Introduction

At Ethfinex, being a user means owning a part of our longer-term journey.

Traders earn Nectar (NEC) tokens, which gives them a claim on a share of Ethfinex’s fee revenues and the ability to propose and vote on governance decisions.

Distributed governance only works in transparent environments, and as part of this we commit to publish open and honest monthly reports, reflecting the trends of each 30-day period.

March at a Glance

March was an incredibly busy month for building. We re-launched the Ethfinex Community Token Vote (EVT voting starts in three days time), launched a new Trading Rewards scheme and moved to 0x V2 for Ethfinex Trustless. We also begun preparations for the next iteration of Ethfinex exchange infrastructure as we progress towards full decentralisation, with the NEC token at the core.

We propose two ‘calls to action’ for the coming month:

1) Kleros – If you haven’t already heard about the new token registration process for the Ethfinex community vote then we encourage you to read about the new end-to-end process here, especially the new Kleros process. Anyone can submit a token to the Ethfinex ‘voting pool’ using the Kleros system and you can also earn ETH & PNK (Kleros tokens) if you become a juror in the Kleros system and participate in disputes. Disputes are where the community thinks that a certain token doesn’t meet the new Ethfinex listing requirements.

2) Trading Rewards – The new trading rewards section on Ethfinex will see some small UI adjustments over the following weeks but it is well worth taking a look now. Given that most small tokens already have 0% maker fees, the new maker subsidy program means that maker fees are now negative on eligible pairs (even before the NEC rebate is taken into account!). Currently ODE, BNK and PASS tokens are eligible for negative maker fees.

Ethfinex Deep Dive – Community Vote Relaunch

The Ethfinex Community Token Vote was relaunched with some slight changes to align the interests of all actors on the exchange.

The new process hands control of the entire end-to-end token selection process to the community. The main changes are as follows:

1) Using the Kleros distributed dispute resolution process, anyone can now propose a token to be put forward for the Ethfinex community vote. Once a new token is registered with Kleros, 25 ETH needs to be staked to signal that the token meets the new Ethfinex token listing criteria. The token can then be challenged by Kleros token (PNK) holders and a crowdsourced jury of PNK holders then judges the case based on evidence presented by both parties. If the jurors rule in favour of the challenger then that earn a proportion of the ETH stake.

2) Once a token has passed the Kleros process, it then enters a ‘pool’ of eligible tokens from which 12 are randomly selected to be put forward for the monthly community vote.

3) The voting period now has been split into two seven day segments. The first seven days is an eduction period to allow the community to research and assess each token. The second period of seven days is when voting is allowed, using Ethfinex Voting Tokens (EVTs).

4) Voting using EVTs earlier in the 7 day voting period is rewarded with higher multiples of EVT tokens. This multiple starts at 2x and linearly declines down to 1x on the last day of voting (note: for the first community vote this is fixed at 2x for the whole 7 days)

5) ETV voters who voted for a winning token are rewarded with a share of 10% of trading fees for that token for the next 12 months. We believe that this could be a significant source of revenue for EVT token holders under certain scenarios.

