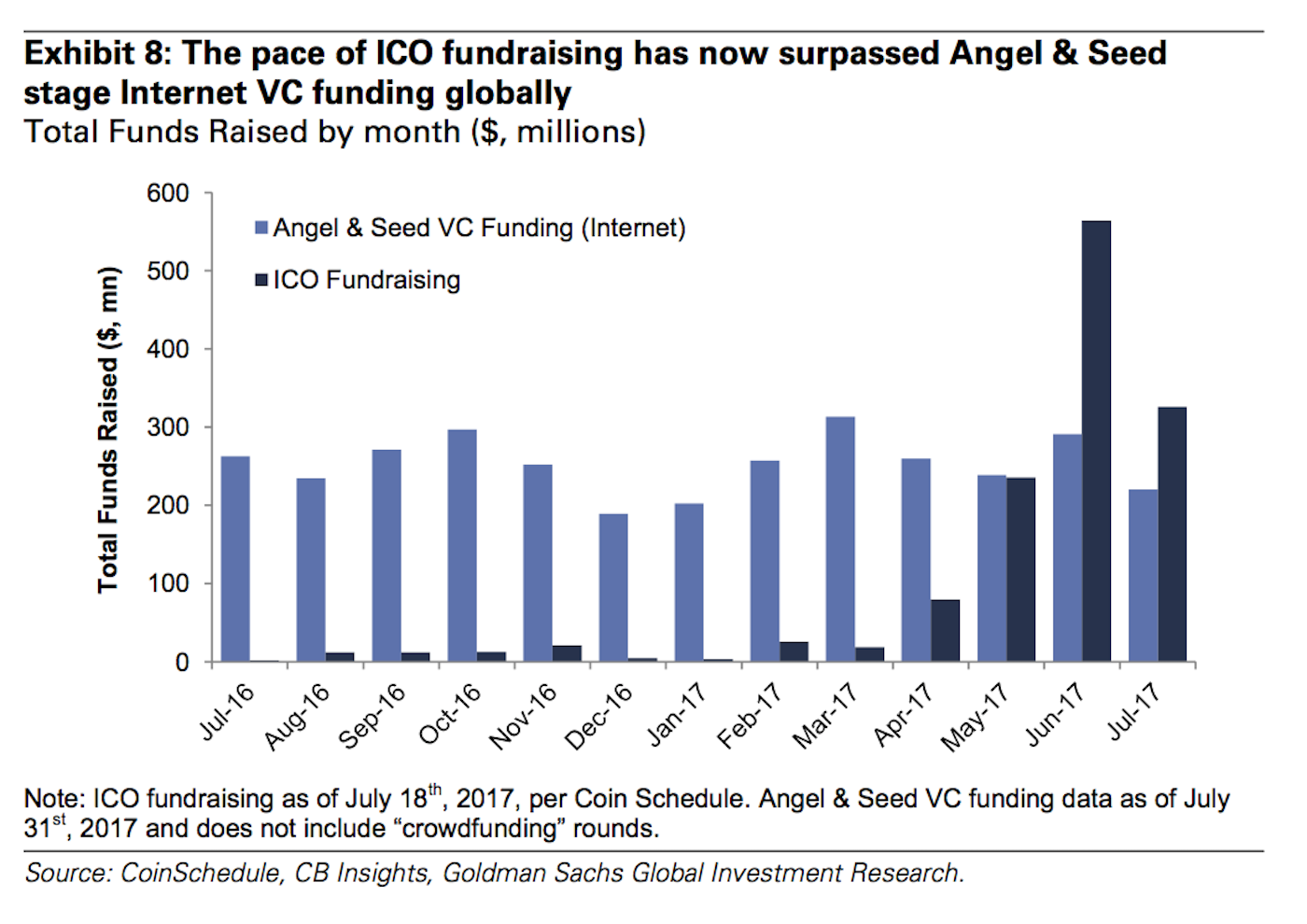

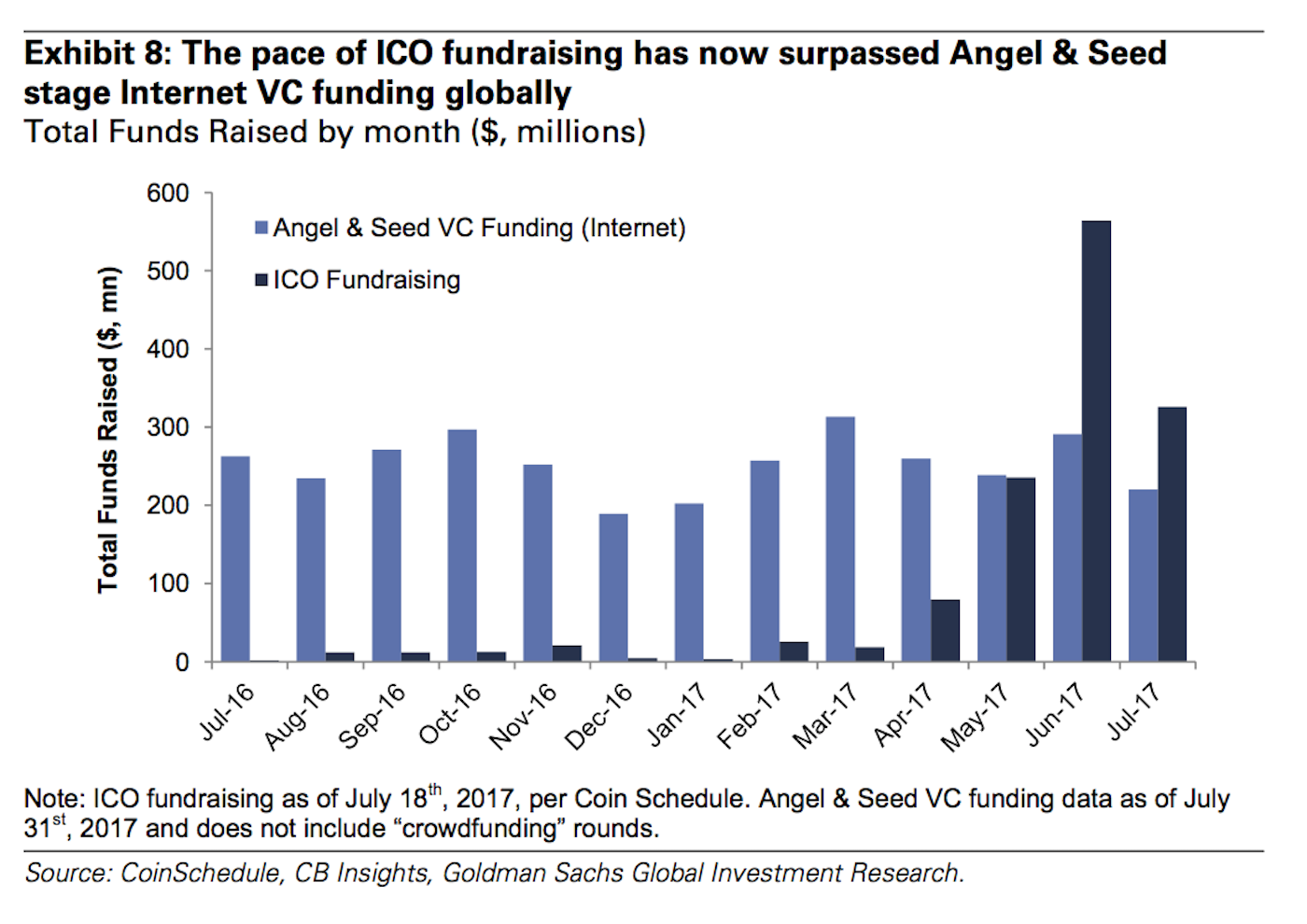

Despite regulatory uncertainty, ICOs have quickly cemented themselves as the key funding mechanism for blockchain-based businesses.

As of August this year, the total amount raised through ICOs in 2017 has equalled roughly 1.5bn USD, with notable projects like Tezos and Bancor raising 100m+ USD each. We’re currently seeing new token launches announced daily — according to ICOAlert, there are 7 ICOs taking place today, with another 7 taking place tomorrow — suggesting a bullish period for ICOs in general.

“In the world of ICOs, fraud is never hard to find”.

