Monthly insights into the performance of Ethfinex

With an aim to be as transparent as possible to Nectar holders, Ethfinex publishes detailed reports showing the results of each 30-day period.

The fifth month of trading on Ethfinex finished on 13th July. The market remained steady and quiet, although against a backdrop of positive news.

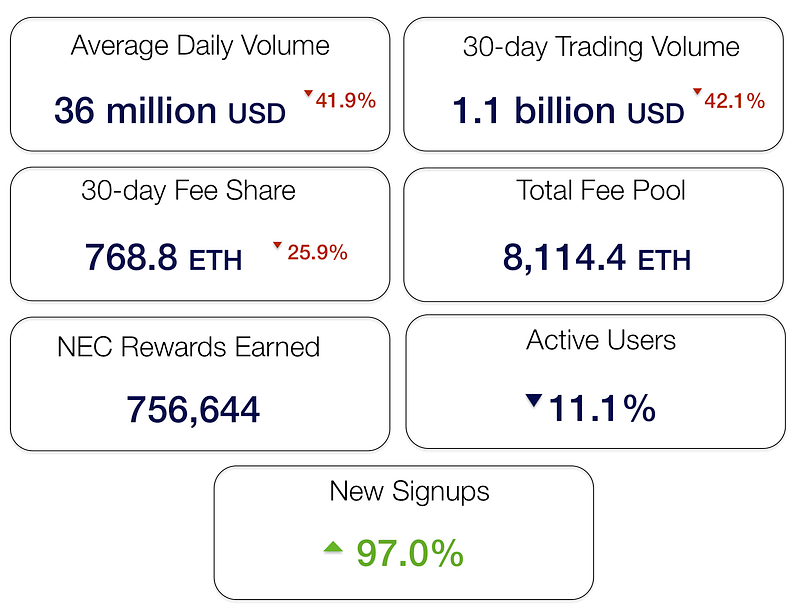

The month saw significantly higher new sign-ups but a continued relatively low number of actively trading users, reflecting the overall market downturn. Total trading volume was at 1.1 billion USD for the month (down 42%).

In combination with the upcoming launch of the trustless trading portal, which makes access to trading much more accessible for all users whilst eliminating a number of trading frictions (sign-up, deposits & withdrawals), we are now focusing on tailoring the Ethfinex experience for larger customers, including via the Nectar market-maker loyalty program.

“We are working on a number of initiatives aimed at attracting corporate accounts, including funds, high net worth individuals and market-makers. Feedback from existing corporate users has been positive with regards to user experience, NEC token economics and trading via the API but the standout point was that our branding and on-boarding was letting us down. This also echoes our own hypotheses and is something that we are working to address.”— Ross Middleton, Commercial Director

This following report breaks down monthly trading revenues, volume and user growth, and will continue to provide more detailed statistics each period to our community of users.