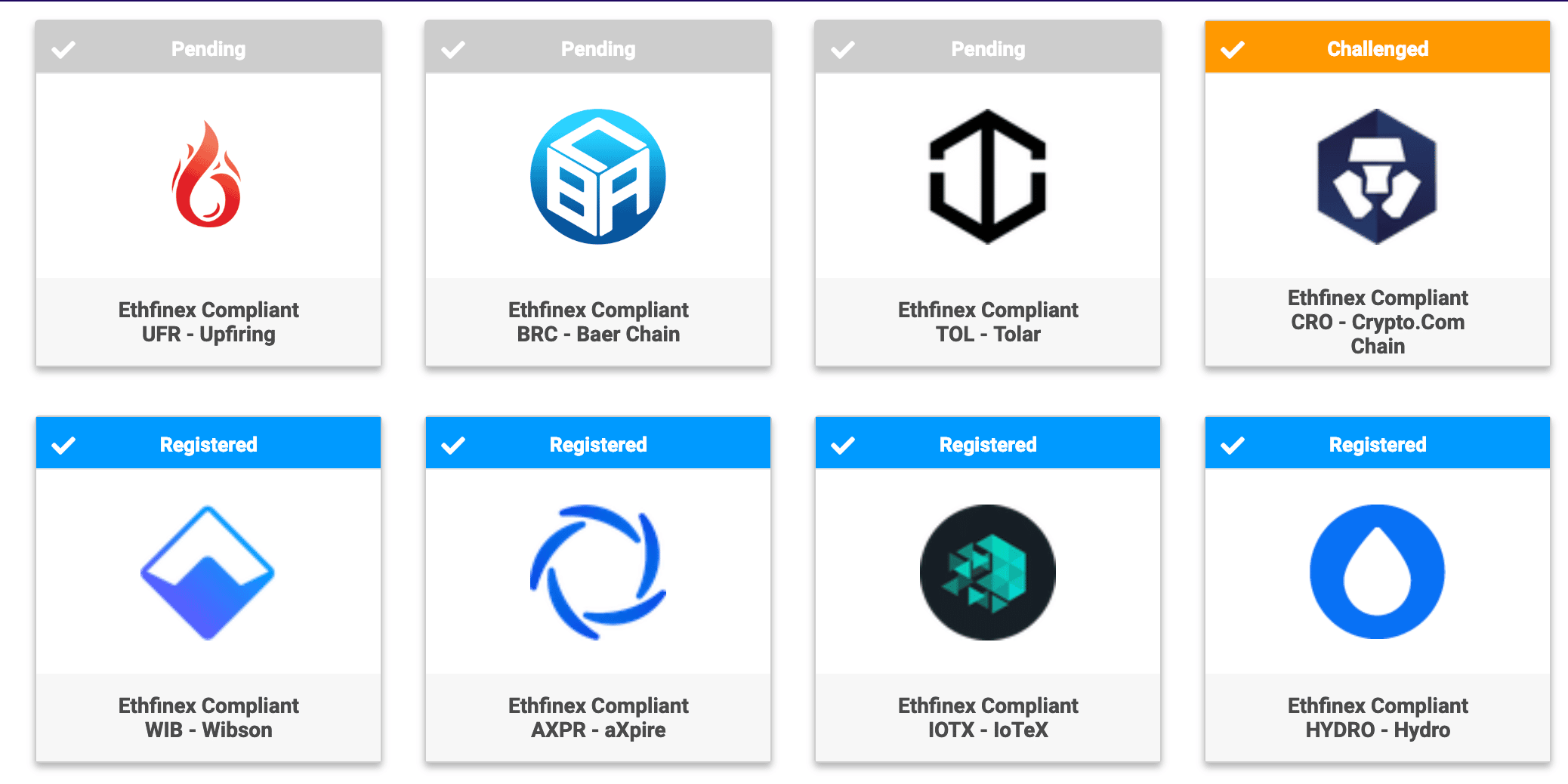

This new process has already proved very controversial. There has been several Kleros challenges, including:

- INK – dispute concerning on which blockchain the token resides

- SpendCoin – dispute concerning the transparency and progress of the project

- Crypto.Com Chain – dispute over the 10% minimum circulating supply criteria

Kleros is the first ever blockchain based crowdsourced dispute resolution service and the disputes mentioned above highlight how Ethfinex is successfully outsourcing part of the due diligence for token listings to the community.

To give you some ideas of numbers, there are now nearly 40 Kleros jurors, with over $100k of PNK tokens already staked in the Kleros ‘courts’ system. There has also been over 45 new tokens registered with the Kleros system. These numbers are growing every day as word gets out about the new dispute resolution service and we look forward to seeing how the Kleros project (and the Ethfinex community vote) evolves over the coming months.

To see the Kleros system in action, to propose a new token for the Ethfinex community vote, or to become a Kleros juror, see the Kleros DAPP (Metamask enabled browser needed)

Important dates:

The first draw, EVT distribution and market open happened on the 27th March

Next vote opens: 2 April

Winner announced: 9 April

Executive Summary

The performance period covered in this report is 9th February 2019 – 10th March 2019.

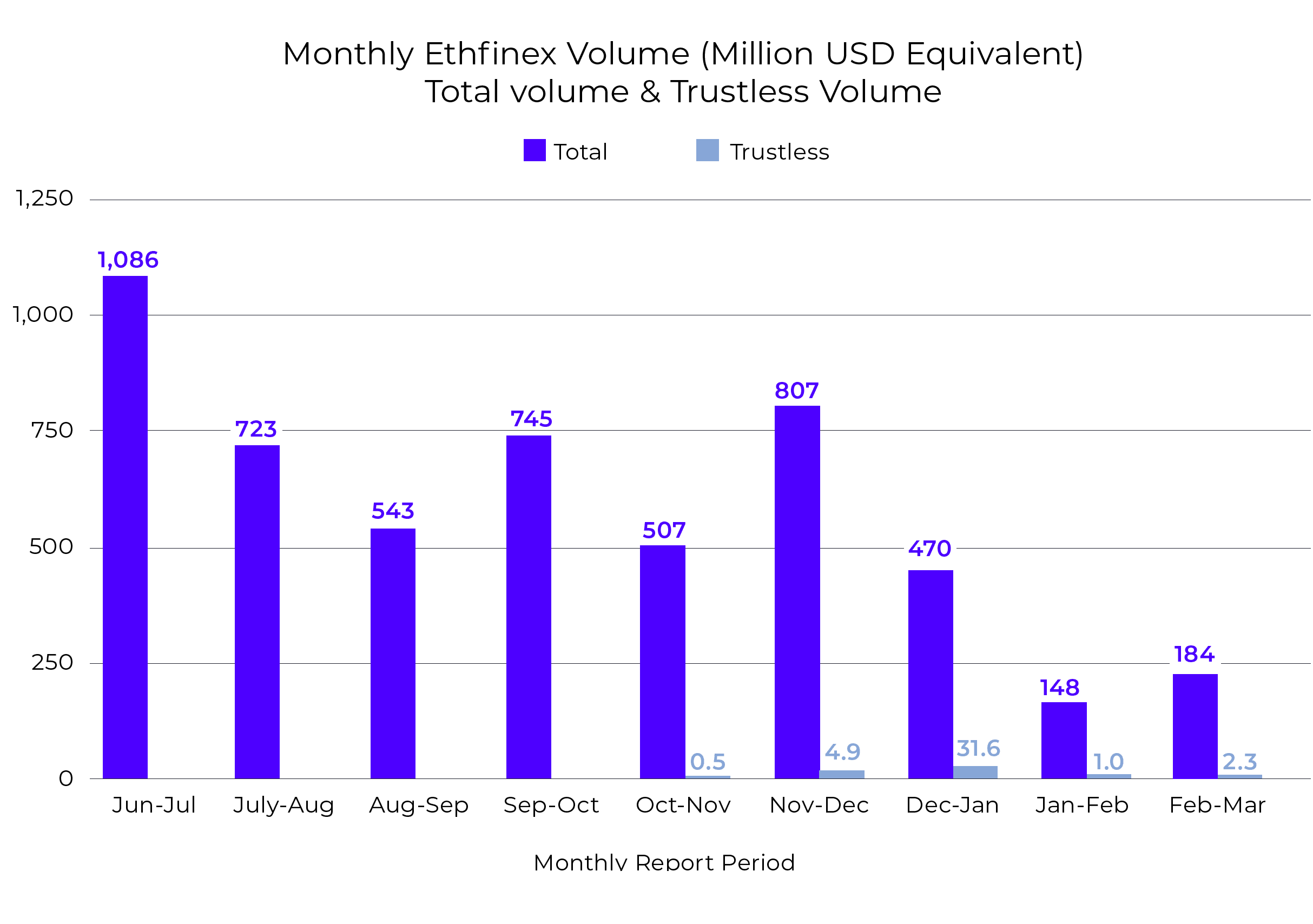

- Total trading volume for the period equalled $184m, a simple average of $6.1m per day, and an increase of 24% from the previous period.

