Introduction

At Ethfinex, being a user means owning a part of our longer-term journey.

Traders earn Nectar (NEC) tokens, which gives them a claim on a share of Ethfinex’s fee revenues and the ability to propose and vote on governance decisions.

Distributed governance only works in transparent environments, and as part of this we commit to publish open and honest monthly reports, reflecting the trends of each 30-day period.

February at a Glance

Behind the scenes our focus is currently on building our next major product and consolidating foundations ready to take advantage of the next upwards market wave.

We have to acknowledge that by numbers the January/February 2019 period was our lowest month on record for fee income, and we dive into potential causes further down in this report.

The number of opened accounts is still growing daily with almost no marketing spend, and we are building a strong team which can not only ride out the ‘crypto winter’, but also thrive.

As we head towards the next stage of our journey, we are asking the Ethfinex community to vote on our mission statement. The mission statement is incredibly important as it articulates what Ethfinex stands for, provides a yardstick to help measure future decisions against, and unites us as we continue to grow and distribute ownership.

Ethfinex Deep Dive

We are working hard to benchmark our performance better both internally and externally. This is not easy given the prevalence of fake data throughout this industry, but we are gradually improving our own analytics tools.

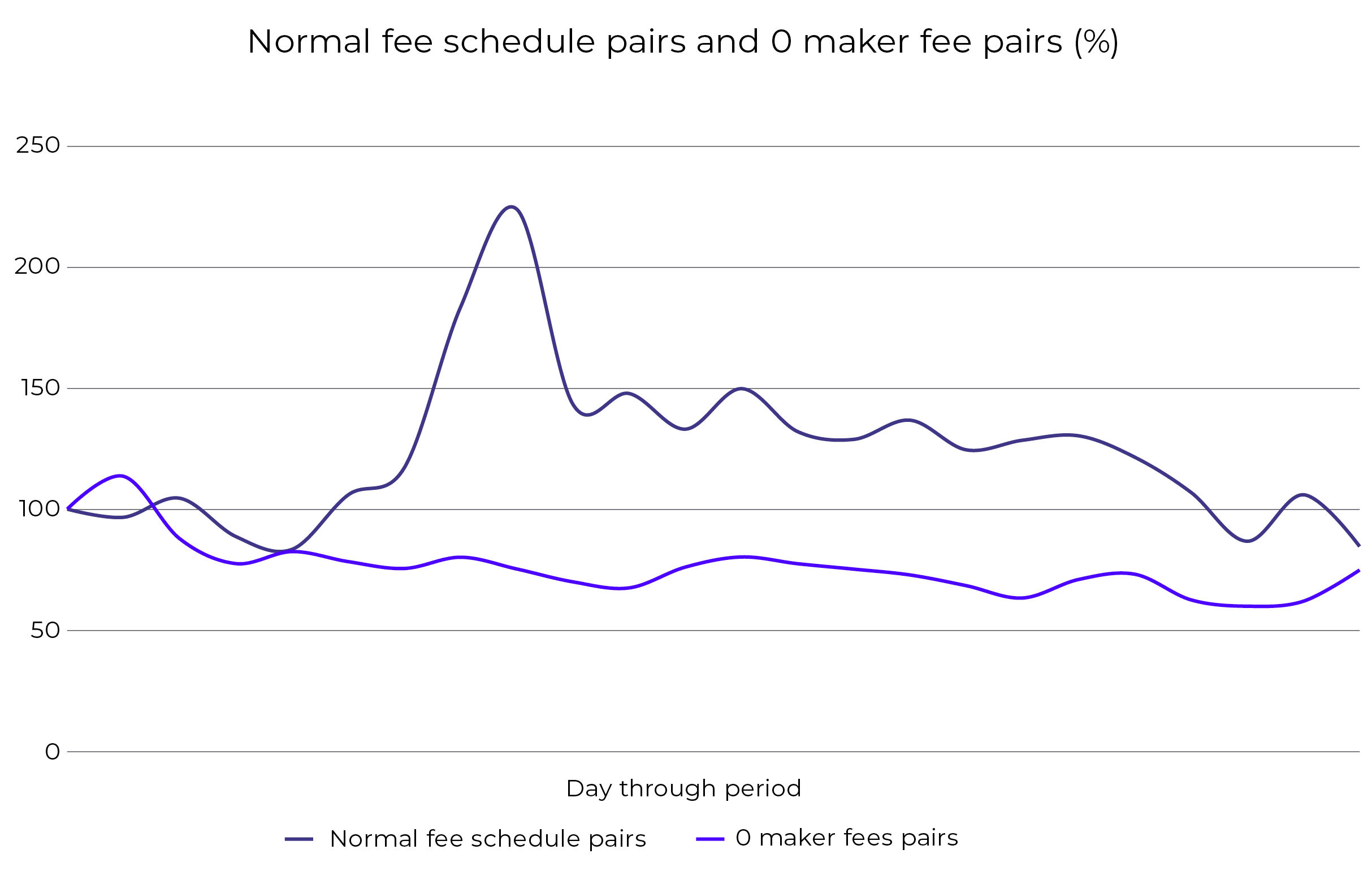

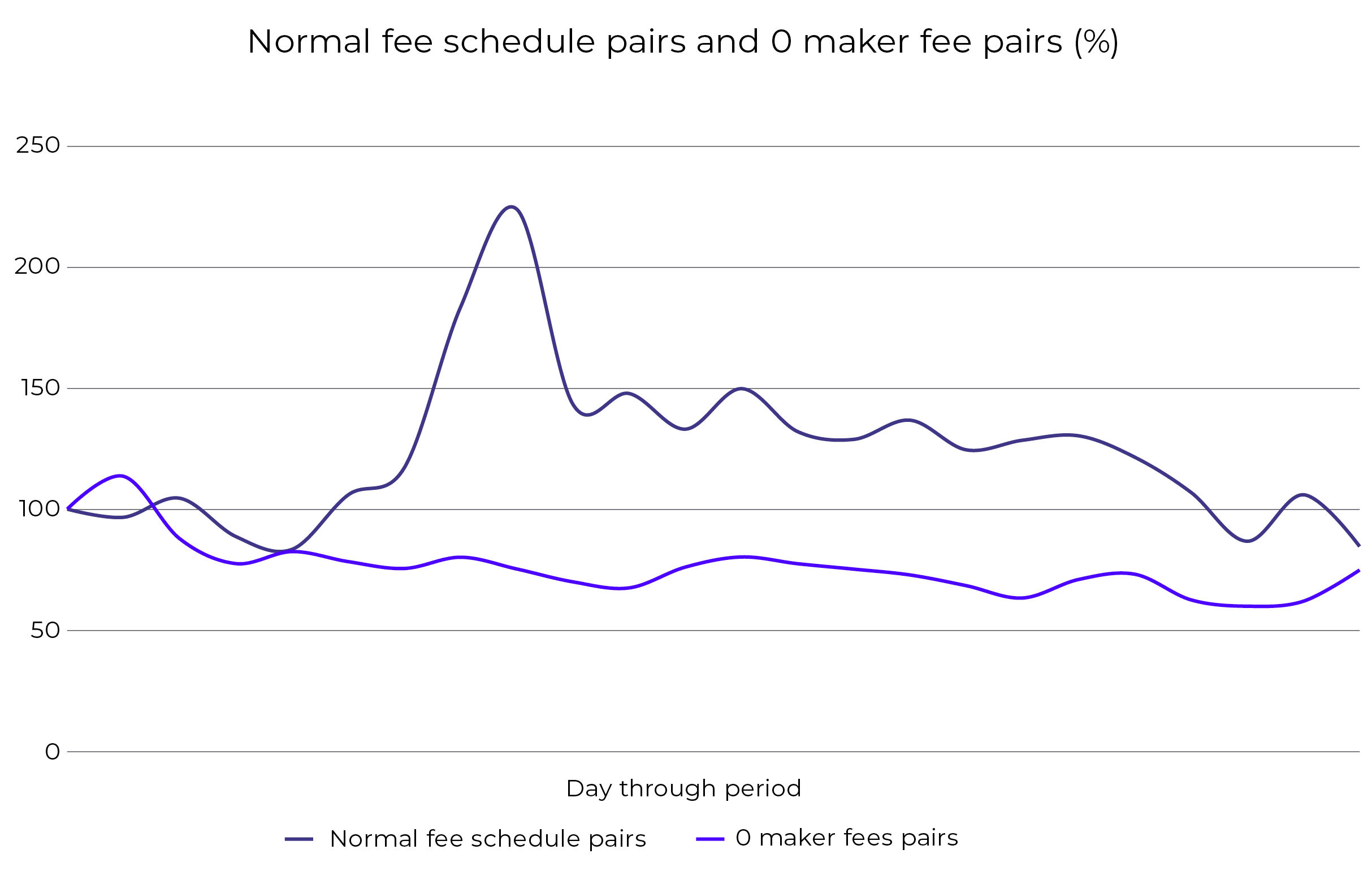

During the past month we launched our Zero Maker Fee initiative with the aim to boost trading activity on tokens with small trading volume. We are happy to report that this lead to a gradual reduction of 40% in the average bid-offer spreads of the pairs benefiting from no maker fees. This month the general market trading volume has been lower than last month’s and this has been reflected in the increase of the spreads of our pairs with unaltered fee schedule. If we take those high volume pairs as benchmark for the market conditions, the spread reduction of the Zero Maker Fee pairs is even larger. We look forward to seeing the impact in higher volume periods.

Daily average spread for pairs with zero maker fees vs normal fee schedule pairs indexed to their levels at the beginning of the period.

Executive Summary

The performance period covered in this report is 10th January 2019 – 8th February 2019.

