Welcome to our January Performance Report

With an aim to provide Nectar (NEC) token holders with a clearer view of the inner-workings of their exchange, we publish monthly reports reflecting the trends and financial results of each 30-day period.

Happy New Year to all Nectar holders

The holiday period saw a sharp and choppy rally, with Ethereum leading the way with an impressive price increase of 102% from low to high. Although most tokens have since failed to hold onto all of their gains, we hope that this is the start of the longer term recovery for 2019 – not investment advice!

Although the holiday period was relatively quiet in terms of new feature releases, we made a significant update to the central exchange’s performance thanks to a data migration and switch to our own dedicated hardware. The migration was a mammoth task and we really have to thank everyone who was involved internally for such a smooth switch over. We also made significant improvements to the Trustless on-boarding & UI as well as introducing the new ‘Tether market shift’ for USDT markets to allow USDT pairs to trade on Trustless, whilst still bootstrapping liquidity from the centralised exchanges USDT markets

Ethfinex Deep Dive

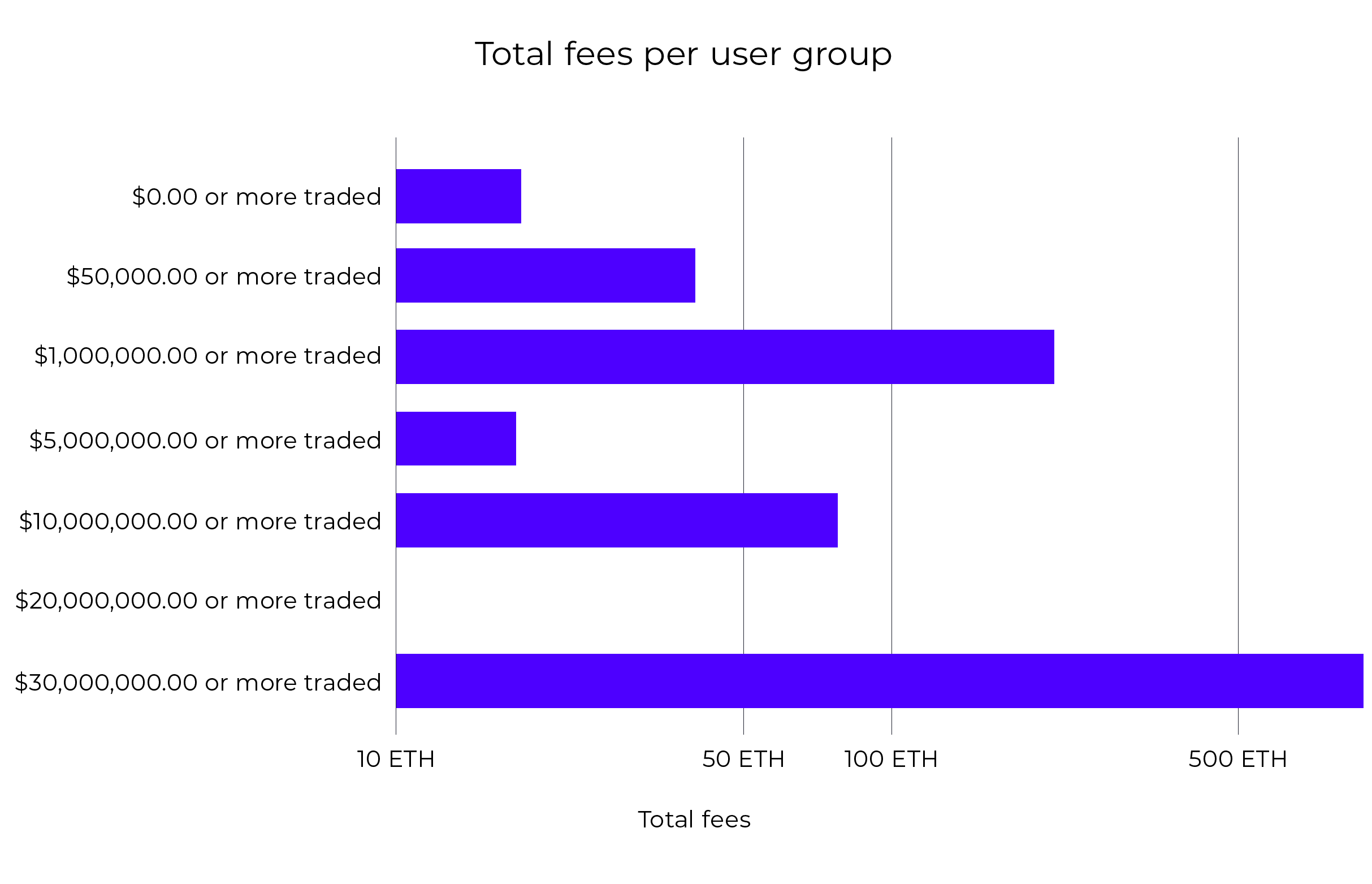

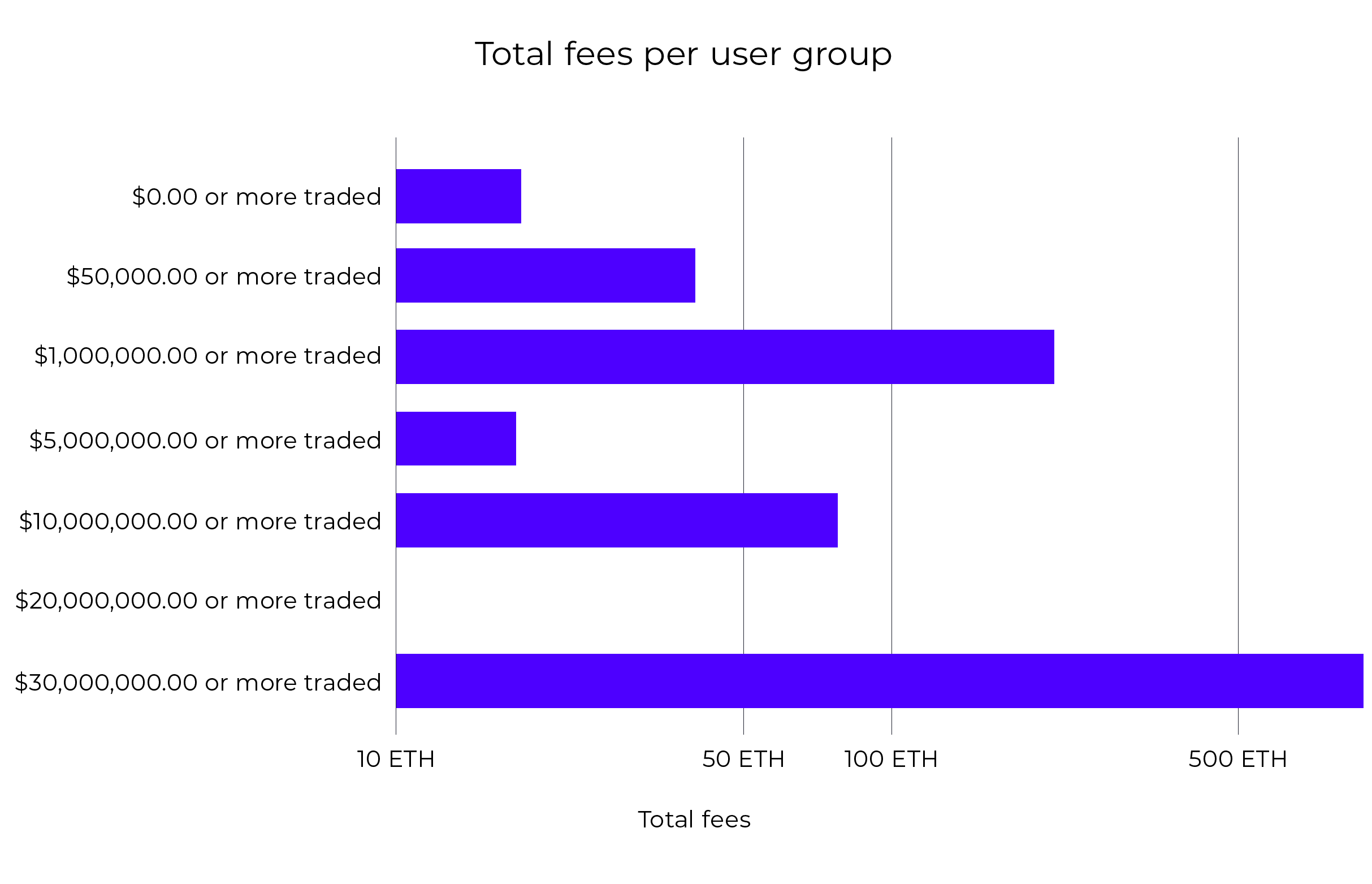

This section provides an example of the sort of deeper analysis that we conduct when we benchmark our performance both internally and externally. This week we begin with the distribution of fees among our tiers and the implications behind it.