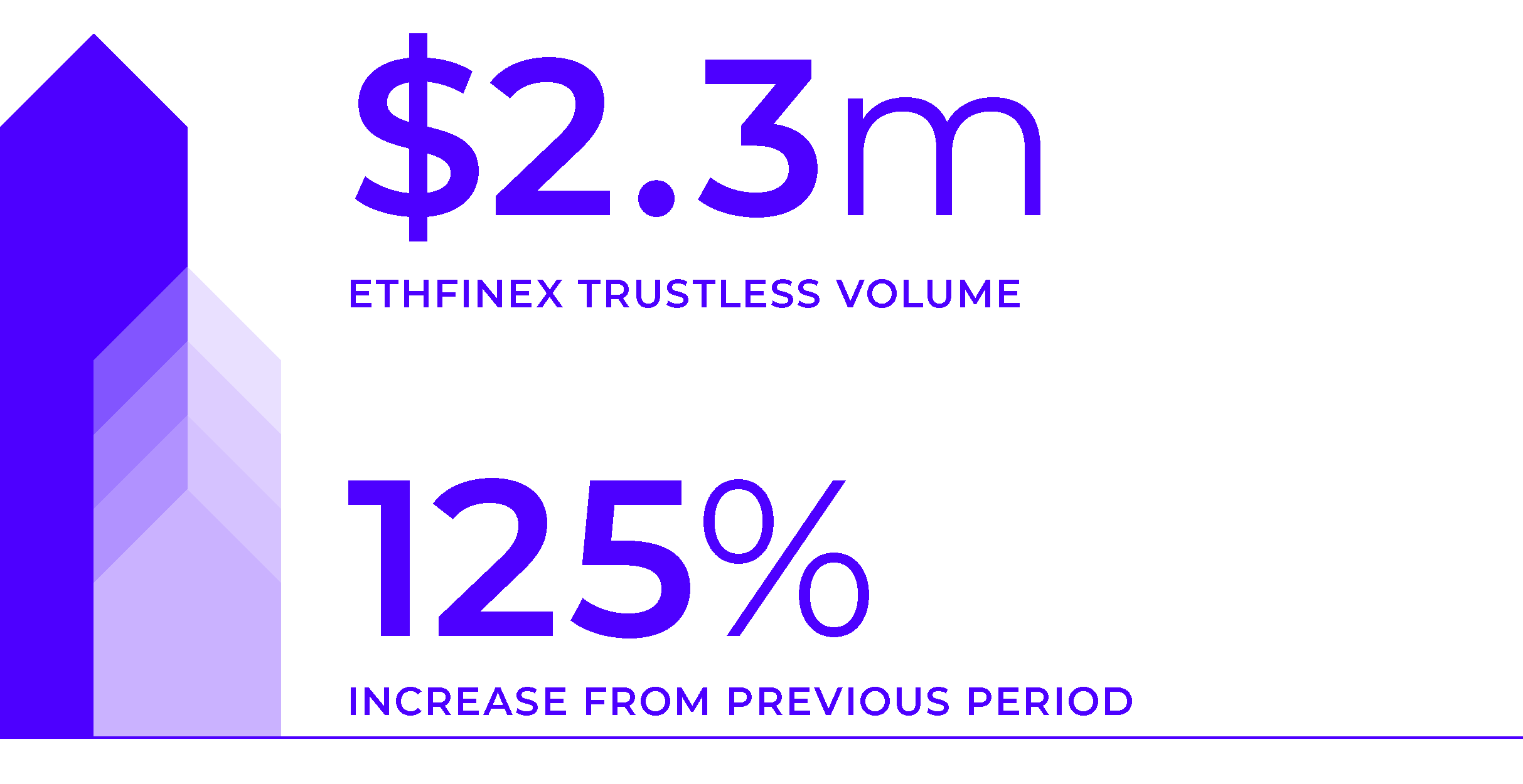

- Ethfinex Trustless volume for the period totalled $2.28m, an increase of 125% from the previous period.

- Total trading fees of ~$140k (average daily ETH/USD across the period) were collected through trading over the period, an increase of 23% from the previous period.

- In line with the amount of fees collected, 518.7 ETH have been contributed to the Nectar token contract, pledged to NEC holders.

- 502,205 NEC tokens were distributed to reward market marking activity on Ethfinex in the past month. Statistics can be viewed on Nectar.community.

