Lessons from DeversiFi as one of the first layer-2 protocols on Ethereum and a look at the mission ahead…

Summary:

- $300m traded on DeversiFi in its first year

- 4200 happy early adopters

- $5m raised from the best industry investors and supporters

- DVF token soon to launch to transition DeversiFi to community governed protocol

- DeversiFi’s mission: make DeFi tools for financial freedom accessible to everyone

On June 3rd 2020, with much trepidation, we unveiled DeversiFi to the world.

DeversiFi was one of the first ‘layer-2’ (L2) protocols to launch. Ethereum and other ‘layer-1’ blockchains are expensive to interact with and have limited block space for transactions. L2 solutions use ground-breaking technology to pack more information into the same block space, meaning that they inherit the security and trust minimising properties of Ethereum but with a tiny fraction of the cost.

As one of the very first L2 solutions, and as the first ever protocol to use StarkWare’s zk-proof technology, DeversiFi offers a vastly superior experience when compared with other decentralised exchanges, and has the ability to handle orders of magnitude more users in the long run.

One year after the initial launch, DeversiFi is one of the easiest way to access DeFi: low-cost and reliable trading, token payments, and earning interest, all without any Ethereum gas fees.

This post will explore DeversiFi’s first year, what our team has learned so far, and the mission ahead to scale DeFi for the entire world.

One year ago

Today several Ethereum scaling solutions are live and many more are close to launching. Many side-chains, such as Polygon, have also become popular offering an Ethereum like experience for developers and users. Whilst the technology and ecosystems are still early and iterating fast, the general concept of L2 and rollups are now widely accepted and acknowledged as being an essential part of Ethereum and DeFi’s future.

A year ago it was not as clear that this path would be the right one. For DeversiFi, launching a L2 exchange was a wild and risky experiment. Almost nobody had done it before (with the single exception of Loopring), and so we knew that we would be facing a challenge and that we would need to learn fast.

Many doubted the concept that L2 was necessary or would ever gain user adoption. As a team we had analysed the industry, many alternative solutions for scalability, and tried to predict how L2 tech might evolve with DeFi.

However we knew that there was only one way to continue to learn the answers to the questions that remained… and that was to launch with real users.

- Would anyone use it?!

- Would the huge benefits once you were on L2 make up for the additional steps needed to start using DeversiFi?

- How soon would other L2 solutions begin to launch, and how would real users value the different trade-offs that each makes?

- Would bridges exist to allow users to move funds between different L2 solutions, and if so, who would build them?

- What would the community think of Validium (cryptographic proofs on-chain but off-chain data availability)?

- Is the temporarily sacrifice of DeFi composability (money lego) worth the huge increase in scalability and improved user experience?

As we launched we soon began to see answers to some of these questions. Some highlights from the last 12 months:

- 4200 registered addresses

- 300 million dollars of assets traded

- Trading, swap, yield, transfers functionality launched

- $5M raised from top investors including ParaFi, Defiance Capital, Delphi Ventures, Blockchain.com, Lightspeed, Fenbushi VC, OKEx