Our fee schedule is adjusted to reward traders for their loyalty and contribution to the liquidity of the exchange. We would expect to see a correlation between the fee tiers and the fees collected per tier as they are both dependent on monthly trading volume. We see that this relationship holds true for the the first three and last tiers. However, the activity levels in the forth, fifth and sixth tier are not as high. This suggest that we are not capturing that market as effectively as we could be. This could be due to the clarity and competitiveness of our fee schedule or the marketing efforts to promote Ethfinex to traders of that level.

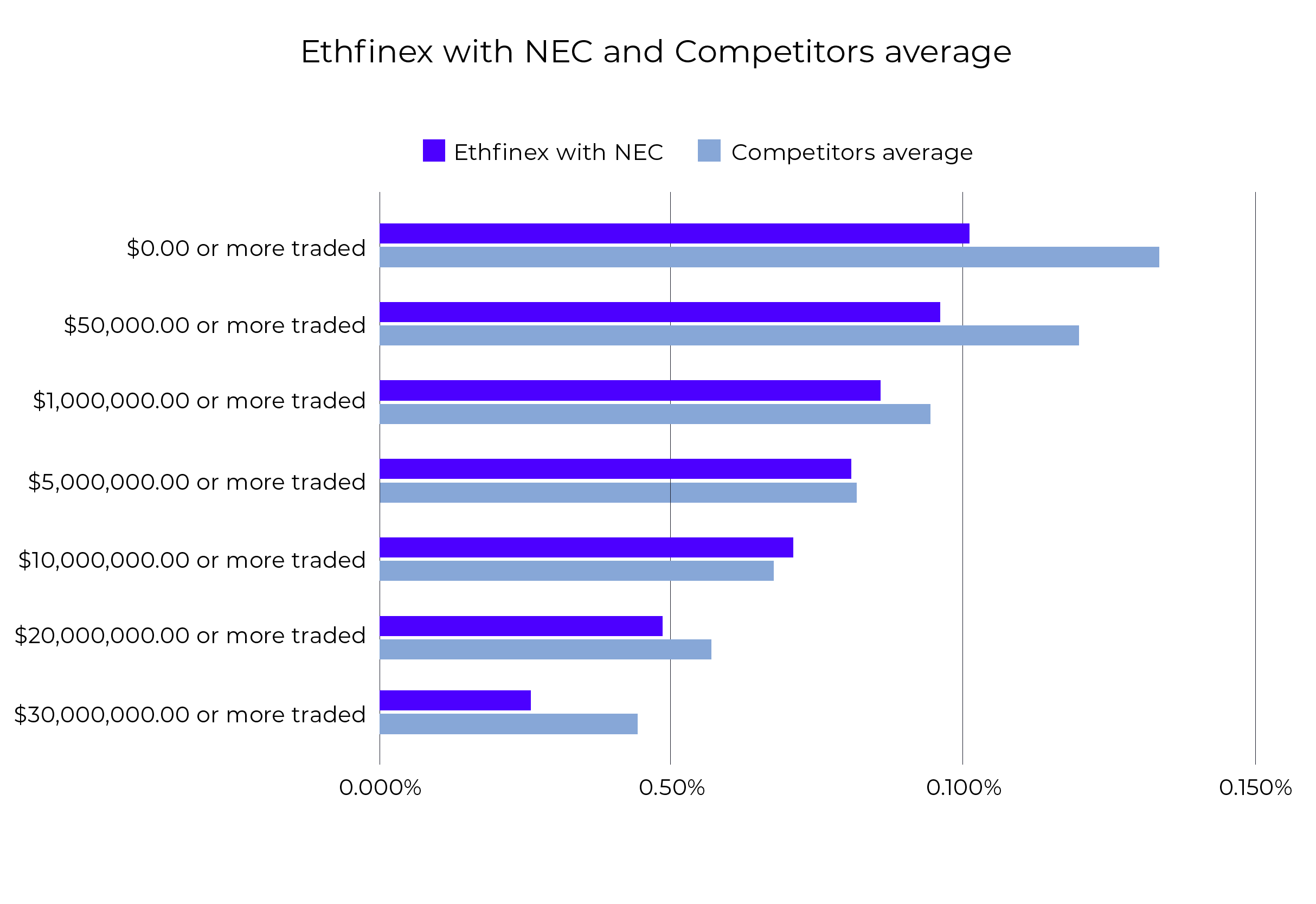

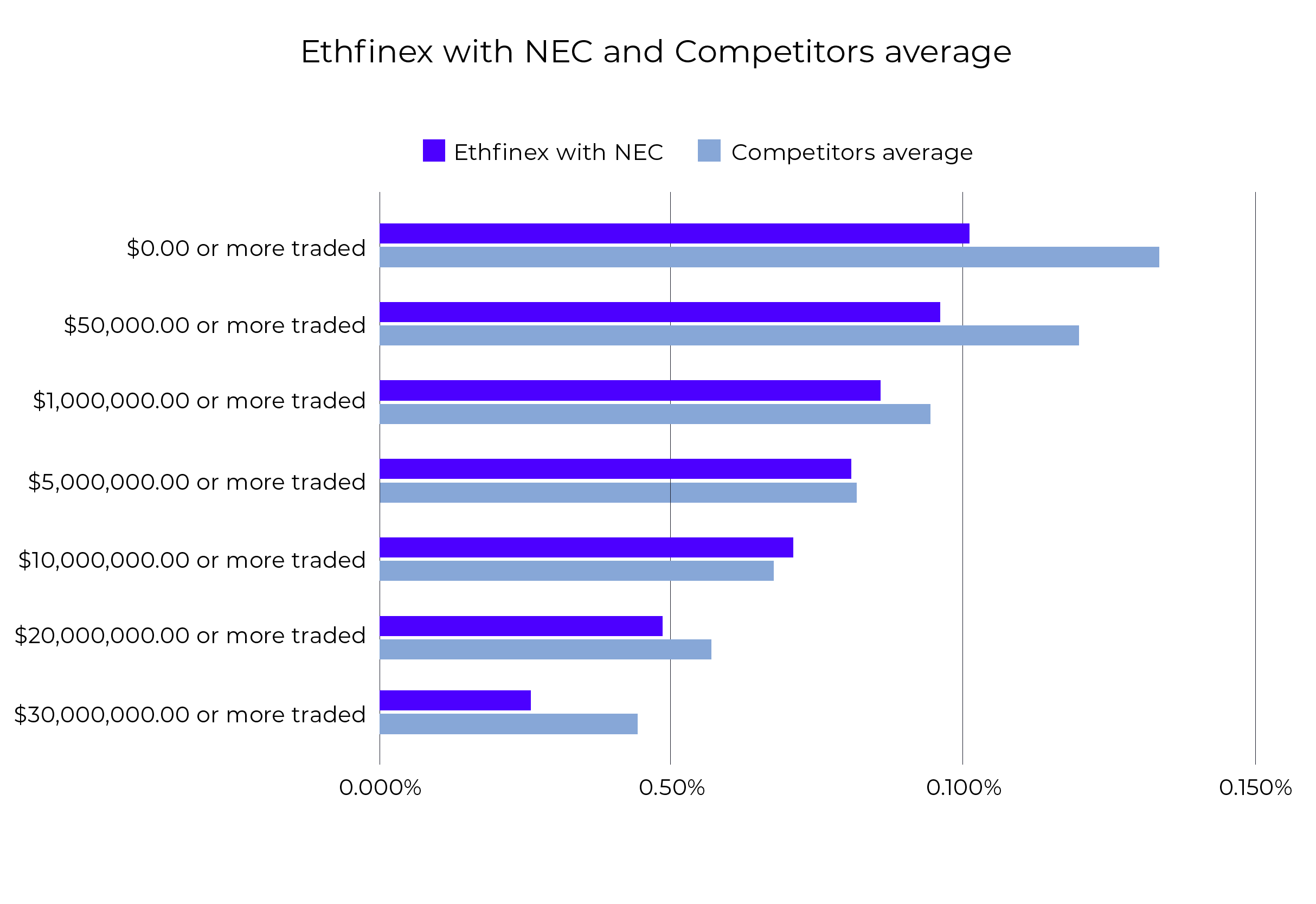

Evidence shows the answer might be a mixture of both. Benchmarking our fee schedule (including NEC rebates) against 3 other industry leading exchanges with real volume shows that indeed under $5m and above $30m monthly volume our fees are very competitive and we see the volumes to reflect that. However, in the $5m-$20m range although our fees are comparable we see a drop off in customers. This suggests that the perceived value of the NEC rebates is lower than its true value. Although there might be some practical considerations that cause that like carrying the cost of capital for a whole month until a rebate is received or the risk of NEC price fluctuations, we believe this is an indication of something different. We see the main drivers behind this to be:

- uncertainty about the future long term price of NEC

- uncertainty around what the exact value of the NEC rebate will be at the end of the month and hence the exact fees paid by the trader.