Month in Review — March

Revenue & Activity Reports

1. Cryptocurrency Trading Volume and Volatility

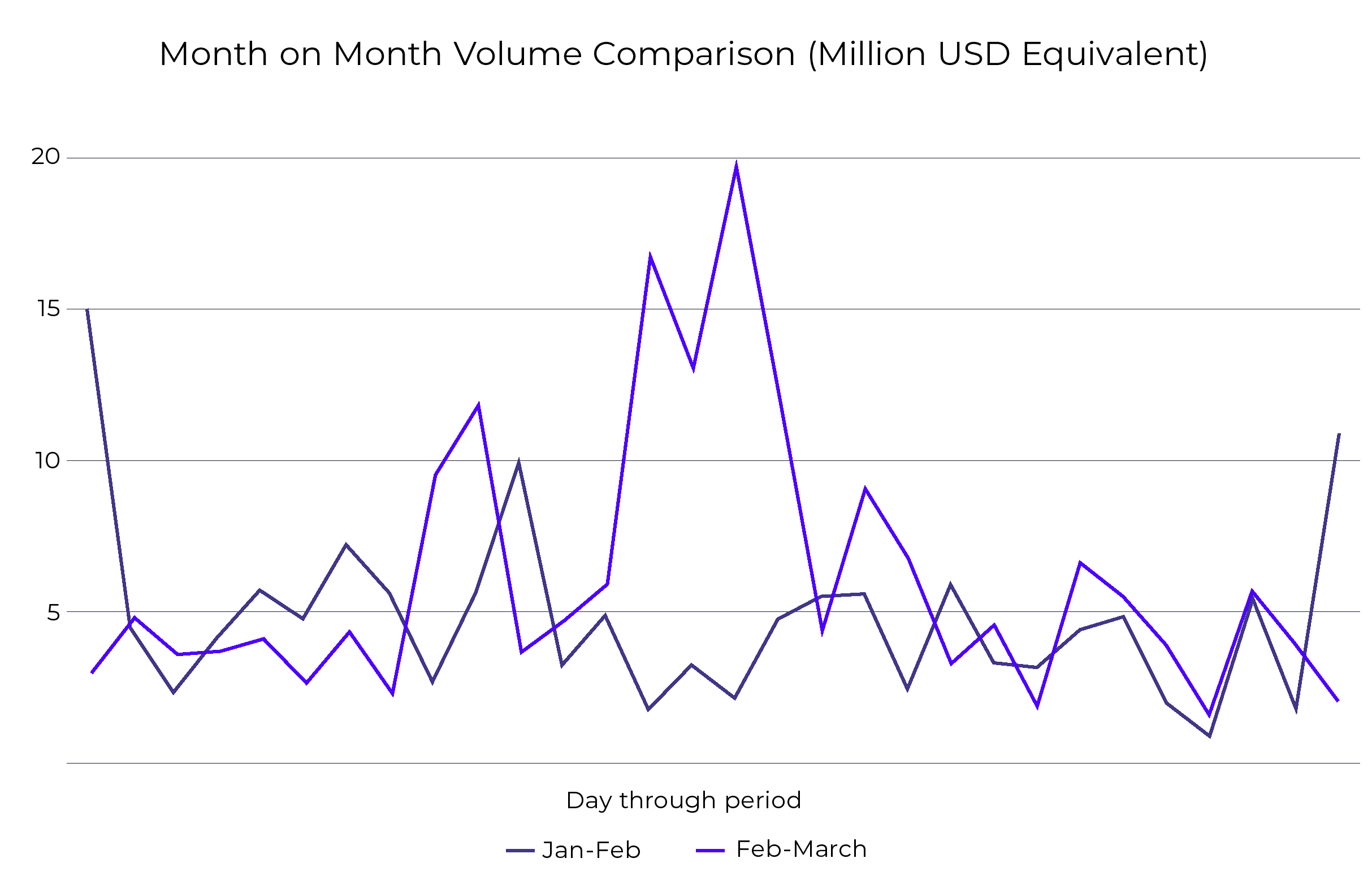

Ethfinex total 30-day trading volume increased 24% from the previous period in USD terms to $184m. March proved to be another very quiet period across most reputable exchanges (see volatility reports below). We think that the continued lack of volatility for ETH/USD was again the main driver of this behaviour, as when volatility returned to the markets in the middle of the report period, volume and activity jumped again.

