At the heart of the Ethfinex platform lies the Nectar token (NEC).

Following the Ethfinex announcement and subsequent whitepaper release, we have received a large amount of community feedback and questions about the Nectar token.

This post will present the characteristics of the refined NEC model, and answer some of the most common questions we have been asked.

The Ethfinex platform will pioneer a hybrid, decentralised model for exchange, with a vision to gradually shift towards true decentralisation whilst providing the tools and modules necessary to interact with and contribute to the continuous development of related Ethereum projects.

As the field of decentralised exchange matures, Ethfinex will be able to provide a generalised set of APIs and contracts through which other protocols can interface with Ethfinex. This results in an experimentation zone whereby new protocols can access the Ethfinex liquidity pool, stress test, accelerate the learning process for decentralised exchanges and ultimately facilitate the development of scalable trustless exchange.

We envision a technology agnostic experimentation zone, where new decentralised exchange protocols can learn, integrate, and grow from Ethfinex’s established pool of liquidity.

NEC Overview

The Nectar token is not intended to raise funds, and will not be sold through any form of crowdsale, ICO or fundraising mechanism.

Instead, the Nectar token will act as a loyalty token. The NEC is designed to maintain liquidity and market efficiency through the incentivisation of platform loyalty. Users who choose to register for the scheme and take on the role of market maker on the Ethfinex platform, or using integrated decentralised exchange protocols, will automatically generate NEC’s, as a loyalty reward, and subsequently earn a stake in the future development, governance and success of the platform.

As more tokens are earned, the ownership structure of Ethfinex will unconditionally become more decentralised, contributing to the vision of a truly community-owned exchange. Having a network of users that own the exchange will incentivise its owners to remain loyal users, benefiting all users through fostering liquidity and maintaining market efficiency.

NEC will adhere to the ERC20 Token Standard to ensure cross-compatibility with alternate exchange protocols interfacing with Ethfinex. This allows other protocols and exchanges to reward users for the liquidity they contribute.

Token Functionality & Governance

The fundamental purpose of the Nectar token is to reward market makers for the value they create, in turn encouraging them to maintain market thickness and minimised spreads on the platform trading pairs.

To achieve this, NEC will combine three fundamental functionalities:

- Loyalty points entitle holders to loyalty rewards held in the Liquidity Token Smart Contract, which can be redeemed (in part or in whole) through the Redeem Mechanism upon request.

- Loyalty points enable holders to exercise influence over the future governance of the Ethfinex platform. In addition to feedback and criticism, larger token holders (or coalitions of token holders) owning 5% or more of NEC’s will be entitled to elect a representative in the Ethfinex board.

- Loyalty points can be traded on a secondary market amongst whitelistedEthfinex users.

As market makers and takers trade on the Ethfinex platform, they incur standard trading fees. Of these trading fees, a proportion are collected and directed into a smart contract. At the end of every 28 day cycle, NEC’s will be distributed to market makers in proportion to the total trading volume conducted by the market maker that month. For example, a market maker who holds 5% of the tokens issued in a certain period would be entitled to 5% of the rewards collected by the smart contract. Alternatively, rather than claiming the collected rewards, a market maker can choose to hold their tokens, or sell them on to another whitelisted market maker.

