Welcome to your weekly newsletter, delivering top stories, must-reads, expert analyses and guest contributions from leading figures in the blockchain space… Enter the ether below and let your friends know where they can subscribe.

The incident at QuadrigaCX reminds us that no matter how secure a technology is, the weakest security link is almost always the people who interface with the system. – Avivah Litan

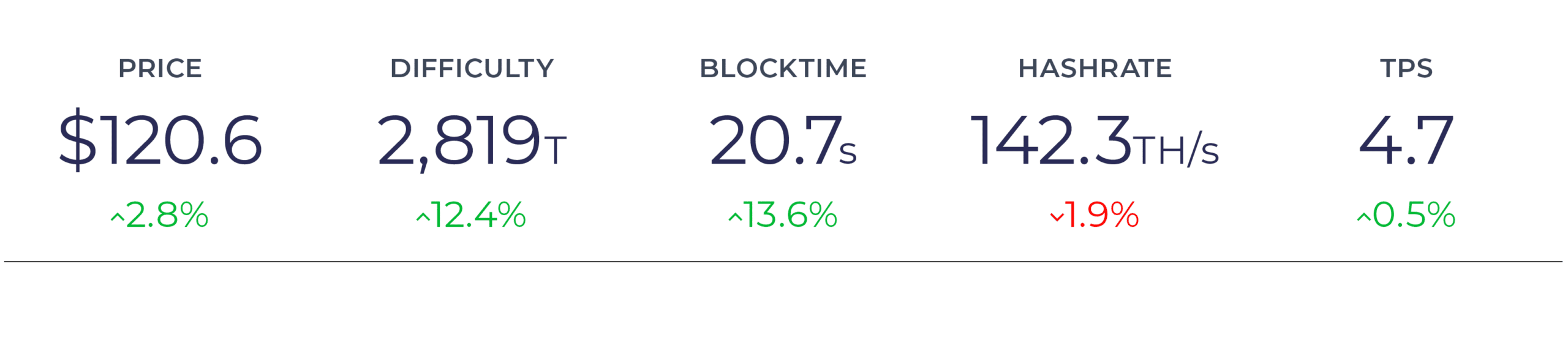

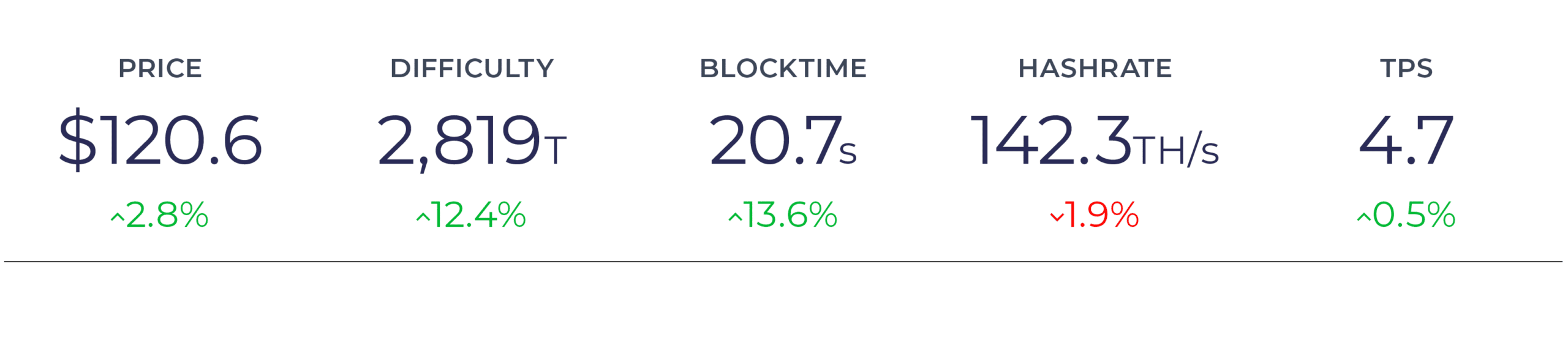

LTC led a wider market rally last week with BTC clearing $3.6k (BFX price feeds) resistance to hit the upside target of $3.8k. Short term, the BTC rally looks a little exhausted, with bands of support and resistance either side ($3.5k-$3.8k) likely to contain price action for a while longer.