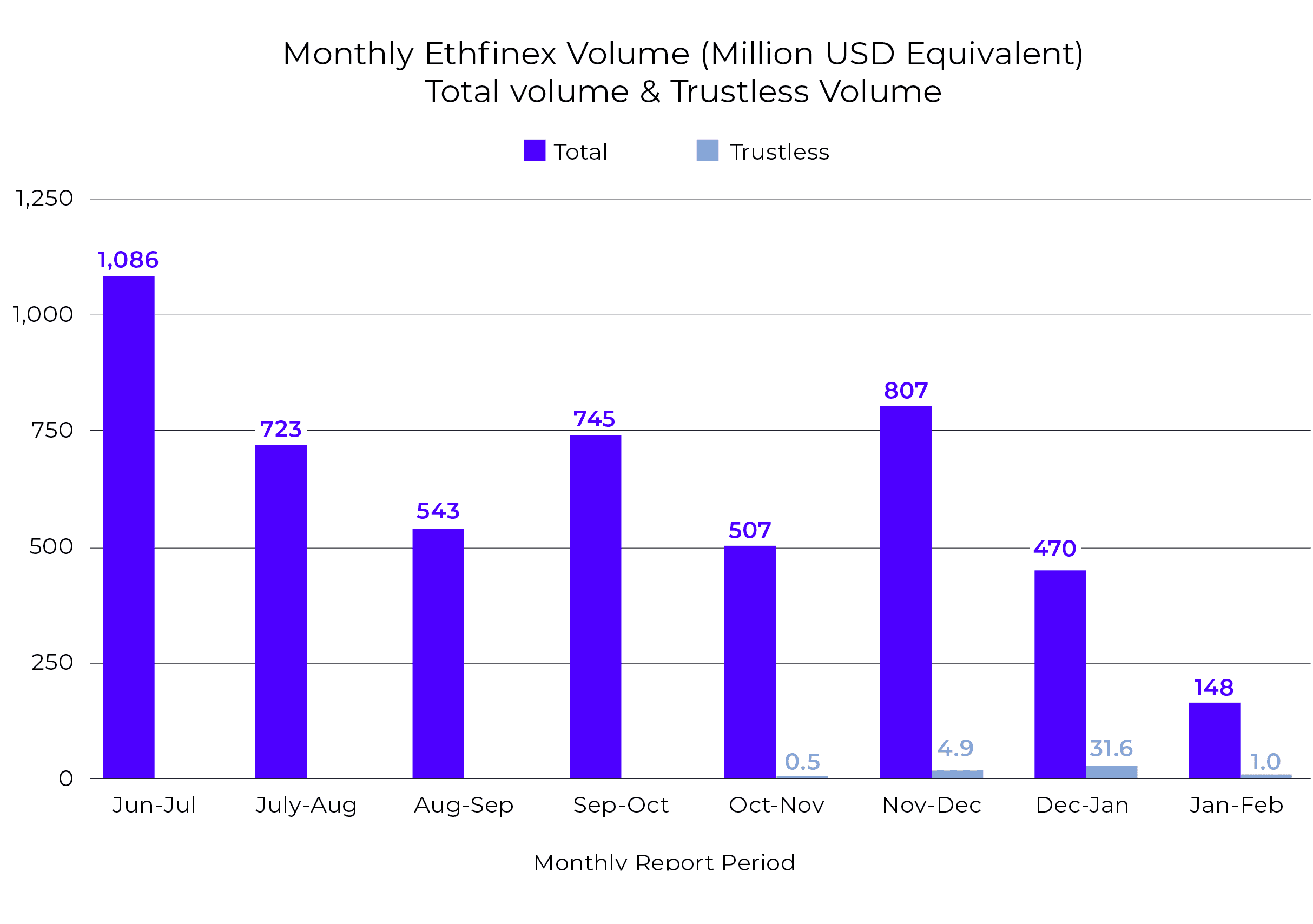

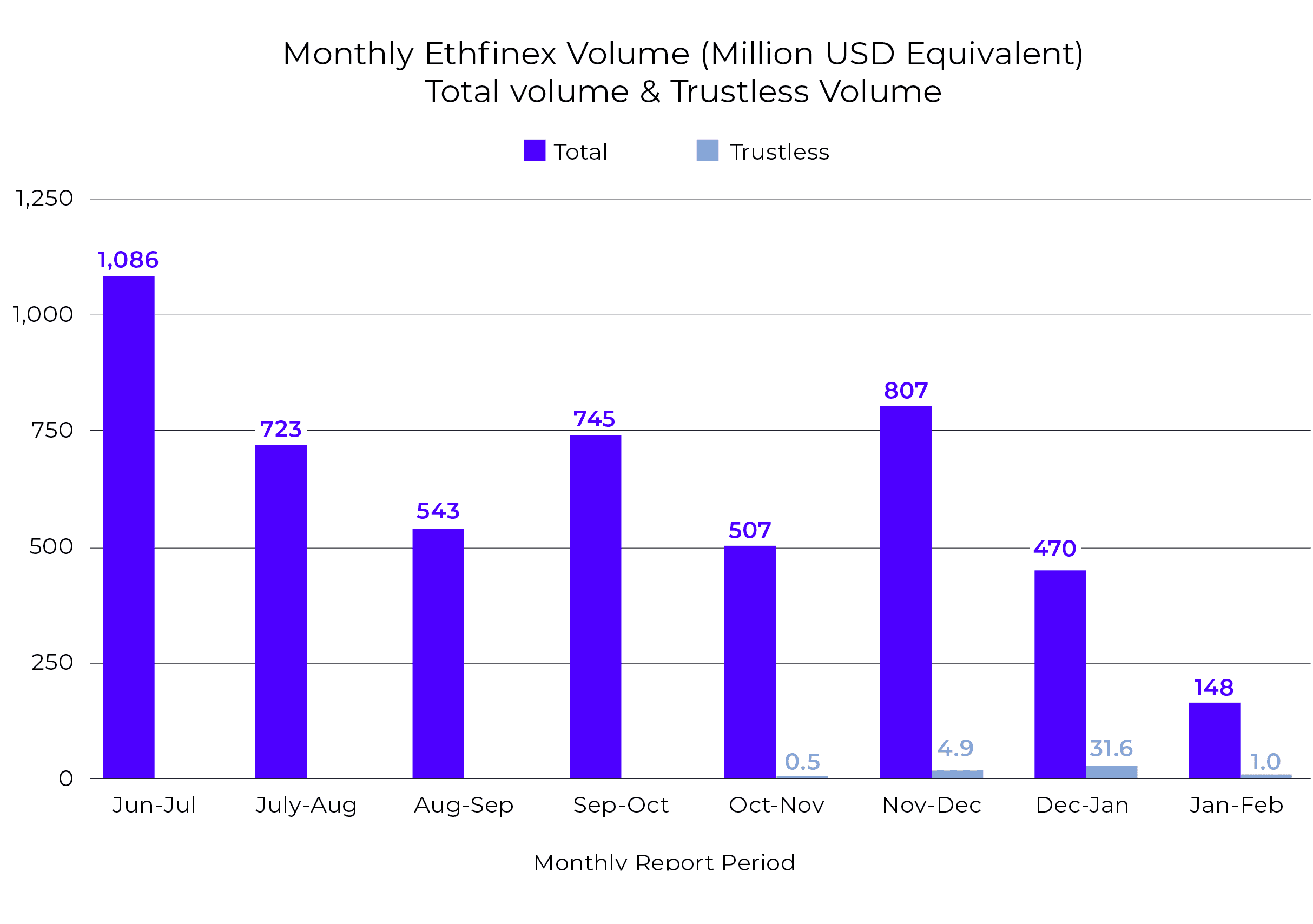

- Total trading volume for the period equalled $147m, a simple average of $4.9m per day, and a decrease of 69% from the previous period.

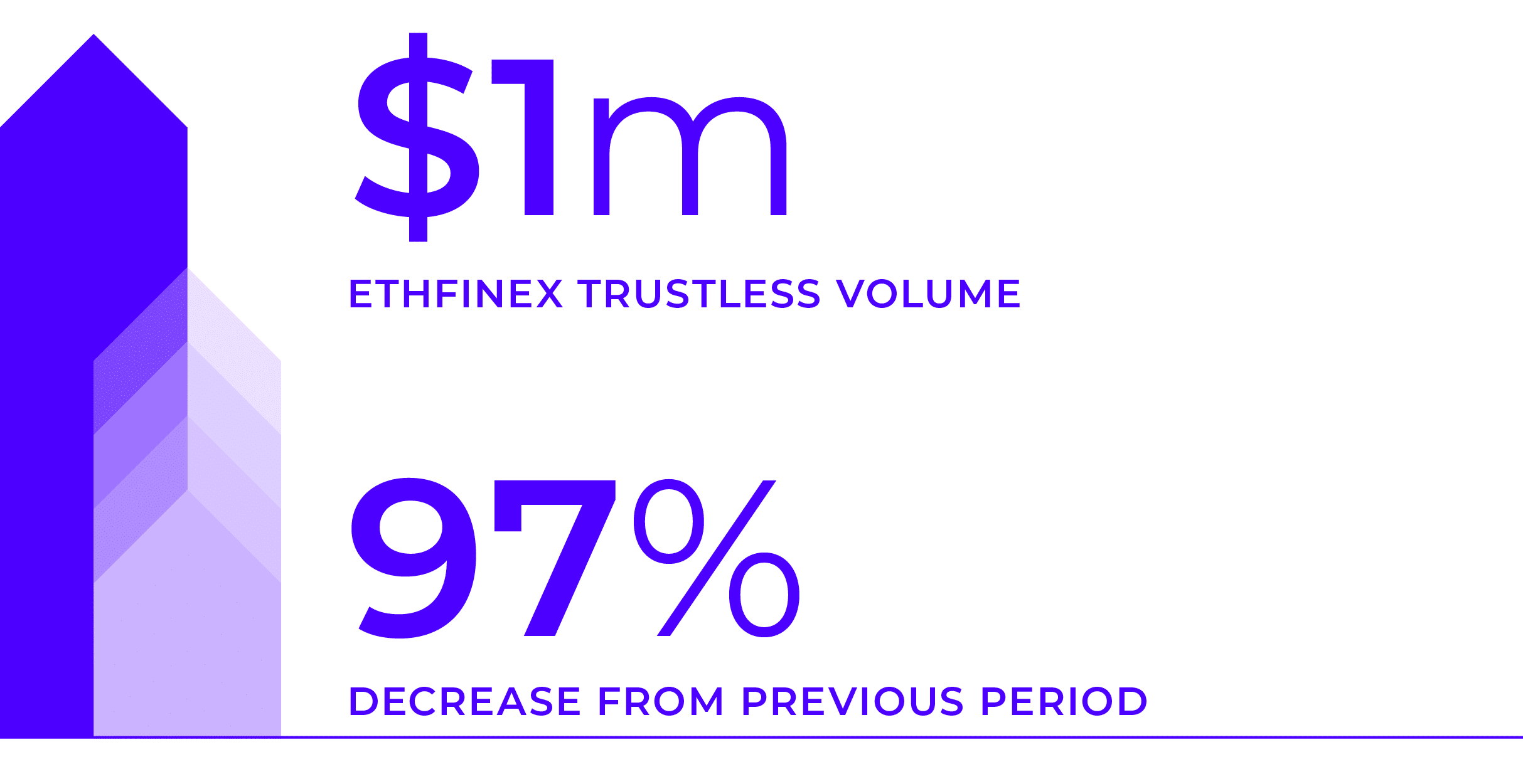

- Ethfinex Trustless volume for the period totalled $1m, a decease of 97% from the previous period.

- Total trading fees of ~$110k (average daily ETH/USD across the period) were collected through trading over the period, a decrease of 73% from the previous period.

