Welcome to our December Performance Report

With an aim to provide Nectar (NEC) token holders with a clearer view of the inner-workings of their exchange, we publish monthly reports reflecting the trends and financial results of each 30-day period.

Although November saw some welcome volatility return to the markets, we all wish the direction of travel had been up, rather than down. If you are reading this then we hope you survived the incredible $121 crash in the ETH price over Nov-Dec. Hopefully the bottom is in… (not investment advice!)

December has been a month of building, with our greatest visible achievement being the growth story of Ethfinex Trustless. Towards the end of the period this report covers, Trustless volumes were beginning to creep over the $1m per day level, and has now surpassed $2m per day on two separate days. We believe that Trustless has huge benefits for both Ethfinex and the crypto industry and it is great to see that the word is slowly creeping out.

Executive Summary

The performance period covered in this report is 11th November 2018 – 10th December 2018.

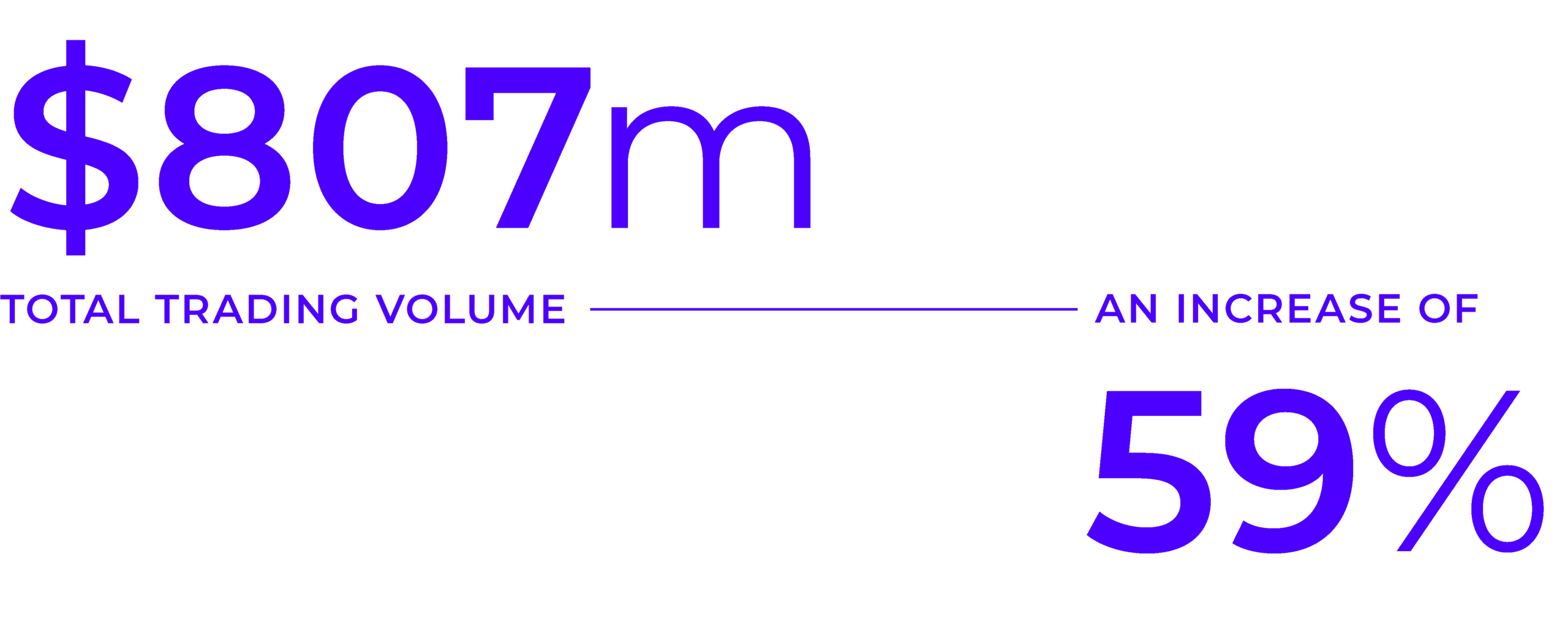

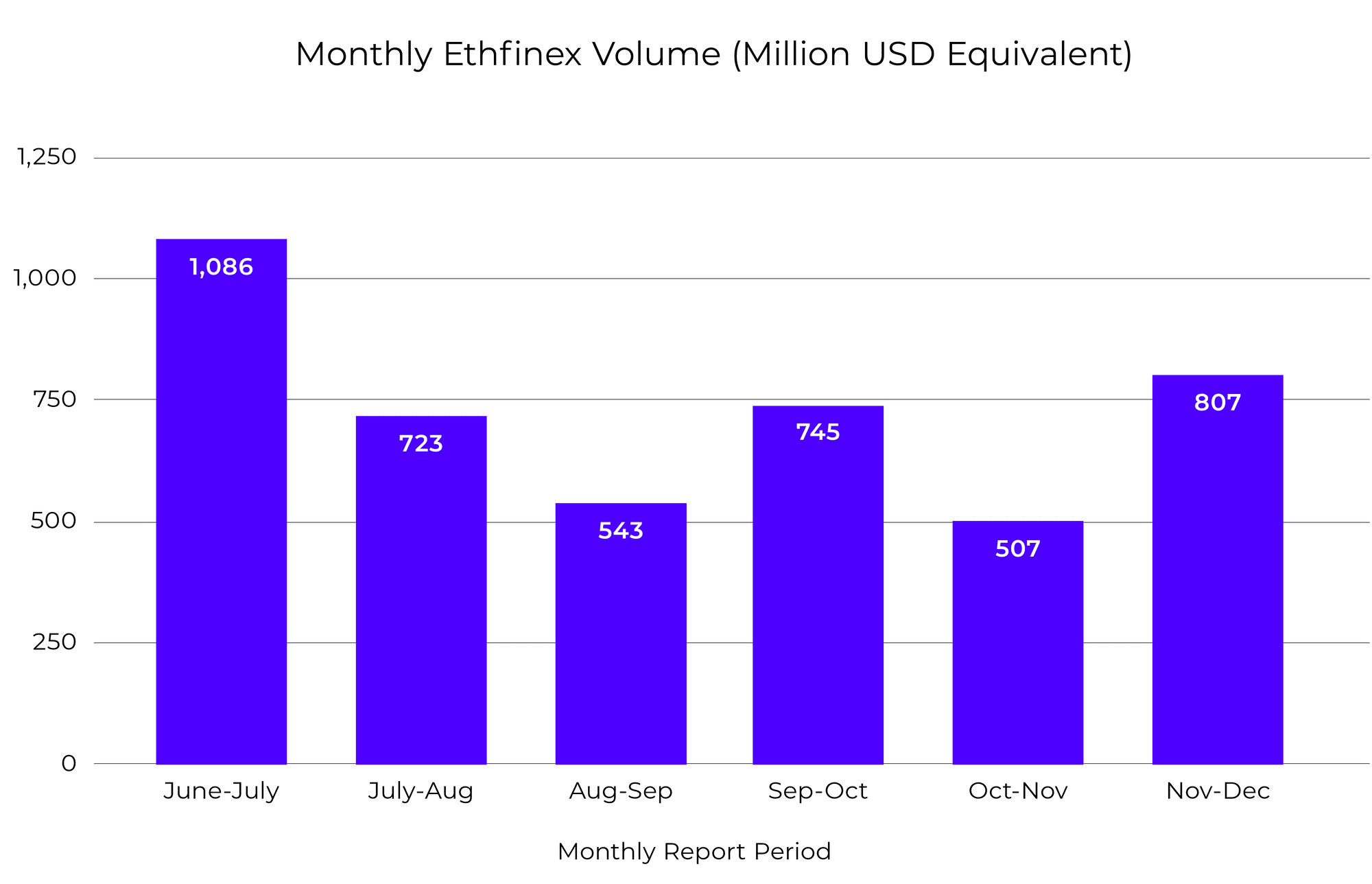

- Total trading volume for the period equalled $807m, a simple average of $26.9 million per day, an increase of 59% from the previous period.

