On December 1, DeversiFi will launch its first-ever layer 2 automated market makers (AMMs). This is a major step forward, not just for our platform but for our vision of making DeFi truly accessible.

TO ENSURE THE SAFETY OF OUR USERS, OUR AMMS WILL KICK OFF WITH A SOLE LIQUIDITY PROVIDER: DEVERSIFI LABS. BUT ONCE WE’VE TESTED THE AMMS AND GUARANTEED THE SAFETY OF LIQUIDITY, WE WILL OPEN THE POOLS UP TO OUR COMMUNITY AND BEGIN LIQUIDITY MINING.

THIS POST EXPLAINS THE LIQUIDITY MINING PROGRAM AND AMMS IN MORE DETAILS, SO THAT YOU CAN BE READY TO PARTICIPATE IN THE PROGRAM WHEN THE POOLS OPEN.

AMM pools will facilitate the gas-free trading of a huge number of tokens on DeversiFi by removing the need for professional market makers to quote prices. The traditional order-book-only markets will be complemented with hybrid, community-driven liquidity pools that anyone can deposit into – and you can earn fees and rewards by contributing.

This is the future of decentralised finance – fast, simple, trustless and gas-free. However, we recognise that many users will have questions: the query ‘how do AMMs work’ is one of the fastest-rising search phrases on Google (although admittedly it’s still got some way to go to match skateboarding cats!)

This post will focus on what makes DeversiFi’s AMMs different to others. We’ll explain the novel technology being developed, as well as the liquidity provider rewards programme that will launch straight after the production testing period. If this is the first time that you have heard of AMMs then make sure to check out this AMMs primer for some general background.

How will DeversiFi’s system of AMMs work?

DeversiFi is a layer 2 exchange built on Ethereum. This means that you always stay in control of your tokens via your Ethereum wallet, but you benefit from gas-free and instant trading. If DeversiFi were to go offline for any reason then you could simply withdraw your tokens back to the Ethereum mainnet via DeversiFi’s Data Availability Escape Hatch – unstoppable trading without the expensive fees!

Our AMMs extend this benefit. We’ve taken the AMM model that you will be familiar with from Balancer or Uniswap V2, and replicated it on the DeversiFi layer 2 with a few (pretty awesome) additions. We’ve built the pools to sync between the two layers, which means you get all the benefits of layer 1 custody with all the benefits of layer 2 trading. As well as the security guarantees of the Ethereum mainnet, you can enjoy the gas-free trading through DeversiFi.

Another significant innovation is the hybrid nature of the DeversiFi AMMs. For the first time ever, you can now interact with an AMM in the way that suits you. You can swap from mobile whilst you are on the go, or you can place limit orders on the DeversiFi order book. This hybrid model means stakeholders have much more flexibility when it comes to connecting-to and making use of the DeversiFi AMM liquidity – and swappers benefit from the best possible prices!

Which Pools are Launching?

As the DeversiFi AMMs are a new product, it is important to have a phased launch so that we can monitor and optimise the technology over the coming weeks. Therefore we are starting off with six liquidity pools, although there’s the potential to add many more as the technology is proven and matures.

The six initial pairs are as follows

- DVF/ETH

- CRV/ETH

- LDO/ETH

- MPL/ETH

- RAI/ETH

- MATIC/ETH

We’ll also be launching the following pools as soon as possible:

Pools Chosen by DeversiFi

- UNI/ETH

- SUSHI/ETH

- USDC/USDt

- stETH/ETH

- ERP/USDC

Pools Chosen by the Community

- YGG/ETH

- ILV/ETH

- COMP/ETH

- TOKE/ETH

- REN/ETH

- BOND/ETH

Our community voted on which pools they wanted to see on DeversiFi so we’ll be prioritising launching these in trade-only mode as soon as possible.

With AMMs, the pools are filled by the community itself. Members like you have the chance to fill them up by staking your own tokens, in equal matching pairs. In other words, you get the chance to be the market maker and earn a share of trading fees as well as other rewards.

Ok, so tell me more about those rewards…

When we launch our AMM Liquidity Mining programme, the first 17 liquidity pools will be highly incentivised. Which means that when you stake your tokens, you’ll be eligible for two sets of rewards.

1. Trading Fees

A 0.3% trading fee is applied to a simple swap. Just like on Uniswap, 0.25% of fees will go to LPs, and 0.05% to the operator (DeversiFi Labs) to cover the layer 2 batching/proof gas costs. These fees may be changed at a later stage with a DVF governance vote.

