We designed Nectar with the aim of creating a highly liquid, community-owned Ethereum exchange.

Summary

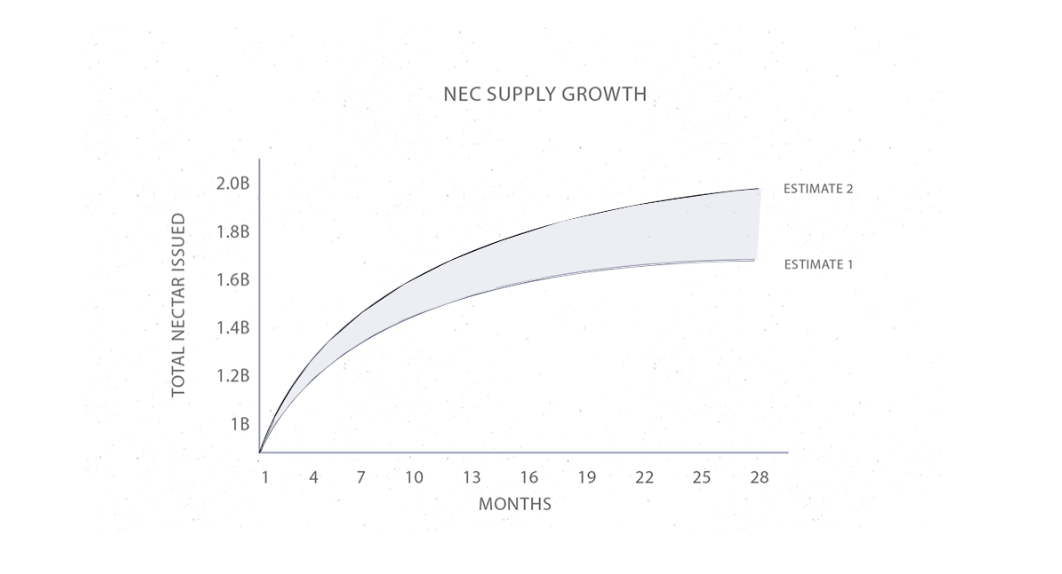

- The current circulating supply is 500,000,000 NEC.

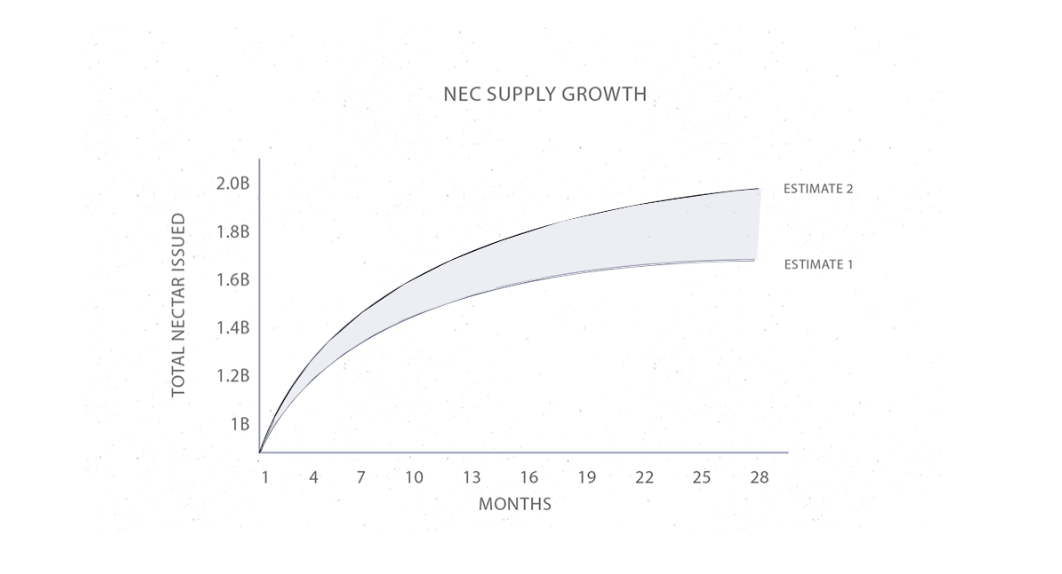

- The circulating supply of Nectar will grow each month, at a decreasing rate, based on total conducted trading volume.