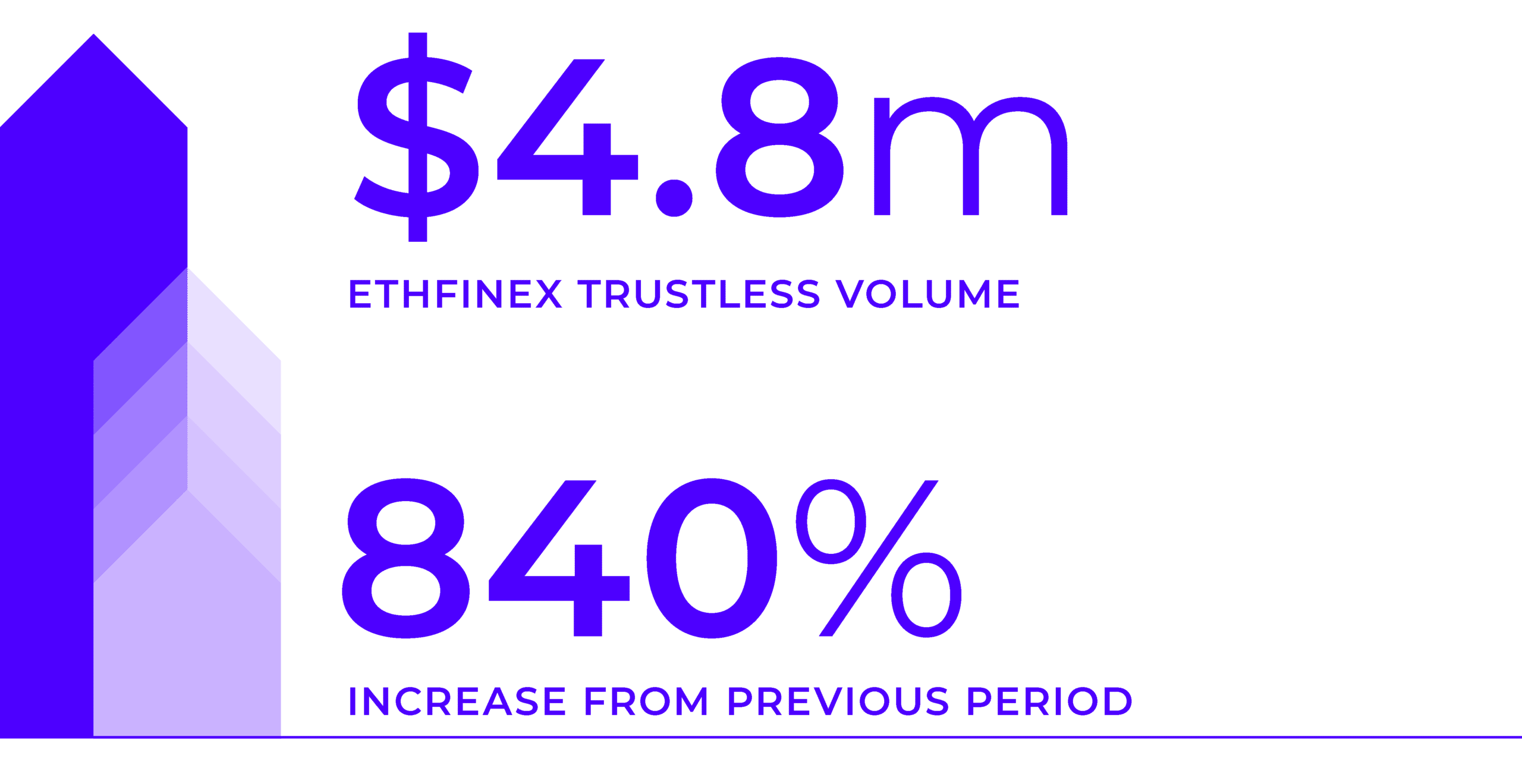

- Ethfinex Trustless volume for the period totalled $4.8m, an increase of 840% from the previous period.

- Total trading fees of ~$486,778 (average ETH/USD collected rate) were collected through trading over the period, an increase of 12% from the previous period.

- In line with this, 2046 ETH have been contributed to the Nectar token contract, pledged to NEC holders.

- 1,997,357 NEC tokens were distributed to reward market marking active on Ethfinex in the past month. Statistics can be viewed on Nectar.community. We wrote a blog post about token distribution and why we think the way we are distributing Nectar is so powerful.

