The journey of a thousand mile[stones] begins with a single step. – Lao Tzu

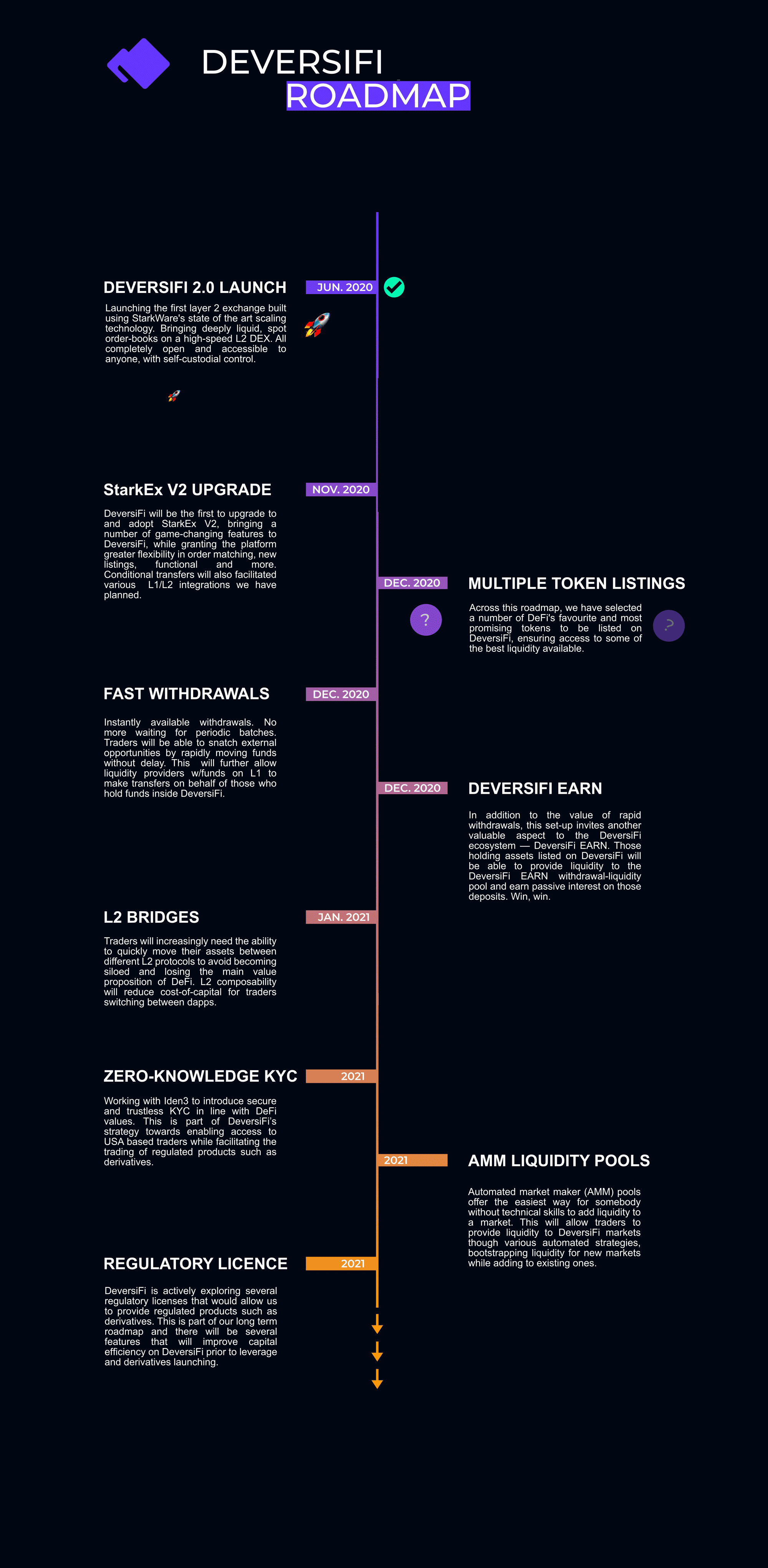

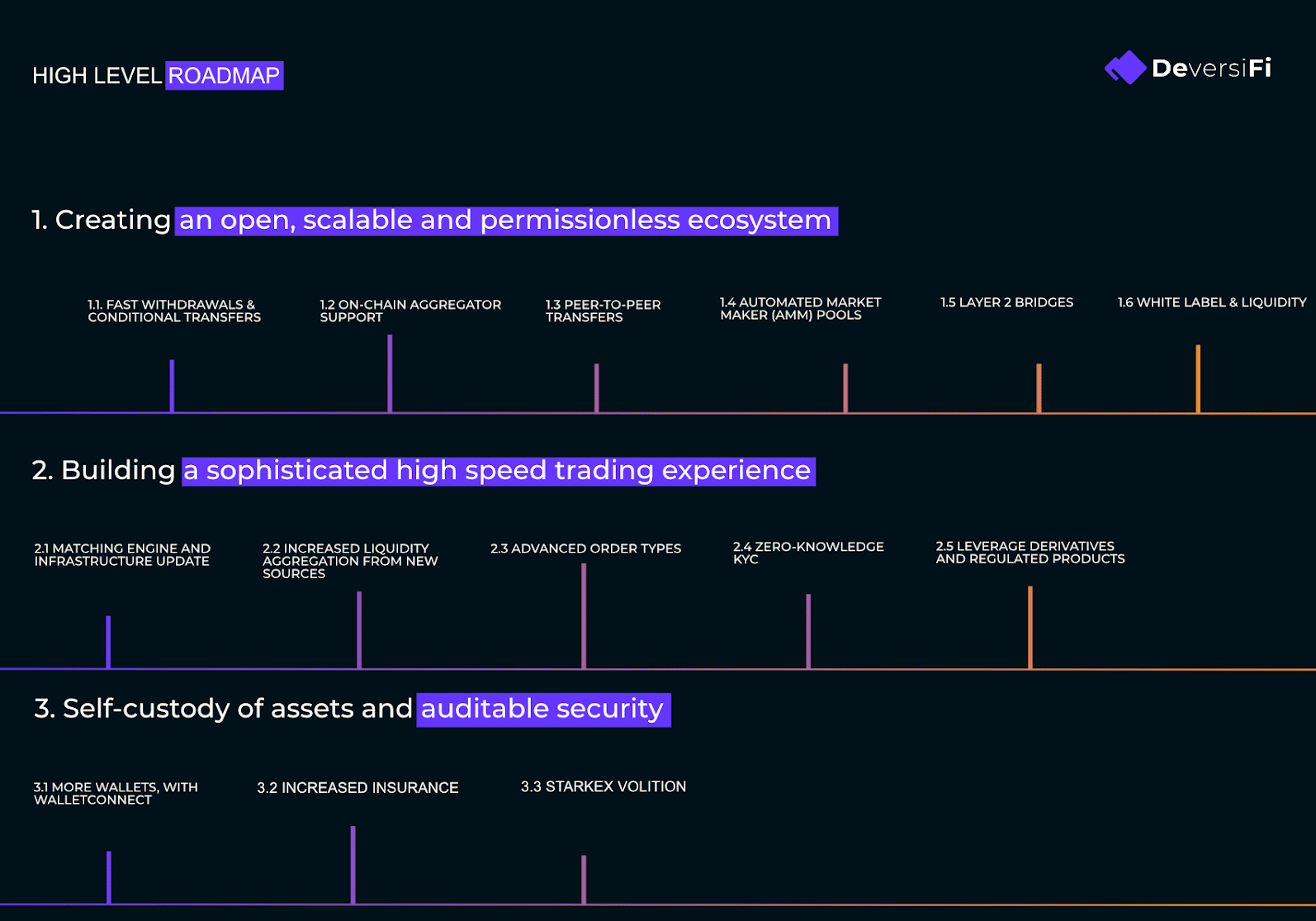