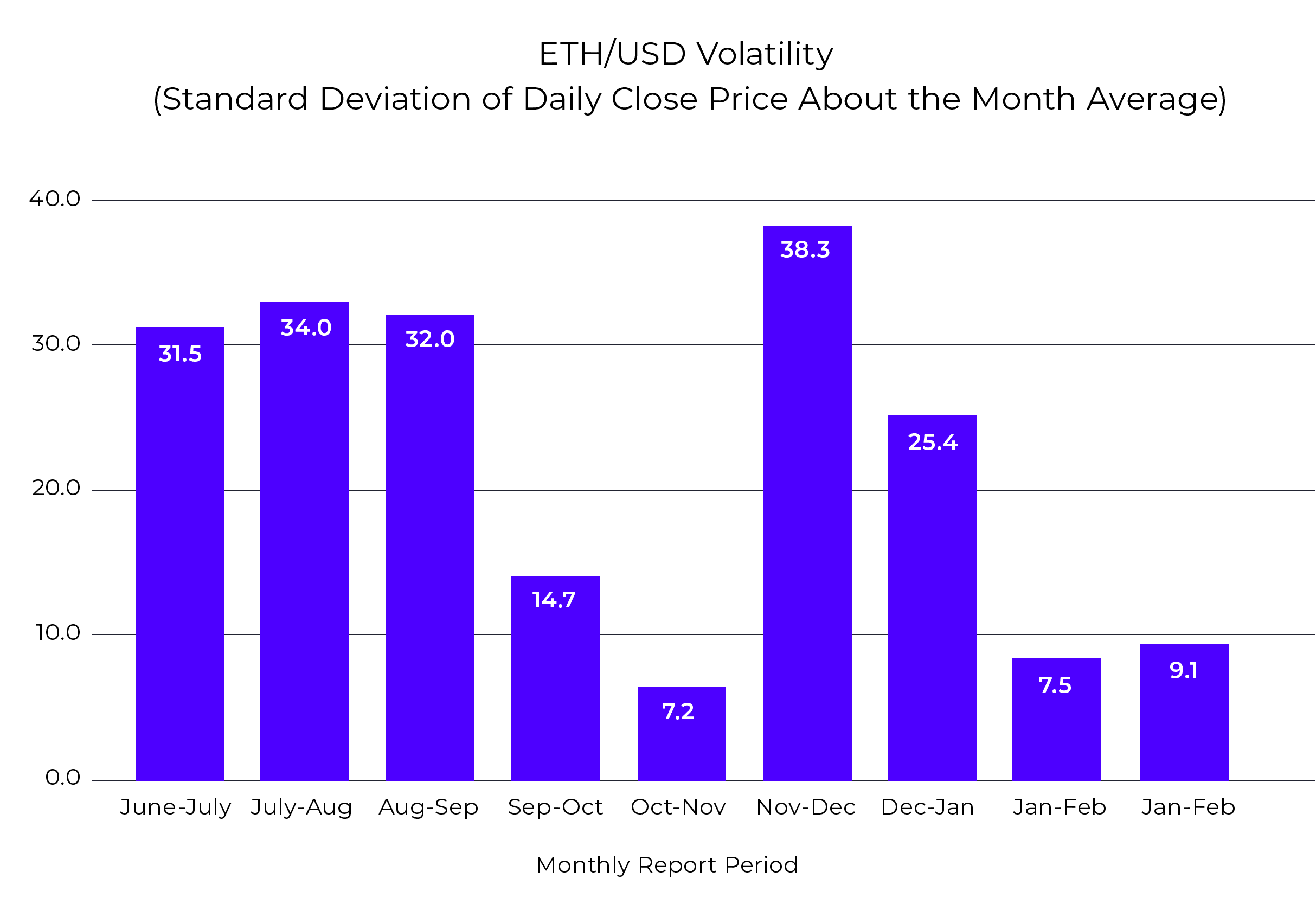

Daily ETH/USD volatility, as measured by the standard deviation (the square root of the average squared daily close price variance vs the average month price), increased slightly by 21% compared to the previous month, but still remained at very low levels compared to the past 12 months.

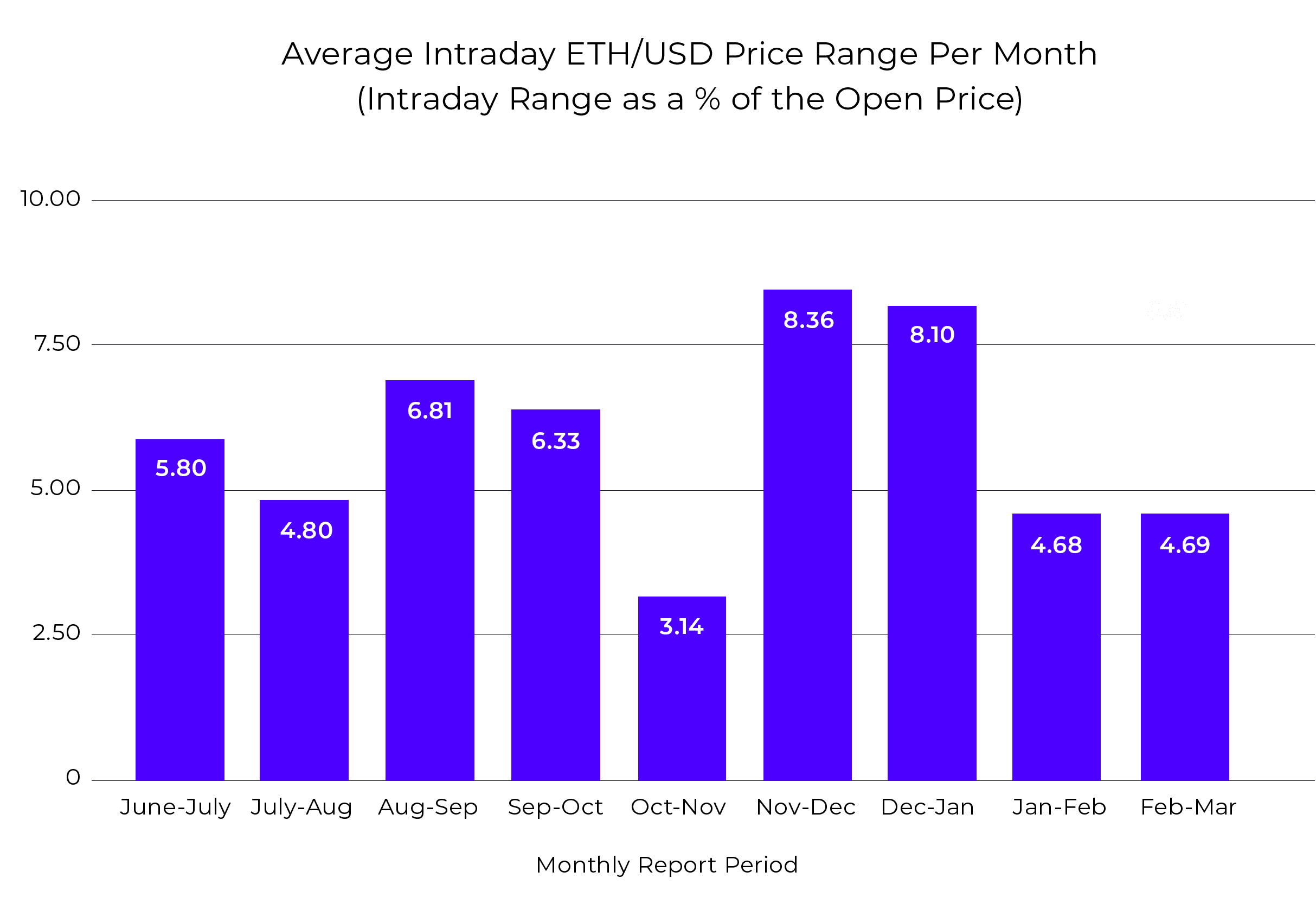

Intraday ETH/USD volatility (as measured by the intraday range as a percentage of the open price) was almost unchanged from the previous month. Again, this was one of the lowest levels of intraday volatility for 16 months

