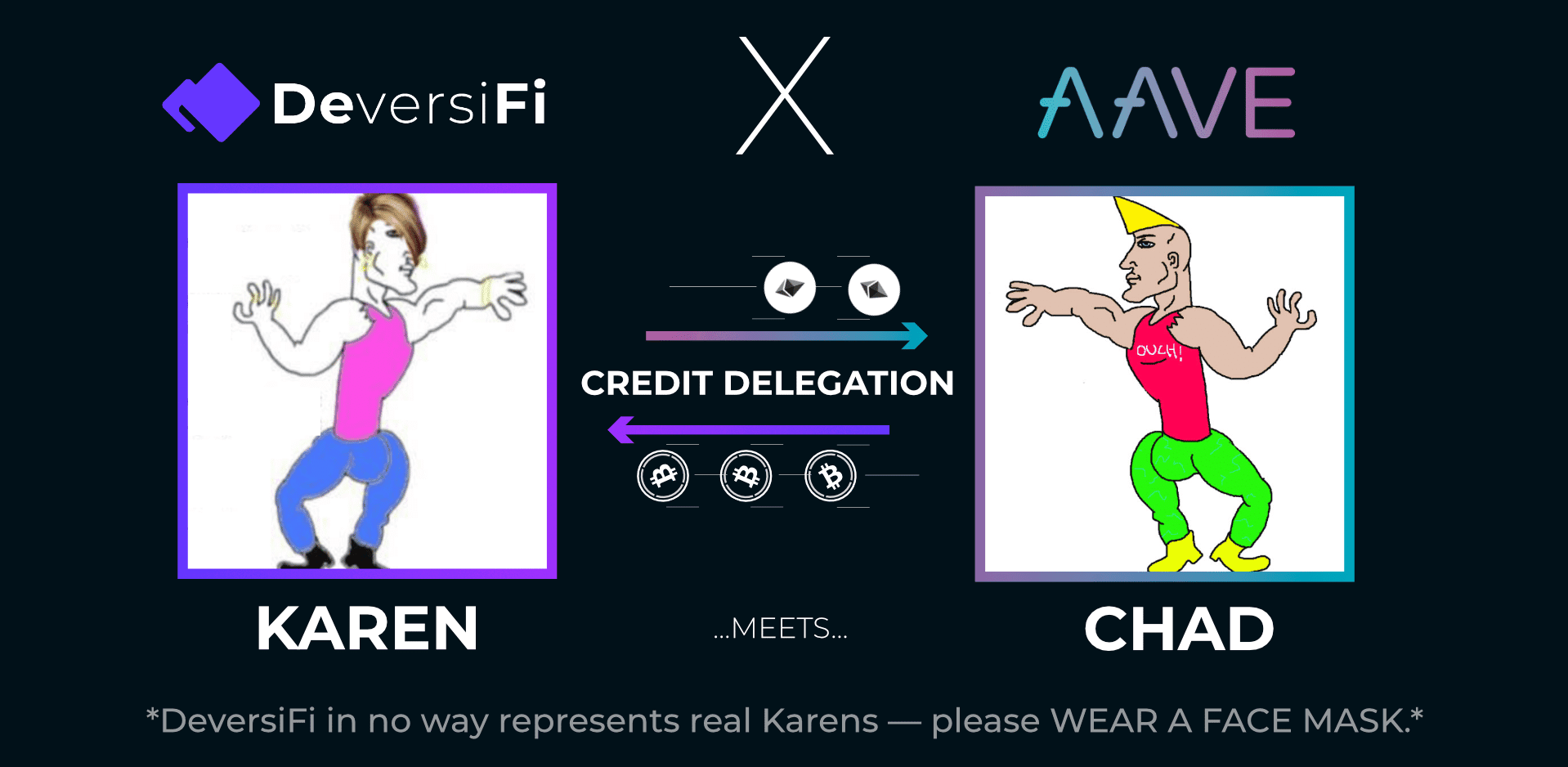

DeversiFi is proud to be the first DeFi project to help pioneer Aave’s innovative new Credit Delegation functionality. Credit Delegation allows DeversiFi to harness real world relations to access unsecured crypto-asset loans for use within the DeversiFi ecosystem, instead of needing to rely on expensive under-collateralized loans from legacy crypto lenders.

How Credit Delegation works, step by step

Aave’s new Credit Delegation functionality allows lenders to extend credit lines to individual borrowers on individual terms, such as specific collateral levels and/or benchmark interest rates set in a fair and transparent manner based on supply and demand. This new Credit Delegation system solves a real pain point for DeversiFi as it allows us to refinance our existing crypto loans at much more favourable terms, in a similar way to taking out an unsecured loan at a reasonable interest rate with a trusted party in the legacy finance world.

DeversiFi negotiated terms for a 20 wBTC unsecured loan based on a fixed 3% interest rate plus the wBTC Variable Rate on Aave, as well as adding in some additional protections in case the rate spikes due to tail risk or a black swan event.

After the terms were decided, Aave drafted the loan agreement and both parties signed via Open Law, meaning the loan agreement is legally enforceable.

Aave then deployed the wBTC Aave Vault with a 20 wBTC limit and funded it with aUSDC as collateral.

DeversiFi then called the loan and took possession of the 20wBTC.

Vault Contract: https://etherscan.io/address/0xc7f2d2884f7d24a5d5963d665e560e313310d839#code

DeversiFi pays monthly interest to the Aave Vault using repay() function

Everyone is happy and Aave and DeversiFi keep building their DeFi products. Ethereum hits $5000 within one year and Aave buys Bank of America’s loan business.

For a technical overview of the Credit Delegation process, see the AAVE documentation

About Aave

Aave (fun fact: the name is taken from the Finnish word for “ghost”) is a decentralized, open-source, and non-custodial protocol for money market creation on Ethereum. Depositors earn interest by providing liquidity to lending pools, while borrowers can obtain loans by tapping into these pools with variable and stable interest rate options. Aave Protocol is unique in that it tokenizes deposits as aTokens, which accrue interest in real time. It also features access to Flash Loans, the first uncollateralized loan option in DeFi. Currently, Aave Protocol offers 2 markets: the Aave Market and the Uniswap Market.

Website: https://aave.com/

About DeversiFi

DeversiFi gives traders the edge in fast moving decentralised finance (DeFi) markets by allowing them to trade at lightning speed and with deep aggregated liquidity, directly from their privately owned cryptocurrency wallet.

Traders can take advantage of more trading opportunities while always preserving control of their assets for when they need to move fast. DeversiFi’s order-books are off-chain, but settlement occurs on the Ethereum blockchain. This means that traders benefit from fast moving order books and instant execution, without having to trust the exchange and whilst always maintaining control of their assets at all times.

For the first time, traders can enjoy all the benefits that they would expect from a legacy large centralised exchange, but with no exchange or counter-party risk.