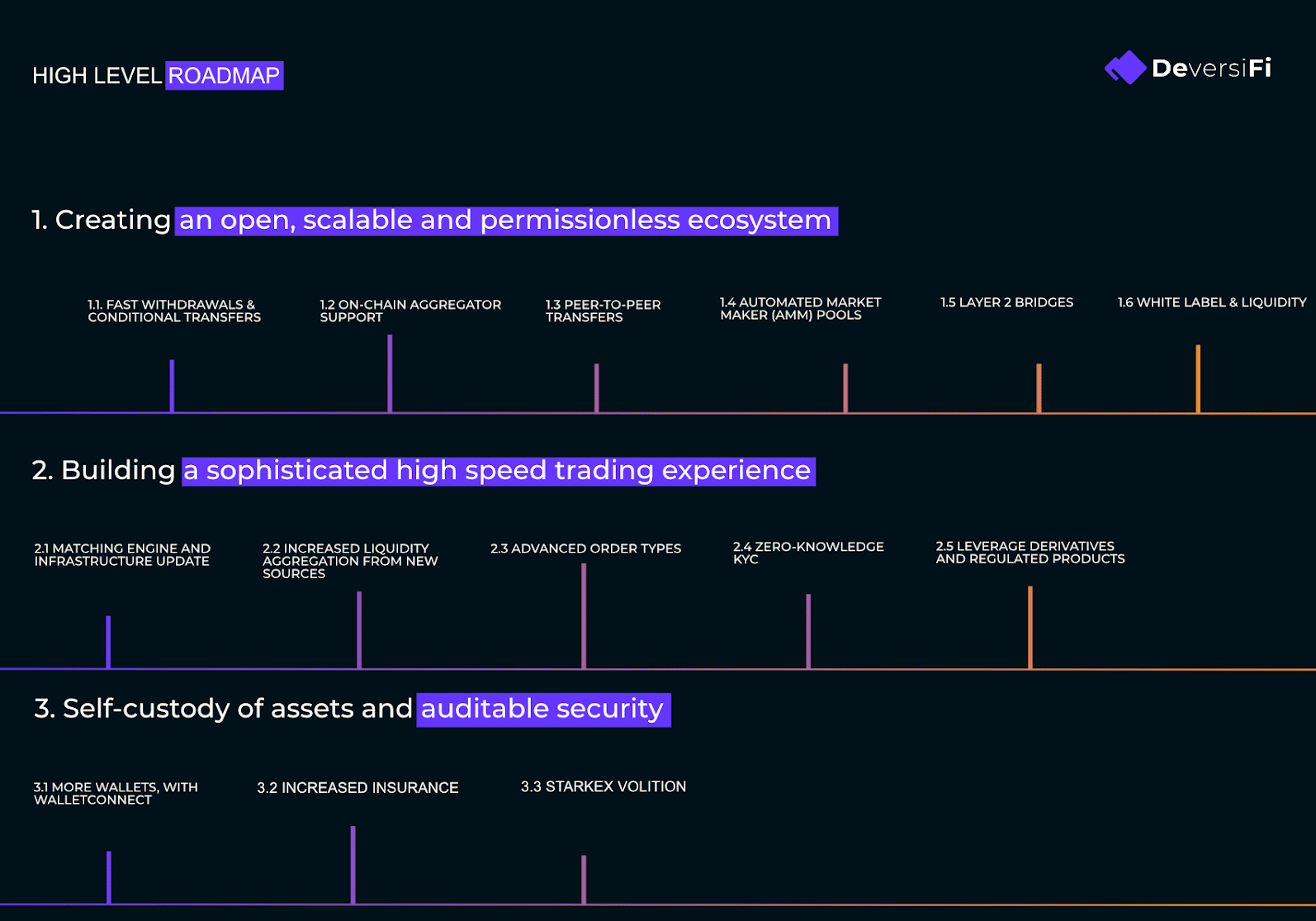

The following blog post dives deep into DeversiFi’s roadmap for the months, and more, ahead. For the full deep-dive make sure to read the full article, otherwise we have condensed the essentials into the TL;DR and high-level graphic below. Dive in 👇