- NEC is earned through market making on Ethfinex and can be traded against USD, ETH & BTC.The NEC contract address can be found here.

- NEC withdrawals are suspended for the first 30 days of trading.

- The Nectar token is an ownership stake in Ethfinex, earned in the form of loyalty points through trading on the platform.

Nectar entitles holders to claim rewards from fees generated on Ethfinex, maintain a stake in the long-term success and participate in future exchange governance. The ownership will become more decentralised as trading grows, resulting in a hybrid exchange platform owned and run by the community.

Nectar tokens will be distributed to Ethfinex traders on a 30 day basis in proportion to the trading volume conducted throughout each period. Nectar can be earned on all traders executed as a market maker regardless of currency and volume.

Getting Set Up

- Access Ethfinex.

- Navigate to account settings and find Loyalty Program.

- Click Register and follow the instructions to start earning Nectar.

Upon successful registration you will be able to see an overview of your earned Nectar rewards. As of this moment, any of your matched limit orders on Ethfinex (where you take on the role of market maker) will earn you Nectar tokens in proportion to your trading volume.

Your Nectar rewards can be found under Your Rewards. Please keep in mind that the numbers given are estimates and fluctuate in response to the value of Ethereum and trading volume on Ethfinex.

The Nectar token is compatible with the Ethereum ERC20 token standard. This allows for the Nectar token to link with (and reward users of) decentralised liquidity pools external to Ethfinex. As a result of this, you will be able to store your Nectar on whichever wallet you use to manage other ERC20 tokens.

Please keep in mind that your external address must be whitelisted in order to receive NEC. Withdrawals will not be available for the first 30 days following the launch of Nectar.The Nectar Smart Contract address can be found here.

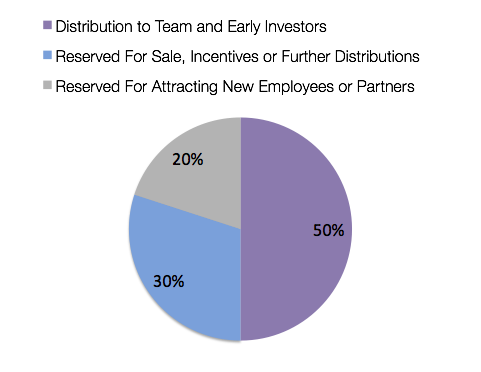

Token Distribution

Locked Supply

Out of an initial 1 billion tokens, 50% will be locked up in a 3 of 6 multi-signature wallet and held here.

30% of the initial supply is reserved for Ethfinex to be used if needed for operational activities or further incentives, whilst the remaining 20% are reserved to be potentially used to attract and on-board future development partners who will help us to improve and act upon our vision.

Circulating Supply

The remaining 50% of the initial supply will be distributed to the team and early investors. This circulating supply will grow every 30 days, with new tokens being created based on the maker trading volume which occurred during that period.

The creation rate each month is governed by the Nectar Controller Contract here.

The process of NEC creation and issuance can be considered loosely inspired by Proof of Work blockchains like Ethereum or Bitcoin. In Proof of Work, new Ethereum or Bitcoin is created each block and given to the miner who mined the block. For NEC, traders are considered to be the ‘miners’:

PoW consensus algorithm === Market consensus algorithmHash power === Maker trading volumeBlock reward === New NEC creation every 30 daysElectricity cost (to run nodes) === Exchange trading fees

Difficulty grows as Total Supply grows every 30 days, making it harder to earn new tokens (higher maker trading volume is needed to earn the same number of tokens).

In the long term, the vision of Ethfinex is a transition towards complete decentralisation — an entirely trustless exchange run by its community of users. At the heart of this transition lies the Nectar token.Ethfinex retains an initial supply of Nectar which does not grow. As trading volume increases across Ethfinex, so will its degree of decentralisation.