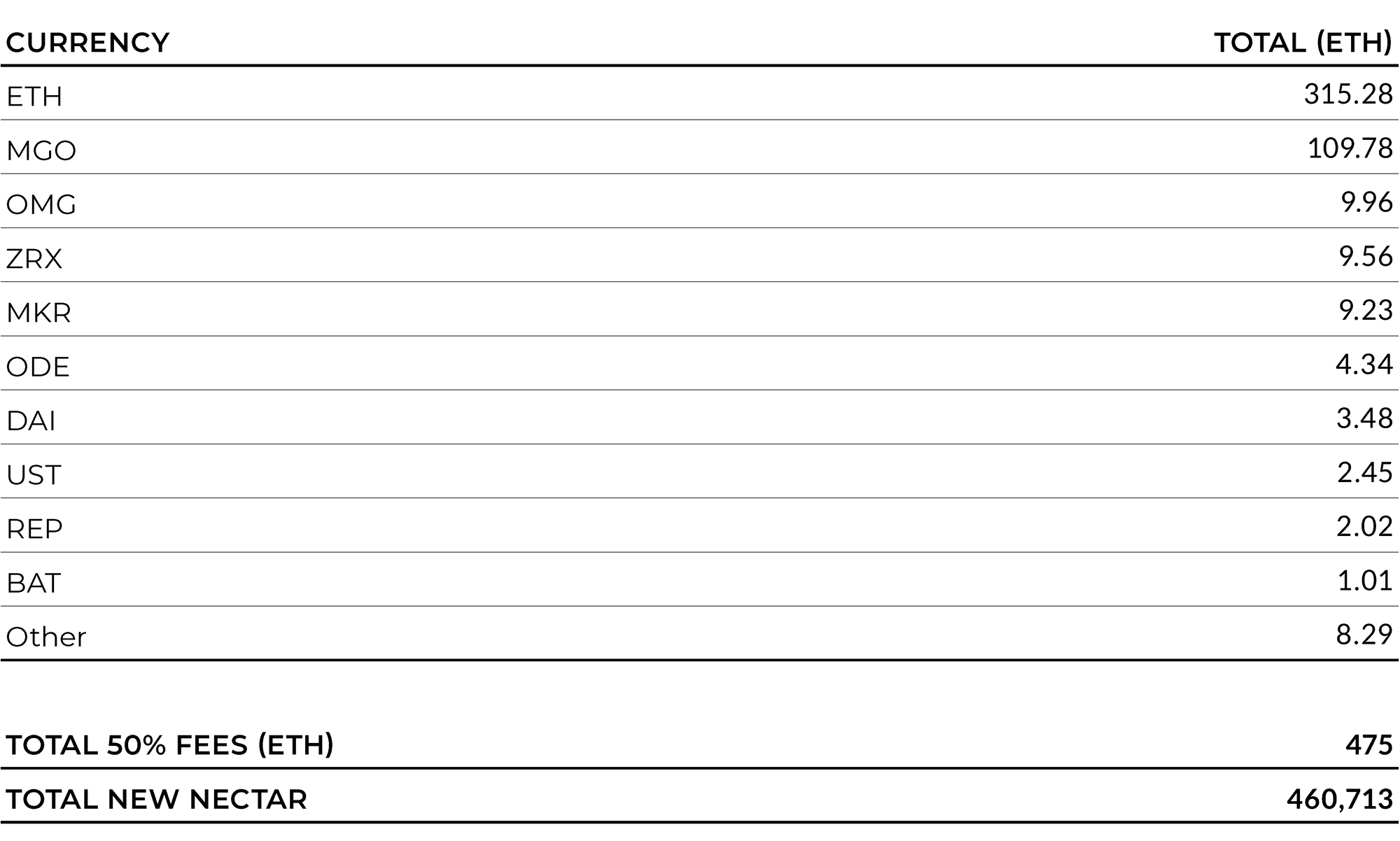

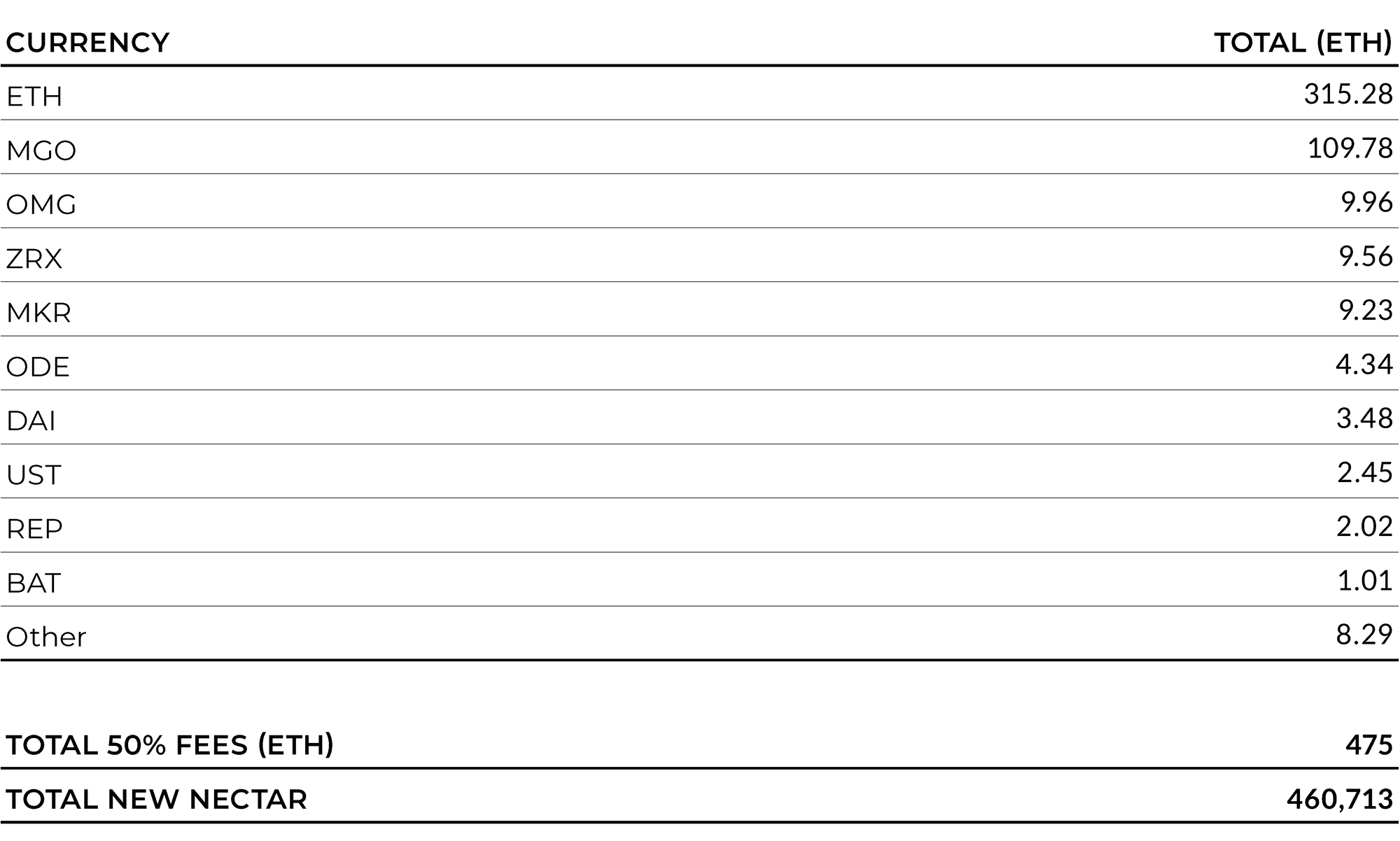

- In line with the amount of fees collected, 475 ETH have been contributed to the Nectar token contract, pledged to NEC holders.

- 460,713 NEC tokens were distributed to reward market marking activity on Ethfinex in the past month. Statistics can be viewed on Nectar.community.