Executive Summary

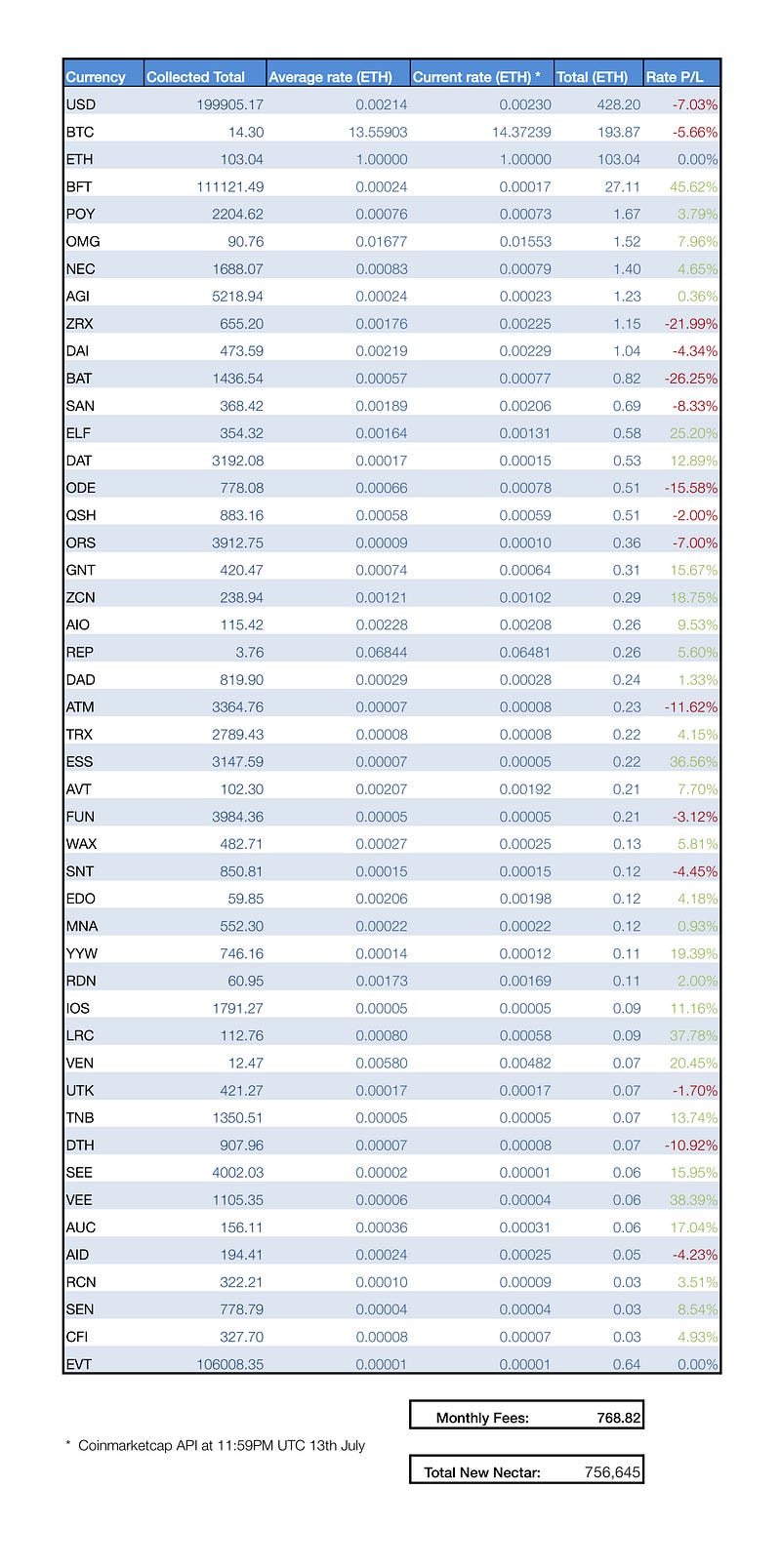

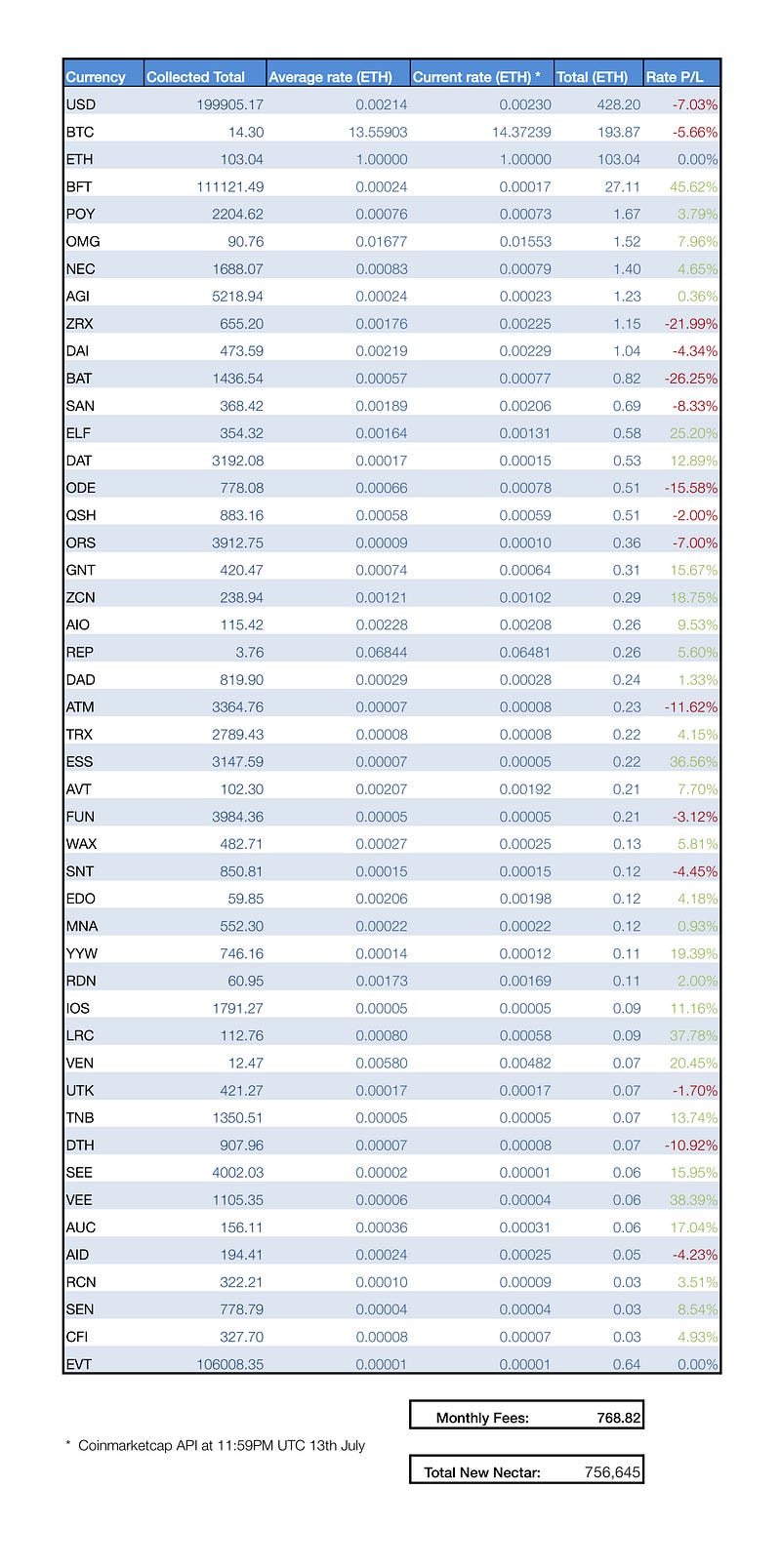

- Total fees of ~$692,000 (depending on price feeds) were collected through trading and other fees in the 30-day period.

- In line with this, 768.82 ETH have been contributed to the Nectar token contract, pledged to holders of NEC.

- 756,644.6 NEC tokens were issued to reward market makers active on Ethfinex in the past month.

- The credit of new tokens happened directly to trader’s Ethfinex accounts on the 13th July.

The Ethfinex trustless portal, allowing anyone to easily trade against the order books of a major centralised exchange without trusting that exchange has been released into the world for the first time at the Bitfinex hackathon this weekend. Ethfinex is sponsoring a $5000 prize for teams building with the new trustless API.

Month in Review — July

Revenue & Activity Reports

This month the report includes new statistics on user numbers, activity, and further breakdown of fees. We are currently develop several new models which will be included in future months.

1. Statistics

2. User Behaviour and Acquisition

This month the marketing team refocused on new user acquisition, driving new signups through a series of campaigns and new experiments. These were particularly focused around the new token listings, and community voting process running at nectar.community/#/listings.

Interestingly, whilst this was successful at generating a huge increase in new signups (the number of new signups was 97% higher than the previous 30-days) the majority of these did not convert to active users, and we saw another drop over the period. Active users are defined for the purpose of our internal analysis as any user generating more than 1 USD equivalent in fees over the past 30-days.