Month in Review — December

Revenue & Activity Reports

1. Trading fee revenues

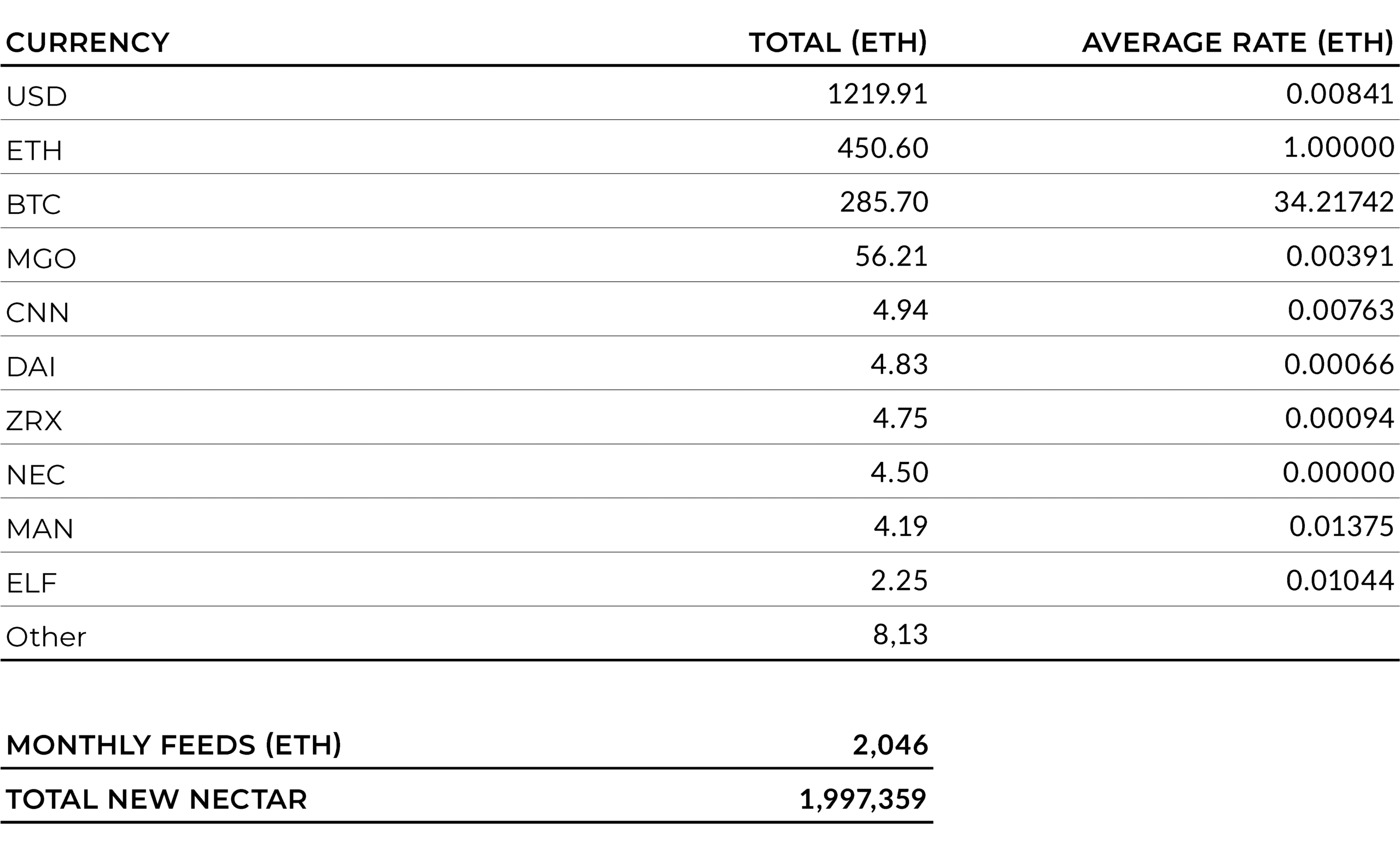

All fees were converted as they were collected into ETH to provide an averaged conversion cost across the month and average out the effects of price volatility during the period.

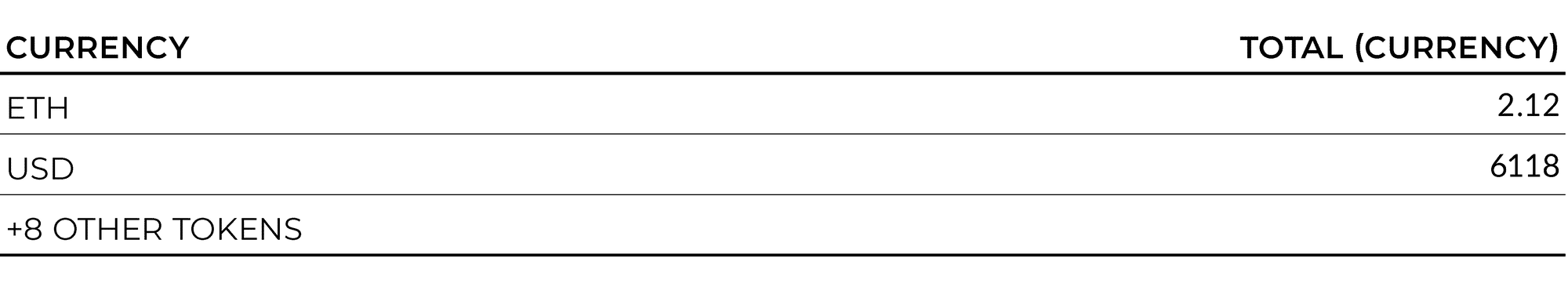

Fee currencies in the table are ranked in order of most collected. Quick note — fees cannot be extrapolated directly to trading volume as users can set their preferred fee currency (hence the popularity of USDT and BTC).

The above chart shows 50% of fees in all currencies collected. 2046 ETH were collected during the month and pledged to NEC token holders. Although the ETH/USD remains the main fee generator, MGO and DAI generated notable fees in their own currencies.

Total trading fees of ~$486,778 (average ETH/USD collected rate) were collected through the period, an increase of 12%. The key takeaway is that the significant 59% increase in trading volume did not entirely translate into an increase in revenue and stayed relatively static. This continues the trend of the previous month, whereby the drop in trading volume did not have a notable impact on fees. We hypothesise that this is because higher fee paying taker volume is routed through Bitfinex during times of market volatility, whereas the lower fee generating maker volume stays on Ethfinex. Taker fees are relatively similar between Bitfinex and Ethfinex at higher volume levels so this needs some more investigation.

2. Trading Volume

Ethfinex total 30-day trading volume increased 59% from the previous period in USD terms to $807m, with the increase in the overall ETH/USD volatility and ETH/USD trading volume across all exchanges being the main driver. December was the best month for Ethfinex in terms of the absolute USD measure of trading volume since June-July (see the below chart).