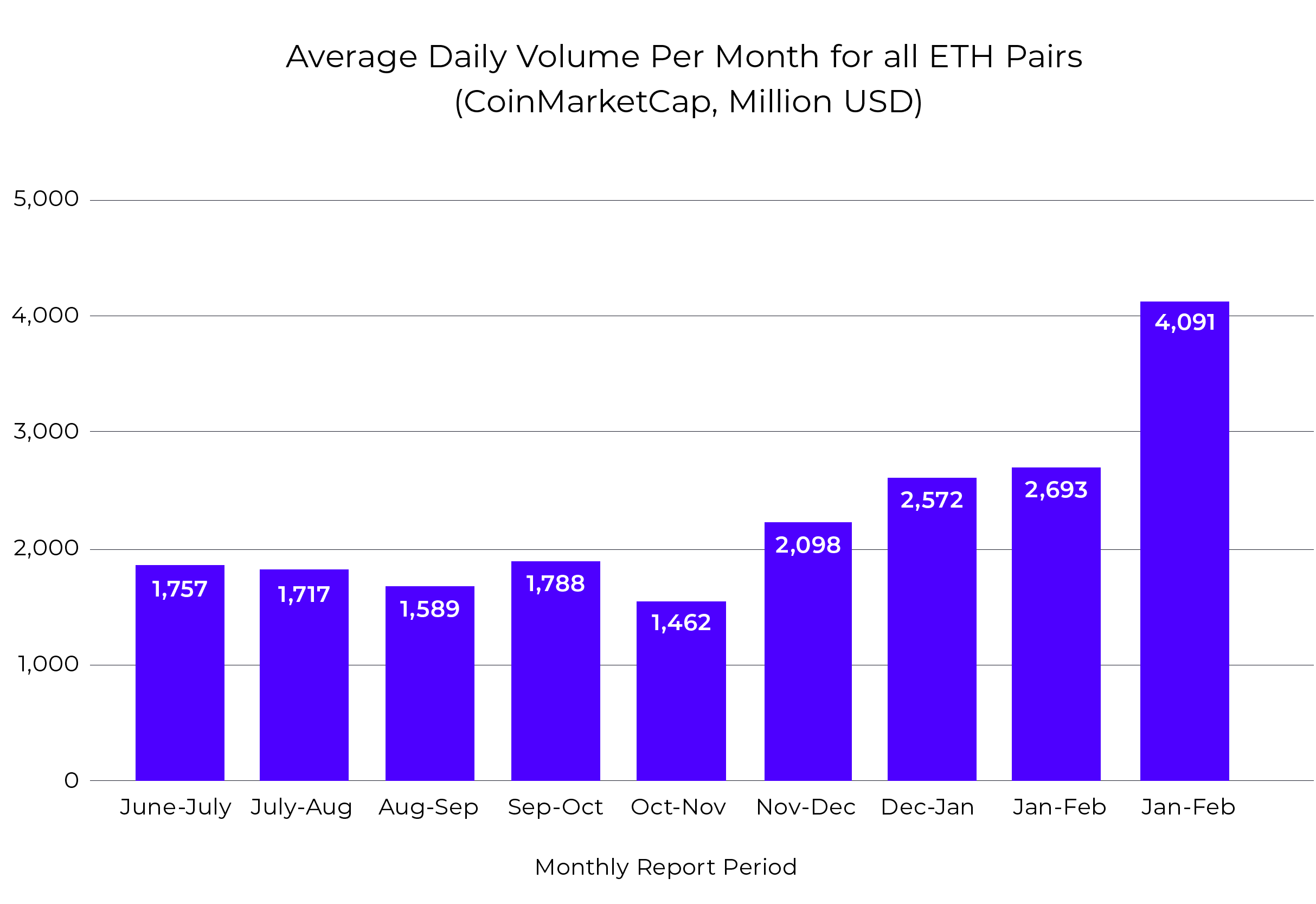

Average daily USD volume for all Ethereum pairs, across CoinMarketCap exchanges increased 60% from the previous period to $4bn. This highlights a key reputational problems the problem that the industry faces when it comes to accurate volume data reporting. CoinMarketCap has been inundated by new (often Asian based) exchanges that artificially inflate their volume data. For more information, see the Bitwise study (click the ‘read full analysis’ link on the linked page) that was presented to the SEC in support of the Bitwise ETF application. TLDR; Bitfinex (and therefore Ethfinex due to the shared order book) and Binance were the two top exchanges real BTC volume.

Ethfinex trading volume correlated to the most volatile days in Feb-Mar. Peak daily trading volume was $19.5m (24th Feb), an increase of 34% compared to the peak trading day in the previous period.

Unique user numbers increased marginally by 1% across the period compared to the previous month. We expect visitor numbers to continue to increase now that the community vote has been relaunched.

