After seven voting rounds and 24 new tokens listed, it’s time for a change.

Based on what we have learned so far, we are proposing to make a series of improvements to our token voting model.

A Unique Opportunity

14 weeks ago we began the Ethfinex token listing votes as an experiment into governance and decision making. We chose token listings as an issue which has a genuinely high value and strong incentives around the outcomes of the decisions — people genuinely care strongly about which tokens are listed because there can be a direct impact on their value.

There are very few opportunities to run voting experiments such as these in an environment where the stakes are not either ‘too high’, or ‘too low’. Testing on low economic value decisions tends not to simulate behaviour which is reflective of how a governance or voting system would behave ‘in the wild’.

For our token listing process we implemented a somewhat controversial and unique design, unlike any other system we had seen in development within the blockchain space. Partly this was to make sure that we would learn something new, and contribute to the progress being made, rather than only replicate common design patterns such as the Token Curated Registry. In some ways we felt that some of the assumptions behind these design patterns, such as the need to stake tokens during decision making, were increasingly considered almost unquestionable despite having never been strongly challenged. We felt that taking a completely different path at this early stage was important.

We have now reached the limit of what we can learn from the current process, and have been re-designing the smart-contracts involved for the past month based on several design goals.

The current round which we have just begun will be the final one taking the current format. Afterwards we will be re-launching the process with several adjustments. The smart-contracts used for the votes have importantly been redesigned to be far more modular, allowing us to frequently adjust parameters and run experiments, to maximise the speed at which we can test, learn, and improve.

Previous Design

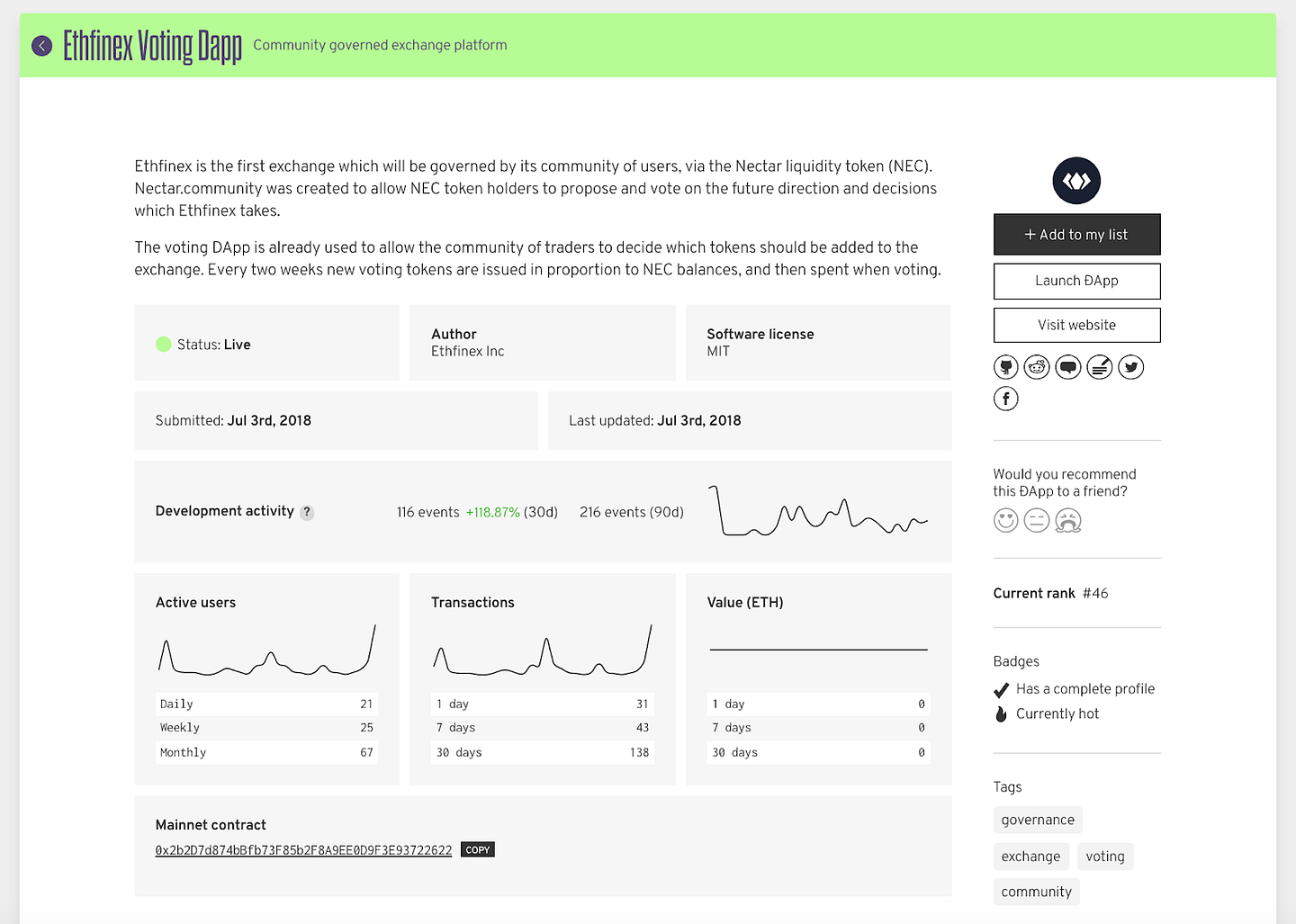

Throughout the past few four months, Nectar.community has steadily risen to become the 3rd most used governance application, and the 45th most used general application, on the Ethereum network.

