The Nectar token (NEC) is designed to achieve two main objectives on Ethfinex.

Firstly, NEC will incentivise users of Ethfinex to bring liquidity by rewarding them when taking on the role of market makers: placing bids and offers onto the order book to provide small spreads and full order books to other traders.

Secondly, the token will be an extremely important tool in the process through which Ethfinex will decentralise both its governance and infrastructure and become truly community run.

Ethfinex is set to launch soon, and this launch will be followed by a gradual transition towards full, scalable decentralisation.

Throughout this transition, the role and function of the Nectar token will keep evolving. To make this possible the Nectar token smart contracts are based on MiniMe, a framework by Jordi Baylina, open sourced by Giveth.io. MiniMe tokens are incredibly versatile and well-written, but most importantly have modular components, can be easily cloned with their user balances and are upgradable— this will offer Nectar a straightforward upgrade path whilst maintaining user balances. Among potential first upgrades for Nectar in future versions will be to add governance functionality for token holders. Aragon are basing some of their frameworks on MiniMe, and so our use of it should leave the door open as much as possible for compatibility with their protocols.

This article is designed to lay out the initial performance and structure of the Nectar token, as well as how it is planned to change.

Nectar token — V1

The initial functionality will be as follows: As users trade on the Ethfinex platform, they incur standard trading fees. A proportion of these trading fees are collected by Ethfinex and sent to a smart contract.

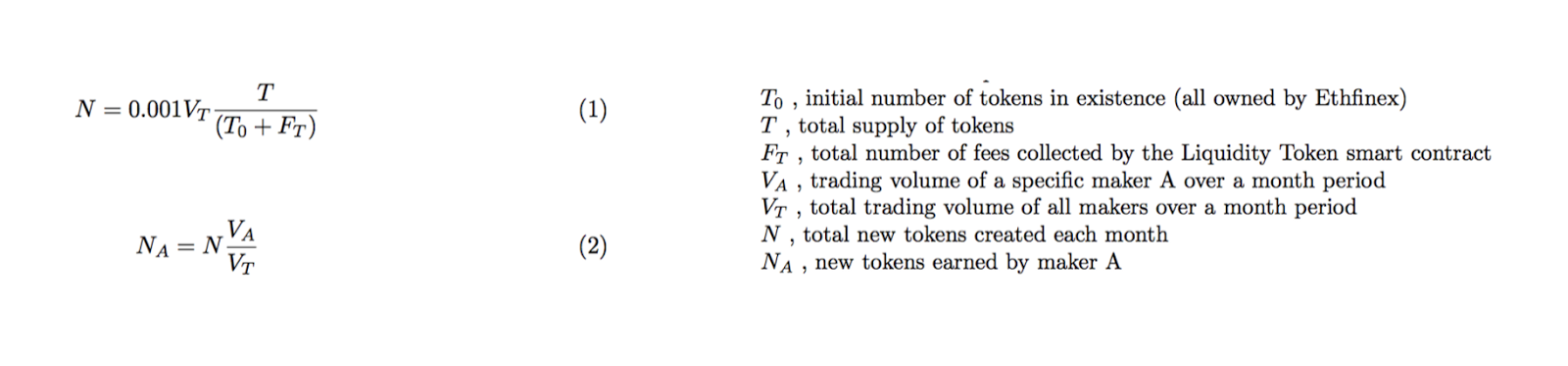

Tokens are generated depending on the amount of fees sent to the contract, and the issuance per fee decreases gradually, as per the equation seen below –

Initially, Ethfinex will retain majority ownership of the tokens whilst refining the token and governance mechanism; ultimately, however, as the ownership of the platform becomes decentralised to its users, we will target for 25–50% of tokens to be in the hands of Ethfinex users. As no more Nectar tokens are to be created, the Ethfinex ownership stake is set to gradually decrease as the Ethfinex platform gains popularity.

The Nectar tokens can eventually be redeemed for rewards from the Nectar token smart contract. Alternatively, the Nectar tokens can be held to advise on governance of the token and related aspects of the platform. An individual or organisation holding 5%+ of the Nectar tokens will, for example, be entitled to an Ethfinex board set.

Ownership and trade of the Nectar token will be subject to whitelisting, both on and off blockchain. On-chain this is by ensuring that any transfer which is not to a whitelisted Ethereum address will fail. Off-chain instead we can make sure to only allow the Ethfinex markets to be accessed by registered accounts who can buy and sell. This results in only registered users being able to ever own and transfer Nectar tokens.

Deep integration into Ethfinex: Aside from its main purpose, the token will also be used soon after launch as an incentive layer on Ethfinex. This will be to encourage and reward open source development, as well as to incentivise token related research and analysis on the Ethfinex discussion platform. Open source development is one of the most important model shifts of the previous decade and tokens can play an immense role in enhancing and incentivising this.

Nectar token upgrades — V2

One of the primary focuses for future token upgrades will be around governance. There are a number of approaches which may be viable, and we are exploring and experimenting with several options.

Upgrading to a distributed model of governance, and thereby releasing control, is one of the most difficult steps we will take with Nectar. In part what makes releasing control so difficult is that testing and comparing new governance models without stress testing them in real environments is almost impossible, and once a certain choice is made, it is no longer up to us to take decisions to improve things which are not working.

We are impressed with the vision and work being done by Aragon and hope to stay aligned with them in order to make use of the frameworks they are developing. Liquid democracy-style governance, allowing token holders to delegate voting to others, currently seems like the most likely solution. For now, however, the options remain open.

In the near future, we may need to edit the issuance equation if needed (simple to do with this design), and also once stable allow for the burning of tokens or other means of distributing rewards to holders.

Honeycomb metamorphosis

Once Ethfinex is established, the primary goals of development and efforts of our research will be towards developing a fully scalable and community owned decentralised exchange. The Nectar token will become a proof-of-stake token, running on its own native chain: Honeycomb.

This will mean that at the point of transition, all issuance of new nectar tokens will completely change and the system will transition to a different model, with different economic parameters and a fixed total supply.

This transition is hoped to take place within 12–24 months from now, but is of course dependent on several other projects in the ecosystem. Some of the related projects whose updates we are closely following include Plasma, Cosmos/Tendermint, and Polkadot.

All unclaimed fees previously pledged to token holders at this point will likely be distributed to them, and the token’s new purpose will then be to secure its native chain, designed specifically for fully decentralised exchange. In the long term when the platform reaches this fully decentralised model, the current percentage fee based model, taken on all executed trades, may no longer be appropriate. Instead a decentralised exchange requires a decentralised revenue model.

Future upgrades

Balances will be preserved with each upgrade or change in the token model, making use of the clone facility of the MiniMe contracts or a more complex migration when it moves onto a native chain.

Decisions on upgrades should be based on direct token holders governance, and owners of NEC will always have a veto right regarding proposals for changes.We have a roadmap for how we would like to see Ethfinex and the Nectar token evolve over time to become the most liquid, fair, and transparent exchange, owned and run by its community of users.

These decisions, however, should increasingly be made by the owners of NEC rather than by the Ethfinex team, and we hope to see new ideas and proposals emerge as the platform ownership begins to decentralise.