- Core team growth from 10 to 20

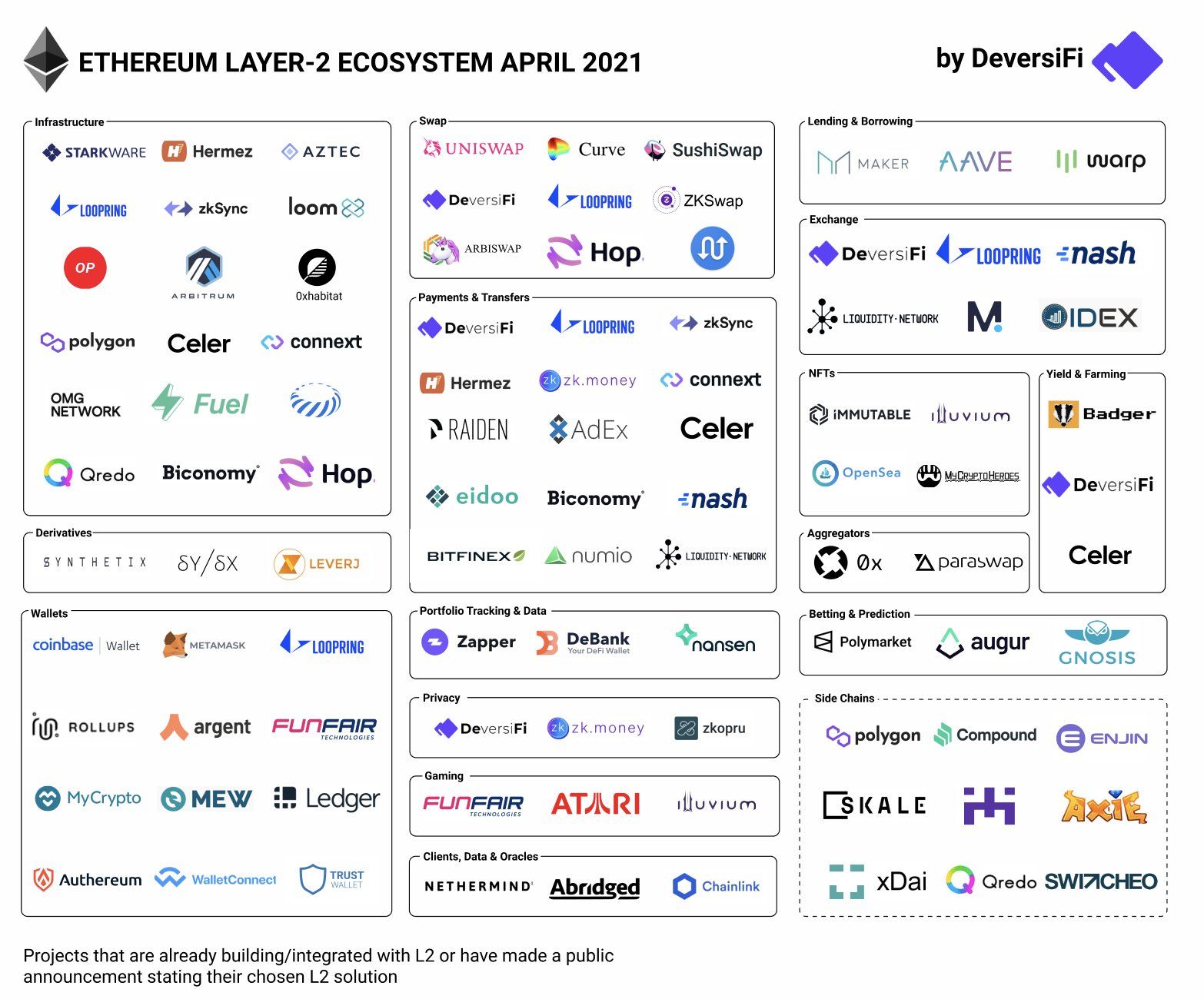

The overall layer 2 ecosystem has grown as well, with many more projects at least now in the design and building phase, although the number of solutions live on Ethereum is still low:

Lessons learned about building on L2

1. Onboarding: By the time you want to use L2 its too late!

- The friction of depositing to L2 is consistently the biggest barrier to adoption.

- Native wallet adoption is low or badly adapted, although improving fast, especially for L2 solutions with JSON RPC support.

- Deposits are thought of as costing too much when gas is expensive (which is when everyone wants to try L2, and when it is most useful).

- Deposits are seen as being too much effort compared to using L1 when gas is cheap (!)

2. Convenience is king, but security leads to longevity

- The huge (and unexpected) uptake of Polygon and BSC for DeFi shows that ease-of-use and low cost is more important in the short term than questions about security.

