We recently joined the high quality r/ethfinance subreddit for an AMA moderated by DCinvestor. Read a digestible summary of the top questions and answers below and don’t forget to join our Telegram community for all the latest news. Let’s dive in!

Background & Key Points

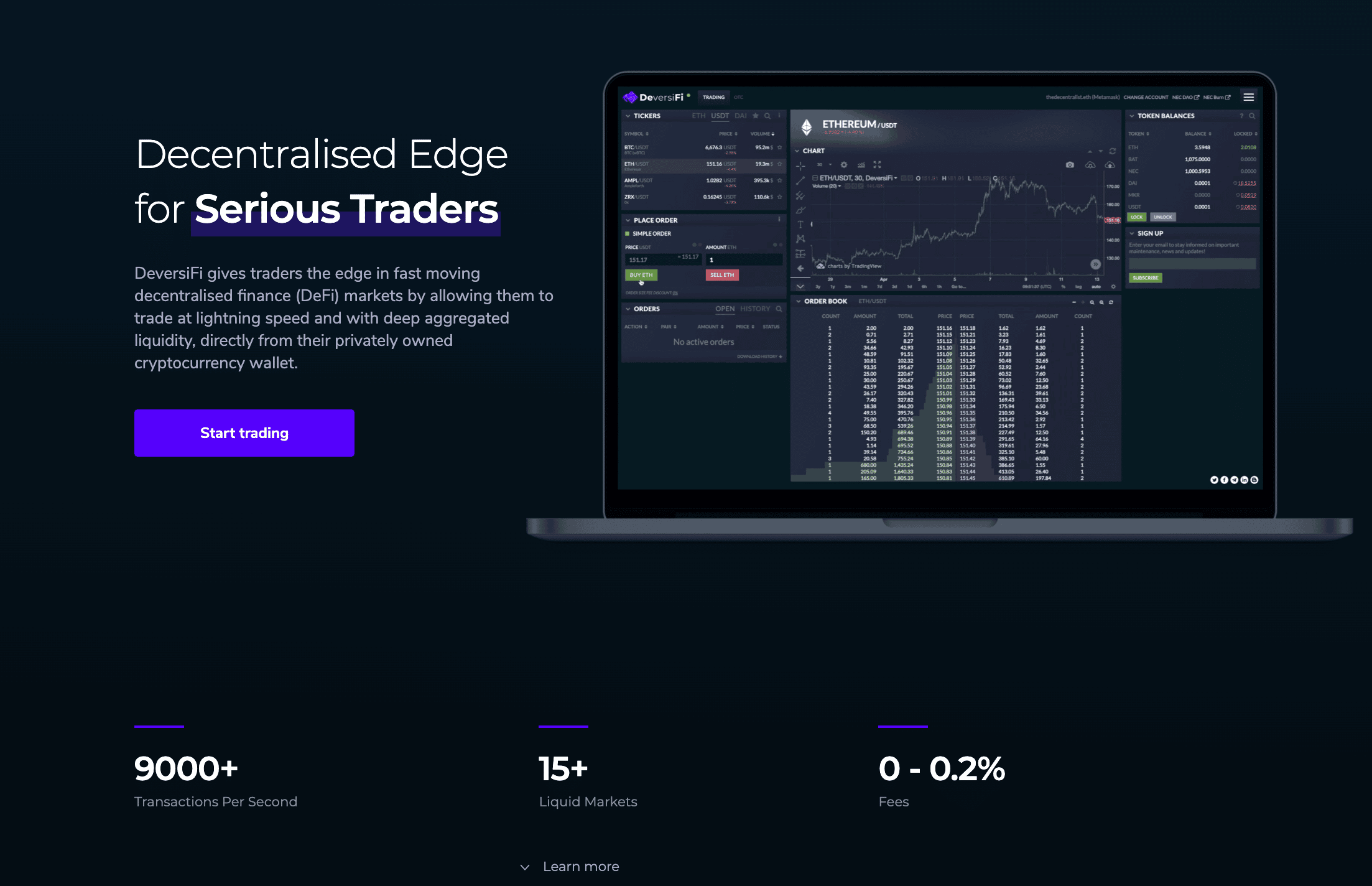

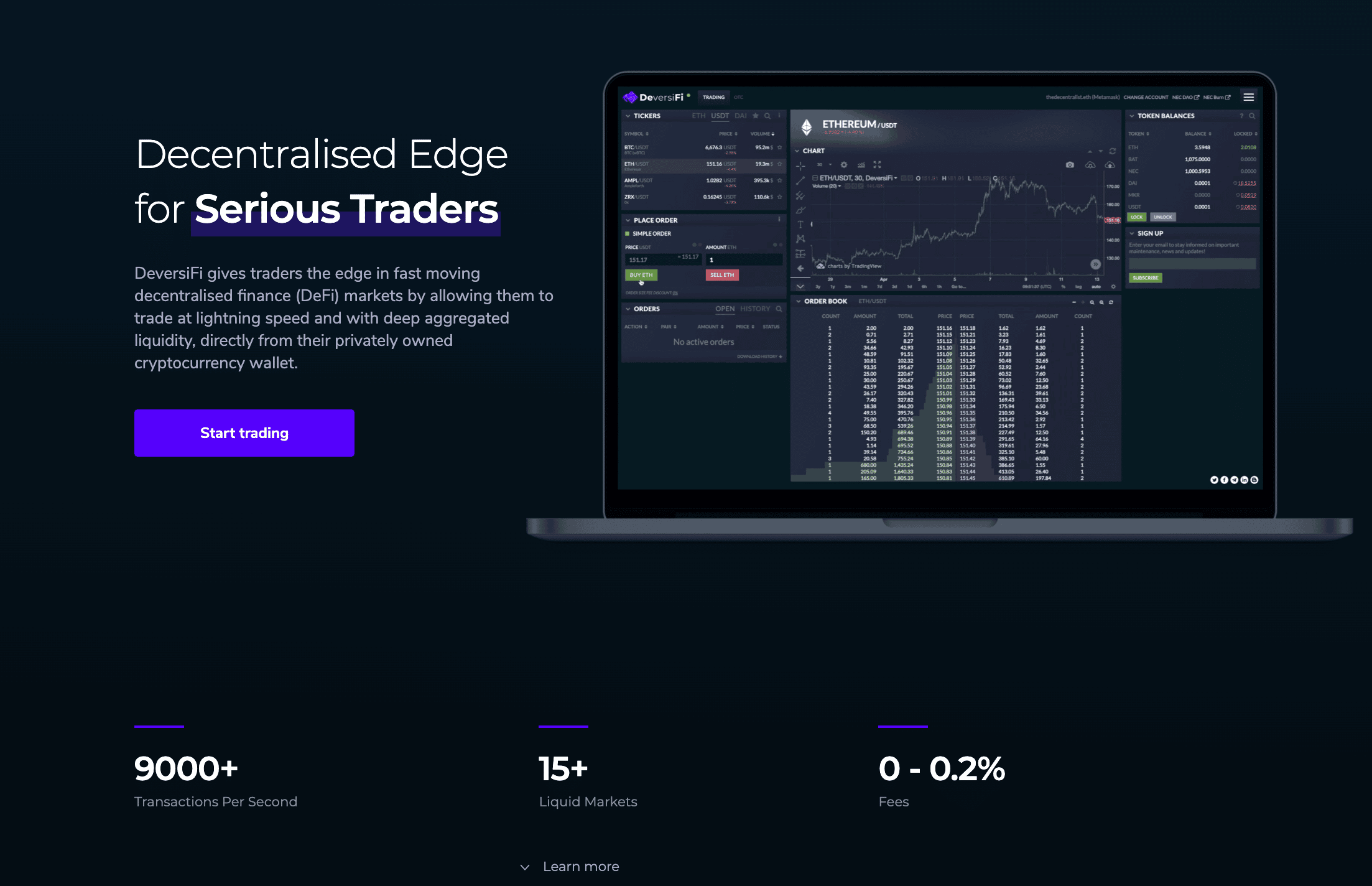

- DeversiFi 2.0 launched on June 3rd becoming a professional-grade, self-custodial exchange built for serious traders

