How to promote sustainable growth through token issuance by identifying and aligning valuable users with a platform or protocol’s long-term purpose

Why Tokens? – Building a Network Effect

For many people in the aftermath of the ICO (initial coin offering) rush of 2017-18, ‘tokens’ have become synonymous with ‘cash grabs’ in the best case, or ‘scams’ in the worst. In fact, one study by ICO advisory firm Statis Group claims that more than 80% ICOs conducted in 2017 were identified as scams.

The reason for this flood of bad practice? The heady promise of raising funds. With $20bn raised since the start of 2017 investors were drawn into a market where it seemed like anyone could double their money, and platforms and protocols leapt at the opportunity to cash in by distributing tokens with little consideration of the long term impact.

This ‘cash grab’ association does a real disservice to the intrinsic potential of tokens. There are many reasons why a newly launched platform or protocol might design and incorporate its own new token. For example tokens can be issued in transaction for one-off tasks such as testing, or to reward longer term loyalty.

However the biggest potential in this space are tokens which genuinely align with the issuer’s purpose as this can be an incredibly powerful way to bootstrap a network effect.

A network effect is a phenomenon whereby a product or service gains additional value as more people use it. A good example of this network effect in practice is AirBnB – this two-sided platform is reliant on matching sellers and travellers. The more people offer their homes for accommodation, the greater the choice and more attractive the platform to travellers. Simultaneously, the more people willing to pay to stay in other people’s homes rather than hotels, the more likely people are to list their properties.

All currencies (fiat and crypto) benefit from network effects. The US Dollar, for example, would cease to hold value if no one was using it or willing to accept it. So it is easy to see how this effect applies to applications in the crypto landscape, as being built on open source protocols such as Ethereum they become more useful the more developers build on top of them (and conversely less valuable with lower levels of participation).

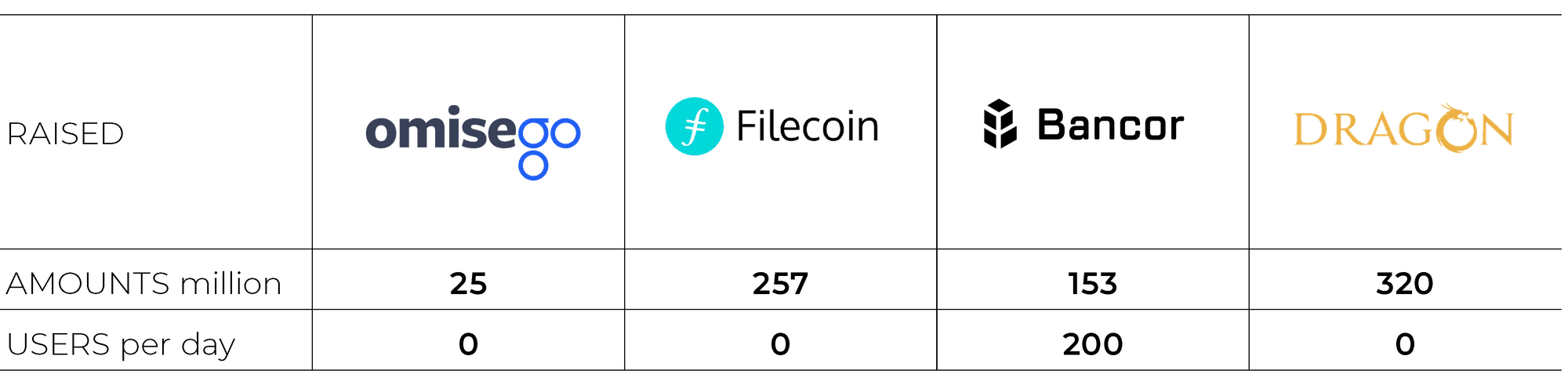

Tellingly almost none of the tokens issued during the gold rush period of 2017 and early 2018 have so far achieved sustainable network effects.

Rather than blaming the concept of token issuance itself, I believe the fault lies in the seduction of quick wins, at the expense of considering sustainable distribution models.

With this in mind, this post will take a look at the evolution of token distribution to date, and what can be learned from each model. We will then share how Ethfinex has flipped the traditional method on its head with our innovative Nectar distribution model which places the network effect at its core.