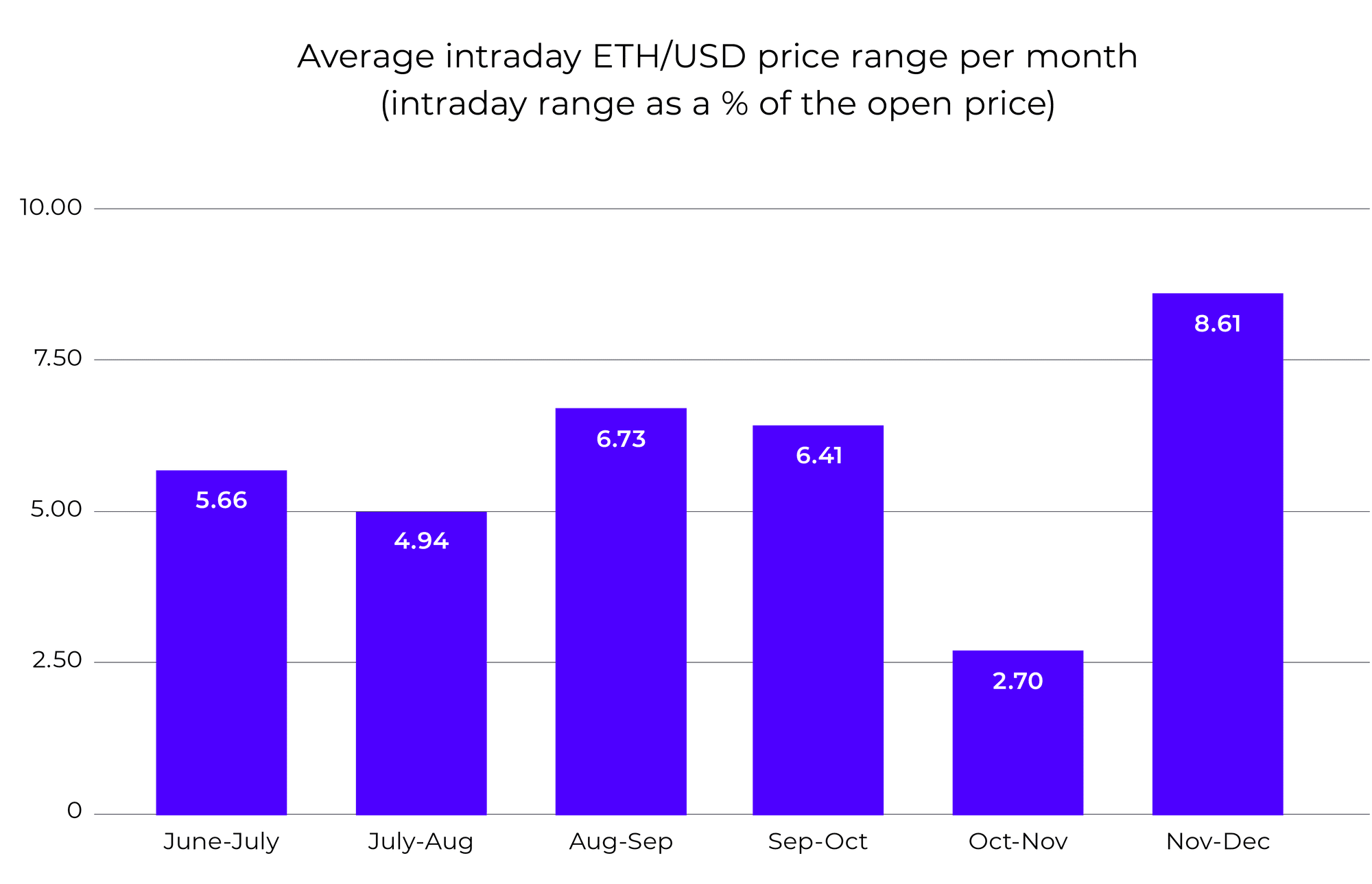

ETH/USD volatility increased almost 500% (as measured by standard deviation across the month) as price collapsed $121 between the start and the end of the period. Intraday volatility (as measured by the intraday range as a percentage of the open price) also increased 200% to 8.6%, its highest level since Q1-2019. This is in stark contrast to last month where intraday volatility hit its lowest level of the year.