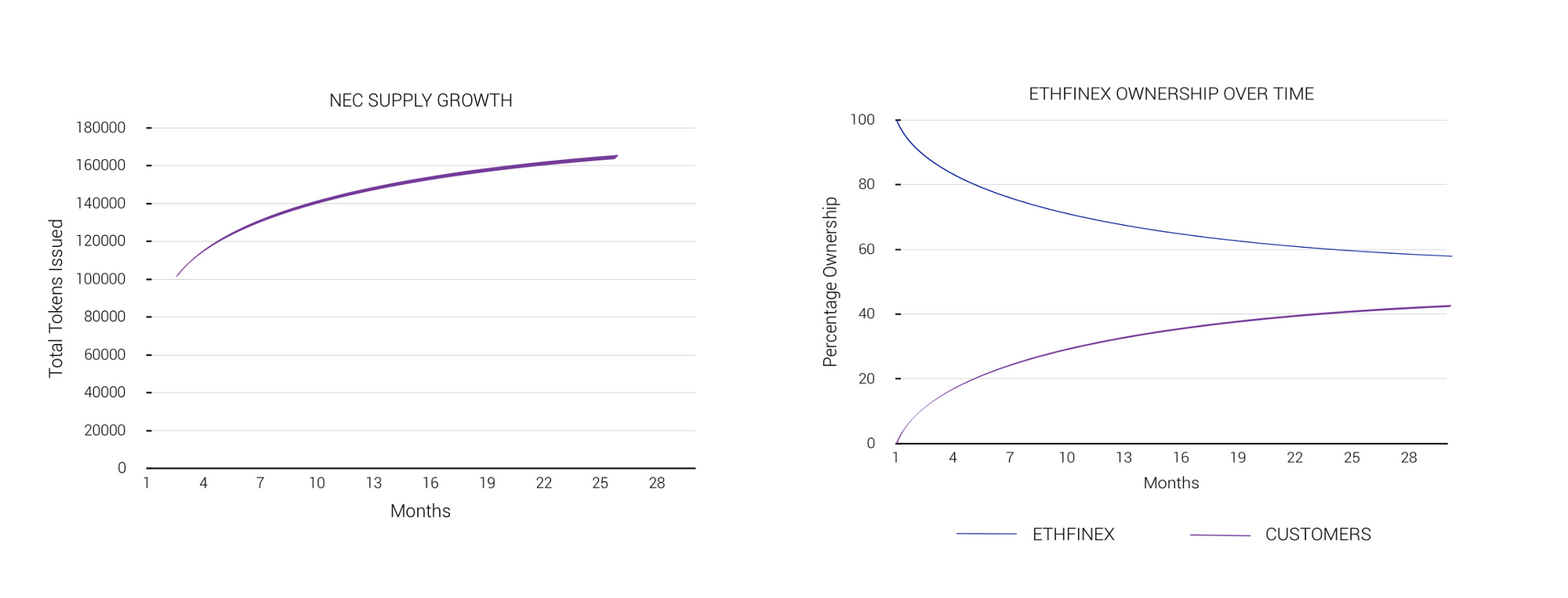

If no tokens are redeemed at the end of a 28 day cycle, the total supply of NEC will grow. Ethfinex will hold an initial supply of NEC which will not grow over time — as a result, the percentage ownership will gradually decrease as new tokens are issued and redeemed.

Initially Ethfinex will retain the majority of the tokens in order to refine the reward and issuance mechanism; over time, however, as more of the ownership becomes decentralised to users, the governance model will allow larger token holders (or coalitions of token holders) to elect representatives who will sit on an advisory board.

Nectar Token Smart Contract

We have received a phenomenal amount of community interest about how the token will be implemented in practice, and so we will provide here an overview of the token issuance and reward mechanism, followed by some specific details on some of the most unique aspects of the Nectar token, such as address whitelisting.

For a more detailed analysis of the Token Economic Model, please refer to the Ethfinex whitepaper.

The issuance of NEC happens following a 28 day cycle.