Fees are collected in the native tokens of each liquidity pool and help the pool size to grow. As a liquidity provider, over time you own a share of a larger liquidity pool, meaning that you are earning trading fees. The greater the amount of trading on the DeversiFi swaps, the greater the amount of fees generated for liquidity providers.

2. DVF AMM Liquidity Mining Rewards

In addition to trading/swap fees, as an AMM liquidity provider you will also earn DVF token rewards!

Over 50% of the total supply ofDVF, our native governance token , has been earmarked for incentive programmes, including the initial DeversiFi AMM liquidity mining programme.

DVF Amount

Once the date for the liquidity mining programme is set, we will announce the number of tokens available for mining each month. This will be in line with the upper limit of 1,277,777 DVF per month that the DVF DAO’s vesting contract allows.

Duration

In order to get the DVF token into as many hands as possible there will be an initial three-month liquidity mining program, after which the DVF DAO will need to vote to extend, adapt and change the program. We don’t anticipate any emergencies, but wanted to have a three-month window where DVF holders can assess the AMM liquidity mining program and propose any changes.

Rewards Distribution

The total amount of DVF rewards will be split across the initial 17 pools, but not all pools will be treated the same. Pools such as the DVF/ETH pool will be eligible for the highest amount of rewards per month.

Initially, DeversiFi Labs will set the level and distribution of AMM liquidity mining rewards in conjunction with soft governance and community feedback. Gauges are being built to give the DVF community direct control over this process but will not be ready for the initial launch.