- Convenience is king for real people, and it is likely a mistake to overly model future DeFi solutions on the existing user base of Ethereum or on early adopters who are going to be more ideologically driven than future users.

- However liquidity is not loyal, and we have seen how fast solutions and protocols can rise as well as fall. Long-term the most secure and reliable solutions are likely to be the ones that retain the most activity.

3. Fragmentation is inevitable making bridges essential

- It was inevitable that with a turing-complete programming language scaling technologies were not going to only evolve in one way! Multiple teams in the Ethereum ecosystem have built great scaling solutions independently.

- Different applications, including exchanges, games, and NFTs have different scaling needs and choose to make different trade-offs on these. Many developers trade off some speed and cost for simpler migration from L1.

- Increasingly we are seeing a multi-chain ecosystem evolve. This pushes the cognitive effort onto the users to move cross-chain, and can lead to a frustrating user experience. It also makes bridges essential.

The mission ahead

The first wave

DeFi is still very much in its first innings. Despite faster growth over the last 12 months than anyone had dared imagine, most of the participants are still ‘early adopters’ and when we drill into the statistics for even the largest protocols like Aave, Compound, Curve, and Uniswap we can see that the user numbers are still tiny in the grand scheme of retail finance, and usage is dominated by wealthy individuals.

Interacting with DeFi is still fraught with challenges: high gas prices, failed transactions, front-running and miner-extractable-value, and the cognitive overload of using multiple chains, wallets, and user-interfaces.

The success of DeFi trailblazers on L1 Ethereum has led to further experiments on Binance Smart Chain and Polygon, with each new wave growing the number of people who have been able to afford to experience a taste of DeFi, and providing feedback for developers. The unlimited potential for innovation that these smart-contract environments offer will continue to be a test-bed for new protocols and applications, and as new scaling solutions launch we will see an iteration towards product-market fit for larger and larger audiences.

DeversiFi’s goal

DeFi has the potential to help millions of people around the world achieve financial freedom. Assets held in desktop and mobile wallets will be able to be used as temporary collateral to borrow funds without an application process, left earning interest in DeFi protocols (achieving rates that have previously never been available in savings accounts), and will always be able to be spent instantly in any currency required (automatically swapping at the best rates).

Most of this is technically possible today for those who are adventurous enough to explore DeFi, and who have the money and time at their disposal to be willing to battle through the frustrations and cost of current protocols. However we are still very far from achieving this vision for regular people. Cost is too high and the experience is too fragmented, confusing, and intimidating.

