Five reasons to be bullish Ethereum and the ETH Price.

It is hard to believe just how far Ethereum and DeFi (decentralised finance) have come over the past year. 12 short months ago, barely anyone had heard of AAVE, NFTs were more associated with 2017 than the future of finance, and if you would have said that the Ethereum price was going to do a 20x from its 2020 lows then you would have been laughed out of the room.

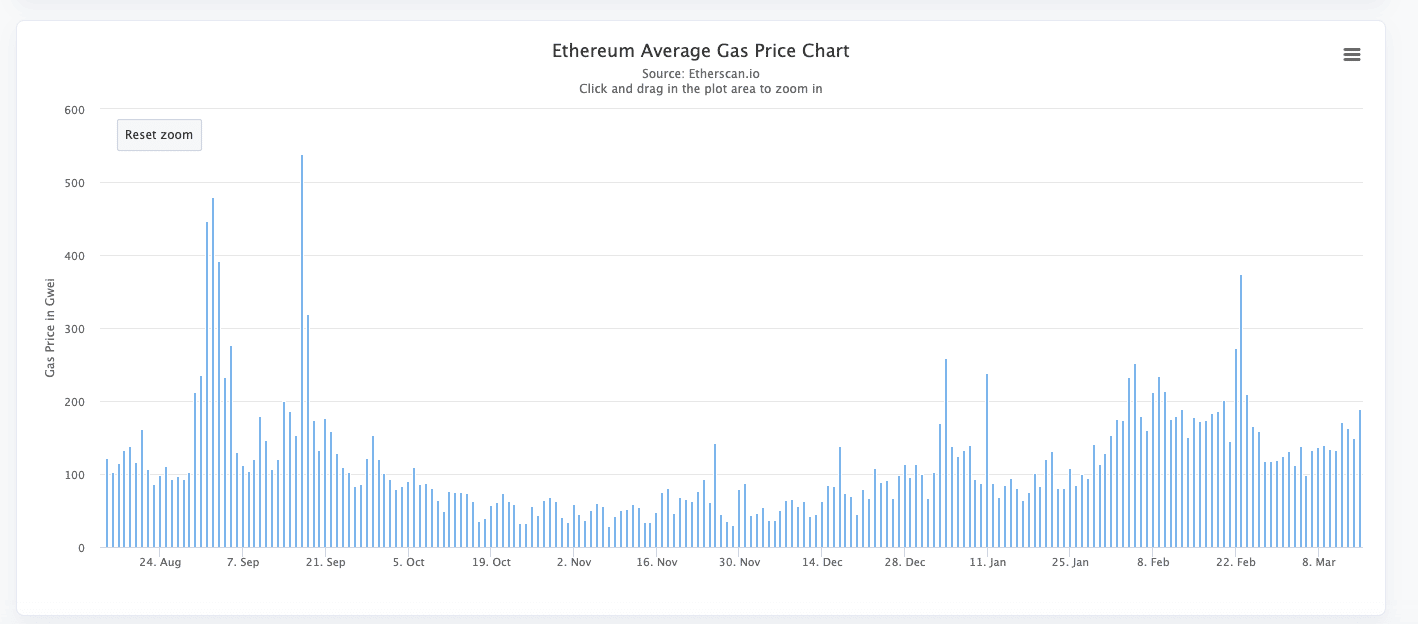

Yes Ethereum gas prices are high, competing layer-1 chains are suddenly finding a brief moment in the spotlight, and environmental concerns are giving some institutions reason to pause on proof-of-work chain investments, but the outlook for Ethereum has never been more bullish.

Below we list our top five reasons to be bullish Ethereum and the ETH price.

Not investment advice, do your own research!

1. Layer-2 for DeFi

DeFi has proven to be the first product-market-fit for Ethereum outside of the 2017 fundraising/ICO boom, but with Ethereum gas fees hitting new USD highs almost every week now, Ethereum risks turning into a chain for the rich. Unless you have a $50k+ portfolio, most on-chain yield farms are not worth participating in and the fees of interacting with complex DeFi smart contracts make using them prohibitive for most.

