If you’ve spent any time engaging with DeFi (Decentralised Finance) you’ll be painfully aware of something called gas-fees. Once upon a time, these fees were negligible (somewhere in the dollar or even sub-dollar range). But as the Ethereum ecosystem has expanded at a break-neck pace, the cost of gas has skyrocketed with it (reaching eye-watering levels 🥲).

In this article, I will break down in simple terms what exactly gas-prices are, why we need them, why they have risen to such insane levels and what you can do about them today. 👇👇👇

So, What Exactly Is Ethereum Gas ⛽️ Then?

The term gas is a metaphoric term. There, of course, is not actually gasoline involved. Simply put, gas-fees are the network fees required to transact on the Ethereum blockchain. For every transaction you conduct, there is a ‘miner’ who will ‘mine’ the transaction ensuring it is included and confirmed in the next block.

These network fees (gas) are payments made in the native currency of the blockchain you are using. So in the case of Ethereum, gas-fees are paid in ETH (and this is why they can grow to such high levels, as growth in the price of ETH equates to a dollar-term growth in the price of gas, but more on this later). These payments are needed to remunerate the computational output needed to both process and validate all the transactions that occur within the Ethereum blockchain.

This is due, in essence, to the POW (proof-of-work) mechanism that secures the blockchain. Ethereum is soon to release an upgrade to the network, transitioning from POW to POS (proof-of-stake) which will go a long way in addressing these issues.

When you send Ethereum or tokens built on Ethereum such as ERC20 tokens, you will need to pay gas. In doing so, there are two main terms you need to know about – ‘gas-limit’ and ‘gwei’.

1️⃣ What is a Gas-Limit?

When transacting on Ethereum, you will be able to set something called a gas-limit. This simply tells your wallet and the Ethereum blockchain the maximum amount you are willing to pay for a transaction to be confirmed. As you’ll learn further on, the ability for people to set high gas-limits contributes to an escalating effect where those who can afford to pay high fees will be chosen by miners over those who can’t.

2️⃣ What is Gwei?

Gwei simply refers to a small fraction of Ethereum (or Ether) which is used specifically for paying network fees. In practice, it is simply ETH itself which is given this contextual name for the purpose of distinction. Gwei is a combination of ‘Wei’ (the smallest possible unit of Ethereum, like a penny is to a pound) and ‘giga’. A gigawei refers to 1,000,000,000 wei. This means that you can refer to gas costs as 100 gwei instead of 0.000000100 ETH. There are various other ways gas can be referred to such as kwei, pwei and so on but gwei is all you really need to know about.

So Why Do Gas Fees Get So Expensive Then? 🤑

Gas sounds rather simple and justifiable, right? So why then does it get so ridiculously expensive? The answer to this lies in the mechanism by which miners decide how much gas to charge. This mechanism is evidently flawed and solutions are being worked on by the Ethereum foundation as they transition into the next evolution of Ethereum known as ETH 2.0 (more on that in our other blog posts). Next to ETH 2.0 there are already some powerful solutions to avoiding gas-fees while preserving the values of DeFi (control, self-custody, decentralisation, and so on).

In short, miners will prioritise those willing to pay higher gas fees as these people represent a more profitable operation. So essentially, the Ethereum gas system is a typical supply/demand bidding one whereby the more people are trying to use the system, the higher the gas cost will be and the more a given user is willing to pay over another will drive the price even higher. This is why gas prices get so high during bull markets like the one we saw during ‘DeFi Summer’ (summer 2020).

Just how high have Ethereum gas-fees gotten?