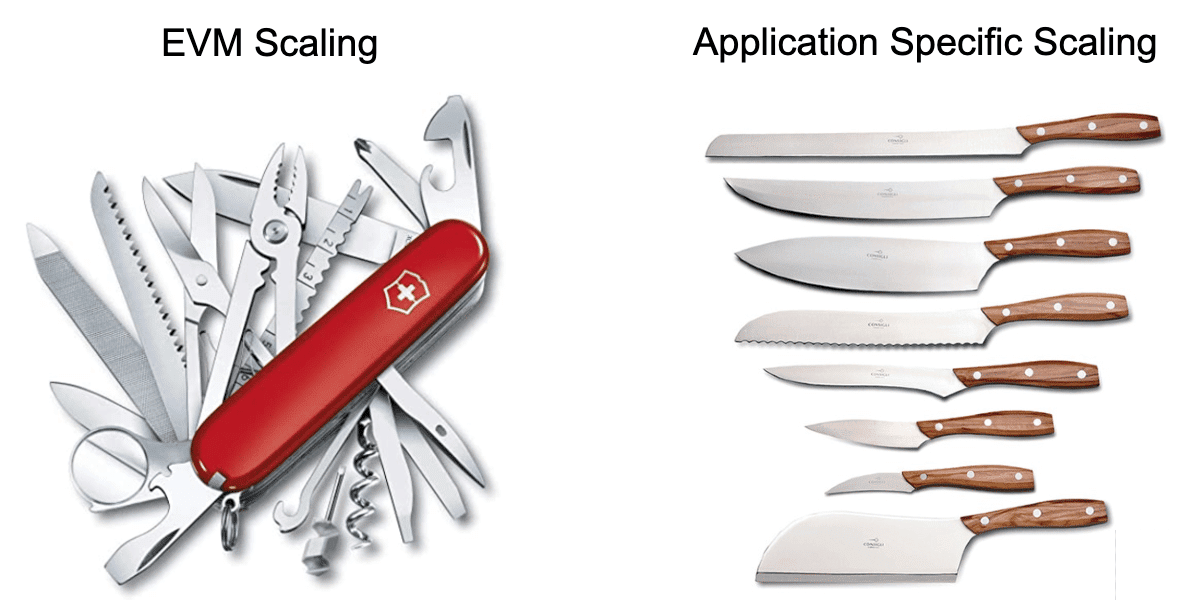

Scaling is happening temporarily via several ‘Ethereum-like’ side-chains, such as Binance Smart Chain and Polygon, which offer the ability to deploy smart-contracts with the solidity programming language. Whilst EVM compatible scaling solutions provide the best test-bed for development of new protocol innovation, it doesn’t offer the optimised experience for large scale use.

EVM Scaling can be though of like a pocket-knife – which is very flexible and allows you to do everything you need to do, albeit sometimes slowly. However if you have decided you want to serve 1000s of customers at your restaurant, you don’t want to be preparing the meals with the pocket-knife, but want instead a sleek set of tailored knives.

We are betting that once DeFi reaches 10s of millions of users, 99% of what people want to achieve will be a short list:

- token transfers

- earning interest

- borrowing and lending

- trading and currency conversion

- passive yield strategies (i.e. DeFi pooling / AMMs)

To make that short list of DeFi actions work for as many people as possible doesn’t require the flexibility for innovation of the EVM, but instead requires the optimised capabilities of an application-specific scaling solution. Building on StarkWare’s Cairo programming language, DeversiFi is building the chef’s expert knife set, rather than a pocket knife, and tailoring everything in the future user experience for large scale adoption with the lowest cost and lowest friction.

DeversiFi is live and being used by thousands of DeFi participants, but it will be a long journey to achieve our vision, so how will we get there?

Achieving scale

In the coming year we will be focusing on three themes to help DeversiFi fulfil the promise of Ethereum and DeFi:

1. DVF token launch, governance, and further decentralisation of the protocol

The DeversiFi governance token (DVF) will empower past and future users of DeversiFi to own and shape the protocol. Initially token holders will able to control upgrades to the contracts including the proof verifier, toggle a fee switch to direct trading fees to the governance module, and spend tokens from a community treasury on liquidity mining and grants. Eventually DVF may help achieve further decentralisation DeversiFi including through incentivising multiple L2 Operators. Learn more about the token, or sign up to be notified about how to participate in the launch.

2. Launching automated liquidity provision pools (AMMs), and expanding the toolset available to developers

The team’s current major focus is delivering AMM pools on L2, allowing liquidity to be added in the simplest possible way to complement the existing order-books. We believe this is the final essential tool required, alongside the existing transfers, yield pools, and order-book trading, to provide a well rounded experience to any DeFi participant.

The focus for the DeversiFi core protocol team will then shift towards expanding the tools available to external developers, making it easier to build on top of DeversiFi and scale other applications.