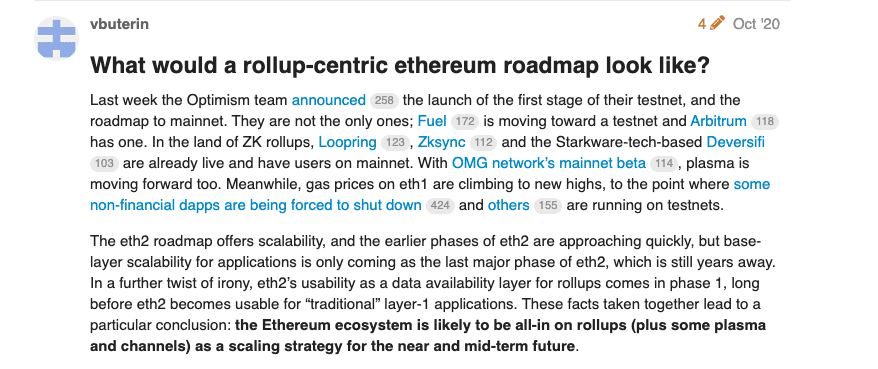

The ambitious scaling solution for Ethereum, called Ethereum 2.0, is a series of upgrades that will turn the current single proof-of-work (PoW) system, into a series of shards, capable of transacting many hundreds of thousands of transactions, whilst also switching Ethereum over to proof-of-stake (PoS). One of the key upgrades that will enable a much higher throughput, is ‘execution’ sharding. However execution sharding is still several more years away. Instead, the Ethereum scaling strategy in the short to medium term has switched to being ‘rollup centric’ by optimising the current Ethereum 1.0 chain to support ‘Layer-2 technology’.

What is Ethereum Layer-2?

What is a layer-2 and what is a rollup you ask? A rollup is a way of abstracting Ethereum transactions off the main-chain whilst (crucially) maintaining the security guarantees of the main Ethereum chain itself. Unlike a side chain or competing layer-1, transactions that happen on a rollup have much stronger security guarantees.

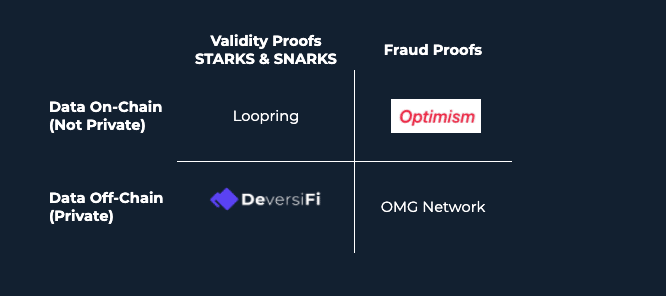

There are two types of rollup, Zero Knowledge rollups (zk-rollup) and Optimistic rollups. In the former, transactions are validated by a smart contract (validity proof) whereas the latter relies on a network of validators to spot fraud (validity proof. In both scenarios, if the operator (the layer-2 dApp etc) is proven to have ‘cheated’ or has gone offline, the rollup ecosystem reverts back to the previous state and users can retrieve their funds on layer-1 Ethereum.

By decoupling sharding for ‘data’ from sharding for ‘execution’ the Ethereum 1.0 chain can support more data per block, therefore making it more compatible for the proof of state change transactions that rollups are dependent on. Depending on the kind of rollup, Layer-2 operators may have to submit several proofs to the main Ethereum blockchain as they cannot fit enough data into one proof submission. Data sharding helps rollup operators operate at scale.