TL;DR

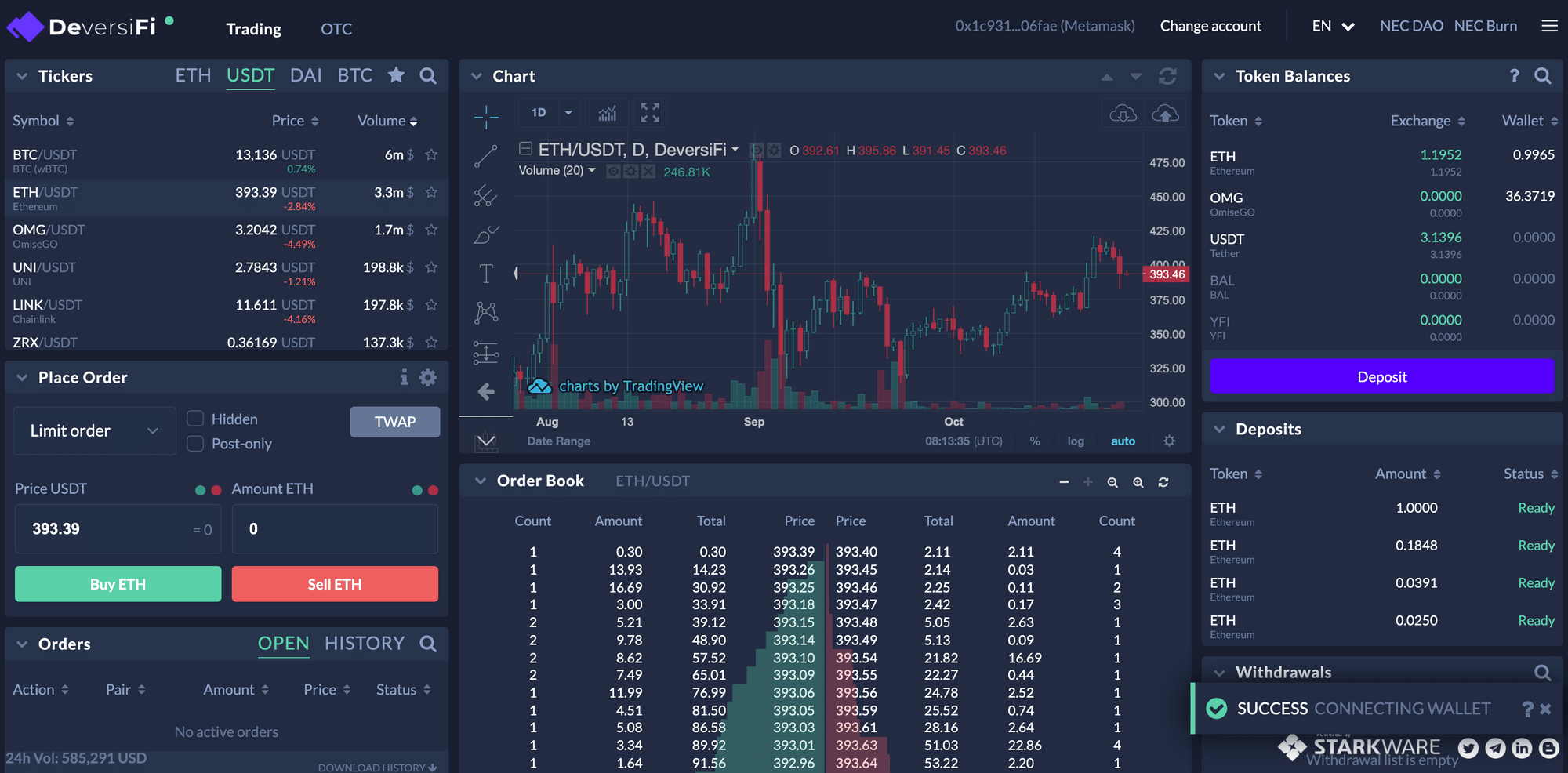

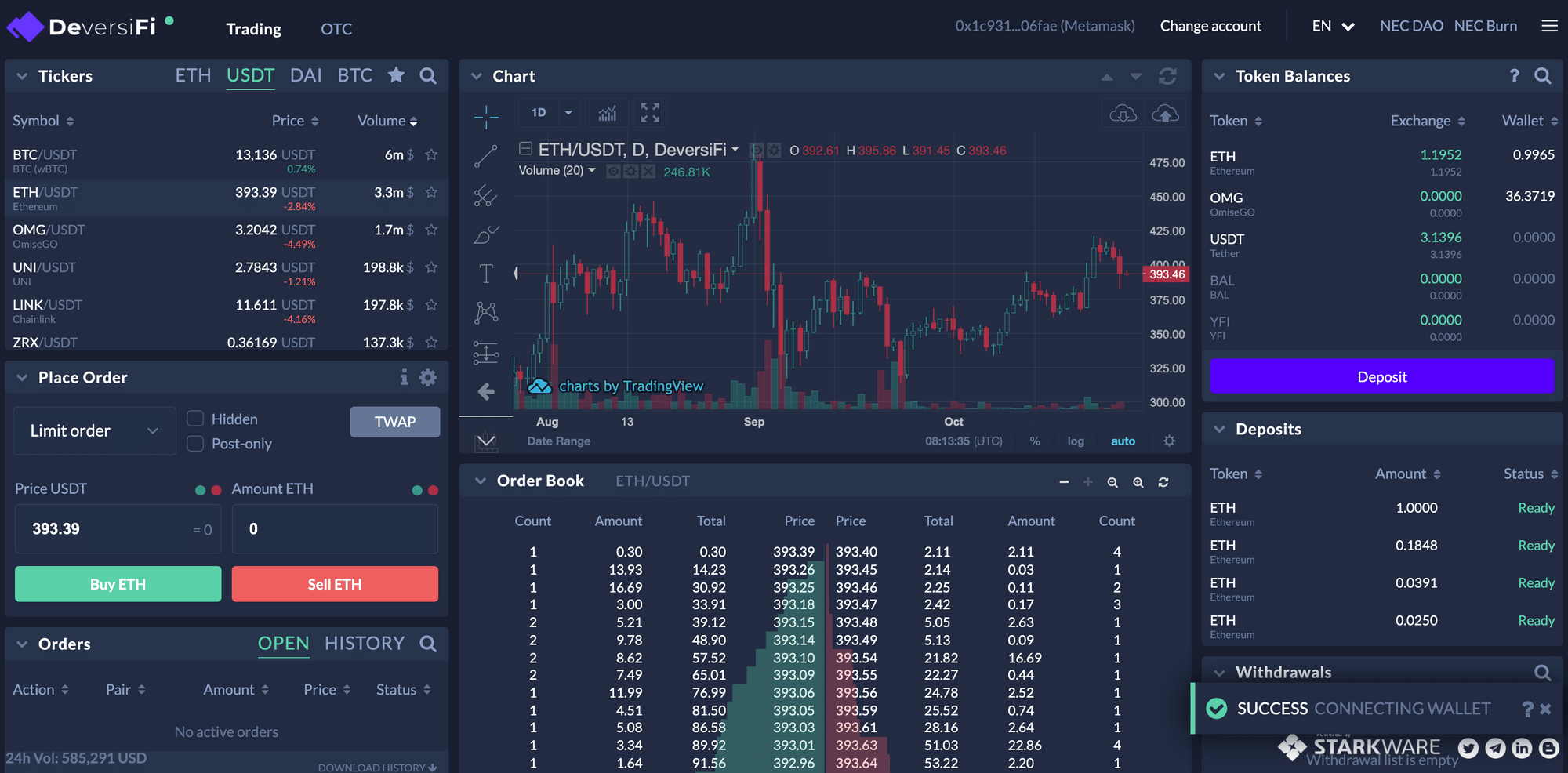

- Phase 1 in the DeversiFi mission was successfully completed. We launched a high-speed, professional-grade spot exchange on Layer 2 Ethereum (using the innovative StarkEx V1). This platform offers high-speed, low-latency, deep-liquidity, privacy, low-fees and gas-free self-custodial trading.

- Phase 2 is on the horizon. We’re talking: Rapid withdrawals (no waiting for batches); DeversiFi EARN (lending & interest earning); Zero Knowledge KYC (w/iden3 for regulated products like derivatives); New listings; L2 Bridges (moving funds between L2 dapps); DeversiFi AMM’s; various DeFi integrations (composability with conditional transfers).

- We are on Telegram, Twitter, Facebook, Reddit, & LinkedIn but all of our community discussion and governance will occur on our Discord. If you prefer to have updates delivered to you directly, join our mailing list.

*The graphic below is a high-level snapshot of our roadmap. Dates given are an estimate and left broad by design. We’ll update the community on a monthly basis, as well as host periodic public stand-up calls. For a greater breakdown of what we have planned make sure you read on below 🚀 👇 🚀

Introduction

This summer we (DeversiFi) completed Phase 1 of our mission, our journey. We launched a high-speed exchange with the look and feel of a centralised one, but with one major difference — traders maintain self-custodial control of their assets instead of transferring them into centralised custody.

This launch meant that we had created one of the first applications to ever use an Ethereum ‘Layer-2’ scaling solution. Layer-2 (L2) scaling means that the exchange can benefit from the security and trust-minimising properties of the Ethereum blockchain, without being constrained by its speed, low throughput and often prohibitively high GAS-costs.

This was just the first stage in our journey, and we have just started to scratch the surface of what is possible in this incredible movement. Merely replicating centralised exchanges (with only the added benefit of self-custody) is far from our end-goal.

Now, we will be pushing beyond this. We’ll be fully leveraging the benefits of smart-contract settlement to create a unique trading experience along with many new profit opportunities for DeversiFi users.

In this spirit, and also to offer a clear war path for our community to rally around, we are excited to reveal not only the next phase of our roadmap but a look at our longer-term plans and milestones. Read on.