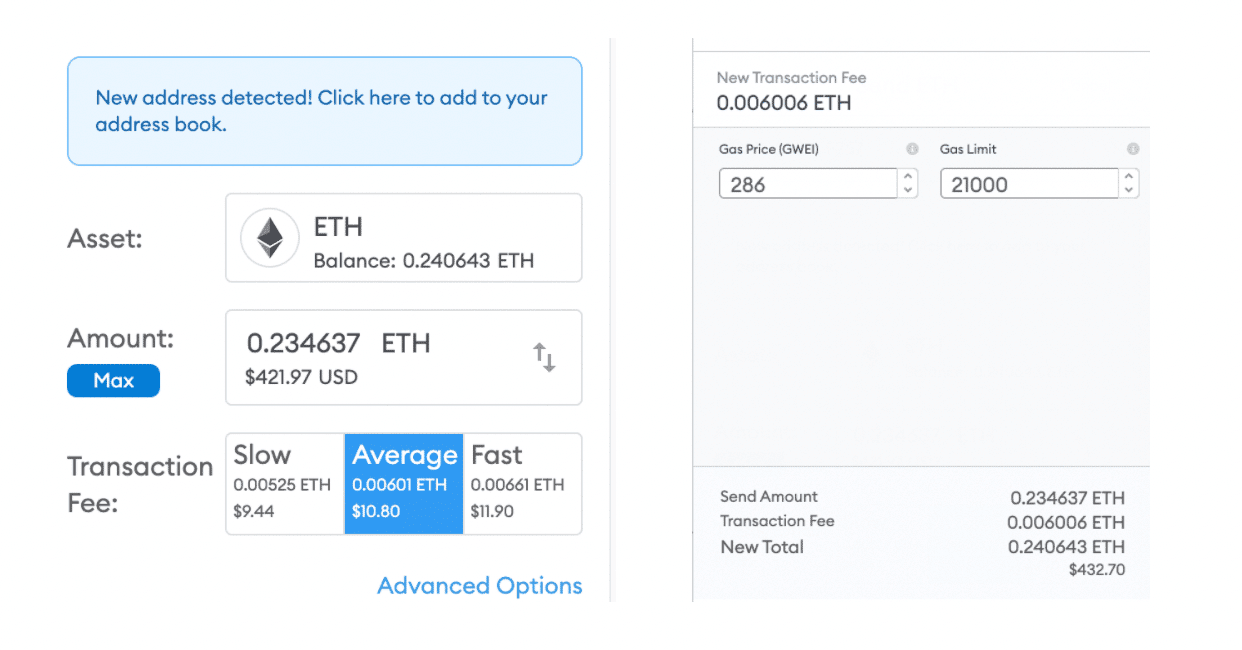

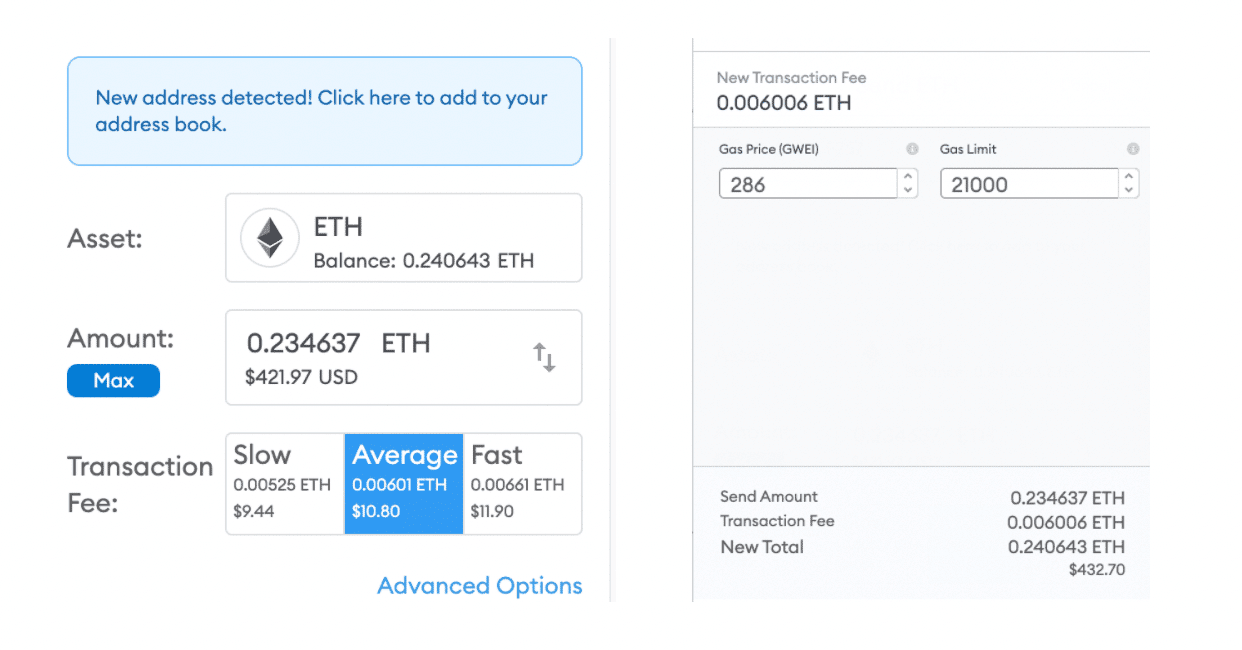

See this image above. Remember how much a gwei is? Well to send 1 ETH to another address (perhaps the simplest computational transaction) a 269 gwei cost would equal roughly $10. In recent times, gwei cost has reached 1000 making the cost of a simple transaction reach $50+. When talking about more complex transactions such as staking your assets in a DeFi protocol (such as Curve, Aave, Compound etc) you are looking at several hundred dollars in gas alone. For many people, this simply isn’t an option as if you’re only staking $5,000 worth of assets, the cost in gas (to stake and unstake) could take months to pay off in yield.

In this example you can see the cost of sending a relatively small amount of Ether. On the right you can see the functions to manually adjust gas.

As you can imagine, such high fees make Ethereum and DeFi unattractive to those who either can’t afford to, or simply don’t want to pay so much. This has opened up the opportunity for “Ethereum Killers” to create a new narrative, positioning themselves as the solution. But in practice, everything worth doing in DeFi is hosted on Ethereum so the solution to this problem must come from within.

What Are Some Real-World Perils of Ethereum Gas?

- In a volatile market where the price of Ethereum fluctuates rapidly and there are many people competing to use the blockchain, the price of gas will change equally fast. That means it’s possible that you will submit a transaction and in the time between you doing so and it being confirmed, the gas price could become too low meaning your transaction will fail. Failed transactions mean lost ETH as the cost is still taken.