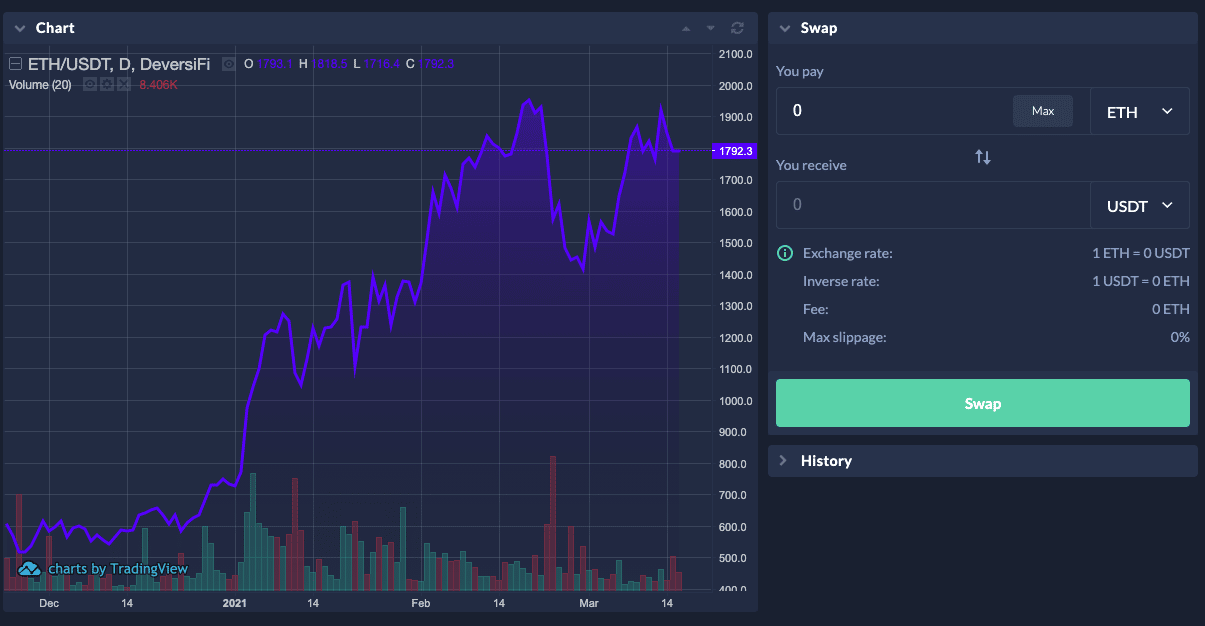

There are already several rollup implementations operating at scale today. DeversiFi operates a zk-rollup exchange (data is held off-chain as something called Validium) which allows users to trade the top DeFi tokens (AAVE, SNX, ETH, YFI, SUSHI, UNI) without paying any gas, saving users $50-100 per trade. Loopring and zkSwap also have operating zk-rollup exchanges operating on main-net.

The launch of Optimism as the first production ready Optimistic Rollup solution will also allow dApps to port all or part of their products onto Layer 2. Optimism will have a full Ethereum Virtual Machine on their rollup, paving the way for a flourishing ecosystem of dApps.

Between zk-rollups (DeversiFi, zkSwap), Optimistic Rollups (Optimism) and Ethereum 2.0 data sharding, Ethereum will be able to perform at scale a long time before the eventual sharding of code execution is launched in several year’s time. Competing layer-1 chains should be very afraid as more of the long tail of economic crypto activity will revert back to Ethereum.

2. Digital Art (NFTs)

If DeFi was the first time that Ethereum truly found product-market fit, then NFTs (non fungible tokens) is certainly the second.

What are NFTs?

For those who have been living under a rock for the past six months, the NFTs or Niftys are essentially tokenised rights to a specific (non fungible) asset. For example, a piece of digital art, or rights to a piece of music.

Initially the NFT sector was geared towards gaming (owned in-game equipment or tokenized power ups etc), which is still going to be a huge use case, but recently the sector has seen an explosion of interest around digital art.

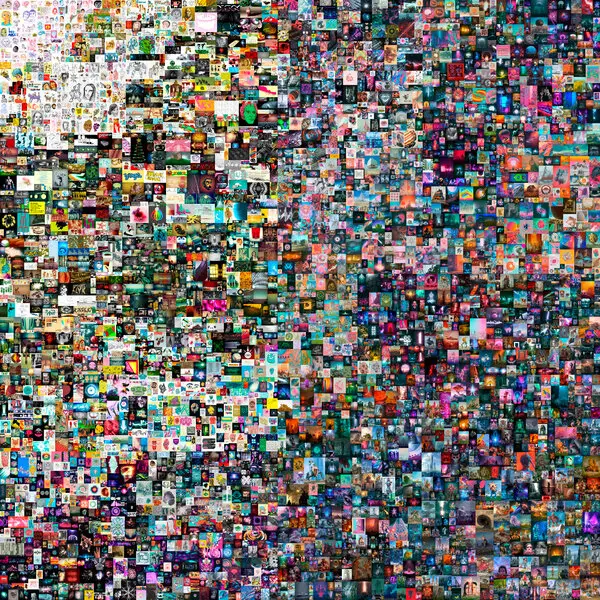

Famous artists such as FEWOCIOUS and Beeple have been dominating headlines with their drops, with Beeple’s ‘EVERYDAYS: THE FIRST 500 DAYS’ selling for an incredible $69m USD via Christie’s. Closer to home, crypto native project such as Punks and Hashmasks have been capitalising on the concept of digital scarcity and have seen some of their rarest tokens changing hands for hundreds of thousands of dollars.