Executive Summary

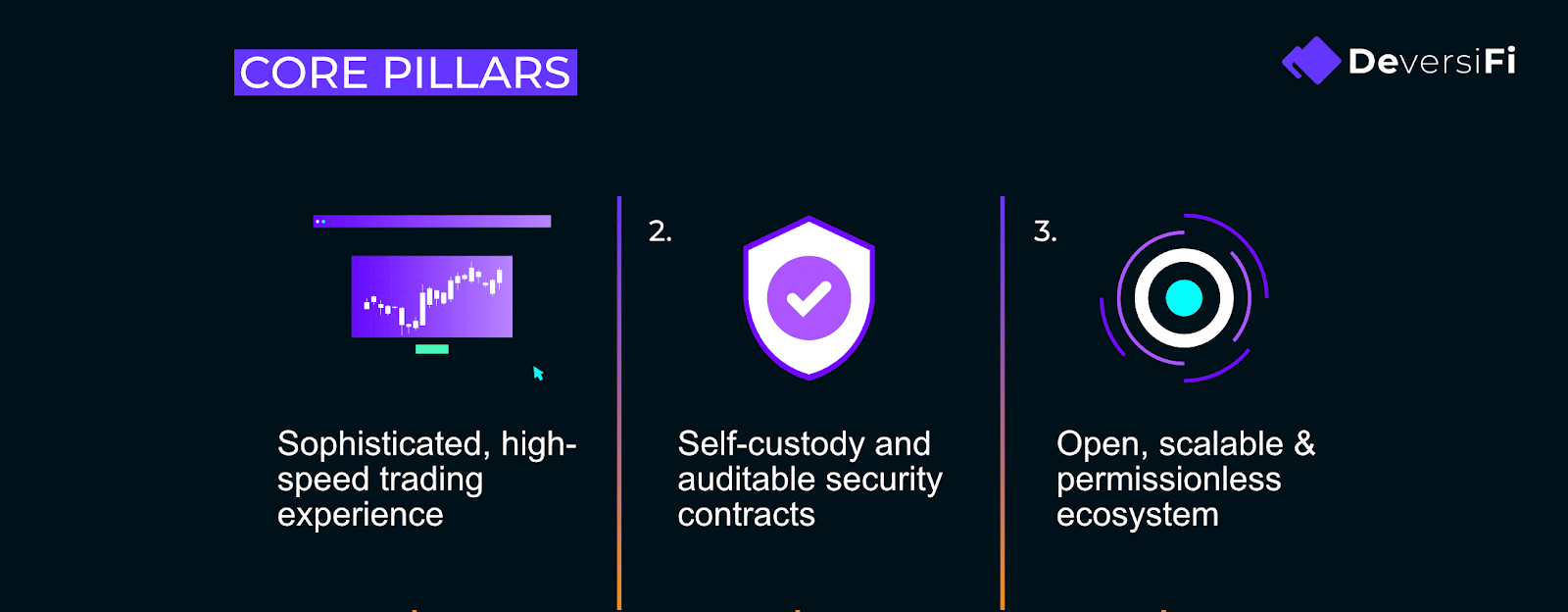

What is DeversiFi all about? Our vision is to build the first exchange ecosystem which fully unlocks the potential of Decentralised Finance for professional traders.

To achieve this, there are three pillars which need to be addressed 👇

Our roadmap for the next year is framed in terms of these three pillars. By launching the current version of DeversiFi using a layer-2 (L2) scaling system (StarkWare’s StarkEx), we have already made great strides on points 1. and 2., and whilst we will continue to make improvements in both these areas, it is 3. which will now be the focus of the coming year.

We believe that in the next year, significant trading activity will shift to L2 solutions like DeversiFi, allowing participants to escape the high gas costs and increasing inefficiencies of on-chain decentralised trading. We are making sure that we are at the heart of this emerging ecosystem, leading the way in terms of liquidity, technology, features as well as best practices.

Timeline Diagram

Below we break down our roadmap specific to each of the four aforementioned themes, highlighting what has already been achieved. A simplified graphic of said roadmap can be seen below. We expound on each point in text beneath.

1) Creating an ecosystem which is open, scalable and permissionless

The driver for DeFi’s growth has been its open and permissionless qualities. Protocols stack together as flexible building blocks which can be used to create all sorts of new profit opportunities for traders.

DeversiFi must open up to the rest of DeFi, and enable traders to create and build new integrations and features without permission. In short, DeversiFi must function akin to a protocol layer, instead of a centralised platform.

What DeversiFi has already shipped 👇

- Deeply liquid, spot crypto order-books on a high speed L2 DEX open and accessible to anyone.