Early Distribution Models

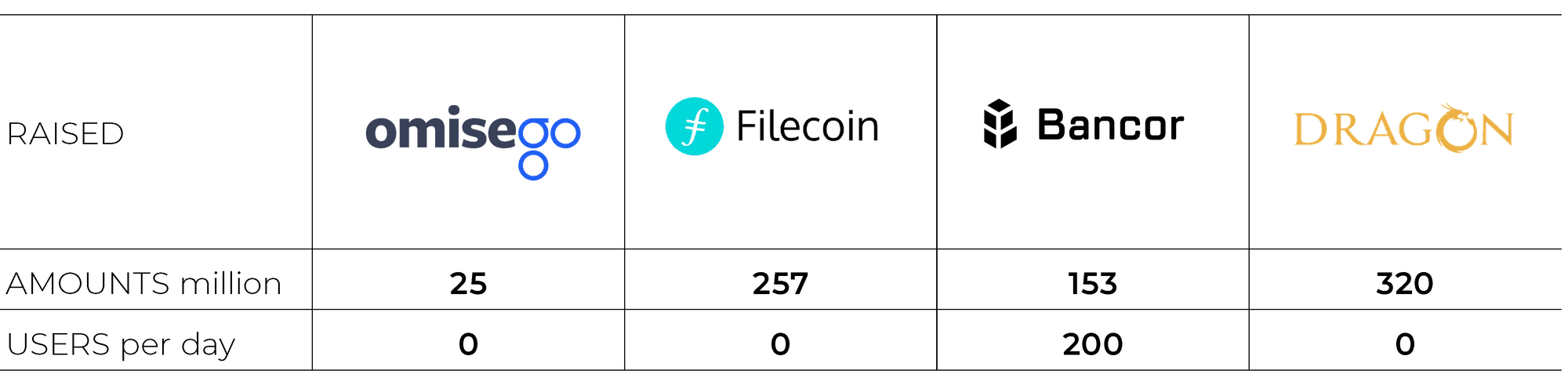

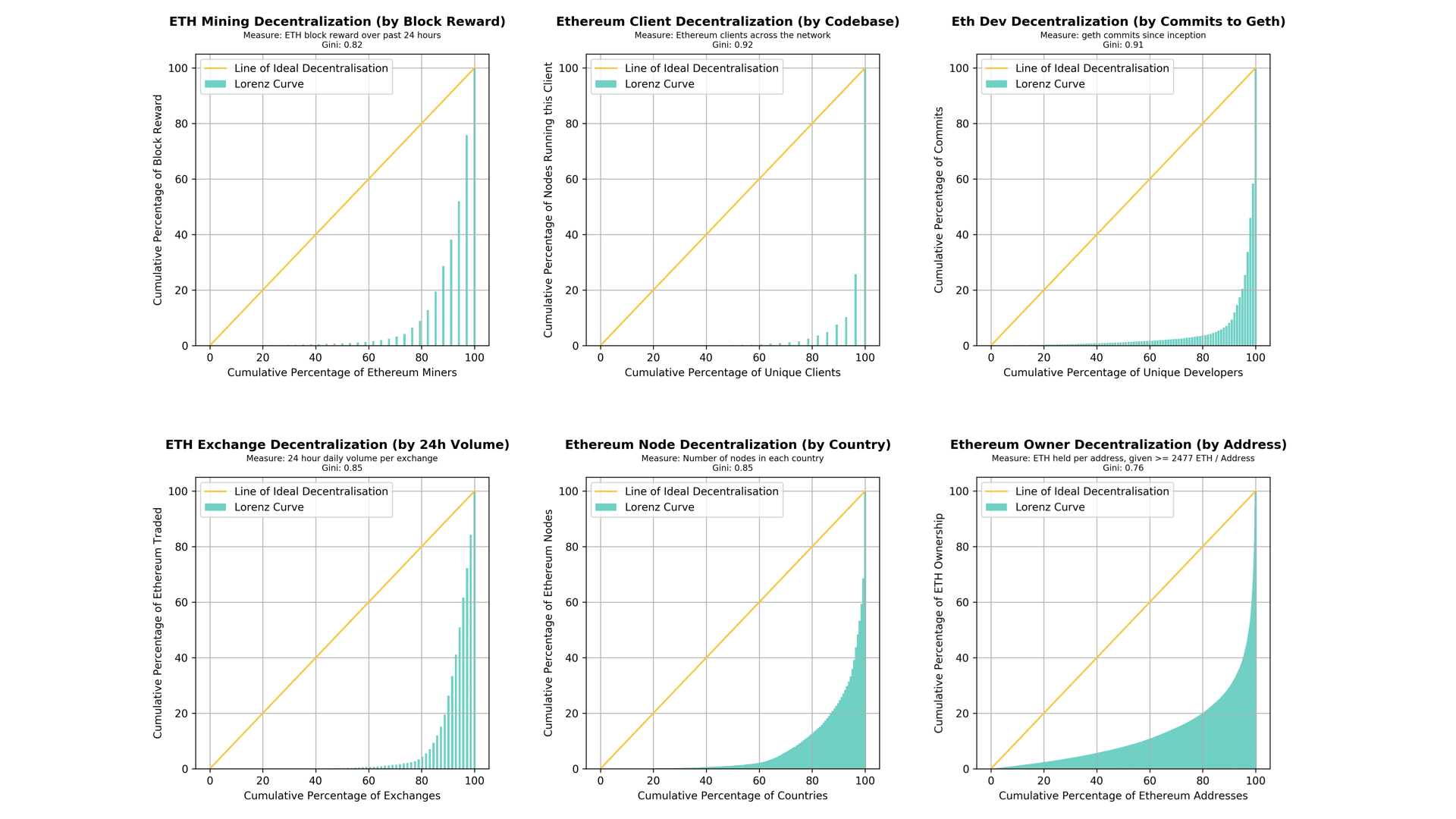

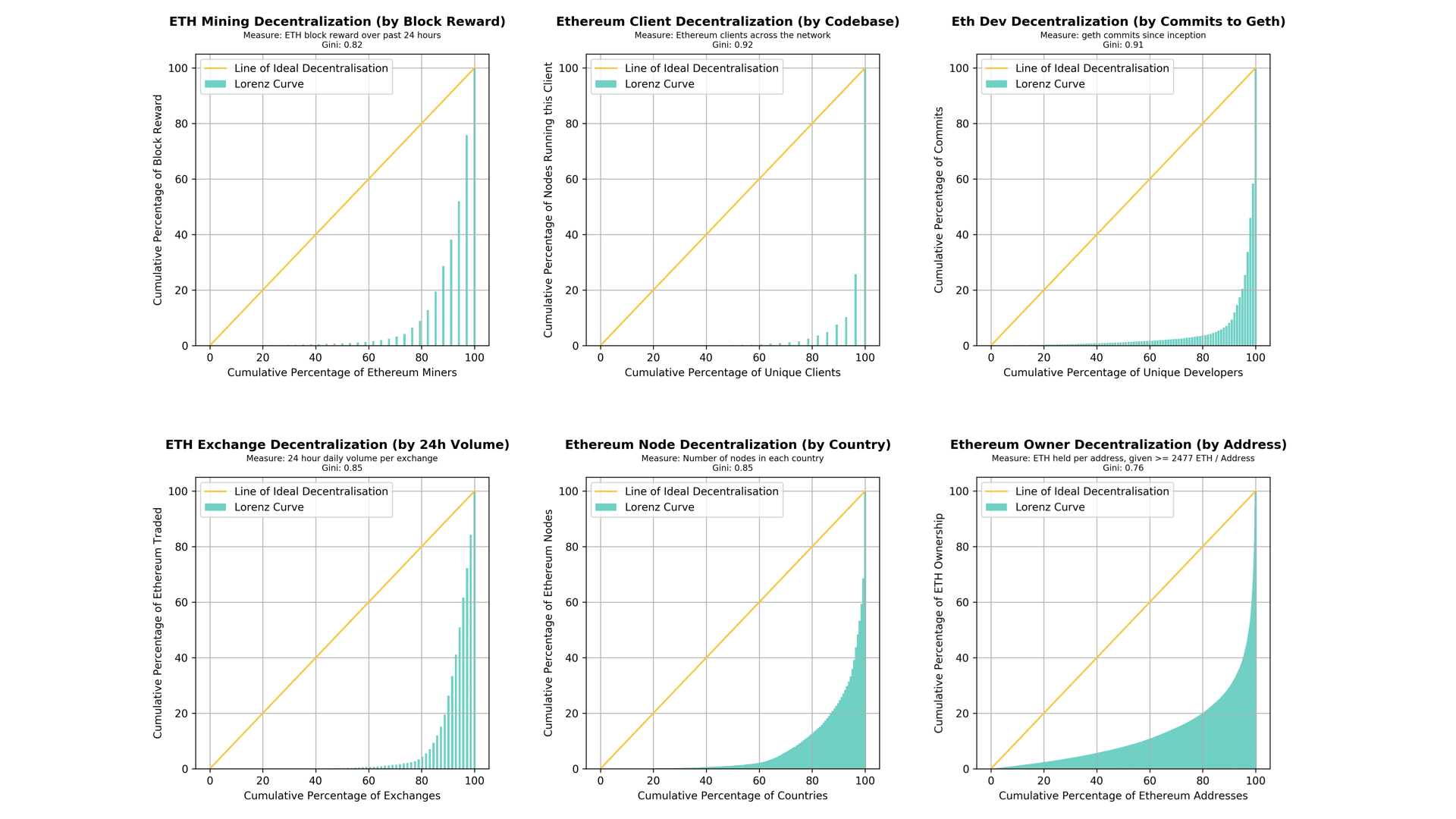

Currencies and tokens tend to aim for distributions which are as wide and equal as possible. However even the larger and more widely distributed currencies such as Bitcoin and Ethereum remain highly concentrated when measured across a range of factors.

