure based companies, but I do not expect a resurgence in retail popularity until more consumer friendly products make using the technology easier and more streamlined, to fit the on demand consumer mentality. Of course, any substantial increase in price would spark another wave of speculators, but I believe we are witnessing the final breath of the crypto ‘wild west’, as regulations and enforcement will continue to work through the ICO landscape, and focus more on the OTC markets and relatively untouched mining space. If you’re a fan of having a U.S. based ETF, accept this as a reality, as more transparency and insight has been one of the main focal points of the SEC throughout the ETF filings and subsequent feedback given.

Bio: I’ve been involved in the space since late 2012, and trading crypto specifically for that past six years. I’m currently serving as CIO at Redact Capital and VP of sales at Square Mining. Get in touch with me on Twitter.

The Top News 📌

- In another instance of adoption, Levi Strauss, Harvard & New America will trial Ethereum blockchain to track factory worker welfare. Granted by the US State Dept. Source.

- Ethereum on-chain transaction volume reached a record high in December last year, hitting 150 million. Source.

The Must-Reads 💭

- Andrew Keys of ConsenSys offers a detailed forecast on ‘The Fourth Industrial Revolution’, breaking down his list of blockchain predictions for the young year ahead. Source.

- Hunter Hillman of Connext eloquently lays down the case for Ethereum Scalability. Source.

The Nitty Gritty ⚙️

- James Prestwich composed a beautifully thorough engineer’s guide to ETH2 (Serenity). Source.

- If you really want to dive deep into technicalities, this is Adrian Sutton’s, Ethereum State Rent Proof of Concept. Source.

What?

This week the Financial Conduct Authority (FCA), the UK’s financial regulatory body, published a Consultation Paper on cryptoassets. Regulation is probably the single most important factor to the success of crypto over the short term so this report has profound implications for the industry.

Why?

The FCA lays out three types of cryptoasset and working out which category an asset falls into is crucial as that determines whether or not it is regulated by the FCA. The three categories are:

- Exchange tokens (unregulated): these are not issued or backed by any central authority and are intended and designed to be used as a means of exchange. They are, usually, a decentralised tool for buying and selling goods and services without traditional intermediaries.

- Security tokens (regulated): these are tokens with specific characteristics that mean they meet the definition of a Specified Investment. The token holder holds the token for either direct or indirect investment purposes.

- Utility tokens (unregulated): these tokens grant holders access to a current or prospective product or service but do not grant holders rights that are the same as those granted by Specified Investments.

What Now?

So, how do we know if a token is a security token? Crucially, the FCA are technology agnostic. This means they look at the intention and use of both the issuer and owner of the asset, regardless of how it is labelled or whether or not it is crypto. This means, if the token has the characteristics of a traditional security, then it is likely to be a security token.

“We consider a security to refer broadly to an instrument (i.e. a record, whether written or not) which indicates an ownership position in an entity, a creditor relationship with an entity, or other rights to ownership or profit.”FCA “Guidance on Cryptoassets” Consultation Paper (2019)

What we think…

Overall this report was positive for the crypto community. The FCA has taken a very different stance to the SEC, which requires a token to be “fully decentralized” for it not to be considered a security (only BTC and ETH are considered sufficiently decentralized at the moment). Hopefully other national regulators take a similar approach.

Getting About

Design Director, Rikke Rasmussen, represented Ethfinex at the Blockchain Convergence Summit in South Korea. The subject? Ethfinex’s brand journey and how we have set-about creating a fluid, multi-faceted brand for a hybrid decentralised exchange.

On Tuesday, Commercial Director, Ross Middleton, will be presenting Ethfinex at the Crypto Valley event in Zurich, discussing the benefits of decentralised trading over the conventional, centralised status-quo. Ross will be on a panel with NASDAQ, SIX, Likke and other heavy hitters, representing Ethfinex and all advocates of decentralised trading. Bring it on!

Take a second to let us know what you liked, or would like to see added, to your weekly newsletter. *no wei’s are distrubuted in the making of this newsletter… we just love a good pun!

Subscribe to our newsletter here.

Start trading on Ethfinex or Ethfinex Trustless.

Stay up to date with Ethfinex on Twitter, Telegram, Linkedin, Facebook and Youtube.