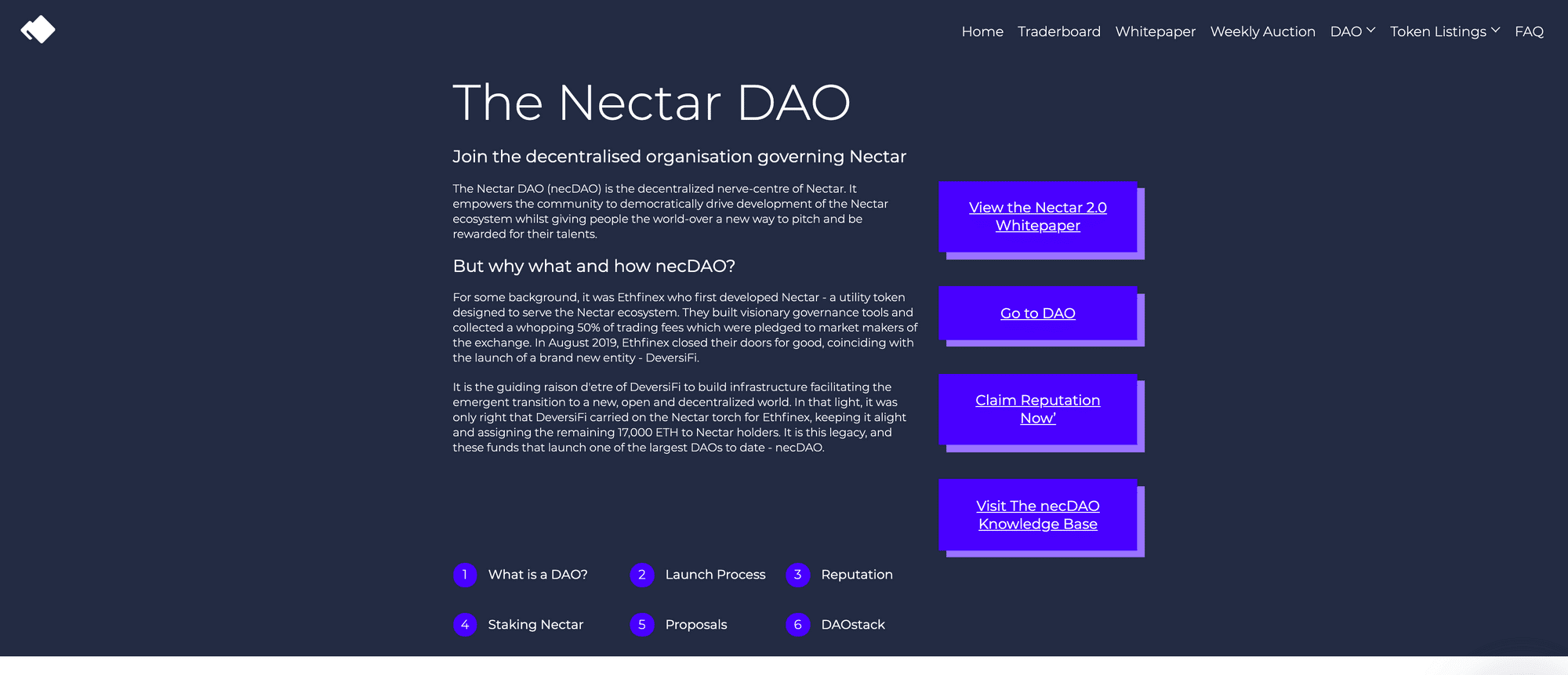

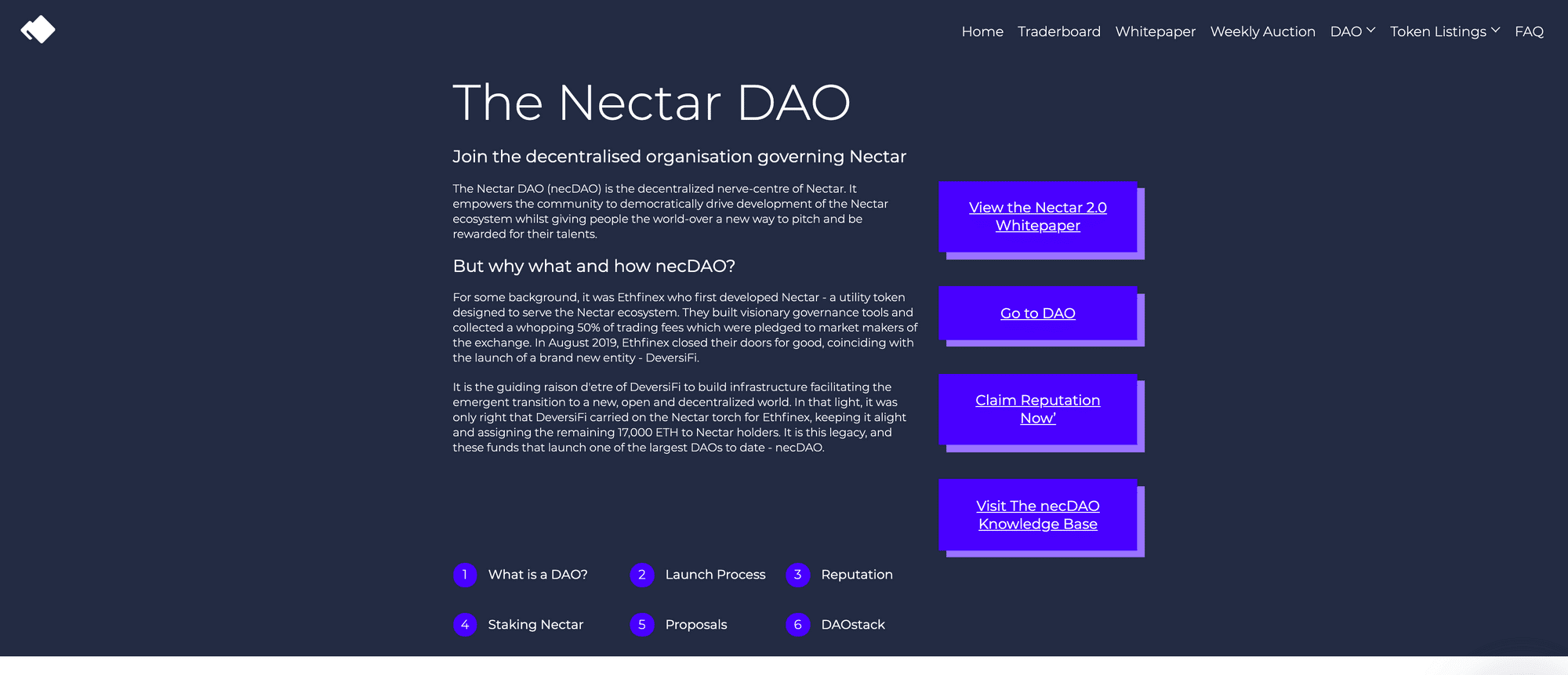

- The Nectar token ($NEC) is a perpetually deflationary token where 50% of DeversiFi trading fees (as well as other burn events such as this) are used to reduce the NEC supply. NEC is also a incentive and utility token by granting holders 20% trading fee discounts and membership in necDAO (with 17,000 ETH pledged). Importantly, the DeversiFi team are evaluating ways to further increase NEC’s utility making it more attractive still in line with the DEFI market up cycle.

- With the goal of adding extra DEFI value, DeversiFi integrations are a hot talking point. DeversiFi is designed for serious traders (that is: algo, quant, arb or day traders). As such, the team have focussed on launching an MVP DEX that brings the cornerstone of a CEX to the self-custodial world with the aim of attracting large traders who otherwise would be forced to remain on a CEX. Now, with this launch complete, the team is focussing on exciting new DEFI integrations to bring even more value to the platform. Nothing is yet confirmed, but imagine earning yield or interest on your DeversiFi trading account deposits? The possibilities are limitless!

Now, Let’s Dive In 🤿

On DeversiFi, General

Useful Link: Website 🟣 Dapp 🟣 Blog 🟣 Telegram

Q. u/yeadave4:

Bitfinex was an important part of DiversiFi’s history/creation. In a recent podcast you described having split off from Bitfinex, but that Bitfinex’s role is still very important. Besides the shared order book, can you please elaborate on what kind of ongoing influence Bitfinex has on the development and direction of DiversiFi? Are any DiversiFi team members also currently tied to or employed/compensated by Bitfinex?

