Proposed Nectar Controller Smart Contract upgrade

Overview

As first discussed in the original Ethfinex whitepaper, the parameters of the token reward issuance were difficult to model without first testing the underlying assumptions in a real market.

Approaching the end of the second 30-day period, and following the first issuance of NEC to traders on Ethfinex, it has now been possible to collect further information and observe the effects of the market making incentive.

This has led to some proposed adjustments to be made, including a replacement of the first issuance equation. While these changes represent a technical divergence from the whitepaper we believe that, in real market conditions, the changes reflect more closely the spirit of the intended performance.

As the full decentralised governance mechanisms for NEC are not yet developed, and the current proposal and voting dApp for Nectar governancehas not been tested, we feel that this update ought to go ahead as soon as possible. However this article is to give any community members an opportunity to first voice concerns (if any).

The new Controller contract has been deployed already, and the final step will be to call upgradeController on the current Controller contract to switch over (planned before the next token distribution date on the 14th April).

Issuance Rate Equation v2.0.0

New equation:

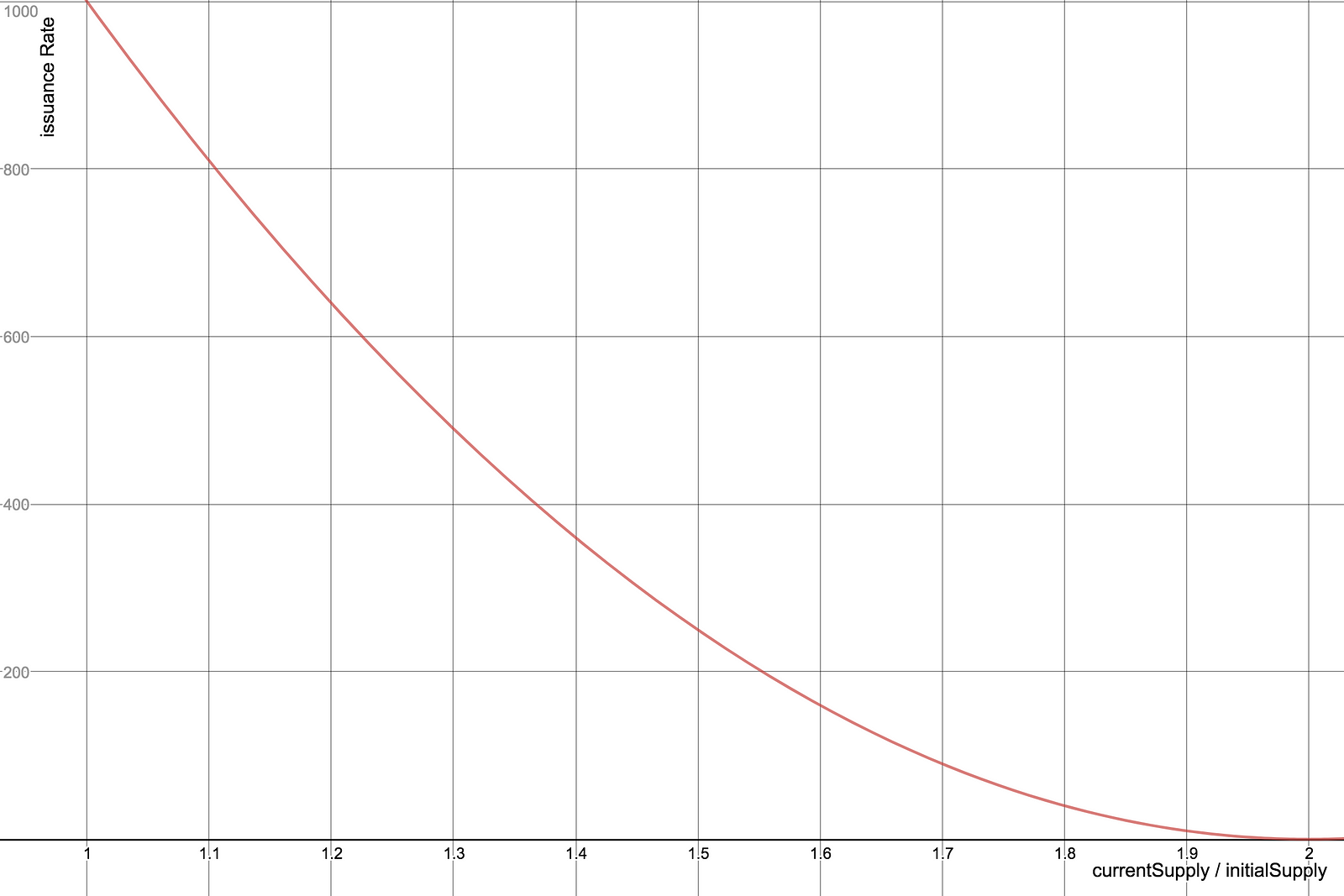

rate = 1000 * (2 — currentSupply / initialSupply)²

The equation is valid for initialSupply ≤ currentSupply ≤ 2*initialSupply , with initialSupply = 1,000,000,000 and therefore the maximum theoretical supply being 2,000,000,000.

Proposal: Update to issuance equation v2 by plutoegg · Pull Request #11 · ethfinex/nectar

Advantages of the new rate equation:

- A fixed rate curve and easily determinable maximum number of tokens (2 billion hard cap)

- Simple first-order equation (rate not dependent on fees collected but now only supply) — this new simplicity is essential as the first equation was complicated to model, making it less attractive to market makers who want to understand it and incorporate it into their profit calculations and trading strategies

- Simpler to calculate and issue new tokens on Ethfinex’s side based on trading. This can potentially enable it to be done more frequently in the future.

- No dependence on ratio of maker:taker fees in the equation (which was different than expected when the original model was developed)

New tokens will now be distributed as follows each 30 days:

To calculate the total number of reward tokens to be issued:

total_new_tokens = rate * total_fees_collected_in_eth

To calculate the number of reward tokens each user receives:

users_new_tokens = users_proportion_of_total_volume * total_new_tokens

Other Adjustments

The whitelist functionality was amended with this update, giving it the ability to have multiple approved admins who can add to the whitelist (rather than just one).

The fee structure on Ethfinex will likely also be adjusted in the upcoming weeks, particularly to add reducing maker fee tiers at higher volumes.

Governance

In the future, as Ethfinex and the Nectar Token Loyalty Program matures, these sorts of updates will be made exclusively by Nectar token holders using a decentralised governance process.

You can try out the first iteration of our governance dApp at nectar.community by submitting a proposal, or contribute new features on GitHub.