1. Bitcoin – Mining aka ‘Proof-of-Work’

The original cryptocurrency (like several which followed it) had no initial token sale, or issuance to founders. Everyone who owned Bitcoin received it the same way – by running an algorithm on hardware to create new Bitcoin blocks.

Whilst Bitcoin mining is theoretically open to anyone to participate in, there is a bias towards those who are technically able to figure out how to run a miner, or can afford to invest in hardware. As a result those who held early bitcoin were necessarily technically savvy, but also ideologically aligned with Bitcoin’s core values of equality. This combination provided a hotbed for bootstrapping its use within all sorts of applications and networks.

This mining/inflation model is still one of the most successful models. However, logistically it is limited by hardware and using huge amounts of electricity for proof-of-work. It is also difficult to target any specific group who suit best the token’s utility (such as privacy for Monero) as it lacks flexibility.

Mining remains one of the most successful models for creating (relatively) wide and equal distributions, however it is inflexible and limited in applications for protocols or platforms beyond currencies.

2. Token sales – (ICOs)

The focus of many sales has been to maximise the value of the funds raised, often targeting tens of millions in their raise. In consequence large VC backers often replace smaller scale individuals attracted to the utility of the token. This therefore reduces distribution of the token to those who might be early users of the protocol and generate longer term value and a future network.

In some of the early sales the field of distribution was even narrower, with a modest amount of tokens reserved for the creators (often between 5-10% of the total), and the rest distributed in open sales, for example using an open access smart-contract. As ‘ICO’s became common, this morphed into something almost unrecognisable, where in some cases 70-90% of tokens were retained by the initial issuer, and only a small proportion sold to participants who met certain requirements.

Now, in an attempt to address compliance issues, token issuers have put initial token distribution rounds behind closed ‘Know your customer’ walls, often with high requirements such as proof of being an accredited investor. This significantly stifles the diversity of people who can participate, limiting tokens to wealthy investors hoping to make a quick profit, but not adding value to the network themselves.

The limitations to participation combined with the powerful incentive to focus on short term value has mutated what ICOs were intended to achieve in the first place: the distribution of tokens to long-term network participants.

3. Airdrops

OmiseGo pioneered the concept of an ‘Airdrop’ – distributing tokens to the members of another network, in order to align their interests with the new token. This was a fantastic innovation in concept, making sure the strong community around Ethereum would have an interest in OmiseGo.

However, as airdrops have become more common, the inherent limitations of this approach have come to light. By giving away tokens for free, their value is undermined. Instead of adding value the majority of those receiving airdrops simply sell them or ignore them as spam, cutting the intended network effect short in its tracks.

In order to give long term value to the tokens they must be earned rather than received for free. The work required to have earned the tokens aligns the recipient with the project and adds intrinsic value. It also ensures that those receiving are self-selected to have taken an interest in the token and more likely to be significant instigators in the network effect.

4. Proof-of-burn

Back in 2014, Counterparty, who were creating a protocol to extend Bitcoin functionality in innovative ways, wanted to ensure fair, transparent and wide distribution of their XCP token.

They wanted to recreate the decentralised spirit behind Bitcoin, and ensure that from the outset everyone was on an equal footing in their new network. In their view, selling their XCP and collecting a centralised pot of funds for development would have established them as just another centralised project.

Their solution – anyone wanting to receive XCP were required to send Bitcoin to an un-spendable address, effectively ‘burning them forever’. They equate this process as analogous to the burning of electricity to create Bitcoins in Proof-of-Work.

Whilst this might seem like an extreme approach, there was appetite, with 2125 bitcoins burned in this process, which would equate to $7.2m today (current market rate), or an incredible $42.5m at the peak of Bitcoin’s value.

Whilst there was still a clear cost to the initial distribution of XCP, this burning mechanism as opposed to a sale fundamentally will have impacted who participated in the initial distribution and through such a symbolic commitment aligned them more closely with the vision of Counterparty.