Hypotheses for further investigation:

- The user journey and interface after signup is too intimidating, leading to many new users never depositing and becoming active traders. It may be possible to convert many of these recent sign-ups into regular traders through education, gentle support, and with some of the new updates in the pipeline.

- The customer segments which are currently being targeted are mainly missing the mark and need to be refocused.

Some analysis of current customer behaviour and fee tiers:

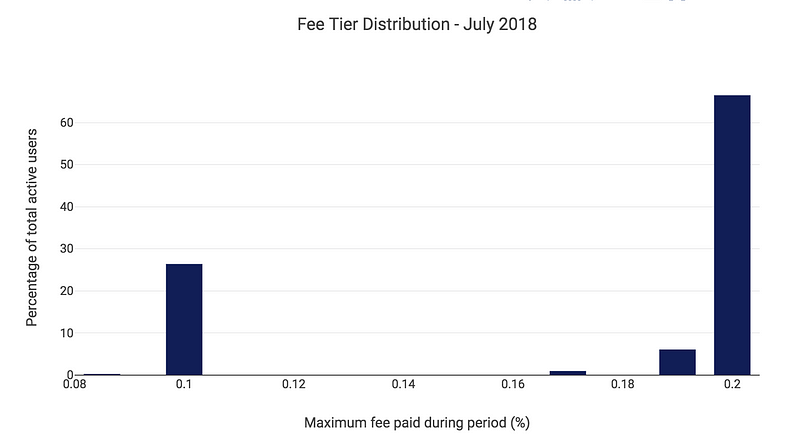

The majority of active users fall into two brackets:

Either at the top end of the fee tiers, trading over 30 mil USD monthly giving them the most favourable fee schedule and earning the most Nectar tokens, or at the bottom end of the fee tiers, with only low volume and paying maximum fees. We intend to review current tiers with the aim of seeing a significant number of these lower volume customers shifting gradually left on the graph above.

3. Trading fee revenues

All fees were converted as they were collected into ETH to provide an averaged conversion cost across the month and average out the effects of price volatility during the period.

Fee currencies in the table are ranked in order of most collected. Note — fees cannot be extrapolated directly to trading volume as users can set their preferred fee currency (hence the popularity of USDT and BTC).

The above chart shows 50% of fees in all currencies collected. 768.82 ETH was collected during the month and pledged to NEC token holders. BFT in particular, and also POLY, OMG, NEC, AGI, ZRX and DAI pairs all performed well.

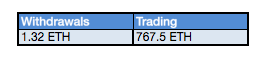

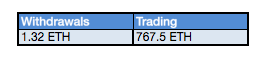

For this month we also provide an illustrative breakdown of the impacts of Withdrawal fees.

These fees are only intend to cover gas costs for processing deposits and withdrawals, and act as a disincentive to request many small withdrawals (which contribute to congestion on the blockchain and slow down processing time for other users).