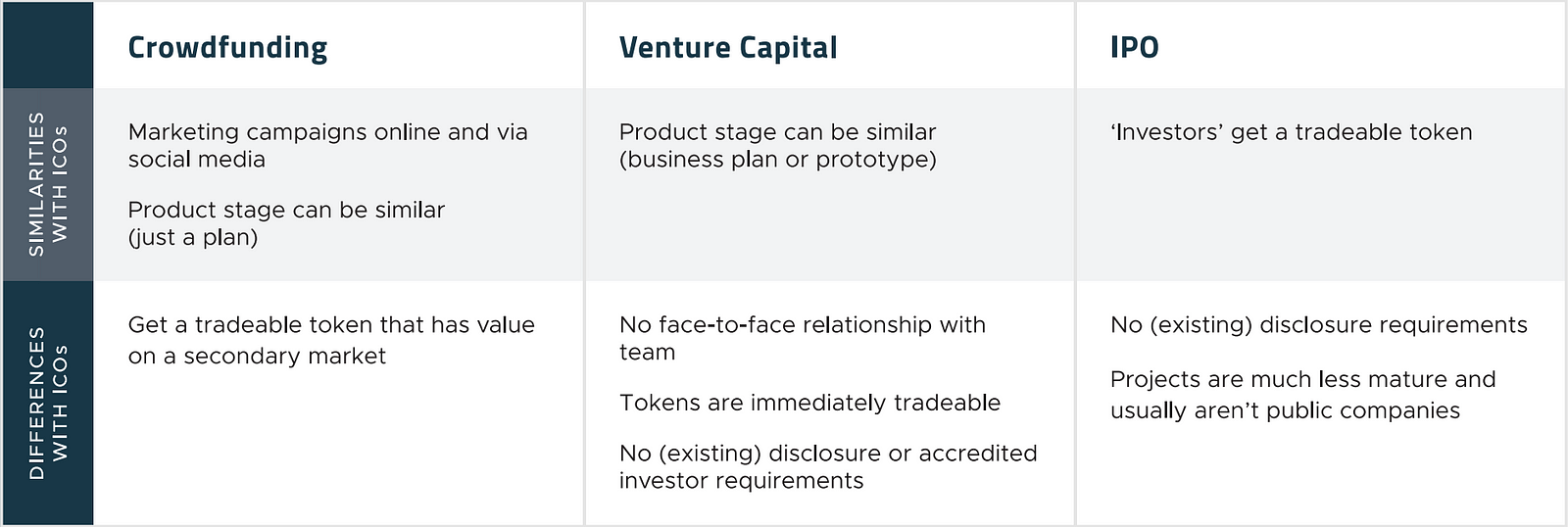

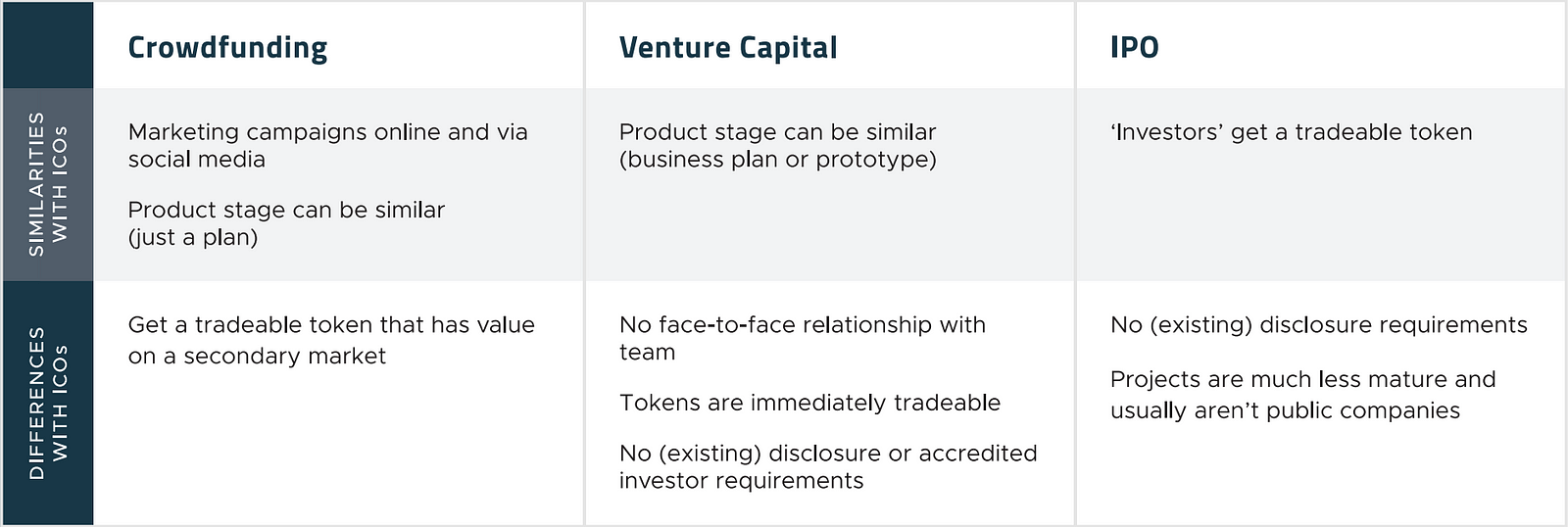

ICOs provide an excellent opportunity to crowdfund innovative projects and build loyal, passionate communities whilst harnessing the incredible value of network effects. The increased accessibility of ICOs to “everyday-investors”, relative to IPOs or VCs, is both fantastic and horrifying, however.