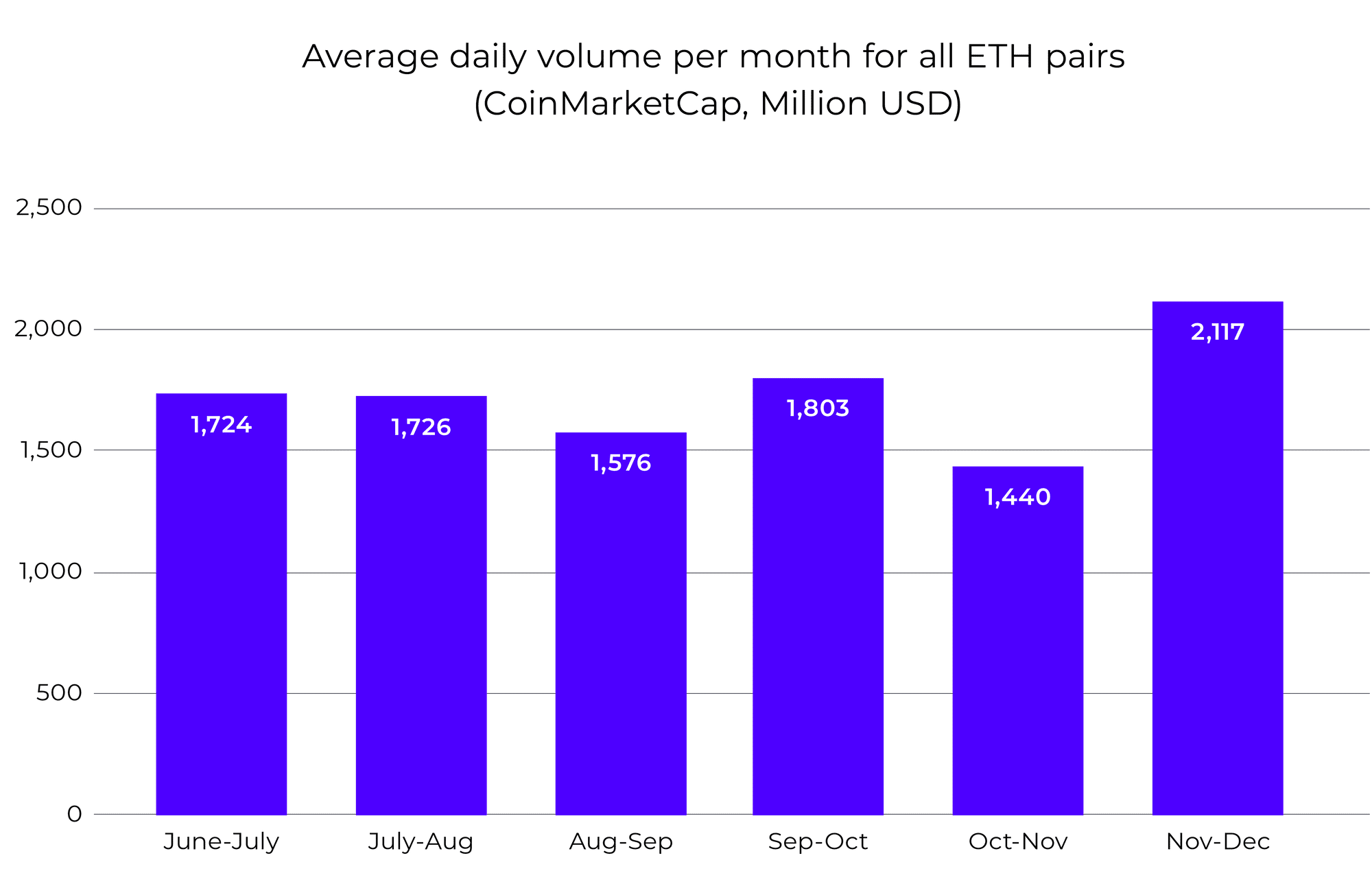

Average daily USD volume for all Ethereum pairs, across a sample of exchanges (CoinMarketCap data) increased 47% from the previous period, slightly less than Ethfinex’s total volume increase of 58%. Although this is not a perfect measure by any means, it suggests that Ethfinex grew volume market share across the period.

