How Santa Got His Groove Back

Last night UTC time we discovered a small but annoying bug in the smart contracts that we upgraded on Tuesday (the update to facilitate L2<>L1 composability, conditional transfers and fast withdrawals).

Funds are completely safe and no funds have been lost.

TLDR – USDt and OMG are non-standard ERC 20 tokens and therefore deposits & withdrawals of those tokens will not be available until StarkWare make a change to the smart contract. The contract takes 28 days to upgrade (a design goal for safety & security reasons) and therefore we are assessing additional short term temporary options to minimise any temporary disruption

Konrad’s post from last night details the timeline and explains the issues in more detail. The main lesson learned is that Will can never declare that he is offline for the evening!

The Plan

So how are we moving forward?

We have discussed several temporary fixes to the deposits & withdrawals issue with the Starkware team, including adding a wrapped USDt and others options. Although some of these options are feasible, the added risk of introducing a new mechanism to DeversiFi as well as the relatively short time span for the long term fix (28 days) has meant that we favour the more straightforward option of staying on course for 28 days whilst we wait for the smart contract upgrade to take effect.

Taking the straightforward approach means that we can continue to focus the efforts of the entire team on launching the exciting new features that will make DeversiFi both a powerful place for DeFi traders to trade on, as well as being the first L2 exchange to be composable with L1 and other DeFi protocols. We think that focusing on delivering on our roadmap is the single best way to deliver value to traders, the DeFi community and necDAO members/Nectar ecosystem NEC holders

With the above in mind, our plan of action is as follows:

- Add more USDC, ETH and wBTC based trading pairs for DeFi tokens such as AAVE, ANT, SNX and ETH

- Potentially remove some USDt trading pairs from DeversiFi if there are any risk of dislocations

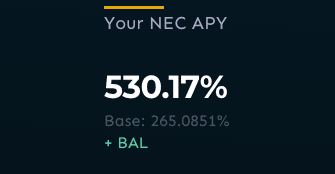

- All Beehive participants will be given the maximum 2x APY booster for at least the next two weeks

- The team will double-down on on launching the following powerful features- DeversiFi EARN lending & borrowing platform, DeversiFi fast withdrawals, DeversiFi composability with DeFi applications, Easier trading key management

- An additional $100k (in ETH) allocated to spread awareness of the launch of DeversiFi EARN, Beehive the and the other exciting other new features coming to DeversiFi over the coming months

More details below

Beehive Two Week Booster

Beehive V1 is a 12 week program (the first of many) to start providing on-chain trading venues for NEC, in order to propagate NEC into more DeFi venues.

As DeversiFi may have less/different trading pairs than traders were expecting over the following weeks, it may be more difficult for traders to achieve the 24/hr volume levels needed to achieve the Beehive boosters. Therefore for Beehive periods 1 and 2, all participants will have the 2x multiple applied to their rewards. The APYs with the 2x booster are currently 422% for NEC and 22% for BAL

We will continue to apply the 2x reward booster for at least two weeks, maybe longer

Potentially Remove Some USDt Trading Pairs From DeversiFi

We may de-list some USDt trading pairs if any markets are at risk of becoming dislocated

If you have USDt on DeversiFi and either do not wish to trade it for another token, or are unable to (lost trading key etc) then please reach out to a member of the DeversiFi team and we will detail your compensation options.

List more USDC, ETH and wBTC based trading pairs

A six month project to upgrade the DeversiFi matching engine and back-end services will be finished next week, paving the way for the addition of new markets and pairs.

From next week onwards we will add key DeFi tokens for trading against ETH, USDC and wBTC as an interim step, before re-adding the USDt pairs in 28 days time (after the contract upgrade)

Focus On The New Product Launches

Fast Withdrawals and Composability with DeFi on Ethereum L1

ZK-proof batches are submitted to the blockchain by DeversiFi and StarkEx (usually every 1-3 hours). Withdrawals cannot be processed until each new batch is completed.

The solution is a novel fast withdrawal mechanism, implemented using a flexible design pattern called conditional transfers. The mechanism allows liquidity providers with funds on L1 to make transfers on behalf of those who hold funds inside DeversiFi and be guaranteed to receive those funds back, plus a fee, effectively earning passive interest for liquidity provision.

We believe this is a killer feature that will start to make L2 open to DeFi by allowing for composability with L1.