Executive Summary

The performance period covered in this report is 11th December 2018 – 9th January 2019.

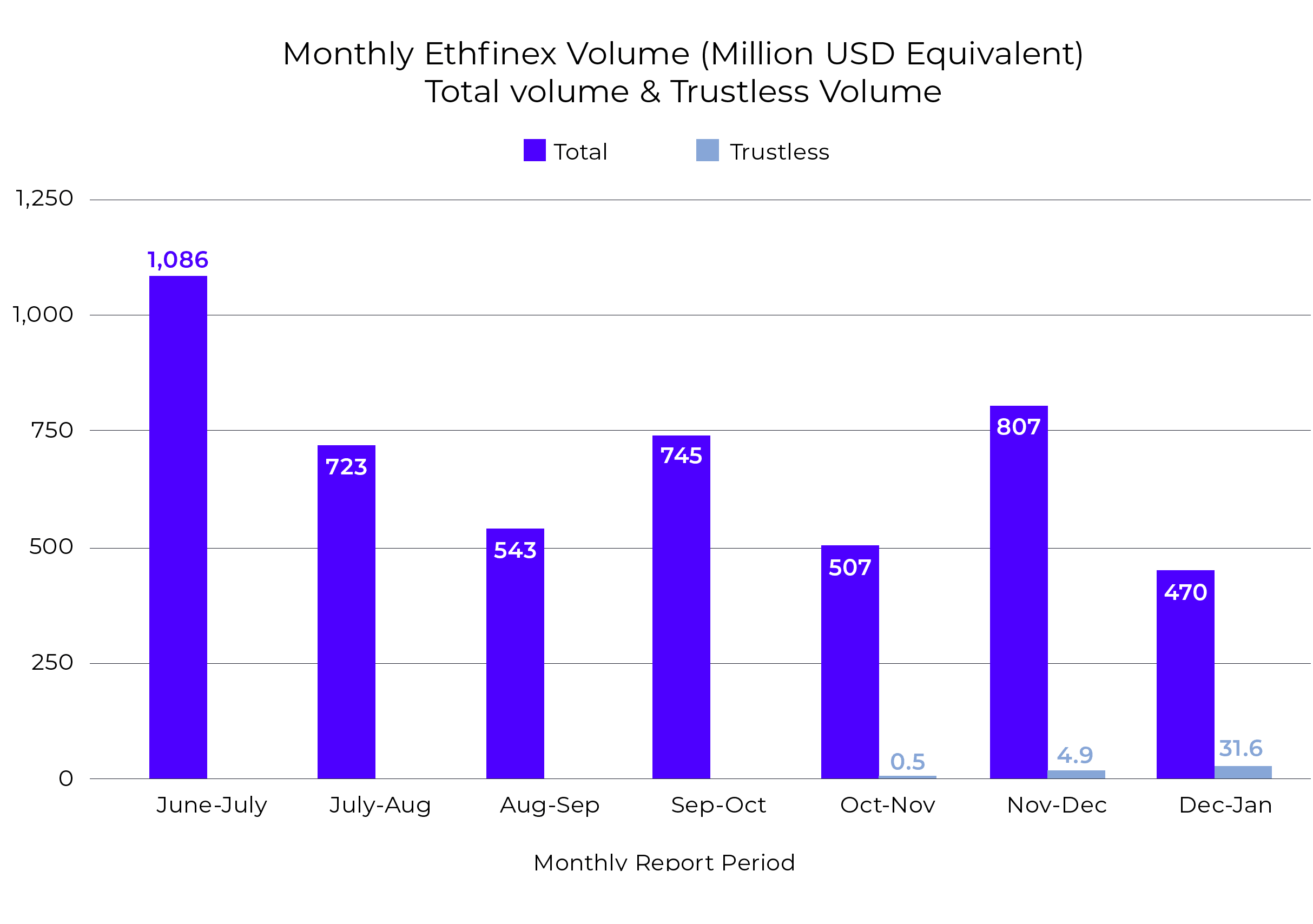

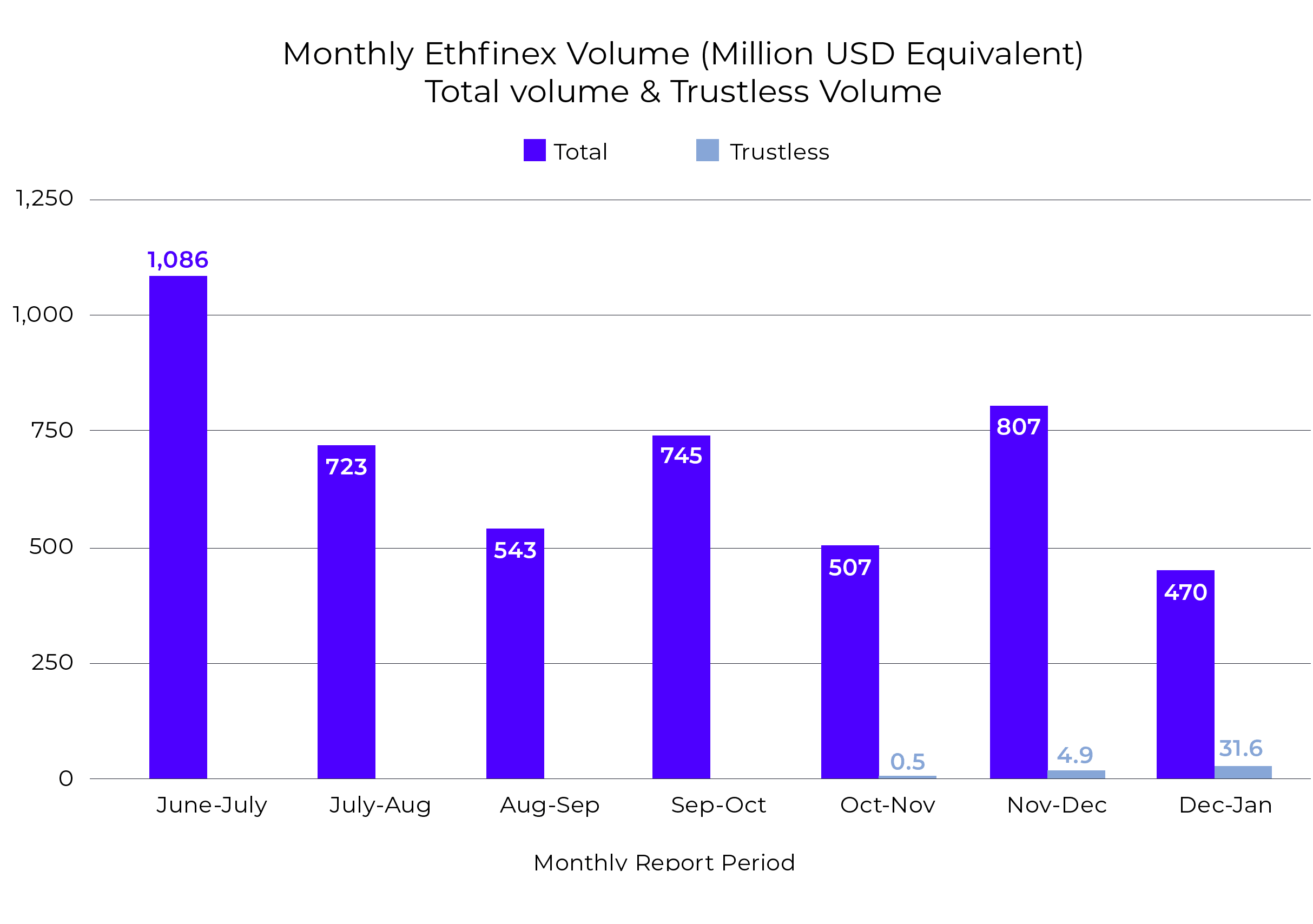

- Total trading volume for the period equalled $470m, a simple average of $15.6 million per day, a decrease of 42% from the previous period.