Although this is an extreme approach, and might raise a few eyebrows, it is a good example of thinking differently in terms of tailoring the initial distribution towards long term rather than short term value.

Ethfinex’s ‘Trade-Mining’ Model

In this environment there was no distribution model in existence that matched Ethfinex’s ethos and long-term ambition.

Ethfinex was developed with the community at its core. The ultimate aim from its conception has been the eventual complete decentralisation of the platform, with governance distributed between stakeholders.

Token distribution is a key part of this mission, but given the pitfalls witnessed in the market it was necessary to reinvent the existing models to ensure the future of Ethfinex would be in the hands of a wide range of participants who shared our vision and could add value, rather than passive speculators.

We believe we’ve found a solution to distribute our Nectar tokens efficiently to those who can genuinely bring value to the Ethfinex network. At the time of our August 2017 Whitepaper, Nectar token was one of the first examples of a distribution-for-use rather than distribution-for-creation model. Subsequently, similar models have been popularised by a few other projects, and collectively have become known as ‘trade-mining’ (in the context of a cryptocurrency exchange).

Trade-Mining, the Basic Concept

The concept of trade-mining is an analogy of Bitcoin Proof-of-Work mining, with trade volume becoming analogous to hash-power: through having higher sizes of trading volume, those using Ethfinex earn higher numbers of new Nectar tokens. The total number of new Nectar tokens created through inflation is proportional to the fees collected (denominated in Ethereum).

Market-makers (those who place orders onto the order book, rather than match with existing offers), are rewarded with Nectar tokens. Over time, as their trading volume grows, they receive more and more of these new tokens.

We believe this distribution model is perfectly suited to a cryptocurrency exchange. The core purpose of Nectar is to ensure the alignment of traders with Ethfinex, by giving them voting rights and a share in the ongoing success of the platform.

Building for Long term sustainability and network effect

The equation determining the rate of Nectar issuance (relative to fees on Ethfinex) factors in the current total supply, and therefore falls gradually as supply increases.

While this gives some advantage to those who participate early, it still enables later participation, and ensures that those speculating rather than directly contributing to the network are slowly diluted. This model is therefore effective at aligning token holders long term with the groups who support the platform and ensures there is enough liquidity to trade.

In designing these systems, care needs to be taken to finely tune the parameters, with an emphasis on aligning the distribution timeline with the lifecycle of the platform and token. Getting it wrong can lead to non-organic gaming of the distribution system. Just as with ICOs, while this can have some positive short-term effects in terms of getting attention, it usually comes with a sacrifice of long-term value. As a result Nectar distribution is slow, aiming to last over many years, as the rate of issuance decreases.

Nectar in Numbers

Over the first 10 months a total of 13,477.56 Ethereum were collected and pledged to token holders in a vault smart-contract, and the total number of Nectar (NEC) therefore created over that period was 13,955,535.

Monday 10th December 2018 marked the 10th month of NEC issuance. 2,046.18 Ethereum were collected in fees on Ethfinex between 10th November and 10th December, and these were sent to the Nectar token vault contract, triggering the creation of 1,997,359 new tokens.

These were then distributed in proportion to maker volume, rewarding those who are the most important value drivers on our exchange and in doing so strengthening their long term stake in Ethfinex.

As our active user numbers continue to grow, and as Ethfinex Trustless is now reaching over 1.5 million USD in 24 hour volume, we believe this long-term approach is now paying off!

In summary

- Token distribution has rightly generated cynicism through a flooding of platforms and protocols focussing on cash grabs.

- The consequence of focussing on such short-term goals is to narrow distribution to investors seeking quick financial return rather than active participants bringing long-term value to the network.

- Until now, the demographics and segment targeting of the individuals to whom tokens are distributed have for the most part been too narrow. Getting the right people from the outset is more important than the absolute number involved in the initial sale. Plus the cost to enter the network later on should not be prohibitive to new entrants, taking a leaf from Bitcoin which allows continuous distribution, unlike a once off sale.

- Tokens have much more potential than fundraising – if distributed correctly, tokens that genuinely align with the issuer’s purpose can be an incredibly powerful way to bootstrap a network effect.

- At Ethfinex our trade-mining approach is one of the first examples of a distribution-for-use rather than distribution-for-creation models. This ensures our Nectar tokens are distributed amongst traders who will contribute to the long term success of our platform. By aligning them with Ethfinex through voting rights and a share in the ongoing success of the platform, this model is a natural fit with Ethfinex’s raison d’etre, to become a decentralised exchange.