- Due to Ethereum’s open and accessible nature, anyone is able to monitor on-chain transactions and use that to exploit vulnerabilities or individual transactors or traders. For example, a bot could jack up their gas-limit in order to front-run users and buy a given token before they can. This is a peril for anyone wishing to engage in an ICO, IDO or frequently trading on AMMs like Uniswap as bots can very easily front-run transactions for a profit. More on this in our following posts (make sure to follow our social channels!).

What can you do today to avoid gas-fees?

You can use something called Layer 2 Ethereum. We go into depth on what Layer 2 means here. In short, it abstracts transactions from the main-chain and computes them separately in something called a roll-up before submitting them for confirmation on the main-chain later.

This means users can transact, trade, invest, swap and more without paying any gas fees whatsoever in some cases, while also enjoying either instant or near-instant transaction times.

DeversiFi is one such platform that harnesses Layer 2 Ethereum and indeed one of the earliest in existence having launched back in June 2020. But there are now a growing number popping up all through DeFi.

Another thing you can do is choose to transact when gas-prices are lowest. The site below is a great resource for learning more about gas and viewing historical gas fee prices.

About DeversiFi

DeversiFi makes DeFi easy. Swap, Invest and Send without paying Ethereum network fees.

Website: https://rhino.fi/

Twitter: https://twitter.com/deversifi

Discord: https://discord.gg/bfNDxZqPSvf