In the Roadmap 🗺

1.1 Fast withdrawals & conditional transfers

ZK-proof batches are submitted to the blockchain by DeversiFi and StarkEx (usually every 1-3 hours). Withdrawals cannot be processed until each new batch is completed.

The solution will be a novel fast withdrawal mechanism, implemented using a flexible design pattern called conditional transfers. The mechanism allows liquidity providers with funds on L1 to make transfers on behalf of those who hold funds inside DeversiFi and be guaranteed to receive those funds back, plus a fee, effectively earning passive interest for liquidity provision.

We believe this is a killer feature that will start to make L2 open to DeFi by allowing for composability with L1.

Beyond just enabling fast withdrawals, conditional transfers will be a fundamental building block for many more features on DeversiFi in the future. Traders will be able to make custom transactions which directly interact with other DeFi protocols on L1. This, for one, will make DeversiFi an ideal platform for arbitrage.

1.2 On-chain aggregator support

Aggregators like 1inch and Paraswap can currently only take liquidity from L1 sources.

The next upgrade to the StarkEx smart-contract in November, combined with the conditional transfer mechanism, will make it possible to take liquidity on-chain when prices are available on DeversiFi.

This will be a major source of volume for DeversiFi and benefit anyone using on-chain aggregators because they can get improved prices.

1.3 P2P transfers

The high Ethereum gas prices of the past month has highlighted the need to move simple crypto transfers from L1 to L2. DeversiFi traders will have the ability to move funds to different addresses within DeversiFi improving capital efficiency for traders.

1.4 Automated market maker (AMM) pools

Automated market maker (AMM) pools offer the easiest way for somebody without technical software skills to add liquidity to a market. In 2021, DeversiFi will add the ability for traders to provide liquidity to DeversiFi markets via a variety of automated strategies, bootstrapping liquidity for new markets as well as adding liquidity to existing liquid markets.

Importantly these AMMs will be augmenting rather than replacing our existing high-speed order-books, ensuring a trader can always get the best price, whether it comes from an AMM pool or an order-book.

1.5 L2 bridges

As a greater number of apps make Ethereum their home, more L2 solutions will launch. Traders will increasingly therefore need the ability to quickly move their assets between different L2 protocols to avoid becoming siloed and losing the main value proposition of DeFi.

Quick, low cost transfer of assets between different instances of the StarkWare technology (i.e. DeversiFi and dYdX), will reduce cost of capital and allow traders to cover more market opportunities.

Next year, StarkWare will also start exploring bridges between other forms of L2 technology, including other Validium/ZK-Rollup approaches as well as Optimistic Rollup technologies. The caveat is that although many L2 scaling technologies are coming to market, most of the technology is still in its early days and needs to mature before stable bridges can be built.

1.6 Whitelabel & Liquidity

DeversiFi is uniquely positioned to become a trustless liquidity bridge between CEXs and DeFi. Increasingly we will be releasing open-source components and tools to allow other projects to integrate and use DeversiFi as a backbone for listing tokens, matching and settling trades easily. If you are working on a project and think this might be relevant for you, reach out to [email protected].

2) A sophisticated high speed trading experience

DeversiFi gives traders the edge in fast moving DeFi markets by providing the best features and elements of CEXs, whilst at the same time maintaining the security and control that comes with trading from a private wallet. Or, from a custody solution on a L2 DEX, with no Ethereum transaction fees for trading.

What DeversiFi has already shipped 👇

- Launched with the high throughput StarkWare L2 settlement system, instant clearing and private trading. Mirroring the experience and performance of a large centralised exchange.

- High speed, low latency, self-custodial API access to DeversiFi’s features and aggregated order books.

- Deep liquidity on markets by aggregating both Bitfinex and DeversiFi native orders. The most liquid wBTC/USDt and ETH/USDT markets of any L2 exchange (and most CEXs) are on DeversiFi.

- Advanced order types ranging from market and limit orders to hidden, post-only, and TWAP orders. TWAP being a unique order-type, only available on DeversiFi as of writing.

- The ability to trade algorithmically directly from Custody via the Copper custody provider.

- 25 liquid markets, including the aforementioned world’s most liquid wBTC/USDt market.

In the Roadmap 🗺

2.1 Matching engine and infrastructure update

In development for 9 months, the new matching engine and back-end services will increase exchange performance and ensure that DeversiFi can handle tens of thousands of concurrent orders during periods of intense activity, as well as allowing us to list an enormous number of new markets – making sure we are always amongst the first exchanges to list DeFi’s newest and most exciting gems.