Ethfinex Listing Vote #1 — Debrief

The first set of experiments on our path to full community governanceblog.ethfinex.com

You can read about the current model at nectar.community or in our previous articles on the topic.

The Overview

Nectar tokens (NEC) are earned by trading on Ethfinex.All Nectar token holders receive a 1:1 mapping of their balances in Ethfinex Voting Tokens (EVT) at the start of each vote (every 14 days).

EVT are spent and destroyed when voting on a particular token to be listed. At the end of each 2 week vote period, all remaining EVT expire and are destroyed.EVT can be transferred or traded amongst participants with an active EVT/USDT market on Ethfinex.

One of the more controversial aspects of this design was the inclusion of a direct EVT/USDT market, allowing the voting tokens to be independently traded separate from Nectar tokens themselves.

Design issues

Low incentive to vote on tokens which are not already in the top 3–4, or to participate at all due to the high cost of losing.

Low incentive to participate as a small user due to high complexity (Metamask, setting up a wallet, interacting with the blockchain), cost (fees for voting can be as high as 1 USD during periods of congestion on Ethereum), and lack of incentive (inability to change the overall outcome compared to ‘whales’).

NEC distribution is still relatively centralised, with new tokens only distributed once a month to traders. The final few voting periods have lead to the visible formation of some cartel like behaviour, controlling large amounts of votes. This has been observed several times in other on-chain voting systems (such as DPoS), however it was still surprising to us to see how fast it happened.

We have seen projects voting for themselves, but in a non-transparent way, using ICO funds. We feel when this happens (although in some cases it may be in the interests of token holders of both Ethfinex and the project itself), it needs to be clearly communicated to the token’s community, and ideally they should be able to signal approval for the action.

Plutocracy & Vote Buying

Any system such as this where vote buying is possible, and where voting power is dictated by number of tokens held, is inherently plutocratic to some extent. There are many interesting explorations of this topic:

What is on-chain cryptocurrency governance? Is it plutocratic?

This post is a response to a number of posts from prominent blockchain personalities about how on-chain governance…medium.com

Governance, Part 2: Plutocracy Is Still Bad

Coin holder voting, both for governance of technical features, and for more extensive use cases like deciding who runs…vitalik.ca

Against on-chain governance

Refuting (and rebuking) Fred Ehrsam’s governance blogmedium.com

Our current voting system is vulnerable to many of the criticisms levelled about token voting, as well as vulnerable to cartel formation. However, we view the token listing votes in this particular context only as an improvement to the decision making of a centralised company.

Previously token listing was chosen by a centralised committee behind closed doors. Major differences are that the process is now transparent, consistent, open, and that Nectar token holders (i.e. Ethfinex users) benefit directly (rather than us as an exchange charging a listing fee). This does not necessarily mean it leads to better decision making in the interests of Ethfinex long term, and is clearly not ‘democratic’ in the true sense of the word.

Let us imagine a system where a local government is taking a decision, about whether to construct a new housing development on greenfield land:

- Every land owner within the vicinity of the new housing development is given a landowner credit.

- Property developers who wish to win the bid for the contract to construct on the land need to first acquire a sufficient number of the landowner credits.

- Where previously individual land owners were powerless to influence the decision, and relied only on the decision made by the local government, they are now empowered directly to either block the development (by refusing to sell), or to force developers to directly compete with each other to buy or win their credits.

Power is returned to individuals. In reality it is unlikely that the small landowners will be able to band together to block the development, but nonetheless the fact that they have the power to do so gives them the ability to be compensated and influence the outcome.

Whilst this transferrable and tradable vote system works in a limited context, we still recognise that it in no way reflects the final governance mechanism for Ethfinex and is unlikely to be similar to the types of processes we would want to extend to larger scale decision making.

New Design & System Goals

- Encourage smaller users to participate.

- Encourage participants to vote for their preferred token even if it is less popular and may not immediately win.

- Make it simpler and cheaper to participate, opening up access.

New features:

- The list of competing tokens grows each round, instead of being removed and cycled.

- 50% of votes which are cast are carried over to the next round. This means that there is a greater incentive to vote for a lower token, and that votes cast for tokens which do not win are not ‘wasted’.

- Votes may be split across multiple tokens.

- Votes can be delegated to representatives.

- It will be possible to implement voting directly from 3rd party wallets and from the centralised Ethfinex site, making it far more accessible.We welcome reviews, comments and suggestions to improve the latest smart contract adjustments being made in advance of the new roll-out.

Provided configurability into the EVT voting rounds by nklipa13 · Pull Request #32 ·…

Possibility to change: Number of candidates included in the vote Number of winners in the vote Criteria to win the vote…github.com

Policies

It has come to our attention that several tokens are participating in the listing process by purchasing EVT and using them to vote for their own project to be listed.

Whilst the aim of the process is to encourage as much community participation as possible from genuine Ethfinex users, this behaviour in itself does not necessarily violate the rules of the competition. However we do find it against the spirit of the community vote, and more importantly find it to be a major problem when not done in a transparent and honest way. Since we assume that ICO funds are often used, token holders ought to be made aware of the way they are being spent, and ideally given a choice to decide whether they approve of the expense.

In future we request that any token participating in the process by voting for themselves using ICO funds must publicly announce this to their community of token holders.