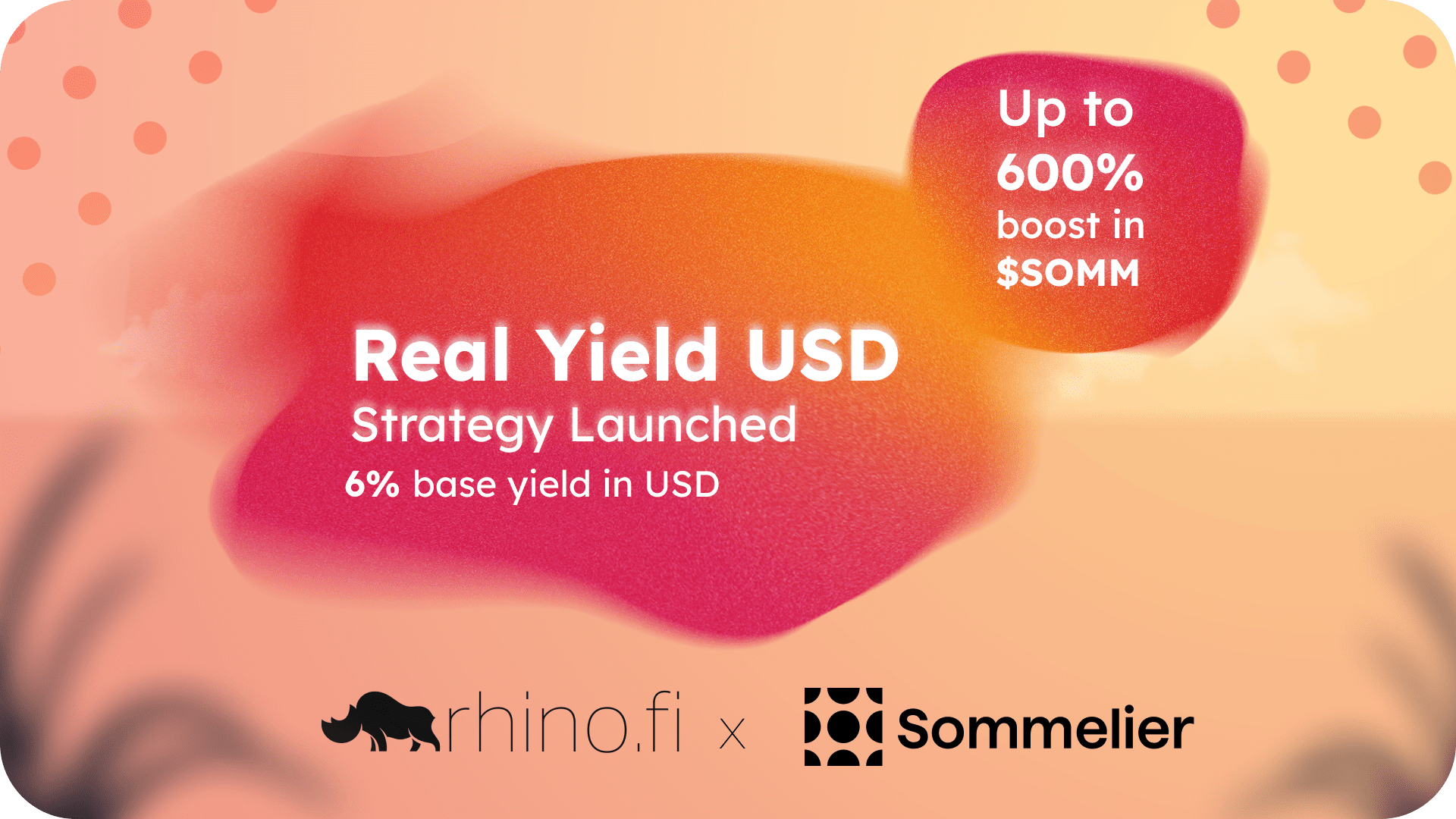

The opportunity offers sustainable yields, with a guaranteed boost. Here’s the TL;DR:

- We’re opening up a brand new cross-chain USD yield opportunity for all users

- The opportunity originates from Sommelier Finance’s Real Yield strategy. It automatically allocates your stables to various lending and liquidity opportunities on Aave, Compound and Uniswap.

- Base yield for the opportunity lies around 6% APY.

- We have partnered with Sommelier to offer a 600% APY boost for early adopters, paid out in SOMM tokens.

The size of the boost is determined by time of entry. As more people enter, the figure will move back closer to the base yield.

To invest in the opportunity, click on the button below.

How does the Sommelier Real Yield USD opportunity work?

Yield farming empowers crypto traders to invest their tokens across multiple lending and liquidity pools simultaneously. But it requires work, too.

You’ve got to keep moving your crypto in and out of different protocols as their returns change. In other words, you’ve got to actively manage a portfolio that’s supposed to be passive.

Sommelier automates this work for you.

A curated strategy, prepared by crypto market experts and voted on Cosmos, automatically allocates your stables to various lending and liquidity opportunities on Aave, Compound and Uniswap, and reallocates the profits in response to changing market conditions. All with smart contracts.

The algorithm puts your funds to work across multiple opportunities simultaneously, mitigating risk, and continually pushes your funds to the point of greatest return, behaving like an old-school fund manager but without the need to trust another human.

And the most crucial aspect of the opportunity is the ‘real yield’ bit.

This refers to the fact that you earn money in mainstream assets, rather than governance tokens, and your returns come from lending or trading fees, rather than incentives.

In other words, you earn in the tokens you want, and your returns come from actual activity, NOT via an initial, unsustainable token pump from the opportunity provider.

How does the rhino.fi boost work?

rhino.fi has secured a launch grant of SOMM tokens from the Sommelier team, which allows us to provide a guaranteed boost.

The APY you receive will depend on the time you invest, and the amount of people who have already done so. So, if you’re first in, you will earn a boosted APY of up to 600%, and the returns will gradually diminish over time. The boost will last for the Real Yield USD opportunity for a total of 30 days.

All users will have until 23rd June 23:59pm BST to claim their SOMM tokens. After this time, users will no longer be able their SOMM rewards.

What are the risks of investing in this opportunity?

Like all yield farming and liquidity provision programmes, the Sommelier Real Yield opportunity is subject to certain risks. These include:

- Smart contract risk. In a very small number of cases, smart contracts have been hacked.

- Liquidity risk. Occasionally, liquidity providers are unable to remove their tokens because there are insufficient assets in their chosen pool, which can be an issue when you want to unlock your tokens. Again, however, this is extremely rare as the pools invested with this strategy have a high TVL within them.

- Value fluctuation. As discussed, impermanent loss can be an issue for yield farming and LPing: this occurs when the value of your tokens in the ‘real world’ fluctuates, meaning you face an opportunity cost if you can’t remove your tokens from the pool and trade them. However, Sommelier has attempted to mitigate this risk by harnessing Uniswap’s tick ranges.