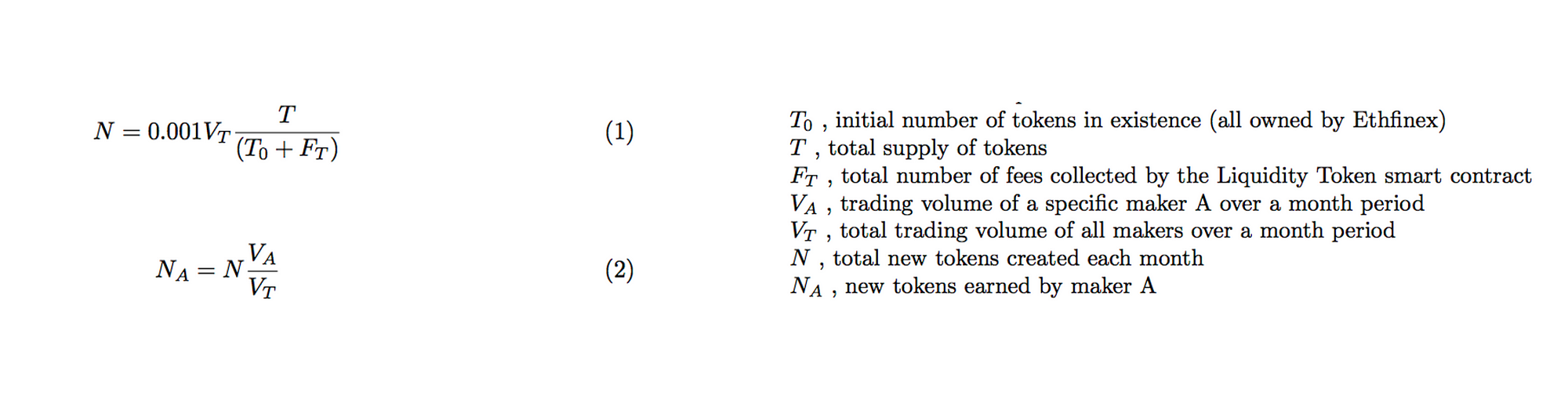

The design of the NEC insures that, at the time of issuance, the reward value of the NECs issued (if redeemed instantly at the end of the 28 day cycle) is always less than the fees paid by the maker. This works to prevent system manipulation, whereby users could earn tokens through high volumes of unprofitable trading in order to redeem the collected platform fees. The issuance is a function of total monthly trading volume, the previous token supply, and total number of fees previously in the contract.

As a result of the steady supply growth of NEC’s, market makers who wish to maintain a certain percentage stake in Ethfinex are required to consistently add liquidity to the platform.

Ethfinex will initially retain a majority stake in Ethfinex to refine token and governance mechanisms. Over time, however, as the total token supply increases, the Ethfinex ownership percentage will fall.

Feedback & Considerations

The exact governance mechanism will be particularly important in ensuring the details and implementation of the token can be refined in time for the Ethfinex launch. Defining the perfect liquidity incentive mechanism will be impossible without continuous testing and feedback in real markets, and the governance will complete the loop in allowing improvements to take place.

Following community feedback, we have decided against the internal redesign of the chosen governance mechanism; instead, we will look to adopt the industry best practise. There are a number of fantastic projects in the space who are currently working on this, such as Aragon and District0x, some of whom we are in contact with, and we are eager to refine our governance model in accordance with them.

Another recognised challenge is the identification and prevention of bots engaging in wash trading with the purpose of accumulating tokens. To combat this, we are exploring the controls we can put in place on Ethfinex as well as how the reward structure can be specifically tailored to recognise and reward trading for real market making.

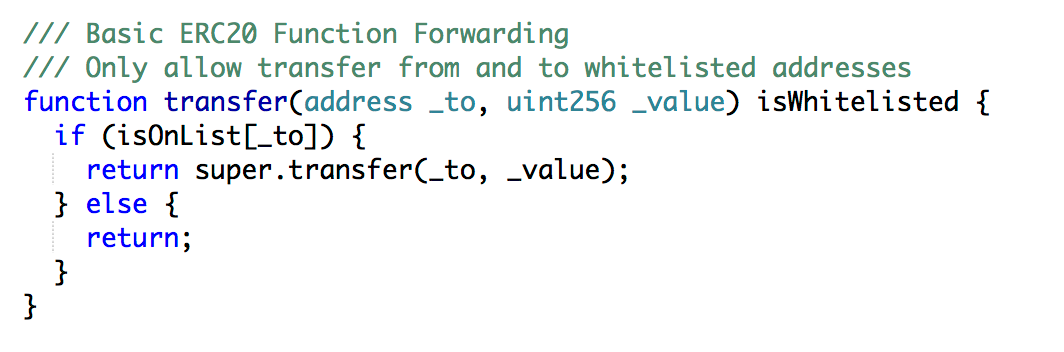

Whitelisting & Restrictions

The token will include on-chain restrictions to transfer and ownership, via an address whitelisting solution.

Trading these tokens on Ethfinex will also be restricted to registered members of the market maker loyalty scheme.