Month in Review — February

Revenue & Activity Reports

1. Cryptocurrency Trading Volume and Volatility

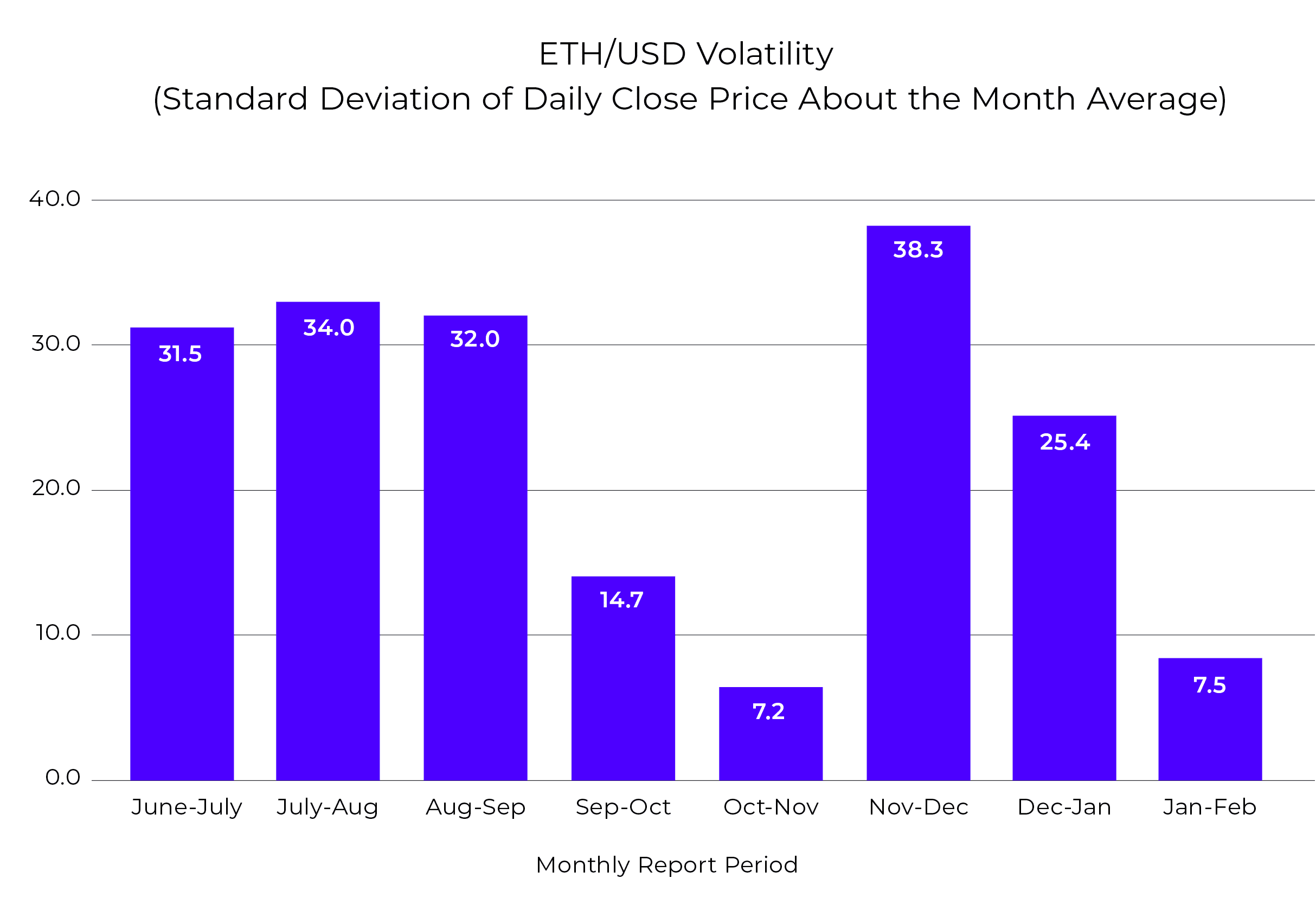

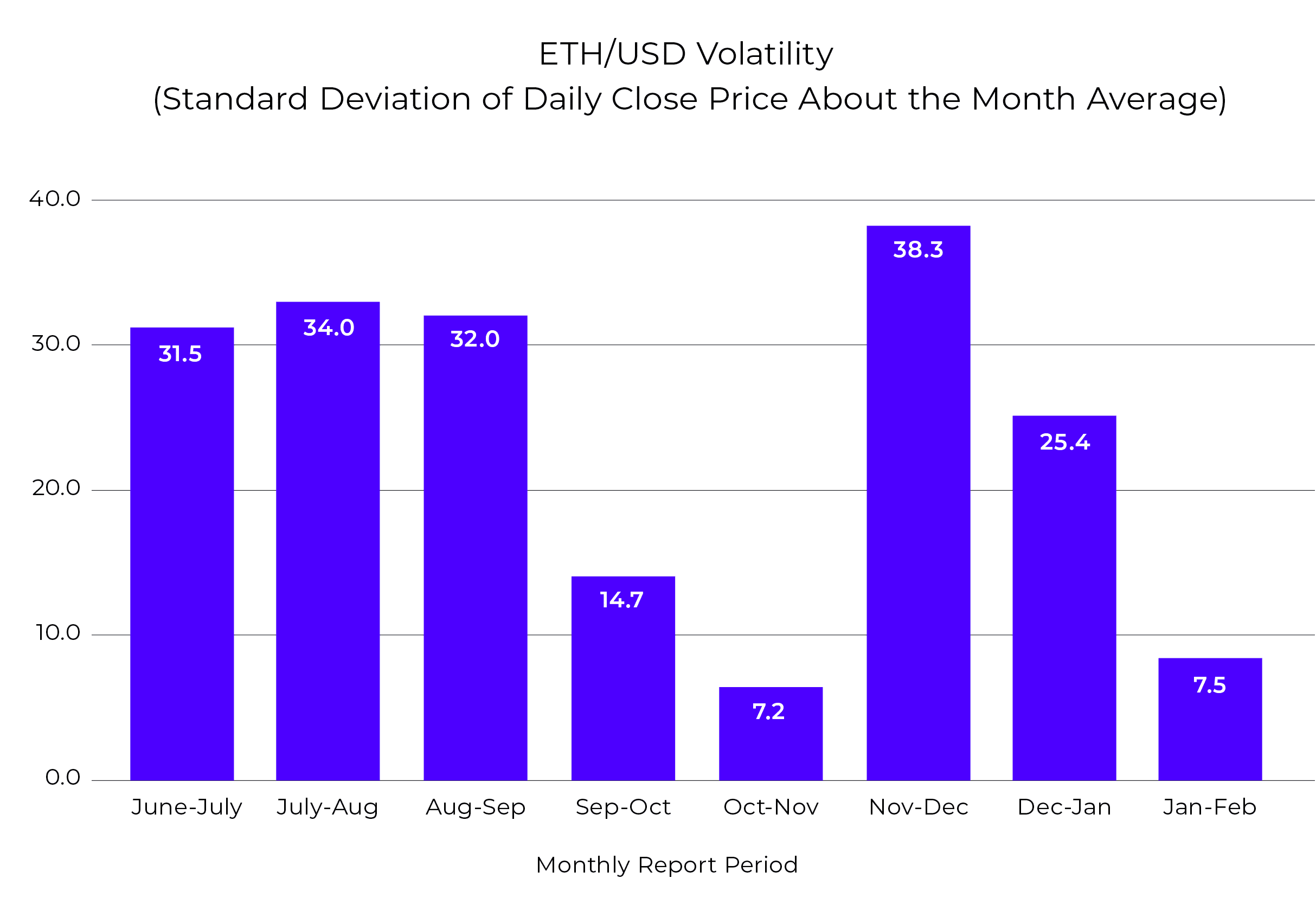

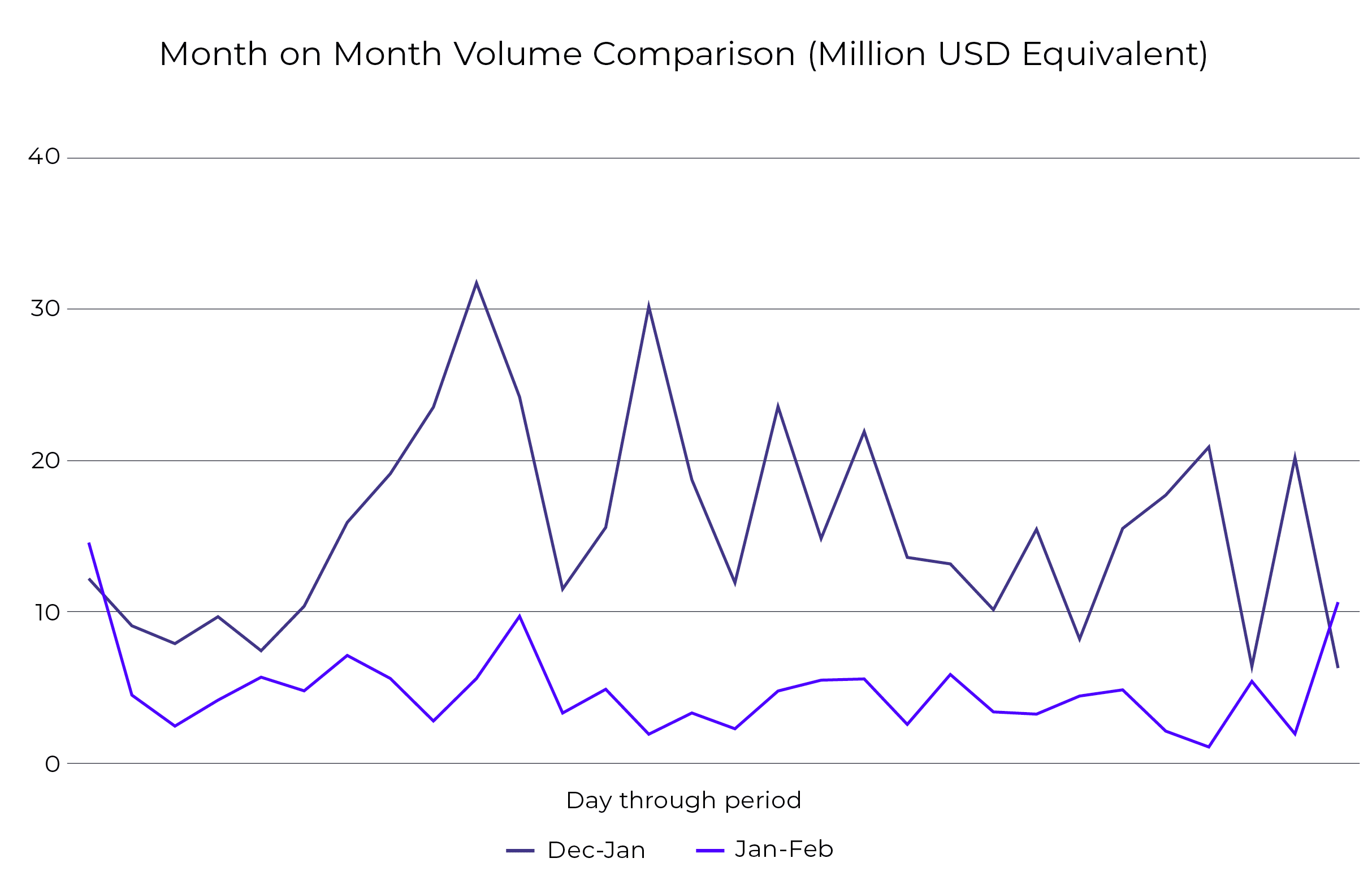

Ethfinex total 30-day trading volume decreased 69% from the previous period in USD terms to $147m. January was a very quiet period across most reputable exchanges (see volatility reports below), appearing that many traders failed to re-engage with the markets after the festive period. We think that the lack of volatility (down 75% month on month) was the main driver of this behaviour, as when volatility returned to the markets from Feb 14th onwards, volume and activity jumped again.

Daily ETH/USD volatility, as measured by the standard deviation (the square root of the average squared daily close price variance vs the average month price), decreased an incredible 75% compared to the previous month to reach one of the lowest levels for 15 months.