The Beeple $69m sale has grabbed the attention of the rest of the world. Over the next few months expect to see wave of celebrities and famous artists establish a name for themselves in the space. A few examples:

Elon Musk selling his first NF

Damien Hurst planning to sell artwork via NFTs later this year

Super high value NFTs require the same security guarantees as any other large transactions. At the same time, digital art investing for super high value pieces is likely to be measured in decades, not days, therefore artists and collectors alike have turned to Ethereum as their chain of choice.

Other blockchains and sidechains may be trying to make their mark, but long term, with the rise of layer-2 specific scaling for NFT market places just around the corner, games and collectibles, value will accrue to Ethereum.

NFTs are the gateway drug to DeFi and the wider Ethereum ecosystem. Come for the art, stay for the DeFi.

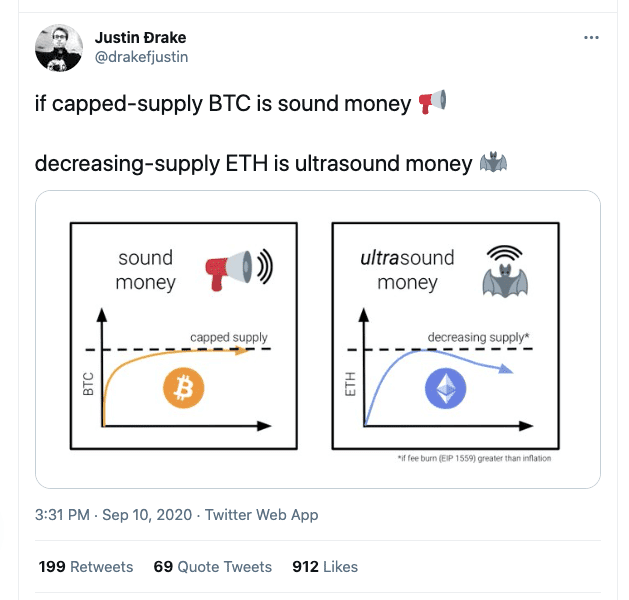

3. EIP 1559 – Ultrasound Money

What is EIP 1559?

Shipping in July 2021 (the London fork), Ethereum Improvement Protocol 1559 is a huge shakeup to the way that gas prices are set on the network and is incredibly bullish for the Ethereum price.

In the current setup, users and dApps blindly compete to second guess the rate at which miners will include their transactions into a block within a certain time frame according to third party estimates. This leads to gas prices quickly inflating as everyone has to overcompensate, leading to unnecessary bidding wars. The result is a large windfall to Ethereum miners, a large cost to users and no real benefit apart from a lot of upset network participants.

EIP 1559 Explained

EIP 1559 introduces a difficulty adjustment type mechanism to Ethereum. Similar to Bitcoin the market rate for Ethereum network transactions will increase or decrease programmatically based on the level of congestion in the network. For urgent transactions, you can add a tip to the base fee to ensure that your transaction is served quicker by validators, with this ‘tip’ replacing the current auction system.

Why is EIP 1559 bullish for the Ethereum (ETH) Price?

Leaving aside the UX benefits that EIP 1559 will bring, the change is also incredibly bullish for the ETH price. Unlike today, the base fee for each transaction will be burned – gone, never to return. As the network becomes more congested in times of peak usage, the base fee increases and therefore more and more ETH is burned. Ethereum becomes a deflationary network, where block rewards are funded by inflation (unlike the Bitcoin network) as well as fees, but overall network security is also funded by an ever diminishing supply and therefore higher market capitalisation of ETH.

Equally as importantly, EIP 1559 enforces ETH as the only currency that can be used to pay transaction fees. This ensures that all of the deflationary pressure is focused on ETH as opposed to any other asset or token. Bullish.

4. Ethereum Accelerated Main-net Switch to Proof-of-Stake (PoS)

Ethereum has an ambitious roadmap to scale at the protocol level, enabling it to transact hundreds of thousands of transactions per second by the end of 2022-2023 in a series of upgrades called Ethereum 2.0.