“Most ICOs today are marketed as ‘software presale tokens’ akin to giving early access to an online game… In order to try to avoid legal requirements that come with any form of a security sale, many ICOs today use language such as ‘crowdsale’ or ‘donation’ instead of ICOs.”

A lack of regulatory oversight stemming from the ambiguous, early-stage nature of some ICOs brings with it significant risk and uncertainty, making the ICO ecosystem much akin to the old wild west. With more and more projects undergoing ICOs — coupled with a huge rise in investors recognising the potential ROI to be made from said ICOs — structured, stringent evaluation has become a necessity.

“There are no requirements for what teams must provide, but most have a website, a whitepaper, multiple social media accounts and several active online forums”

In light of this, and the upcoming release of Ethfinex, we thought we’d share a glimpse into the methodology we use to investigate & evaluate ICOs.

The analysis of an ICO is similar in nature to that of any start-up, blockchain-based or not; there are, however, a number of key differences one should keep in mind when contemplating ICO participation. We typically split our analysis into two parts — let’s call it quality analysis and legality analysis.

Quality analysis focuses on the pure, fundamental quality of the project — the true merit & potential of the idea, team, community and token. The discussion & information element of Ethfinex is designed to facilitate this type of analysis, through a combination of community due diligence and collaboration with external platforms.

When analysing the “quality” of a project, there a number of factors to take into consideration:

- Team

Where have they worked before? What have they achieved? Are they transparent about team profiles and experience? What are they good at? Are they passionate about the technology or are they capitalising on a trend? Who are their advisors? Do you genuinely trust these people with your money?

- Developers

How many developers do they have? Do they have Github profiles? Is there any activity on these profiles? Does the team have the technological capabilities, expertise and experience required to succeed? Is their development roadmap realistic? Finding experienced blockchain developers is proving extremely complicated for many projects, and is not necessarily a problem that money can solve.

- Blockchain-fit

Does the project benefit from being on the blockchain? Should it be on the blockchain? Is the team able to explain, in relatively simple terms, the value derived from using the blockchain?

- Community

Is the team active, open & transparent on social media? What’s the general online sentiment regarding the team? Is the community discussing pump & dump potential or disruption potential? Is the project backed by a worrying number of celebrities?

- Market

How large is the market the project is aiming to disrupt? Is it growing or is it stagnant? Are there competitors around, blockchain-based or not? Can this start-up successfully dethrone these competitors?

- Valuation & Token Generation Event

How much money are they intending to raise? Is there a hardcap on what can be raised? Is there a pre-sale/how many token offerings will take place? How many tokens are allocated to the team, and for what purposes?

- Token

What type of token are they issuing? Does the token provide or derive value from the product? Why is a token being issued? How is value being created for token holders? How large a proportion of tokens are being sold?

If the above questions can be answered in a concise and somewhat digestible manner, then we can proceed (with caution) to stage 2 of the analysis — legality analysis.

Legality analysis attempts to evaluate the fundamental legality of a project, and to what extent the team is complying with regulatory frameworks. This includes the functionality of the token (utility vs profit? Is it in actuality a security disguised as a “profit-sharing software token?”), compliance in relevant jurisdictions, KYC measures, data protection measures taken by the team, etc.

The legal analysis of a token is often difficult and full of uncertainty. Whilst we can observe, to a certain degree, the security and data protection measures put in place over time, factors such as multi-jurisdictional compliance and long-term token legality prove more complicated. The present regulatory ICO landscape is difficult to navigate and will most definitely be subject to huge, fundamental disruptions over the immediate and distant future, for better and for worse.

Given the lack of current regulations, filing requirements and general oversight for ICOs, a number of investors are likely to get hurt. VC and IPO regulation is strict and often limiting, but for a reason. Retail investors typically do not possess the experience, analytical skills, support or risk/capital management expertise to adequately evaluate projects of this calibre, especially when vital information is actively concealed.

As the home of digital tokens trading & discussion, Ethfinex will act as a gateway to ICOs. Ethfinex will provide direct access to a number of token sales, combining this with an information & discussion hub designed to consolidate and organise constructive investment information surrounding these projects.

Our vision is to mitigate a number of the current dangers and complexities surrounding ICO participation (security, KYC, phishing attempts, sourcing credible information), to facilitate quick, simple and rational ICO investments.