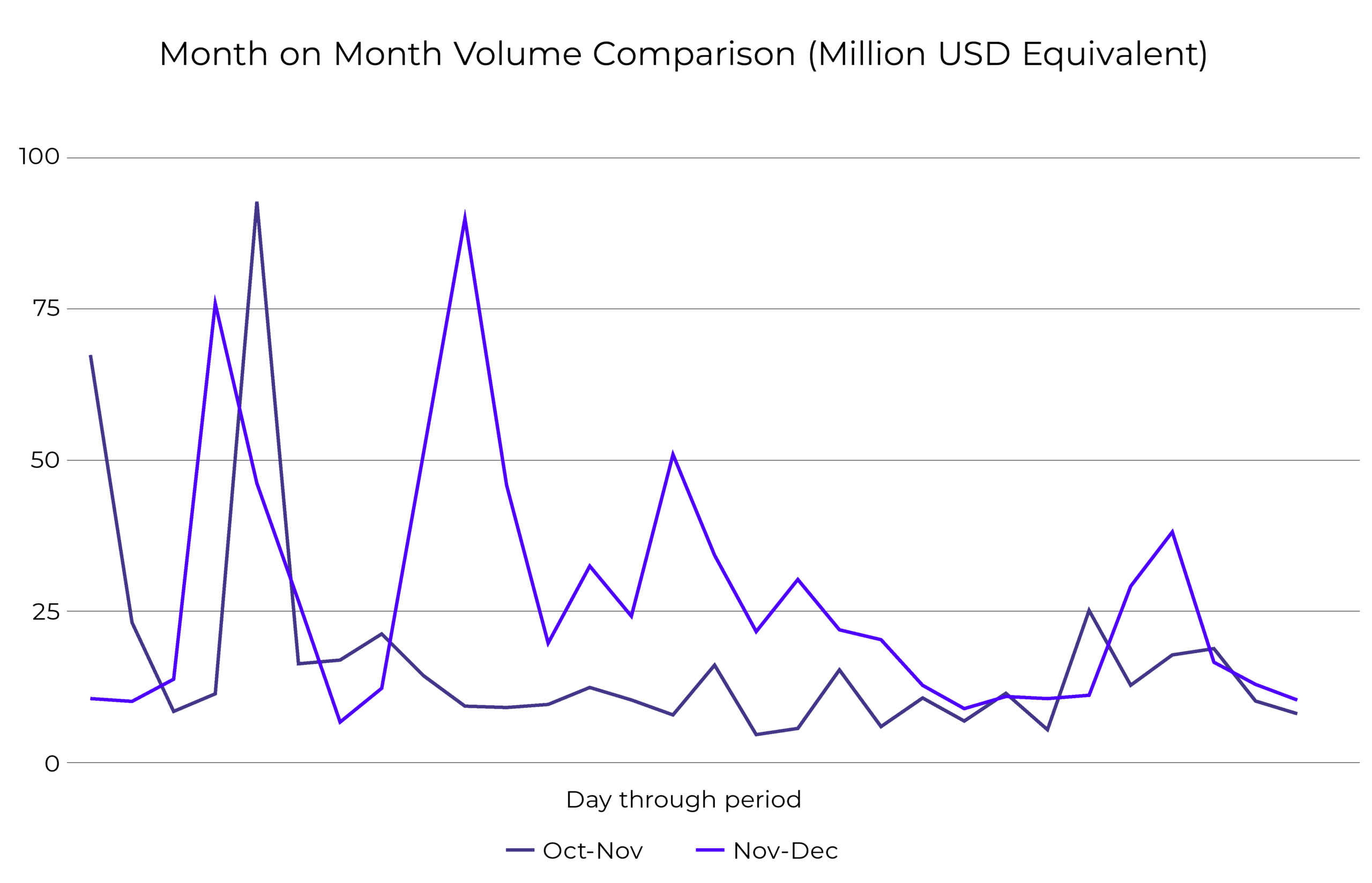

Trading volume correlated to the largest price drop days in Nov-Dec. Peak daily trading volume was $90m (20th November), a small decrease of 3% compared to the peak trading day in the previous period.

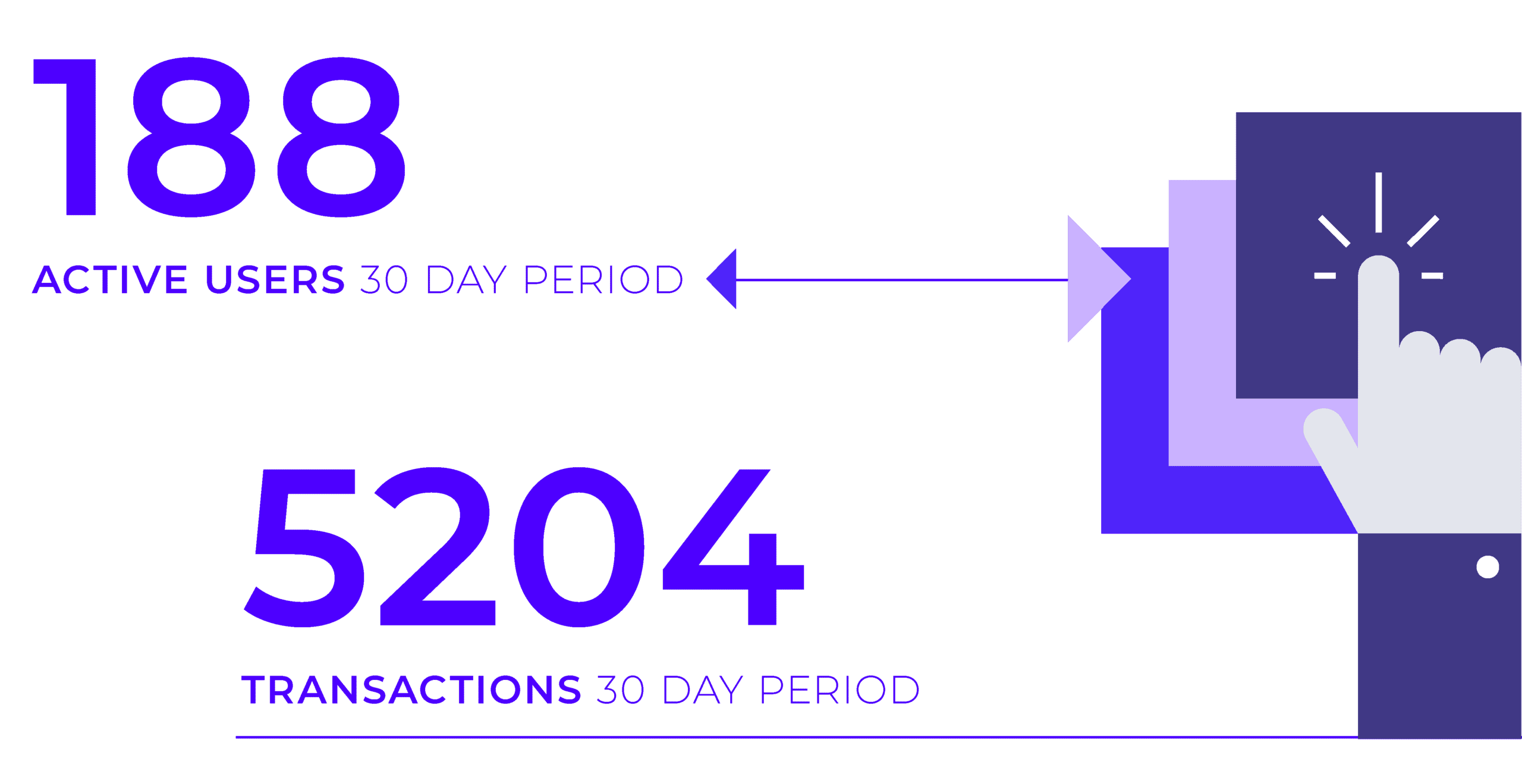

Unique user numbers posted a small decline across the period compared to the previous month. We believe that the main driver of this were as follows, and are both temporary blips as we improve both of the following offerings:

1) The temporary closure of the two-weekly Ethfinex community vote for new token listings. This drew in a large number of users in previous months who participated in the voting and the EVT markets.

2) The end of the Dusk token sale. The Dusk token sale drew in a large number of page views and unique users.

3. Ethfinex Trustless

Ethfinex Trustless volume for the period totalled $4.8M, an increase of 840% from the previous period.

With a fee rate of 0.25% (higher than the fees on the centralised version of Ethfinex), Trustless has the potential to become a serious fee generator for Nectar token holders, and is already delivering on that promise. As we went to press, Trustless volumes were surpassing the $2m per day mark, or put another way, is 1% of total Bitfinex trading volume.

December saw mostly minor updates and bug fixes related to the user trading experience. The changes were deployed in two updates, taking place on 21st and 30th of November. (compared to the usual weekly update schedule). The main goal of these updates was to prepare Trustless for the upcoming changes related to the re-designed on-boarding and integration of Portis wallet.

The key highlight was the addition of advanced charting, which is currently displayed as the default chart, also allowing the user to switch back to the simple chart if needed. We’ve also highlighted the user’s orders in the order book, so that users have bigger control over the flow of the trading process.

The other minor tweaks were focused mostly on speeding up the balances update after order gets posted and settled to allow for quicker trading.

The Month Ahead – January 2019

1. The Ethfinex ‘Un-board’ meeting feedback

At the Ethfinex Governance Summit in Lugano three months ago, NEC community members provided recommendations to help drive forward Ethfinex on key items such as volume, customer acquisition, strategy and new products. After achieving key stakeholder sign off on some of these proposals, we are steaming ahead with some of the priority features.

We will provide more details over the coming weeks, but the headline points are:

1) Restarting the two-weekly Ethfinex community new token listing vote with a new and improved process, which will flip the dynamics of voting on its head.

2) Providing Ethfinex Superusers (those holding certain amounts of Nectar tokens) with valuable benefits on the platform, and giving a strong incentive for new traders to acquire more Nectar and join Ethfinex.

3) Allowing token projects to provide a limited bounty/subsidy to lower trading fees on their trading pairs.

2. Ethfinex Community Meetup No.6

On the 30th January (TBD) we will be hosting our sixth community Meetup event in London, and the first of the new year. We plan on hosting an event themed around mobile gaming – a hot use case for crypto. Stay tuned for more information and make sure that you join the Ethfinex Meetups group (which now numbers over 500 people).

Many thanks to Fetch.Ai and BlockPass for attending our December event.

3. Ethfinex Token Sales

Preparations to launch a new and improved token sale platform are ongoing, with a better design and allowing for better information discovery about projects from within the token sale page itself. In the interim, users will be able to contribute variable amounts of ETH to token sales (this was the main bit of feedback from the Dusk token sale).

We have one token sale over the festive period and have several exciting projects at the late stages of due diligence. Provided the market finds a floor, we expect these projects to come to market in Q1 2019.

If you are planing on a public token sale, or know a token sale who you would like to bring to Ethfinex users, then we would love to hear from you: [email protected]

4. Trustless UX Revolution

The first round of user interviews has finished and the feedback turned into a new and improved on-boarding page redesign. This should be going live shortly and should make it much easier for new Trustless traders to get started.

After the bug fixes and charting improvements of last month, the focus this month is the Portis wallet integration. This should allow for a frictionless interaction with Trustless, no matter what device a user is trading from.

We believe that Trustless has great potential, not only for Ethfinex but also for the industry as a whole. We have developed the portal over the past three months and it is very satisfying to see it become the largest ‘DEX’ in the industry by several magnitudes in terms of daily trading volume. Trustless volume has averaged well over $1m per day for the past week, and 24 hour trading volume sits at over $4m today.

We now believe that Trustless is ready for the world, and a large portion of our efforts over the next several months will be making sure that the community is aware of how Trustless can benefit their trading or product. If you would like to discuss integrating with Trustless then please email [email protected]

Happy Holidays and New Year from everyone at Ethfinex! We are very excited for 2019 and will be posting more about our longer term plans in January. Thank you for being part of the Ethfinex journey so far – onwards and upwards!

Trading is now live on Ethfinex — get started here.

Sign up to our weekly newsletter and stop by our Telegram to learn more about the vision for Ethfinex.

Visit our Twitter to stay up to date with announcements, token additions and more.