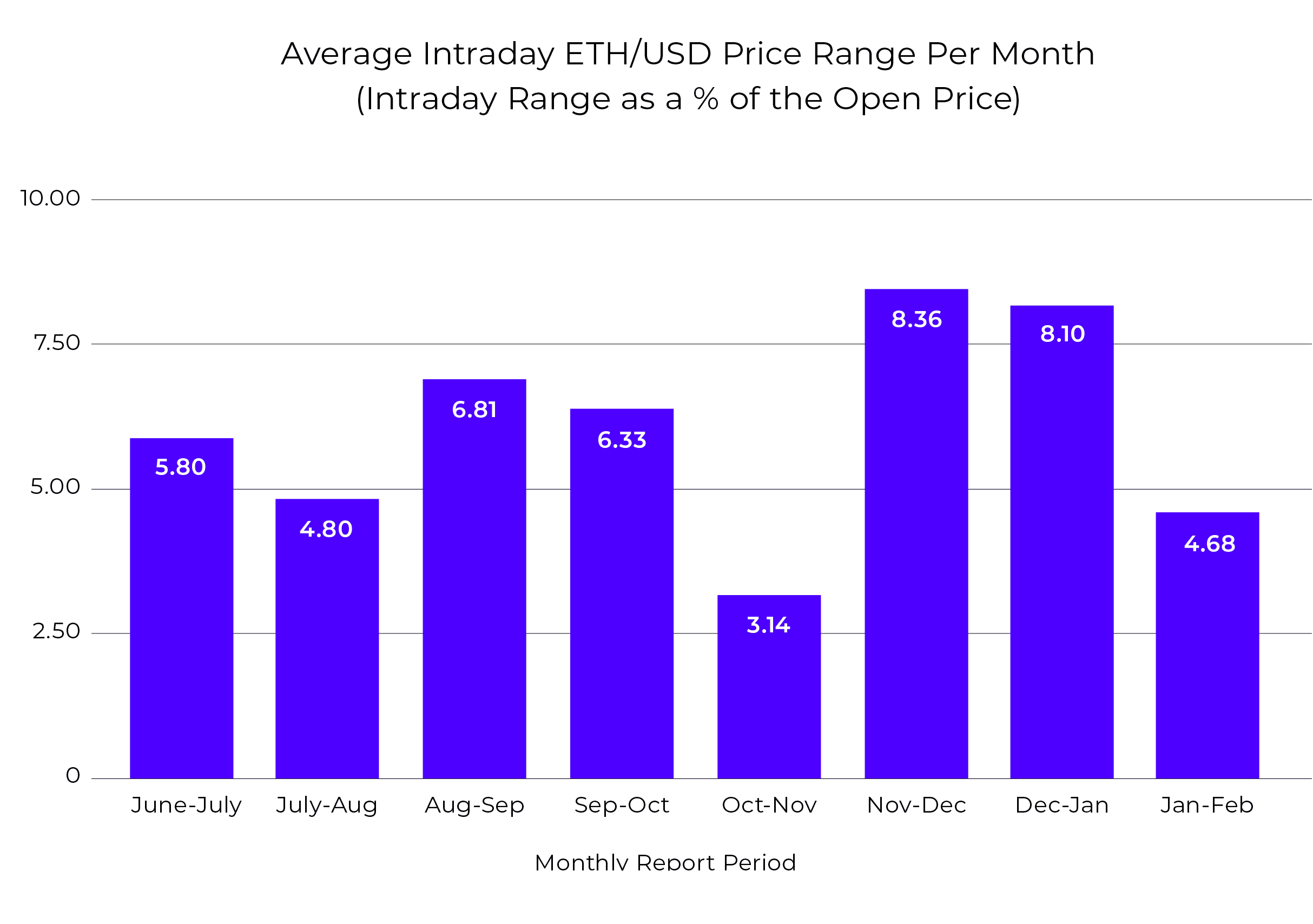

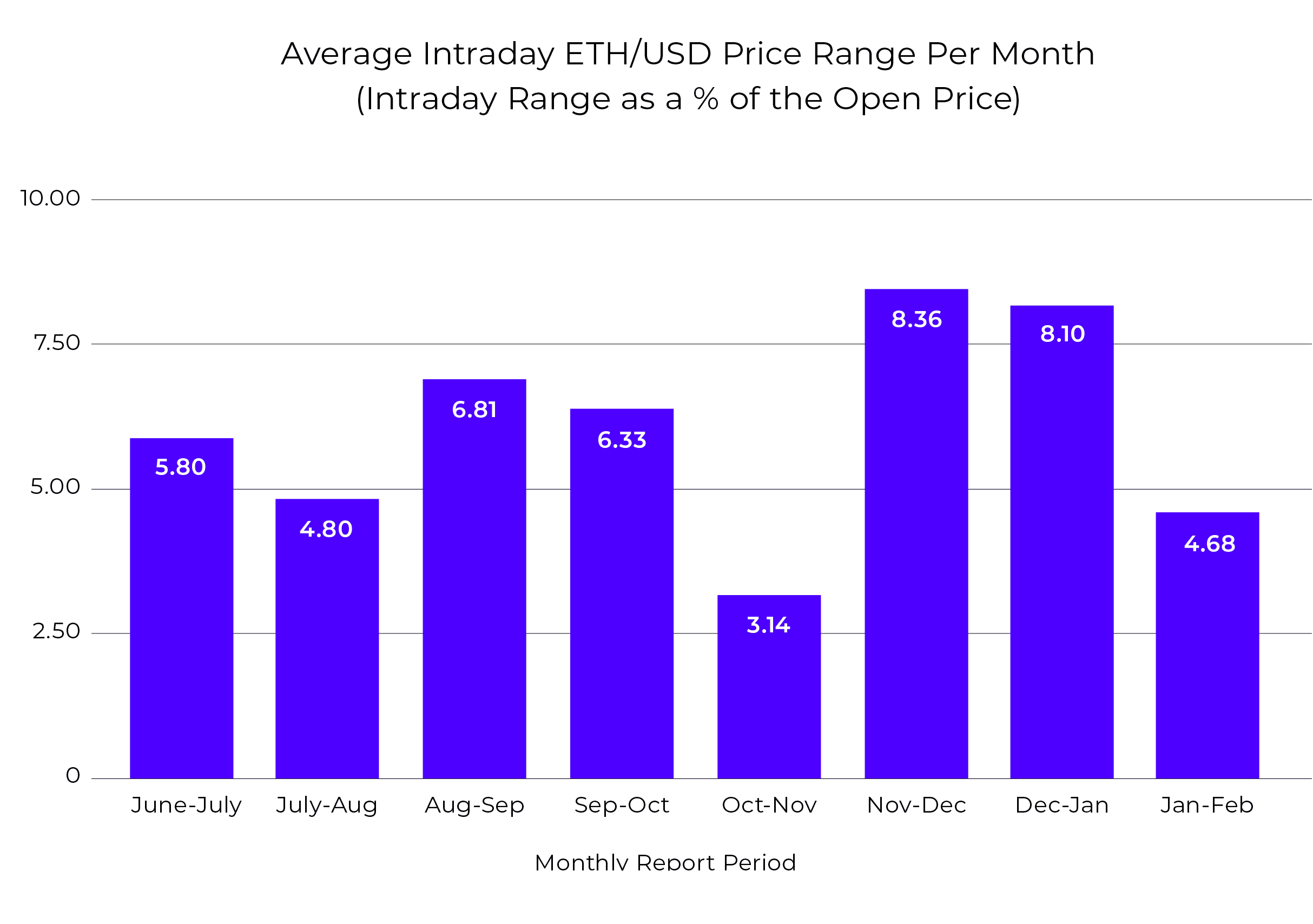

Intraday ETH/USD volatility (as measured by the intraday range as a percentage of the open price) also decreased from 8.1% to 4.8% (a decrease of 42%). Again, this was one of the lowest levels for 15 months