Beyond just enabling fast withdrawals, conditional transfers will be a fundamental building block for many more features on DeversiFi in the future. Traders will be able to make custom transactions which directly interact with other DeFi protocols on L1. This, for one, will make DeversiFi an ideal platform for arbitrage as well as opening up DeversiFI markets to on-chain aggregators

DeversiFi EARN

The mirror of Fast Withdrawals is the DeversiFi EARN platform. Liquidity Providers can provide liquidity to single asset pools in order to earn yield. Initially the leant funds will be deposited to AAVE, so LPs are always earning a base yield. When a DeversiFi trader wishes to make a fast withdrawal from DeversiFi back to layer one, EARN liquidity providers will lend the funds to DeversiFi for a short period of time in order to facilitate DeversiFi filling that withdrawal request, earning a higher yield.

The DeversiFi earn platform is a key part of fast withdrawals and will enable liquidity providers to both power the first fast withdrawal survive from a laye two exchange, as well as earning yield on their funds. The EARN platform will be underwritten with both ETH and NEC

The smart contracts for DeversiFi EARN and Fast Withdrawals has already been built and audited. We are in the final stages of building both products and are excited to launch in January after the 28 day contract upgrade has taken effect

Trading Key Management

As DeversiFi uses a cryptography called STARKs to power the fast layer two trading, traders who connect to DeversiFi using MetaMask need to generate a trading key which is tied to their Ethereum address. Traders currently need to keep a backup of their trading key in order to continue trading uninterrupted (although they can always get their funds back if they lose their key). In a step change, instead of traders needing to keep a trading key backup, DeversiFi will store an encrypted version of their key, that can only be accessed by traders signing into DeversiFi with a password. This will improve on-boarding and mean that trading key issues are a thing of the past!

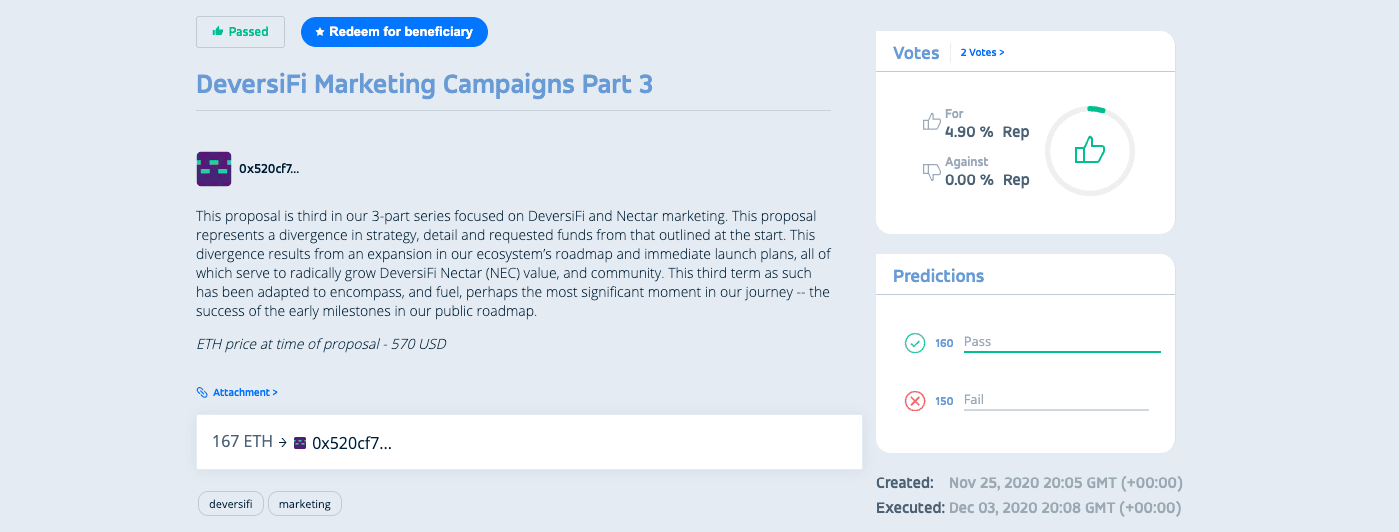

Marketing Focus on Launching DeversiFi EARN and Fast Withdrawals

The DeversiFi team has successfully applied to the necDAO for a 167 ETH grant ($100k) to fund community education & awareness for DeversiFi EARN, Fast Withdrawals, Beehive and all the other exciting products coming to DeversiFi over the coming months. The team will carefully utilise this funding to ensure that DeFi traders are aware of the power that these new features can add to their trading activities

NecDao Marketing Grant Application link:

The full DeversiFi Roadmap can be found here

Please reach out either privately or in our Discord group or if you have any questions at all.

Onwards!