2.2 Further liquidity aggregation and new markets

In order to bootstrap liquidity, DeversiFi market-makes directly from Bitfinex’s order books. This means that traders have access without custody risk to some of the deepest order books in the market for pairs such as ETH/USDt and wBTC/USDt.

We will shortly be massively expanding the number of markets offered. As DeversiFi lists more tokens, the liquidity strategy will switch from aggregation of liquidity from other exchanges, to instead primarily incentivising independent market-makers directly with fee rebates and liquidity mining.

2.2 Advanced order types and features

Advanced order types such as Time Weighted Average Price and Stop Losses are some of the most requested order types and add to a trader’s toolbox. At the same time we will be adding better reporting and some of the more exciting features that traders really find make the difference for them on a high-performance exchange.

2.3 Zero Knowledge KYC

DeversiFi has been working with Iden3 on a Zero-Knowledge KYC service that is compatible with the spirit of DeFi. This would be introduced as an optional step to allow access to a wider range of services, whilst maintaining customer privacy and control of your own data.

KYC is part of DeversiFi’s strategy towards providing access to USA based traders and facilitating the trading of regulated products such as leverage and derivatives.

2.4 Leverage, derivatives and regulated products

DeversiFi is actively exploring several regulatory licenses that would allow us to provide regulated products such as derivatives. This is part of our long term roadmap and there will be several features that will improve capital efficiency on DeversiFi prior to leverage and derivatives launching.

3) Self-custody of assets and auditable security

Self-custodial trading is at the heart of DeversiFi. We believe that traders should never have to choose between security & control and high speed professional trading – a new paradigm in trading that is set to change the way that both crypto native and traditional financial assets are traded. A timely reminder of how even large, well established centralised exchanges are at risk from hackers was the $150m KuKoin exploit in September 2020.

What DeversiFi has already shipped 👇

- In order to achieve scalability without being limited by the speed and cost of the Ethereum Blockchain, we launched the world’s first exchange using the StarkEx Validium technology. This was a complex technological first, working with partners such as Consensys, Nethermind, StarkWare, Iqlusion, Cephalopod and Infura to provide privacy as well as robust security.

- Native support for DeversiFi trading from a Ledger hardware wallet or Keystore private key, as well as connectivity using MetaMask, the most common Ethereum wallet.

- DeversiFi has been operational on mainnet for five months with no security breach, hack or loss of funds.

- Losses are currently insured up to 1001 ETH via Nexus Mutual.

In the Roadmap 🗺

3.1 More wallets, including WalletConnect

As the StarkEx L2 becomes more established, more wallets are natively supporting the technology. This means over time that DeversiFi traders will not need to hold a separate trading key backup as more wallets will generate the trading key deterministically as-and-when it is needed to sign orders, just as happens now when interacting on DeversiFi using Ledger.

Native WalletConnect support is imminent, and will broaden the number of wallets that can connect and trade significantly, including mobile wallets.

3.2 Insurance

DeversiFi aims to support novel insurance and risk management projects to give traders further financial protection and peace of mind when trading on DeversiFi.

3.4 StarkEx ‘Volition’

We firmly believe that validity proofs are the best in class Ethereum scaling technology for our use case. This type of scaling means that the DeversiFi user’s funds are cryptographically secured by the Ethereum blockchain, not by a small market-capitalization side chain, or game-theory assumptions.

DeversiFi is firmly set on its chosen path and will be expanding to give the choice of a full zero-knowledge rollup based approach using StarkWare’s Volition upgrade. Traders will be able to choose between private trading + data availability committee, or public/visible trading but with the reduced data availability reliance of a full ZK-rollup.

Going forward

The future is bright and DeFi/Ethereum/Cryptocurrency is poised to positively change the way we interact. We are thrilled to be playing out part and welcome you to join us if not already.

Say hi to us on Discord, where all discussion and first news will be shared and conducted.

Onward and upwards!

About DeversiFi

DeversiFi gives traders the edge in fast moving decentralised finance (DeFi) markets by allowing them to trade at lightning speed and with deep aggregated liquidity, directly from their privately owned cryptocurrency wallet.

Traders can take advantage of more trading opportunities while always preserving control of their assets for when they need to move fast. DeversiFi’s order-books are off-chain, but settlement occurs on the Ethereum blockchain. This means that traders benefit from fast moving order books and instant execution, without having to trust the exchange and whilst always maintaining control of their assets at all times.

For the first time, traders can enjoy all the benefits that they would expect from a legacy large centralised exchange, but with no exchange or counter-party risk.