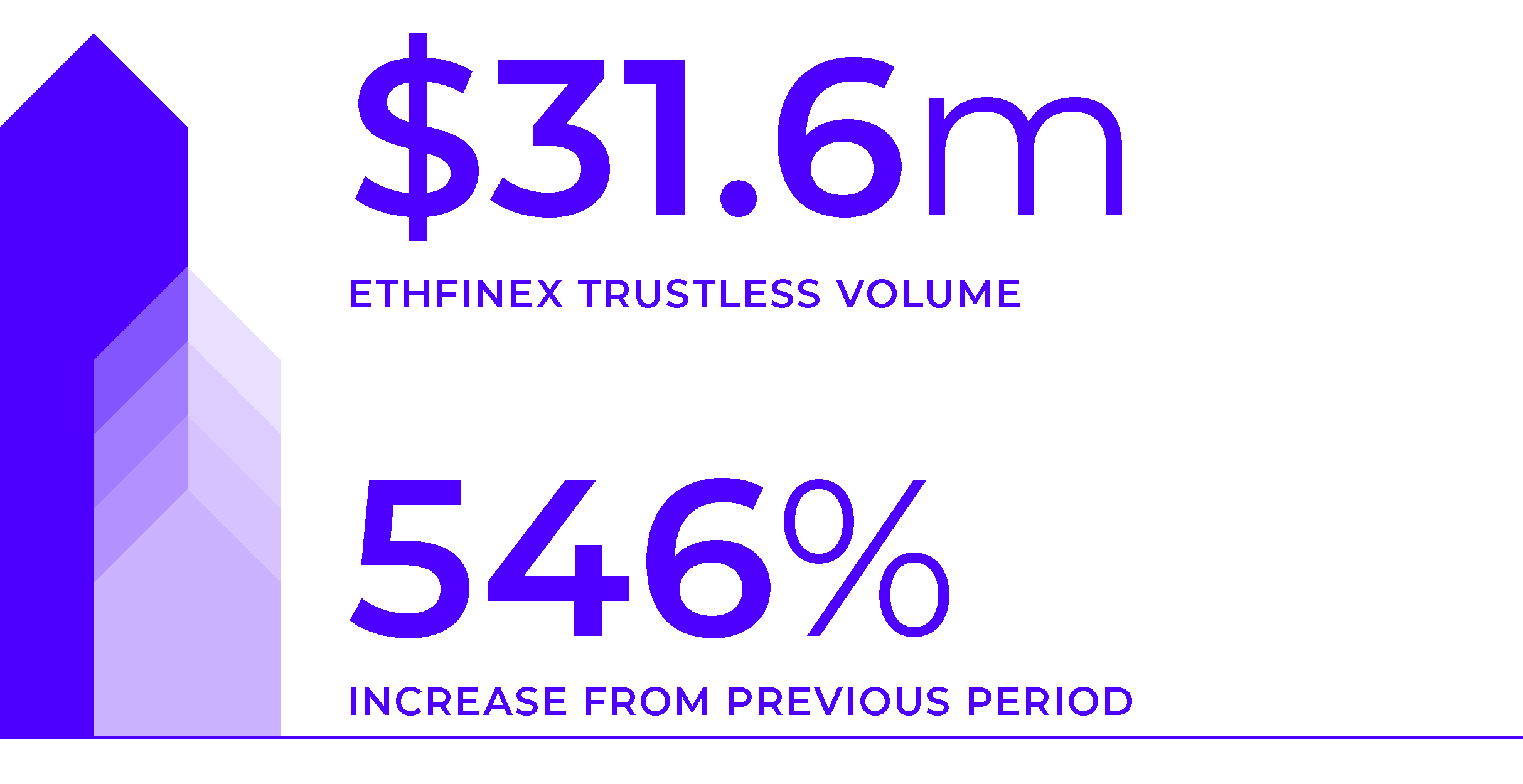

- Ethfinex Trustless volume for the period totalled $31.6m, an increase of 546% from the previous period.

- Total trading fees of ~$407,991 (average daily ETH/USD across the period) were collected through trading over the period, a decrease of 16% from the previous period.

- In line with this, 1658 ETH have been contributed to the Nectar token contract, pledged to NEC holders.

- 1,612,532 NEC tokens were distributed to reward market marking active on Ethfinex in the past month. Statistics can be viewed on Nectar.community.