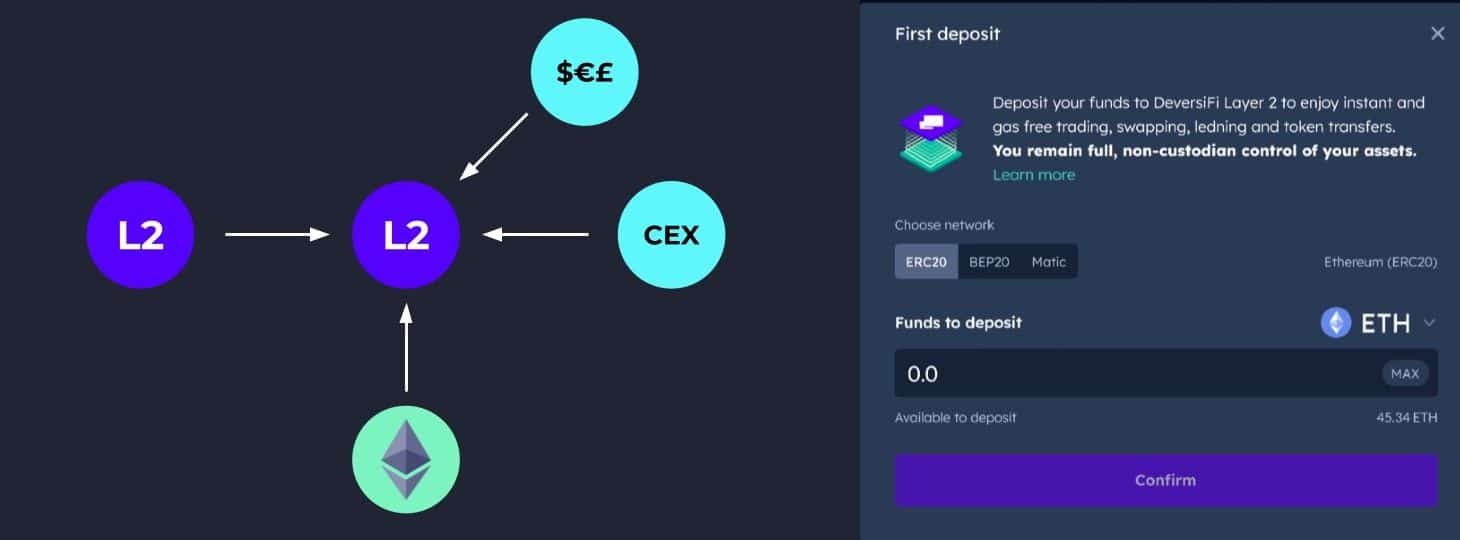

3. User experience and on-boarding (especially via bridges)

On-boarding has been the primary friction for new users of DeversiFi and in particular this has been due to the cost. New users come from Ethereum, and deposit assets that they already have on Ethereum. This limits the addressable audience to those who have been in the industry for a while, already have high wealth, and are willing to pay high gas fees.

We’ve built an oasis but have so far made it only accessible via crossing a red hot desert barefoot! As Ethereum transitions to become a data availability and settlement chain for securing multiple L2s we imagine block space becoming even more valuable, and gas prices continuing to become more and more prohibitive. Therefore our focus is on diversifying the number of ways to access DeversiFi, so that it is not reliant on existing users of Ethereum, including by integrating bridges from side-chains, centralised exchanges, and for making direct deposits using USD, EUR or GBP.

StarkNet

On the distant horizon is also StarkNet, which will be StarkWare’s open zk-rollup network, using the same Cairo programming language as DeversiFi is built with today, but permissionless, allowing any application to be deployed, and to interoperate and achieve DeFi ‘lego’ composability.

We believe this will be a phenomenally powerful network for mainstream DeFi applications, with each protocol able to be written in Cairo and optimised for STARK proofs, whilst still benefiting from interoperability and network effects on L2.

As the oldest and most mature application in production written in Cairo, DeversiFi will be primed to flourish in this permissionless ecosystem when it launches.

Conclusion

Now is the time to jump aboard for the next phase of DeversiFi’s mission!

Leave your email to be notified about how to participate in the launch of the DVF token at https://rhino.fi/token/.