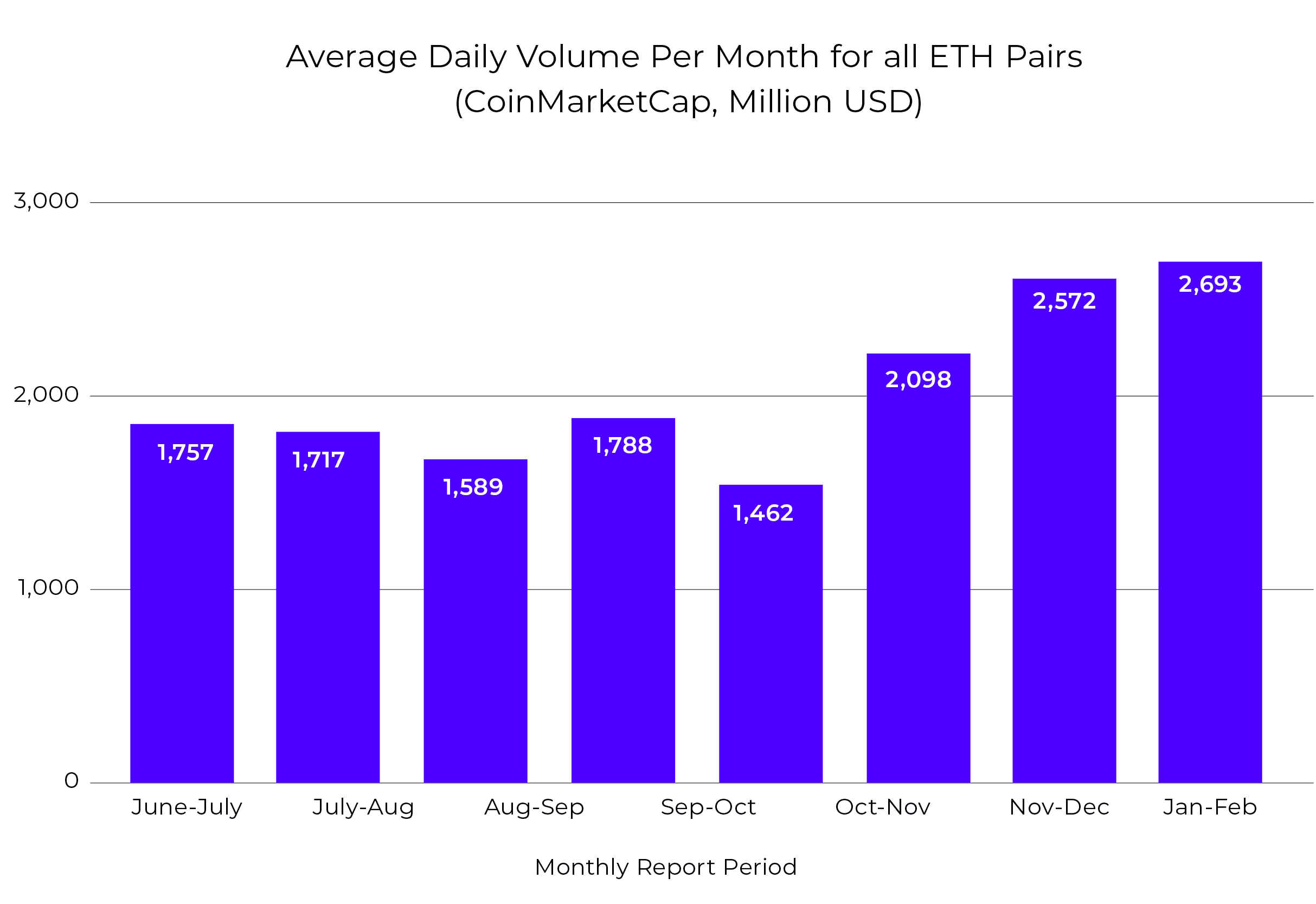

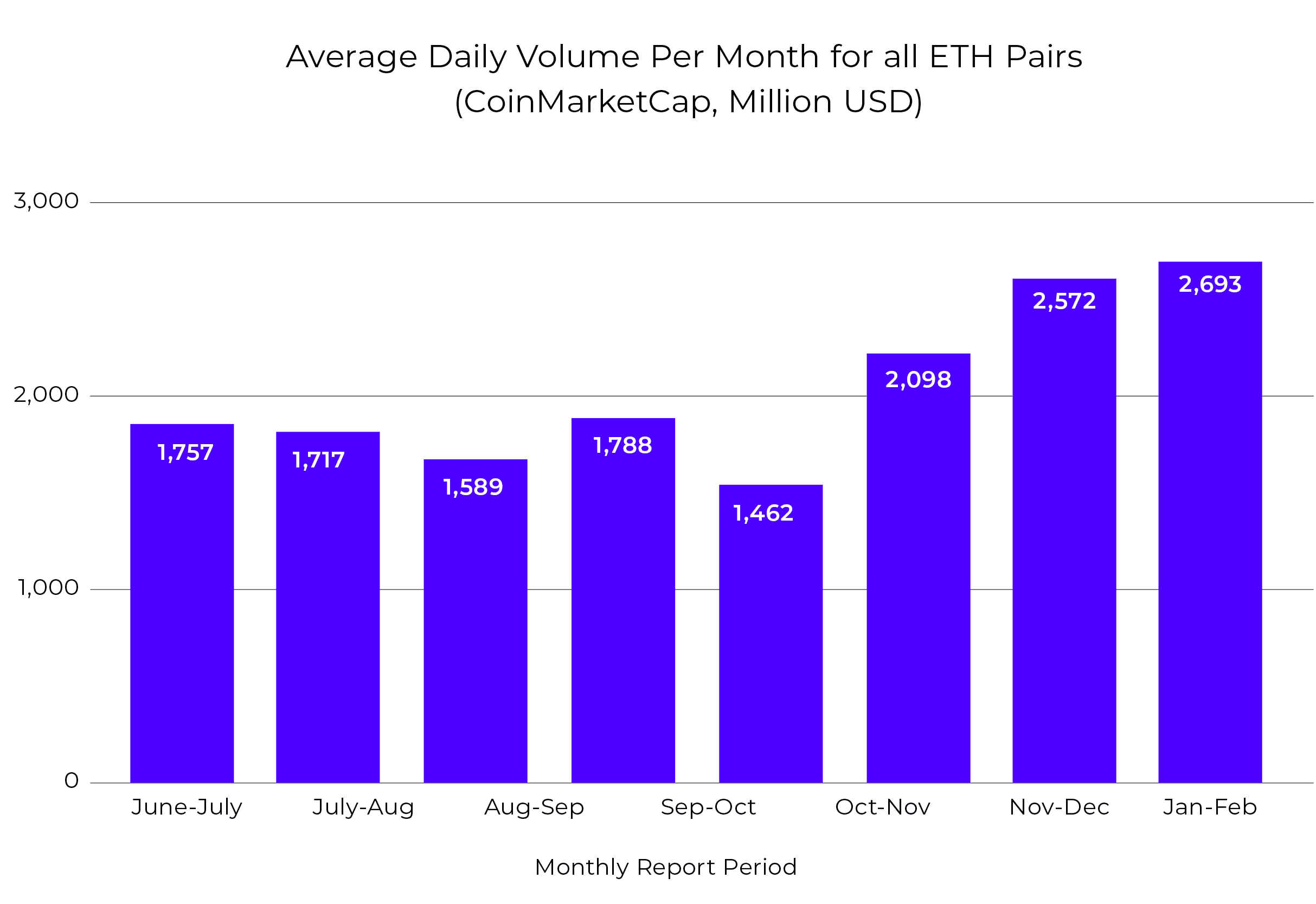

Average daily USD volume for all Ethereum pairs, across a sample of exchanges (CoinMarketCap data) increased 4% from the previous period – completely driven by Asian exchanges who managed to sustain trading volume despite the complete drop in volatility.

Trading volume correlated to the most volatile days in Jan-Feb. Peak daily trading volume was only $14.6m (10th Jan), a decrease of 54% compared to the peak trading day in the previous period.

Unique user numbers declined 10% across the period compared to the previous month. We believe that this is linked to the low volatility and lack of token sales and community votes. With new product launches just around the corner, we expect this trend to reverse imminently.

2. Trading fee revenues

All fees were converted as they were collected into ETH to provide an averaged conversion cost across the month and smooth out the effects of price volatility during the period.

The above chart shows 50% of all fees collected in ETH. 475 ETH were collected during the month and pledged to NEC token holders. ETH/USD and OMG remain the main fee generators.

Total trading fees of ~$110k (average daily ETH/USD rate through the month) were collected through the period, a decrease of 73%.

3. Ethfinex Trustless

Ethfinex Trustless volume for the period totalled $1M, a decrease of 97% from the previous period. The lack of volatility across the month vastly reduced the amount of arbitrage opportunities available via Trustless.

With a fee rate of 0.25% (higher than the fees on the centralised version of Ethfinex), Trustless has the potential to become a serious fee generator for Nectar token holders.

Most of the main changes to Trustless during the past month have been under the hood and have mostly focussed on bug fixes.

Due to popular demand from the community we have also added several new DAI pairs, including MKR, ZRX and OMG.

The Month Ahead – Feb/Mar 2019

1. Additional value drivers for the Nectar token

At the Ethfinex Governance Summit in Lugano five months ago, NEC community members provided recommendations to help drive forward Ethfinex on key items such as volume, customer acquisition, strategy and new products. After achieving key stakeholder sign off on some of these proposals, we are steaming ahead with some of the priority features. We are very close to launching the following three features which will be essential for underpinning Nectar value:

1) Restarting the two-weekly Ethfinex community new token listing vote with a new and improved process, which will flip the dynamics of voting on its head.

2) Providing Ethfinex Superusers (those holding certain amounts of Nectar tokens) with valuable benefits on the platform, giving a strong incentive for new traders to acquire more Nectar and join Ethfinex. The most significant benefit will be the ability to skip fee tiers.