Month in Review — January

Revenue & Activity Reports

1. Trading fee revenues

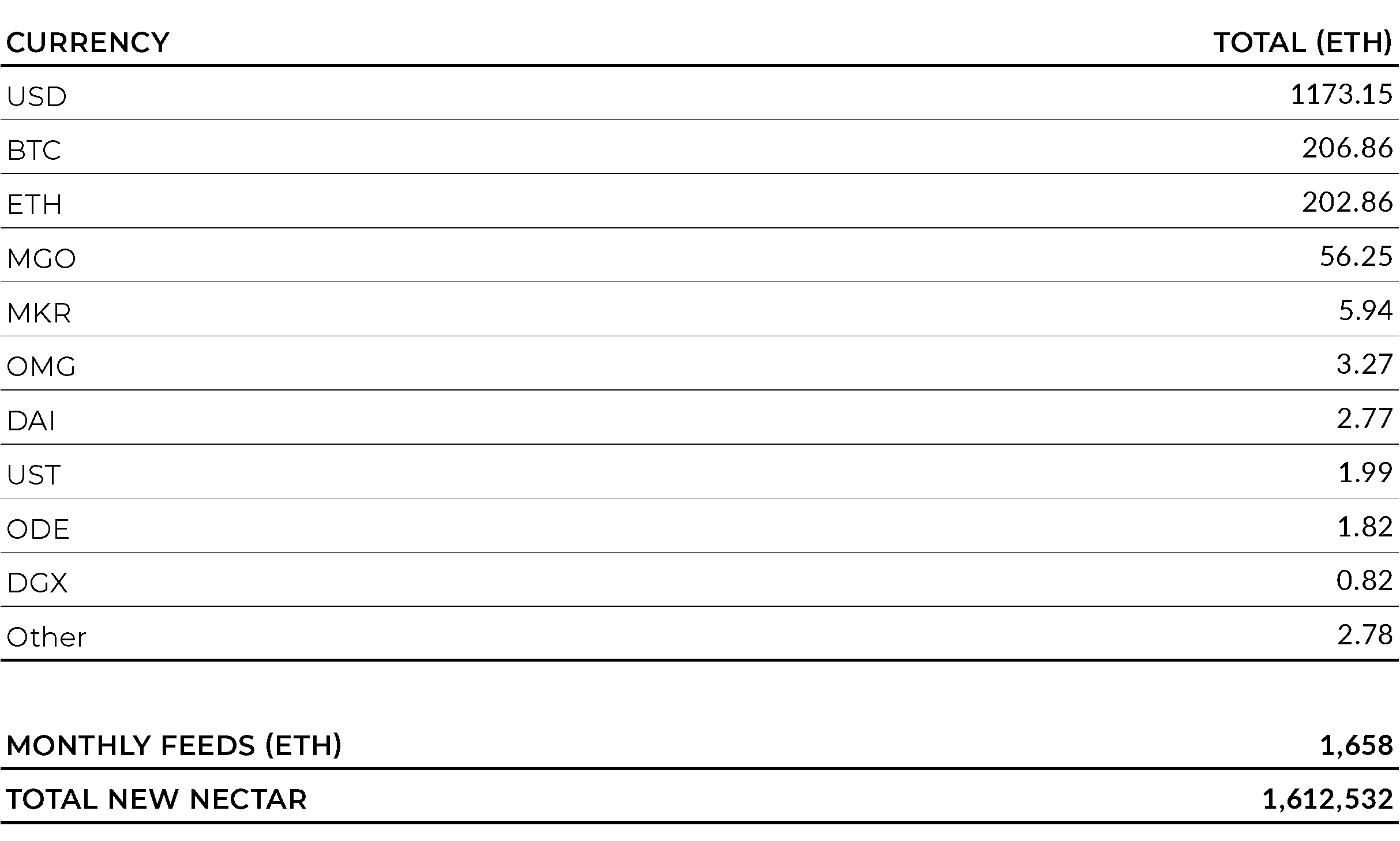

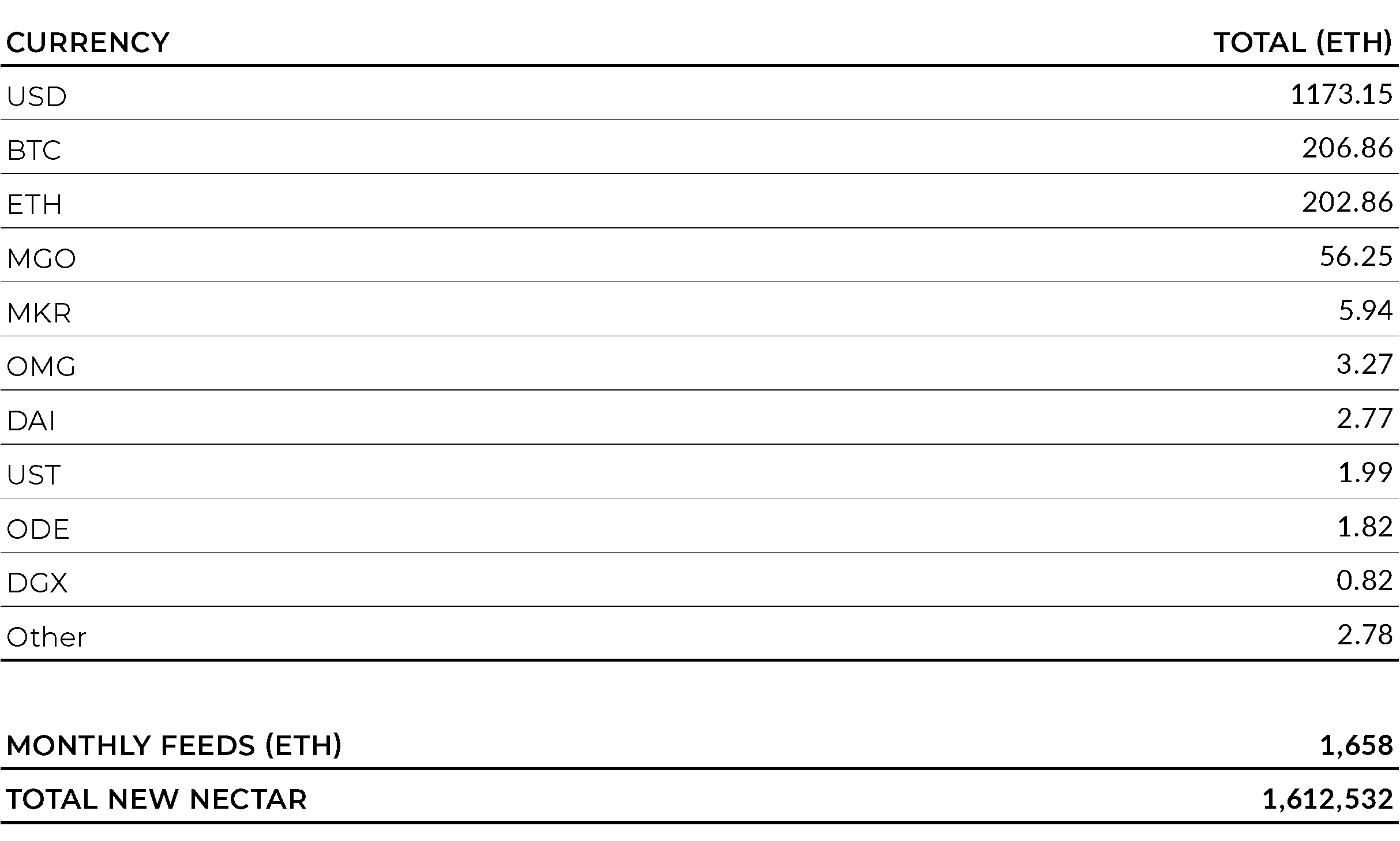

All fees were converted as they were collected into ETH to provide an averaged conversion cost across the month and average out the effects of price volatility during the period.

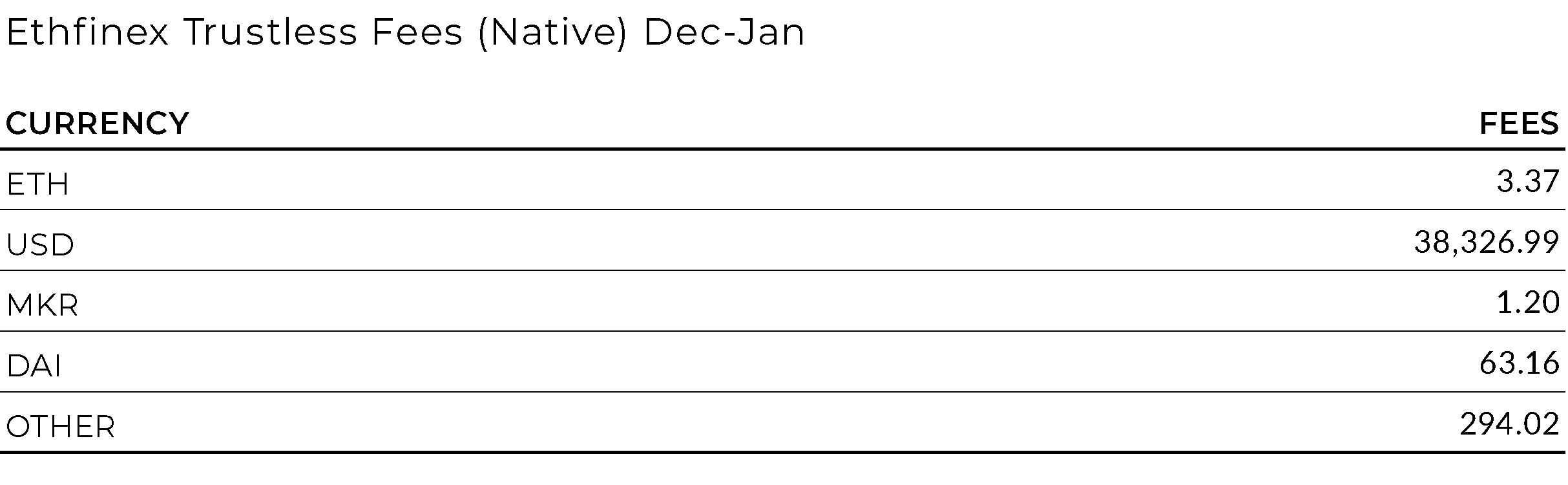

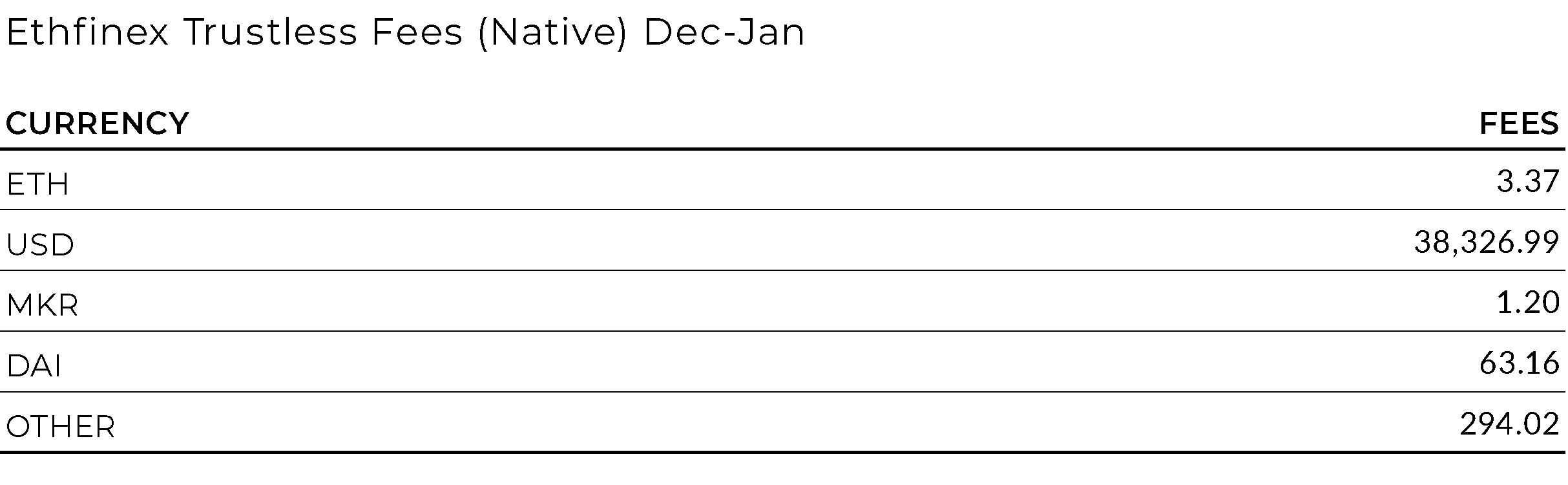

Fee currencies in the table are ranked in order of most collected. Quick note — fees cannot be extrapolated directly to trading volume as users can set their preferred fee currency (hence the popularity of USDT and BTC).