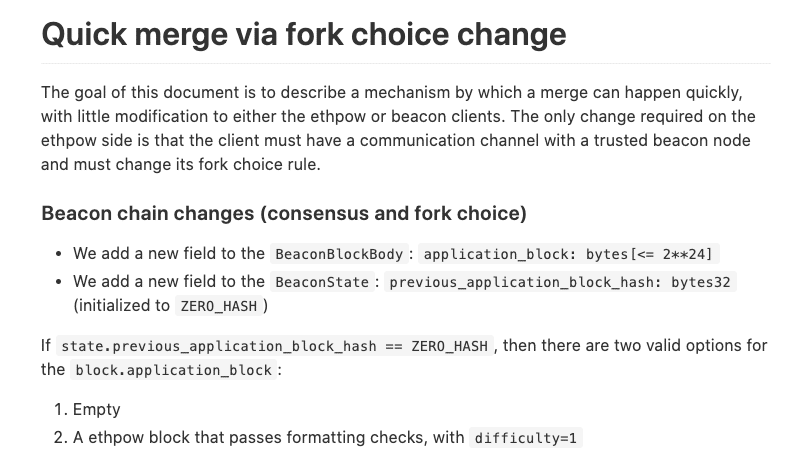

A radical new proposal by the Ethereum founder Vitalik Buterin has suggested a quick-and dirty way to bring the switching of main-net Ethereum (the chain that is in use today) from proof-of-work (PoW) to proof-of-stake (PoS) prior to 2022-2023. Previously the switching of main-net to PoS was one of the last parts of the Ethereum 2.0 launch.

Why Is Ethereum Switching to Proof-of-stake?

The Ethereum 2.0 upgrade is split into three main parts. First, a new beacon chain has launched (2020) which acts as the new coordinator chain. Secondly, ‘shards’ are launched, which will allow Ethereum 2.0 to scale, and finally, the mainnet (the current chain) is switched to PoS in the final piece that means the entire of Ethereum will have switched away from the environmentally unfriendly proof-of-work consensus mechanism.

So why is the mainnet proof-of-stake happening sooner rather than later? As already mentioned above, EIP 1559 redistributes excess profits away from miners and instead burns the transaction fees. Miners are not very happy about this, as you can understand, and some have been very vocal in resisting the planned EIP 1559 upgrade. The Ethereum community has realised that miners are now creating more problems then they are worth and are not aligned with the future of the network. Therefore the switch to proof-of-stake is being pushed sooner rather than later.

Why is the mainnet switch to proof-of-stake bullish for Ethereum?

Put simply, Ethereum transaction fees will be earned by validators instead of miners. If EIP 1559 is shipped prior to the switch to proof-of-stake then the ‘tips’ part of the transaction fee will go to validators. This could result in a huge return on capital for validators who have staked their ETH

With an average of 15,000 ETH paid in transaction fees per day, and 3,527,202 ETH staked, the return on staked ETH would be 150% APR. After EIP 1559, the APR could be closer to 30-80%. This could lead to a substantial buying pressure on ETH, combined with more and more ETH supply being taken out of circulation to be staked.

The mainnet move to proof-of-stake could be the single biggest bullish catalyst for the price of Ethereum (ETH) and we will closely be watching how the upgrade timelines unfold.

5. Bitcoin’s Environmental Concerns

We all know it, the energy hungry consensus mechanism that drives the Bitcoin network is bad for the environment. Bitcoin currently consumes more energy than the country of Ireland. To put it bluntly, Bitcoin is on the wrong side of history in a world that is increasingly more concerned with carbon emissions.

Institutions with environmental pledges are currently either unable to invest directly in Bitcoin, or are unwilling. Ethereum with its smaller market capitalisation and move towards proof-of-work could quite quickly be a much more attractive target for institutional investment. As bitcoin becomes a crowded trade, Ethereum is the next logical choice.

The quicker move towards PoS for the Ethereum main-net could be the catalyst that boosts Ethereum’s environmental credentials, removes opposition from the arts community and leads to Ethereum becoming the only choice for institutional investment.

About DeversiFi

DeversiFi makes DeFi easy. Swap, Invest and Send without paying Ethereum network fees.

Website: https://rhino.fi/

Twitter: https://twitter.com/deversifi

Discord: https://discord.gg/bfNDxZqPSvf