Effective immediately, DeversiFi has migrated to a new back-end codebase, resulting in 10x higher performance, improved order management and a new dynamic fee schedule, paving the way for the StarkWare upgrade in Q1-2020.

The much-awaited codebase migration is finally here!

The current DeversiFi platform started life as an innovative MVP and was the first ‘hybrid’ exchange architecture to be released on the Ethereum main-net. As with most research projects, the final version resembled very little of the first release/subsequent iterations and significant improvements have been made over the past year, pushing it beyond the operations that it was originally designed for. Over the past three months, the DeversiFi team has taken the existing codebase and turned it into a mature, high performance and stable product, from which we can now scale more effectively.

The codebase migration symbolises not only DeversiFi maturing as a product but is also the final step in the spin-out from Bitfinex. DeversiFi is now a completely operationally independent project & company and development speed can now reach orders of magnitude faster as we continue to grow in 2020.

What immediate benefits does this migration bring to you?

‘Proper’ Partial Order Matching

Limit orders that have been partially filled will now remain in the order book indefinitely until they are fully-filled, manually cancelled by the user or expire (unfilled orders automatically expire at the end of the relevant, pre-selected token-locking period), instead of being cancelled automatically.

As DeversiFi shares liquidity with centralised order books (but without the counter-party risk for traders), sometimes small orders from the centralised exchange are matched with larger orders on DeversiFi. This had lead to bad UX for DeversiFi traders as their order would be cancelled, leaving them with a fraction of the position that they intended.

As of today, partial orders will behave as expected, meaning traders can place limit orders into the order book and they will only be removed via either a 100% fill, a user cancel or expiration.

10x Faster Order Handling

Due to the reworked architecture and codebase, order placement and management is now 10 times faster via the DeversiFi API. This also extends to a significant improvement in matching and settlement as well as numerous minor bug fixes that will mainly be noticed by API traders.

This is just the beginning for performance improvements, with the real gains to be made with the StarkWare upgrade later this quarter and the ‘hot path’ upgrades shortly afterwards.

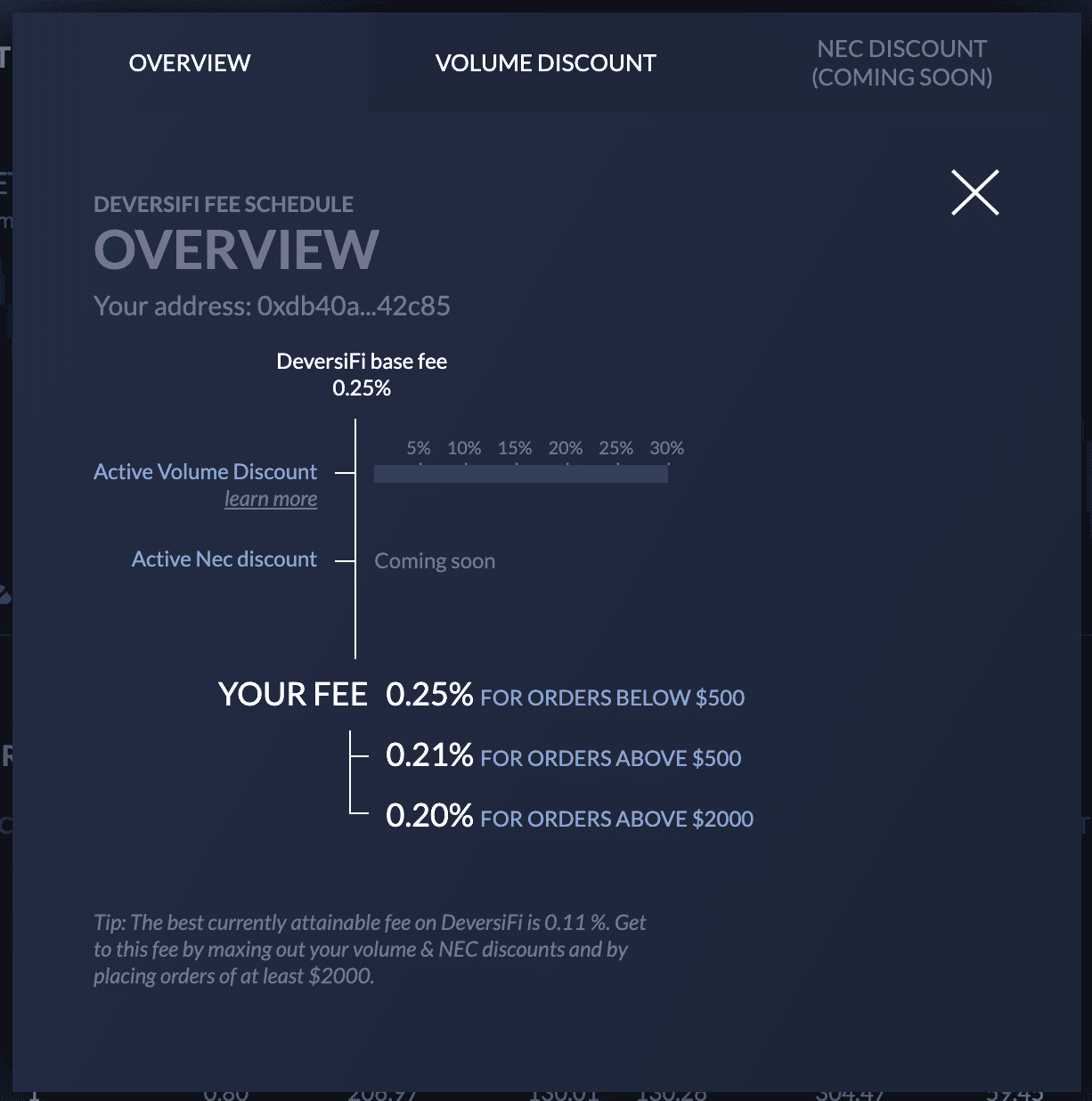

Dynamic Fee Schedule

DeversiFi now offers trade fee discounts based on individual order/clip size and monthly total trade volume. In addition to these, a third discount tranche for Nectar holders will be arriving in Q1 2020 coinciding with the StarkWare integration.

DeversiFi settles each executed order on-chain in order to eliminate counterparty risk for traders. Until the STARK-based batching upgrade via the StarkWare technology is introduced later this quarter, the exchange will continue to pay similar Ethereum gas fees for each trade that is settled, regardless of each trade’s size. Therefore in order to incentivise traders to place fewer, larger orders, instead of a higher amount of smaller orders, higher clip sizes will result in up to a 20% trading fee discount.

We well as a discount for clip sizes, traders can now benefit from higher discounts for higher monthly trading volume – rewarding the traders who use DeversiFi the most.

The order size and monthly volume discounts stack, meaning that the most competitive trading fee obtainable now sits at 0.11%, matching or exceeding those of a large centralised exchange whilst giving traders the added benefit of trading from their private wallet without any counter-party risk.

To see your current trading fees, as well as progress towards higher discount tiers, select the ‘Fees and Discounts’ option in the header drop-down menu on app.rhino.fi.

Removal of Low Volume Pairs

Although not related to the code migration, DeversiFi is removing some low volume pairs to focus on the markets that are most important to DeFi markets & users. We will aim to add more pairs over the coming months, but the current core markets available on DeversiFi are as follows:

We work around the ⏰ on the development of DeversiFi as the home of decentralised token trading, offering the most innovative solutions putting our users in control of their trading experience without sacrificing on speed, liquidity, choice or trust.

Get involved with, play your role and join us together as we fan the flames of the financial evolution.