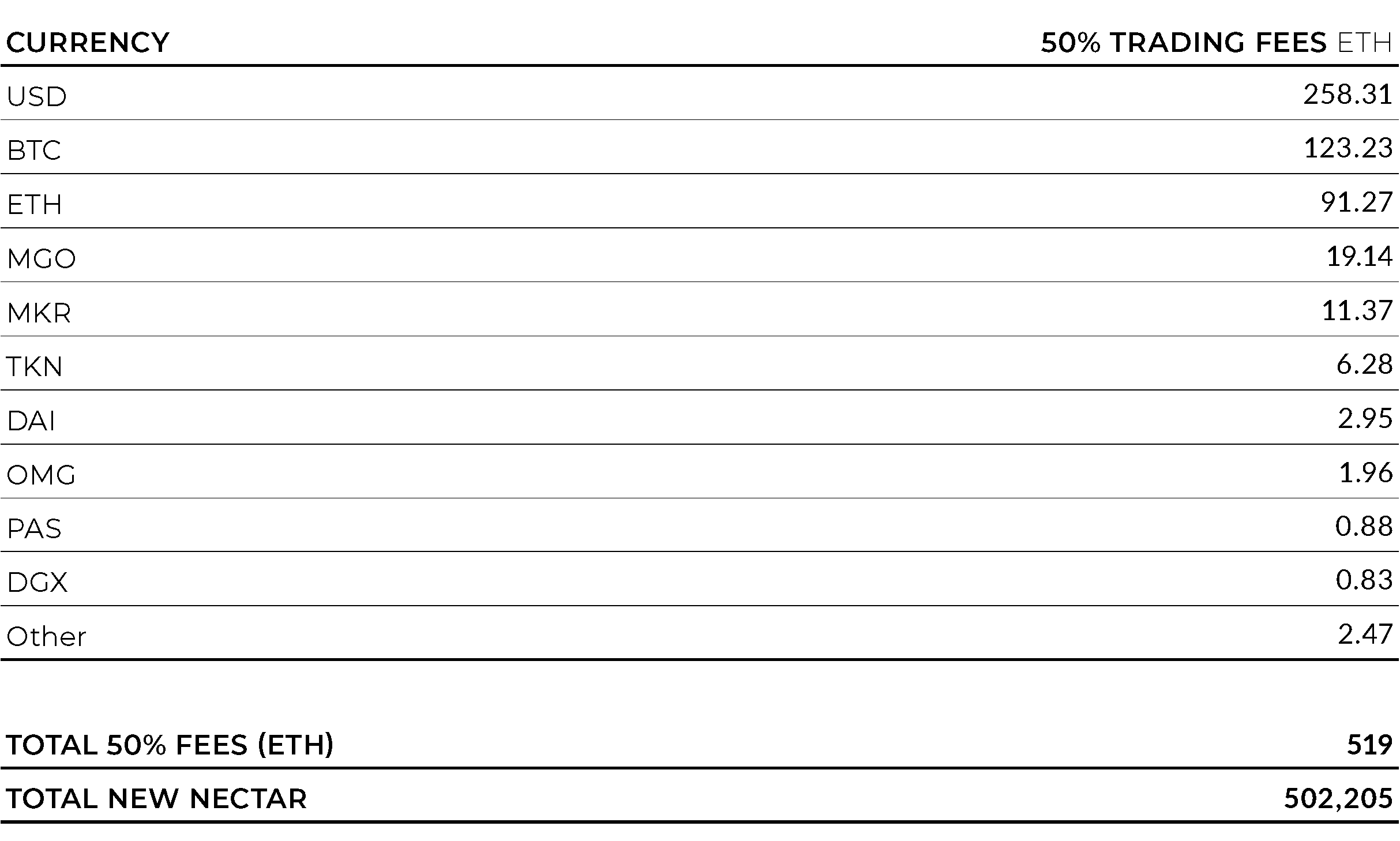

2. Trading Fee Revenues

All fees were converted as they were collected into ETH to provide an averaged conversion cost across the month and smooth out the effects of price volatility during the period.

The above chart shows 50% of all fees collected in ETH. 519 ETH were collected during the month and pledged to NEC token holders. ETH/USD and OMG remain the main fee generators.

Total trading fees of ~$140k (average daily ETH/USD rate through the month) were collected through the period, an increase of 27.3%.

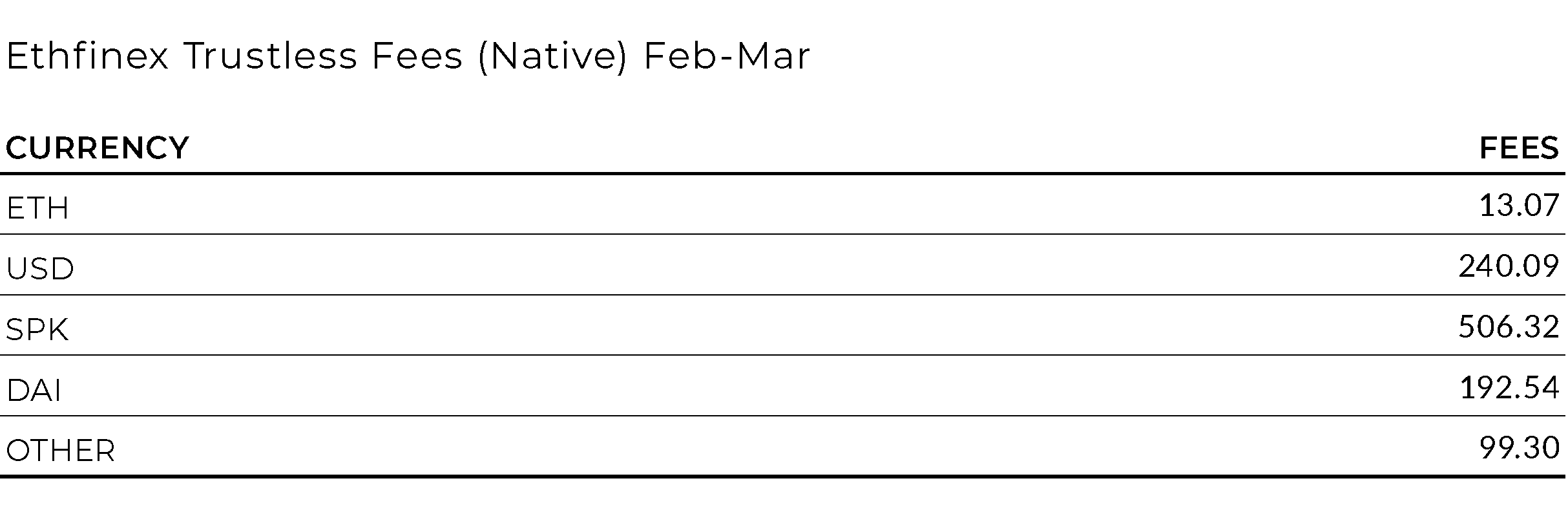

3. Ethfinex Trustless

Ethfinex Trustless volume for the period totalled $2.3M, an increase of 125% from the previous period.

With a fee rate of 0.25% (higher than the fees on the centralised version of Ethfinex), Trustless has the potential to become a serious fee generator for Nectar token holders.

Feb-March Main Trustless Changes:

1) Updated to the 0x Version Two protocol:

- New format of submitted order, gives advanced users more insight into the contents of the message they are signing when e.g. placing order at Trustless

- Support for both ERC-20 (the current tokens) and ERC-721 tokens (new possibilities for future listings)

- Potential performance boost compared to 0x v1 (not sure if this affects us since we didn’t use the full version of 0x v1)

- Read more here

2) Polished the ‘tour around Trustless’ tutorial, giving insights into the most important features for new users.

3) Re-designed the wallet selection section during on-boarding, making it easier for users to select the best wallet for their trading purpose.

4) It is now possible to generate a locally stored wallet in 1 click.

5) Upgraded to the latest Portis SDK – giving Portis users even more options and a cleaner Portis UX.

6) Removed the simplified trading chart to enable a cleaner UX (based on user feedback).