Medium term, we now have a second well established floor for price within two months (15th Dec & 7th Feb) which could be a large bear pendant, or more hopefully, clear support from which to build upon. A break out of the pendant to the upside would open up the $4.3k target.

ETH is still looking slightly bullish and looks skewed towards a short term target of $140 provided that $114 support can hold and that BTC doesn’t have another ‘Bart Simpson’ moment. Else ETH could again have to test rising support of $103-107. Similar to BTC, a clear second bottom within two months has been established and price has also broken out of its medium term channel resistance that started in August.

The only significant warning sign is that BFX buy-side leverage has increased to near all-time-high levels again, so any move down will likely be quick and sharp. There are alot of eyes on LTC at the moment so it could be that ETH and alts take their direction from LTC whilst BTC meanders.

Left Chart – BTC/USD. Indicators: RSI, OBV, BFX Longs & Shorts.

Right Chart – ETH/USD. Indicators: RSI, OBV, BFX Longs & Shorts.

The Top News 📌

- In an interesting change of heart, Facebook buys the team behind blockchain project ‘Chainspace’, in a public move into the industry. Source.

- In another promising case of institutional adoption, the Bank of England looks at ‘saving 10’s of billions’ by harnessing blockchain for settlements. Source.

The Must Reads 💭

- Taylor Monahen breaks-down the importance of building positive experiences to drive the growth of DApps for the people who can benefit from them the most. Source.

- The coincidentally named ‘State of Ethereum 2.0’ google doc serves as great overview of ETH 2.0, including all new tech specs and approaches. Source.

The Nitty Gritty ⚙️

- An elegant, yet unforgiving introduction to zk-Snarks. Not for the mathematical newbie but well worth a read! Source.

- Great, readable overview of ETH 2.0 test-net and other technical specs. Get updated on ETH 2.0 now so you know the score! Source.

What?

Whilst Bounties have traditionally been used to incentivise people to find bugs (in code!), it is now being used to galvanise community participation in an array of innovative new ways that both solve key problems and provide people with an additional income stream.

Why?

“The cool thing about bounties in this use-case is how they easily allow people from around the world to coordinate and pool capital and deploy it towards practical causes.” – Mark Beylin, The Bounties Network

By using blockchain-enabled bounties we are able to know that 100% of the funds go to people on the frontline, without any NGO, Charity or Third-party claiming overhead, marketing or employment costs. It also offers an innovative, novel and rewarding new way to engage directly with your community, in ways that are constructive and conducive to your business goals.

What Now?

More companies are beginning to explore bounties for community incentivisation. E.g. Status created a bounty incentivising community members to submit video footage for a film they are creating. The Ocean Protocol did one that outsourced the organisation of one of their meet-ups.

With the fast growth of this new space and the growing list of use-cases, we will begin to see the lines blurred between corporation and community making for a smarter system, lending to improved collaboration and an incredible marketing hack…

- After a public twitter poll, Ethfinex Trustless adds Enjin coin (ENJ) to its list of tradable tokens.

- Last week saw round 12 of NEC distributions transferred to Market Makers on the Ethfinex centralised exchange. This marks the first anniversary since Ethfinex began sharing its fees with traders on the platform.

- Will Harborne, Director of Operations, recently attended the M1, Melonport summit in Zug and discussed what we’ve learned building a hybrid, highly liquid trustless exchange.

- Ethfinex announced the next event, being held in the heart of London on 27th February, where we have, amongst others, the MakerDAO team stopping by. View the full agenda and RSVP!

Take a second to let us know what you liked, or would like to see added, to your weekly newsletter. *no wei’s are distributed in the making of this newsletter… we just love a good pun!

Subscribe to our newsletter here.

Start trading on Ethfinex or Ethfinex Trustless.

Stay up to date with Ethfinex on Twitter, Telegram, Linkedin, Facebook and Youtube.