3) Allowing token projects to provide a limited bounty/subsidy to lower trading fees on their trading pairs.

4. Ethfinex Token Sales

January saw the token sale platform move to a single page application that is separate to the main exchange. This means that we have more freedom to update and make changes, outside of the scheduled exchange maintenance periods.

We are mid-way through a complete overhaul of the token sale platform and will be relaunching it shortly with an incredible new UI. We have also made the difficult decision to remove the ballot element of the contribution process. Although we still feel that this is the fairest way to give everyone an opportunity to participate in popular sales, many users found this confusing and added unnecessary friction . We want to make sure the whole process is as clean and simple for everyone to participate in as possible.

We also have some incredible token sales lined up for the next six months. Watch this space.

If you are planing a public token sale, or know a token sale you would like to bring to Ethfinex users, then we would love to hear from you: [email protected]

4. Trustless Revolution

We have been yelling form the rooftops about Trustless over the past few weeks. Both Ross and Will have been speaking at conferences around Europe, presenting both Trustless in its current form and the next steps on our journey towards full decentralisation.

We will have a sizeable presence at EthCC in Paris in a few weeks time. If you are planning on attending or are in the area then please do connect with us to say hello.

In terms of product improvements, we have been speaking to a selection of top wallet providers and DEX aggregators about integrating Trustless. Soon you will be able to swap tokens from the convenience of several mobile wallets and custody solutions, trade with decentralised margin and much more. We also plan on upgrading to 0x V2.

We have also been speaking to several token projects who will soon be launching products that require a quick, secure and liquid way of exchanging their tokens at very competitive fees. Trustless is perfect for this.

Please email [email protected] if you would like to explore an integration.

Conclusion

Thank you for taking the time to read the February performance report. It has been a disappointing month for volume, but strong in product development and laying robust foundations for the stretch ahead.

If you have any questions, please feel free to ask them on our Telegram group or send an email to [email protected].

Trading is now live on Ethfinex — get started here.

Sign up to our weekly newsletter and stop by our Telegram to learn more about the vision for Ethfinex.

Visit our Twitter to stay up to date with announcements, token additions and more.