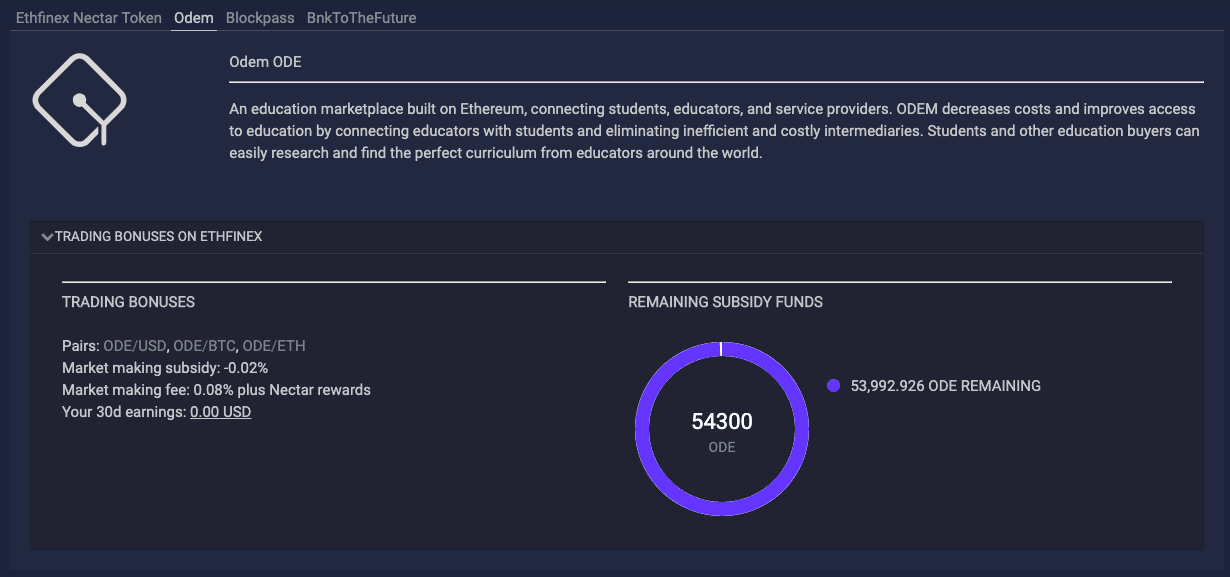

4. Trading Bonuses

It is now possible for individual token projects to subsidise maker fees for their Ethfinex trading pairs. This allows any market-maker to be paid for reducing the spread on participating markets in a transparent way, without needing any agreement in place with the token issuer.

Low volume markets on Ethfinex are already typically eligible for zero maker fee. With the addition of the new bonuses this means that maker trading fees have now become negative for all traders on participating tokens (initially ODEM, PASS, BFT). The negative fee (usually worth 0.02% of trade value) is paid in real time.

In addition to the negative maker fee NEC ‘rebates’ are also earned for those trades, increasing the size of the bonus.

Each participating project allocates an amount of native token funds as a reward pool. The maker subsidy remains in place until this fund pool has been drained.

As an example, you can see the BnkToTheFuture (BFT) maker fee subsidy and remaining rewards pool here:

Currently there are trading bonuses available for BFT, ODEM and PASS tokens.

We believe that this is an incredibly powerful tool for Ethfinex and participating token projects, as this essentially crowdsources a narrower bid-offer and should incentivise market participation.

The Month Ahead – Feb/Mar 2019

1. Additional value drivers for the Nectar token

At the Ethfinex Governance Summit in Lugano six months ago, NEC community members provided recommendations to help drive forward Ethfinex on key items such as volume, customer acquisition, strategy and new products. After achieving key stakeholder sign off on some of these proposals, we are steaming ahead with some of the priority features.

The past month saw the restart of the Ethfinex community vote. We have also launched a new ‘rewards’ section of the exchange, where tokens can subsidise maker trading fees in order to increase liquidity.

Our main focus is now on the next stage of Ethfinex’s journey towards full decentralisation. We are preparing to launch a new exchange which will allow blockchain agnostic, high-frequency, private and trustless trading. Aimed at institutional and sophisticated traders, the new exchange is lightyears ahead of the competition and has been designed to cater for customers who require separation of custody and trading. This new exchange infrastructure has been 12 months in the making and is now in the final testing phase of development.

4. Ethfinex Token Sales

We are mid-way through a complete overhaul of the token sale platform and will be relaunching it shortly with an incredible new UI and proposition (and a new name). The token sale platform revamp has been slightly slower than expected as developer resource internally at Ethfinex and Bitfinex has been focused elsewhere (on some amazing new product launches) but this remains a key strategic priority for us. The Initial Exchange Offerings (IEO) on the Binance Launchpad have been successful at beginning to thaw the ‘ICO winter’ and we firmly believe that the combination of capital raising, token distribution and secondary market liquidity means that most token sales will now move to exchanges like Binance and Ethfinex.

We have some incredible token sales lined up for the next six months. Watch this space.

If you are planing a public token sale, or know a token sale you would like to bring to Ethfinex users, then we would love to hear from you: [email protected]

4. Trustless Revolution

Similar to last month, we are steaming ahead with Trustless integrations, with the focus remaining on mobile wallets. We should be in a position to announce some of these integrations soon. We are also nearing completion of a mobile optimised version of Trustless and a simple ‘swap’ interface.

Trustless volume doubled compared to last month. Due to the activity we delayed the planned 0x V2 upgrade several weeks to make sure that trading was not interrupted.

Please email [email protected] if you would like to explore an integration with Trustless.

Conclusion

Thank you for taking the time to read the March performance report. March was a strong month for shipping products and laying the groundwork for the next iteration of Ethfinex exchange infrastructure, with trading volume also picking up.

If you have any questions, please feel free to ask them on our Telegram group or send an email to [email protected].

Trading is now live on Ethfinex — get started here.

Sign up to our weekly newsletter and stop by our Telegram to learn more about the vision for Ethfinex.

Visit our Twitter to stay up to date with announcements, token additions and more.