The above chart shows 50% of fees in all currencies collected. 1658 ETH were collected during the month and pledged to NEC token holders. Although the ETH/USD remains the main fee generator, MGO, MKR and OMG also generated generated notable fees in their own currencies.

Total trading fees of ~$407,991 (average daily ETH/USD rate through the month) were collected through the period, a decrease of 16%.

2. Trading Volume

Ethfinex total 30-day trading volume decreased 41% from the previous period in USD terms to $470m. The December holiday period was a relatively quiet month for Ethfinex trading volume, despite ETH volume in the wider industry increasing 22.6% to $2.6BN per day. Volume in the wider industry over the holiday period seemed to be driven from the Asian exchanges.

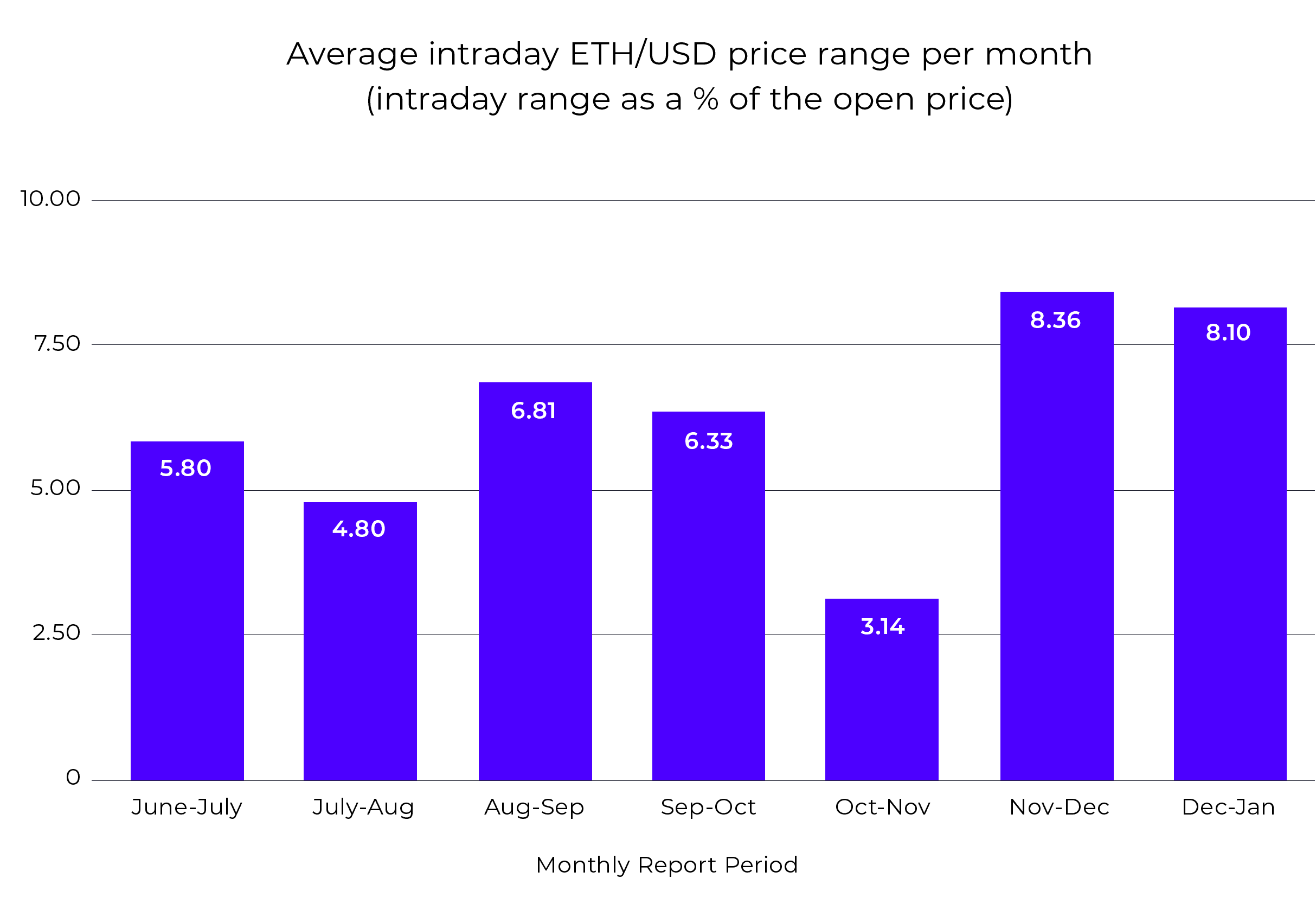

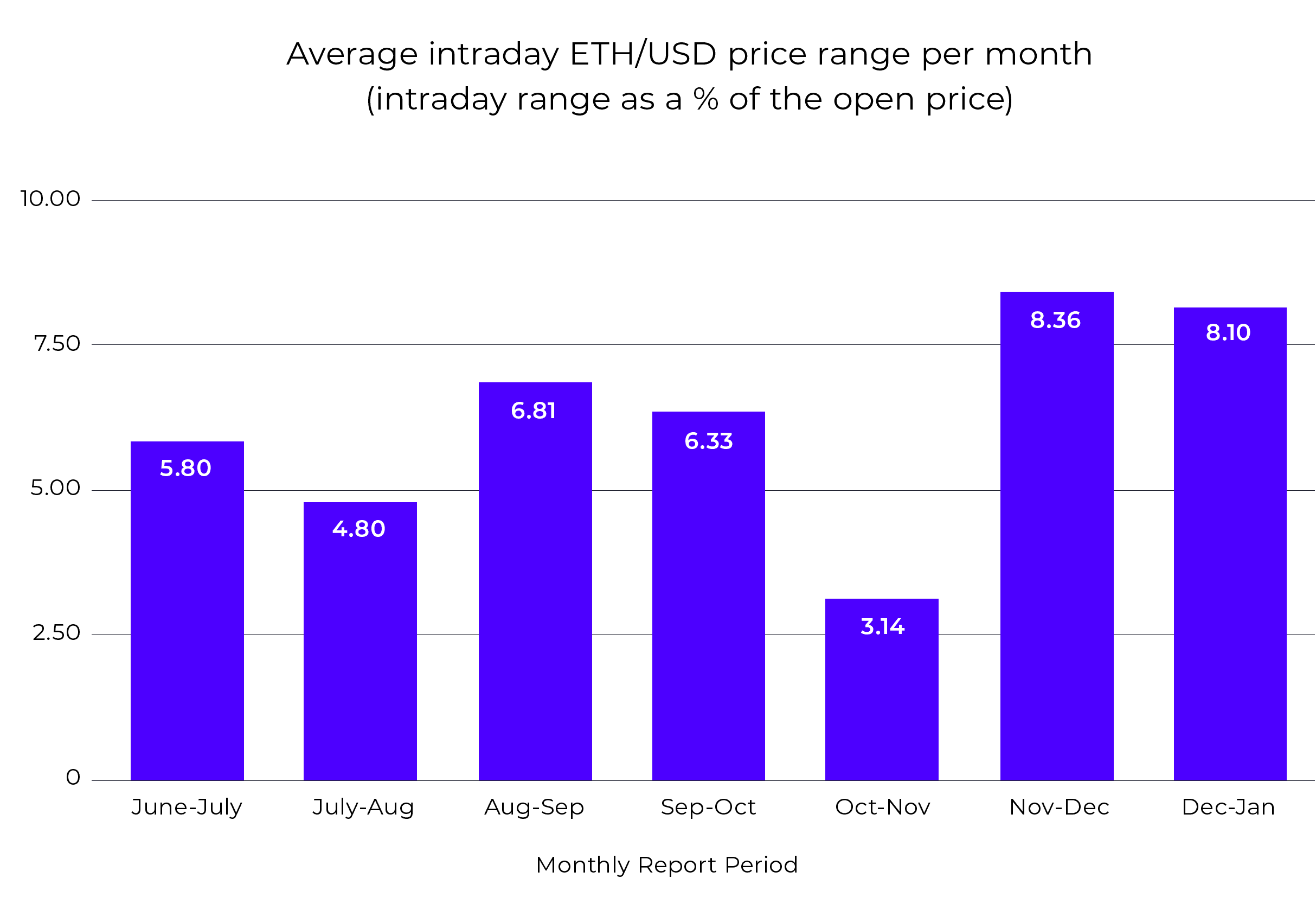

ETH/USD volatility actually decreased 25% (as measured by standard deviation across the month) but was still relatively high compared to two months ago. Intraday volatility (as measured by the intraday range as a percentage of the open price) also decreased slightly to 3% to 8% – still a relatively high level and in complete contrast to two months ago where intraday volatility hit its lowest level of the year.