Lockup

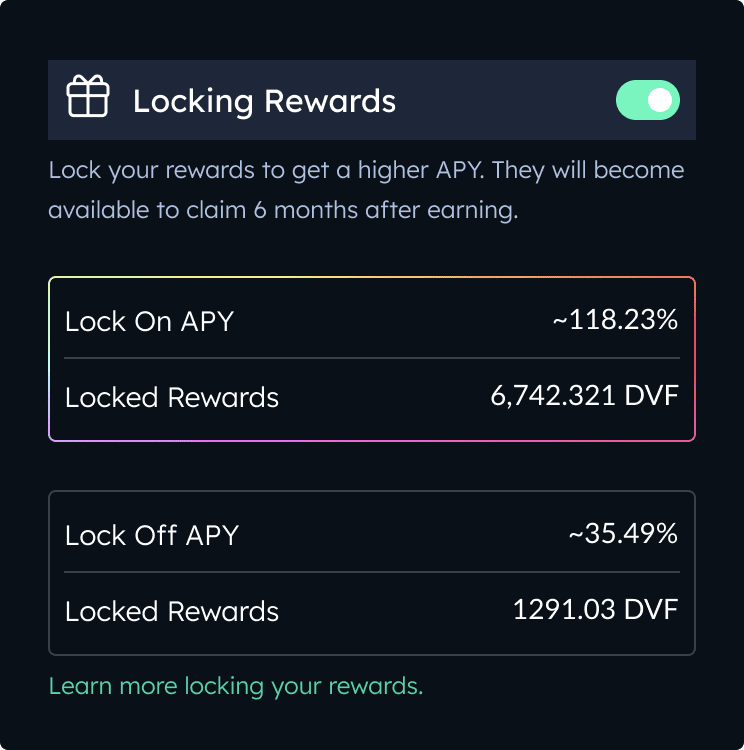

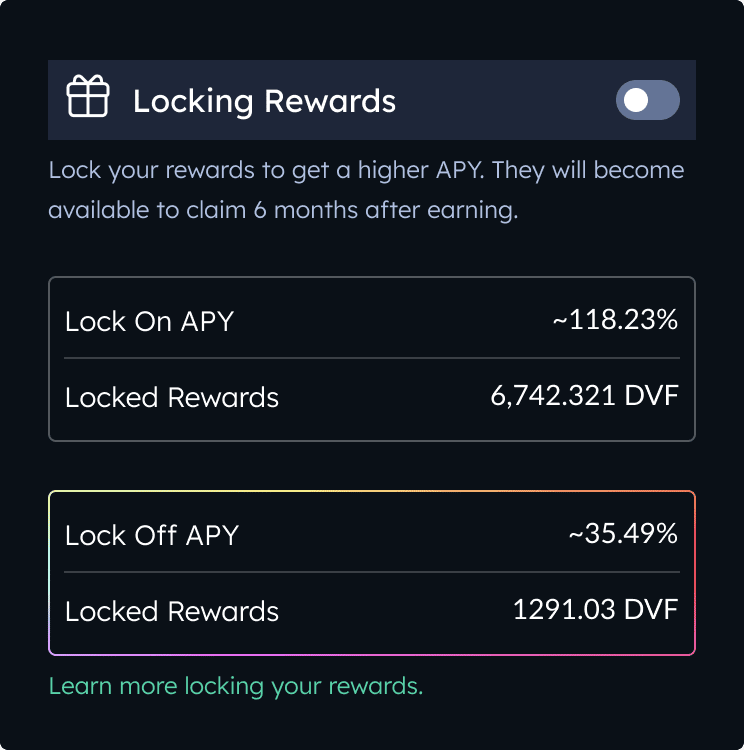

DeversiFi AMM Liquidity Providers can choose to receive 100% of their DVF liquidity mining rewards if they lock up those rewards for six months (real-time rolling unlock after six months). If they choose immediate liquidity on their DVF rewards then they will receive 30% of the DVF rewards.

The lockup programme was discussed at length with advisors and other projects who have implemented their own liquidity mining programmes. The lockup programme has three main benefits to the DeversiFi and DVF community.

- It encourages only those LPs who are long-term supporters of DeversiFi and DVF.

- It ensures that LPs can still access their liquidity positions freely. We did discuss enforcing a time-lock on LP positions but decided that was not very ‘defi’ and could be dangerous for LPs.

- It discourages ‘farm and dump’ automated strategies that have become so prevalent by yield farming protocols.

- It discourages large traders (eg $1bn accounts) from depositing and helps smaller ones.

- It controls the supply of DVF on the market whilst ensuring it reaches long-term supporters.

How to Earn AMM LP Rewards when they launch- READ CAREFULLY

You may be familiar with AMMs and liquidity mining programs from other protocols, but please ensure you fully read the below guide before depositing & LPingAlso make sure you are familiar with the concept of impairment loss and if you have never used DeversiFi before, make sure you are familiar with how DeversiFi withdrawals work before you deposit!

1. Deposit your funds to DeversiFi

Once the programme launches, all you need to do is deposit the funds that you would like to stake in the liquidity pools onto DeversiFi using Metamask, Matamask Mobile or Trust Wallet. All of the tokens that are listed on DeversiFi can be deposited from the Ethereum mainnet.

Compatible Wallets

Currently; ledger users will not be able to LP or swap using AMM markets until the ledger team whitelists the liquidity pool tokens. However, we’ll provide an additional update closer to the time of the launch. You can use other DeversiFi platform features right now, or if you would like to provide liquidity in the future then you can use Metamask (not with a linked hardware wallet)

2. Provide Liquidity – COMING SOON

Want to be ready to become an LP as soon as the programme launches? Here’s how you’ll be able to provide liquidity when it kicks off:

Navigate to the pools section of the DeversiFi platform

Initially there may not be enough liquidity for the newly launched 17 AMM pools for you to swap one token into another (eg turning 50% of your ETH into another token in order to 50/50 LP) therefore we suggest that you deposit the tokens on DeversiFi in a 50/50 ratio if you plan on providing liquidity in the early stages of the liquidity mining launch

3. Select Your Prefered Reward Vesting – COMING SOON

As mentioned above in more detail, you can choose to receive 100% of your DVF rewards if you lock the DVF for 6 months. Or you can choose immediate liquidity, but you will only receive 30% of the full amount. Or, put a different way, if you choose to vest your DVF rewards you will get 70% more!

Fees across various markets

The following fees are applied across our various markets:

- Single Swap - 0.3%

- Order Books - 0% maker - 0.25% taker

- USDT/USDC - 0.1%

- dvf/xDVF staking - Free

Risk Warning

Please ensure that you understand the concept of Impermanent loss before becoming a liquidity provider using the DeversiFi AMMs. Please conduct your own research before depositing your funds or purchasing any tokens. Nothing what DeversiFi, DeversiFi labs or the community says should not be considered investment advice. DeversiFi never has access to your funds and therefore only deposit to DeversiFi if you are comfortable holding custody of your own tokens and are familiar with how to use wallets such as Metamask and Ledger.

Please see the DeversiFi terms of service for additional T&Cs

About DeversiFi

DeversiFi makes DeFi easy. Swap, Invest and Send without paying Ethereum network fees.

Website: https://rhino.fi/

Twitter: https://twitter.com/deversifi

Discord: https://discord.gg/bfNDxZqPSv