We are investigating different identity and registration solutions which can allow us to have the right balance of access. The aim of the whitelisting and restrictions is to maintain privacy for users, while still maintaining control over ownership of the tokens and complying with any relevant regulations, by ensuring that while accessible and tradable they will not be in the hands of restricted groups or used for money laundering for example.

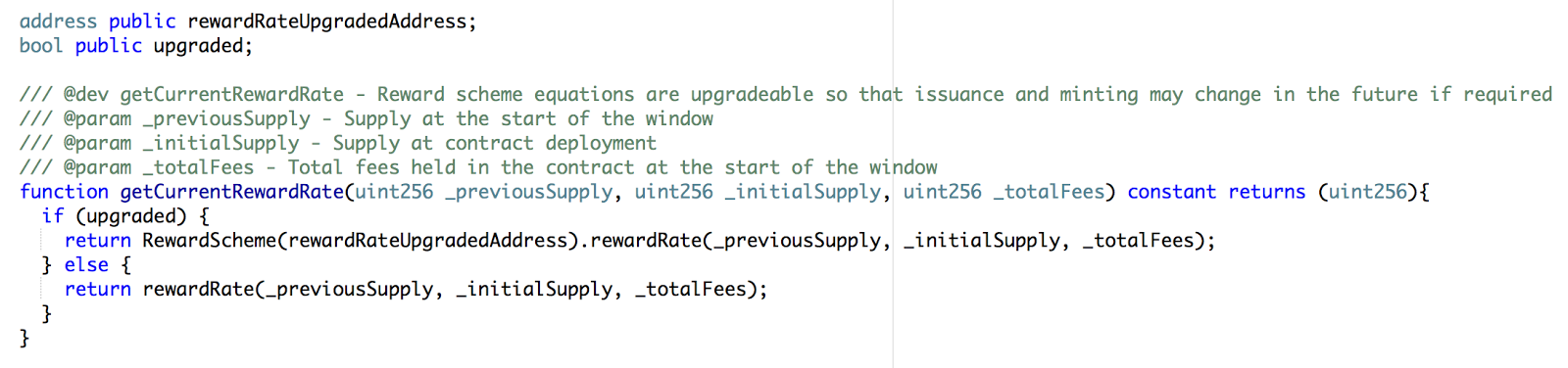

Reward Mechanism Upgradability

In order to future proof the design we are developing an upgrade mechanism for the reward rate equations. This will mean they can be iterated in response to competitive pressures, and the secondary market valuation to ensure rewards remain balanced and fair.

The effects of secondary market pricing on the market maker incentive scheme are difficult (r. impossible) to accurately model given its inherent uncertainty and vulnerability to the behaviours of different market entities. Unintended consequences are a possibility whereby e.g. the secondary market value of NEC’s could grow such that the market value of tokens is greater than the maker fee, incentivising the development of unprofitable trades in an attempt to earn tokens.

This upgradeable implementation is therefore essential in combination with a governance mechanism, and the initial majority token ownership by Ethfinex will allow quick iteration to find the right balance.Different trading pairs may also be able to be given higher NEC rewards or lower fee schedules. We are investigating methods for balancing the variations in NEC rewards associated with large volume pairs with tighter spreads versus newly-established, low volume pairs, in order to adequately incentivise both.

Journey

We are collaborating with a range of exciting teams, from decentralised exchange protocols to market makers and governance networks, and we are constantly looking to integrate with innovative projects in the Ethereum ecosystem. There are numerous planned partnerships in motion, including Tether and 0x and more will be announced when details are fixed. If you are a potential partner interested in how we may be able to collaborate, please reach out to [email protected].

Our Nectar token draft contract is currently undergoing a series of reviews, and we will be opening it for a bug bounty program in due course with details to follow. Feedback on design, or areas of improvement are always welcome, either on /r/ethfinex or [email protected]. We would like to thank those who have provided feedback and have taken it into account as we are designing the final smart contracts which will power the ERC20 token. The details of our token implementation is subject to further change pending community feedback and we therefore welcome any thoughts you may have.

The community has been fantastic, curious and receptive, and we are incredibly appreciative of the positive feedback we have received. We are excited to have you on this journey — sign up to our mailing list to stay up to date with major announcements, and check out the communities below to join the discussion!