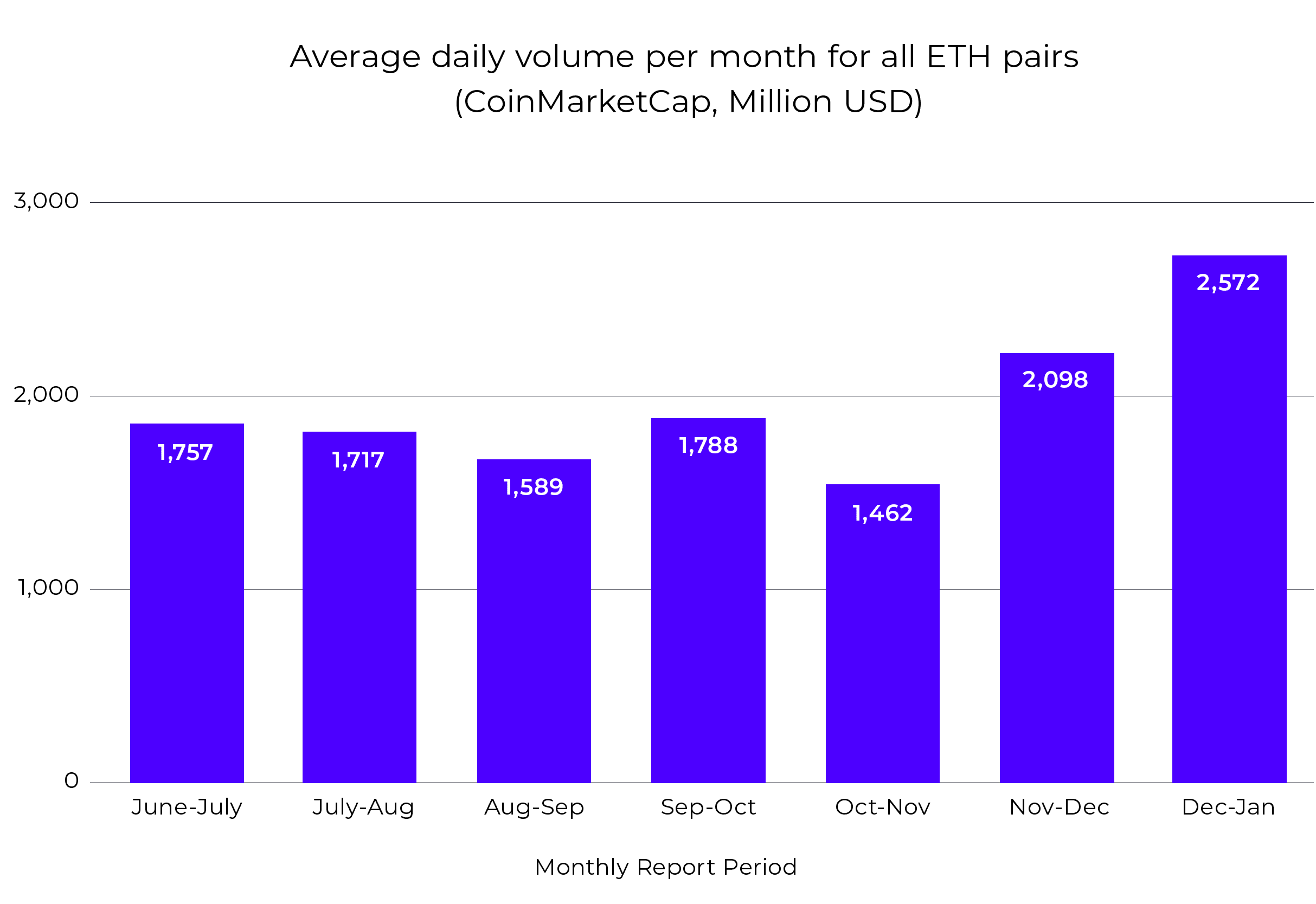

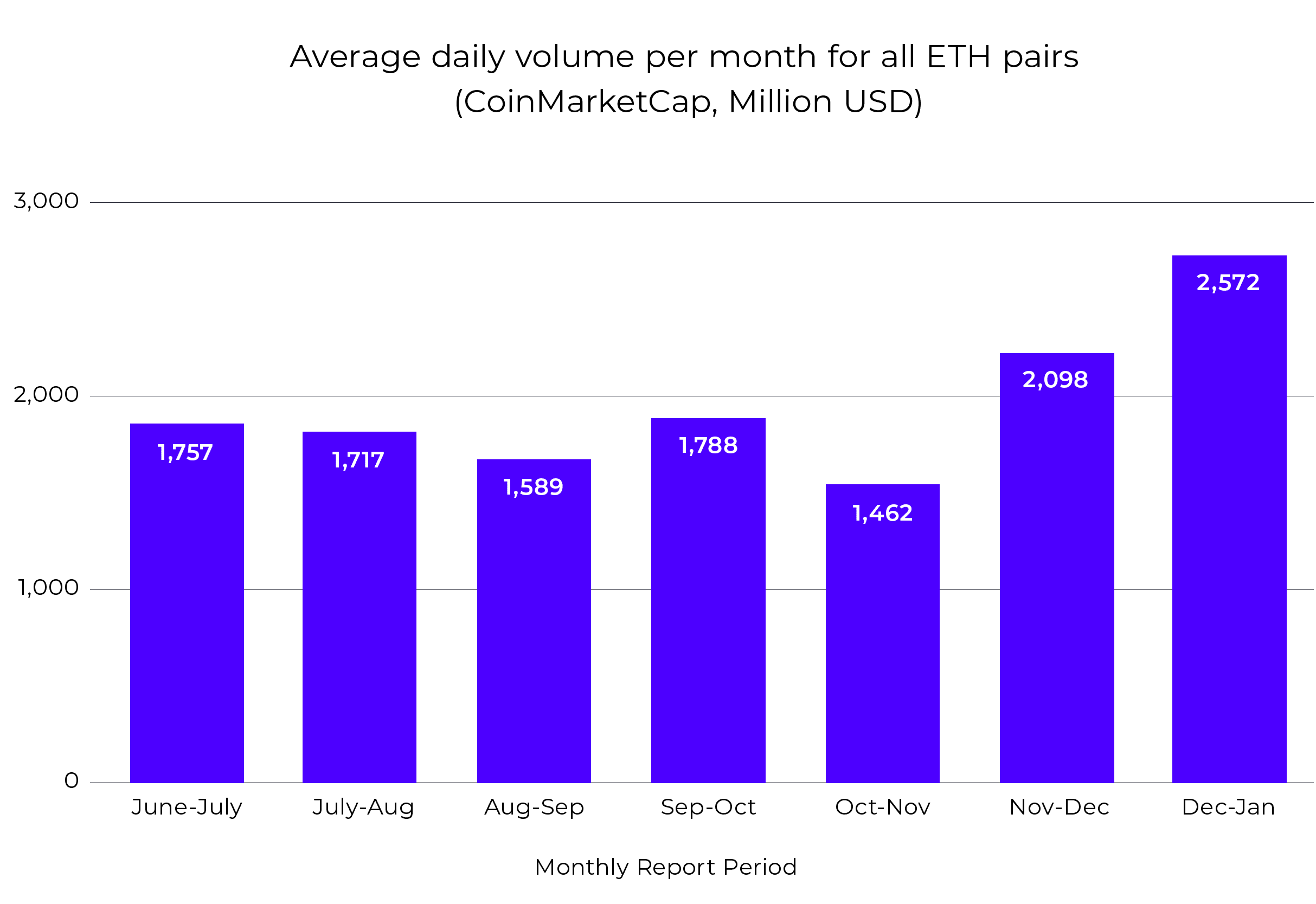

Average daily USD volume for all Ethereum pairs, across a sample of exchanges (CoinMarketCap data) increased 22% from the previous period – mainly driven by Asian exchanges. Although this is not a perfect measure by any means, it suggests that Ethfinex lost volume market share across the period potentially as our user-base wound down for the holiday period.