4. Trading Volume

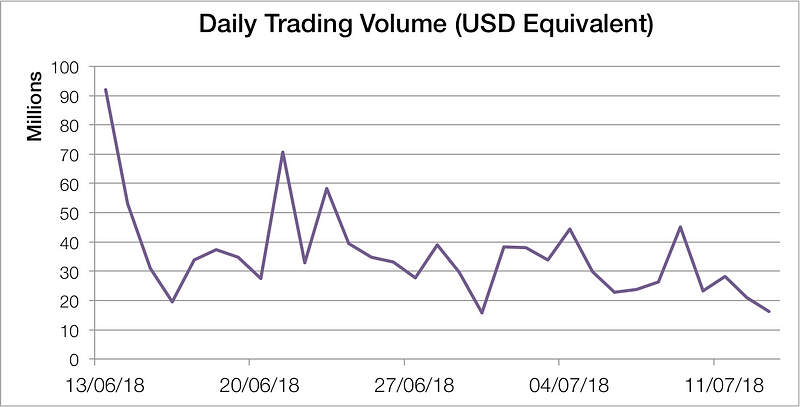

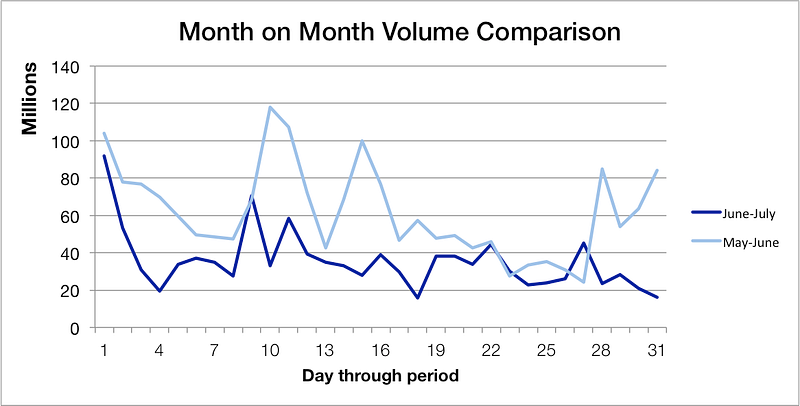

The total 30-day trading volume dropped again, reflecting the relative stability of the markets and low trading volumes market-wide, to 1.102 billion USD equivalent — compared with June (1.9 billion).Some signs began to emerge which may point to a potential recovery in the next months, including significantly increased new user sign-ups and decreasing volatility at steady prices.

Peak daily trading volume was 92 million USD, in line with the previous month, but with an average of just 35.6 million USD. The majority of the volume continues to result from the ETH/USD pair.

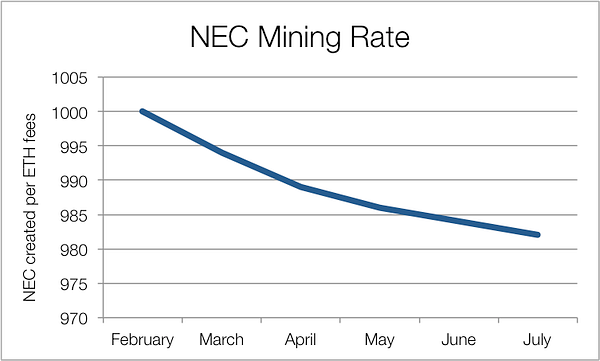

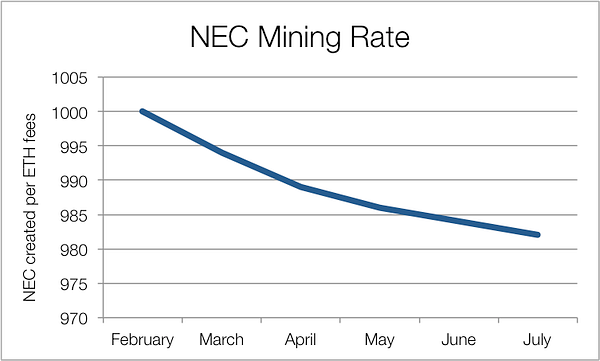

5. Decreasing rate of NEC issuance

NEC mining rate (the rate at which new NEC are issued to traders on Ethfinex) continues to decrease each month, and is now at 982 NEC per 1 ETH of fees collected.

The Month Ahead — August

Public Launch of Ethfinex Trustless (DEX)

After a long journey the public launch of the most important part of Ethfinex is ready. We have been testing the UI with ever larger groups of our community, and are making available all the associated APIs and client libraries to the developer community over the weekend of 20–22nd July at the Bitfinex Hackathon.

Why are we excited about the trustless portal?

- No sign-ups

- No deposits and withdrawals

- No trusting anyone else with your tokens

- Blazing fast, low spreads, and high liquidity order-books providing the fastest, and cheapest trading experience anywhere.

Development Update — 003

An overview of key developments throughout the past monthblog.ethfinex.com

The Ethfinex gateway API will allow users to submit orders in the 0x format, subsequently allowing anyone to create their own UI (e.g. a ShapeShift style interface) to interact with the Ethfinex order books. All this can be done without creating an account, depositing funds or trusting Ethfinex.We are sponsoring the Bitfinex hackathon with a prize worth 5,000 USD this weekend (20th-22nd July).