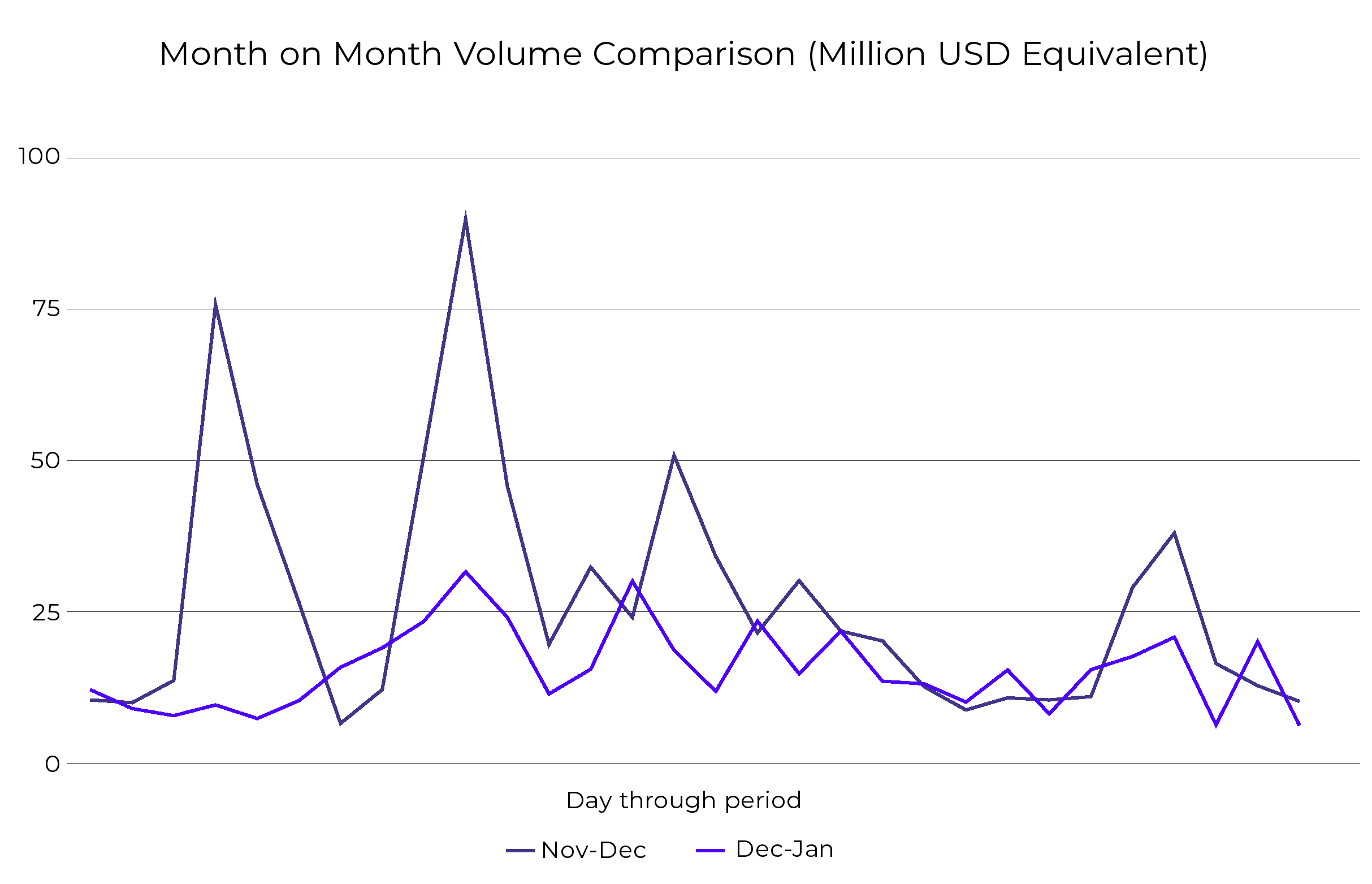

Trading volume correlated to the most volatile days in Dec-Jan. Peak daily trading volume was only $31m, a small decrease of 42% compared to the peak trading day in the previous period.

Unique user numbers posted another small decline across the period compared to the previous month. We believe that the main driver of this was the holiday period. With new product releases on the horizon, we believe this trend will reverse as we enter February.

3. Ethfinex Trustless

Ethfinex Trustless volume for the period totalled $31.5M, an increase of 546% from the previous period.

With a fee rate of 0.25% (higher than the fees on the centralised version of Ethfinex), Trustless has the potential to become a serious fee generator for Nectar token holders, and is already delivering on that promise. The peak volume day was $6.7m on the 20th November. USDT markets were the main driver of volume, as arbiters took advantage of the pricing miss-match between Ethfinex Trustless and other exchanges. This is exactly the sort of trading that Trustless has been designed for, as there is only a very small waiting time for users to be able to unlock their tokens, compared to the longer withdraw times on the centralised exchange.

Due to the large spread between USDT and USD on the centralised order book, we had to make a small change to Trustless USDT markets as the USDT/USD spread has been non-zero. These are now shifted by the USDT/USD exchange rate to ensure that they are still linked to the centralised USD order book but are now more reflective of USDT markets on other exchanges. You can read more about this here

December saw the largest series of updates to the Ethfinex trustless UI since Trustless was first launched. As well as the USDT ‘market shift’ mentioned above, the user on-boarding process was completely re-designed following the user interviews conducted throughout the previous month:

- The on-boarding now takes up a smaller segment of the UI, meaning an increased visibility of the platform.

- The on-boarding includes a 3-step process, with a clear navigation, making it increasingly obvious for users to navigate Ethfinex Trustless.

- Clear connection process with Metamask, Portis, Ledger, Trezor and Keystore.

- Clear explanation of how to lock tokens and a slider that helps users select the exact amount of tokens in a clear and concise manner.

- Square buttons on both onboarding and platform itself to ensure consistency throughout design.

The Month Ahead – Jan/Feb 2019

1. The Ethfinex ‘Un-board’ meeting feedback

At the Ethfinex Governance Summit in Lugano four months ago, NEC community members provided recommendations to help drive forward Ethfinex on key items such as volume, customer acquisition, strategy and new products. After achieving key stakeholder sign off on some of these proposals, we are steaming ahead with some of the priority features. We are very close to launching the following features:

1) Restarting the two-weekly Ethfinex community new token listing vote with a new and improved process, which will flip the dynamics of voting on its head.

2) Providing Ethfinex Superusers (those holding certain amounts of Nectar tokens) with valuable benefits on the platform, and giving a strong incentive for new traders to acquire more Nectar and join Ethfinex.

3) Allowing token projects to provide a limited bounty/subsidy to lower trading fees on their trading pairs.

4. Ethfinex Token Sales

December saw some minor updates to the Token Sale platform, the main update being that there can now be a variable individual to each token sale. This should allow for a wider set of users to contribute to their favourite projects.

Key updates over the next few weeks include moving the token sale platform to page that is separate to the main exchange (for easier updates) and a fresh new UI.

We also have some grand plans to make project information discovery on the platform easier as well changes that have never before seen on any token sale platform in the industry… (more coming soon!)

If you are planing on a public token sale, or know a token sale who you would like to bring to Ethfinex users, then we would love to hear from you: [email protected]

4. Trustless UX Revolution

Following the new and improved UI and under-the-hood updates, we now believe that Trustless is ready for the world. A large portion of our efforts over the next several months will be making sure that the community is aware of how Trustless can benefit their trading or product and we are already exploring some integrations with wallets, DEX aggregators and DAPS. Please email [email protected] if you would like to explore an integration.

Trading is now live on Ethfinex — get started here.

Sign up to our weekly newsletter and stop by our Telegram to learn more about the vision for Ethfinex.

Visit our Twitter to stay up to date with announcements, token additions and more.