A. u/rossmidd:

The most important role Bitfinex plays is helping DeversiFi bootstrap liquidity. Aside from that, Bitfinex are a seed investor in DeversiFi having incubated the project while it was Ethfinex. Bitfinex are a minority shareholder, but DeversiFi is a completely legally separate company and Bitfinex has no strategic or operational control. No DeversiFi team members are contracted/employed by Bitfinex.

If your services are taken offline, are users able to recover their funds?

Yes. One important selling point of DeversiFi is its ability to offer serious traders the privacy they get on a centralised exchange (protection against front-running, or their strategies being compromised). This however means that we use Validum layer 2 scaling (in place of, say, zkSNARKS) to record and verify trade activity off-chain. As such, we have deployed the Data Availability Committee, a decentralised committee of trusted third-party brands (consisting of ConsenSys, StarkWare, Infura, Cephalopod, Iqlusion, Nethermind). If DeversiFi ever goes offline the user balances data will be pushed to chain by the Data Availability Committee, which will allow users to withdraw from the smart contract as normal.

Additionally if only the UI is down users are able to interact with the blockchain directly in order to withdraw locked funds. It is the same mechanism as if they have lost their MetaMask trading key pair. You can see an example of how this is done at https://support.rhino.fi/en/article/how-to-withdrawretrieve-funds-if-you-lose-your-deversifi-trading-key-that-is-registered-to-your-metamask-account-l057d6/

In sum, while some will argue that this provides somewhat less trustlessness, it is the best available and most secure way to provide professional-grade self-custody trading where privacy is an uncompromisable cornerstone. Users always have custody of their assets and control over them in any eventuality.

Competition in the DEX market is heating up, with rollups as well. How does your tech compare to projects like what Loopring is doing?

We hope that L2 exchanges such as Loopring, IDEX and Synthetix all continue to grow as we would like to see L2 trading becoming the norm for traders over the next few years. L2 exchanges are in their infancy and therefore all startup L2 exchanges need to work hard to provide traders with a real alternative to large centralised exchanges

DeversiFi uses the StarkWare settlement technology, which has been branded as ‘Validium’ and uses zkSTARKs. Loopring uses zkRollup technology based on zkSNARKs. The main differences are that DeversiFi can handle higher amount of TPS (9000+) whilst keeping trader’s trading activity private. Loopring’s technology is slightly slower in terms of TPS and trading is fully visible to external parties, but it is completely trustless insofar that it is a zkRollup. DeversiFi uses a data availability committee to make sure that if DeversiFi were to go offline that traders could always get their funds back. This was a purposeful design goal as one of the main reasons why more funds and large traders are not trading on self-custodial exchanges is that they require privacy.

More information on the DeversiFi Data Availability committee is available here:

Have you considered integrating other functionality into your L2 rollup such as token send, lending protocol integration etc?

Definitely. The past 12-18 months have focused on delivering a truly scalable self-custodial exchange. Now that the high-speed version of DeversiFi is live on mainnet and performing well, the next 6 months (and beyond) are focused on building all the exciting features that traders are asking for. This ranges from exchange specific features such as some of the advanced functionality you would expect from a large centralised exchange, to DeFi integrations and some features that are only possible on a L2 exchange. We are actively examining ways in which we can utilise the technology to support transfers within DeversiFi (between accounts on DeversiFi for example) and other StarkWare L2 products, but the immediate focus is on building exchange specific functionality and wider DeFi integrations – watch this space.

Do you have plans to leverage the zk technology outside of just the exchange, perhaps in something like payments?

On that, have you considered joining the Reddit scaling competition?

The core business of DeversiFi is trading, and we are 100% focused on making that as good as it can possibly be for our users before branching out to other businesses. As L2 evolves the services that it encompasses will expand as well.

On your second question: We did catch this competition and considered the opportunity although it is perhaps more one for our partners at StarkWare. While DeversiFi uses innovative scaling technology, said technology isn’t our direct business purpose so it wouldn’t be as relevant for us as for StarkWare. They will smash it out the park anyway much better than we could! I’m keeping a lose eye on it and am very bullish that Reddit is looking at this. As a side note, I’ve also noticed a number of subreddits, particularly Ethtrader but also CryptoCurrency who have their own tradable tokens with incentives so not sure how that plays in but all strong signals for DEFI/Crypto.

I love what you are doing to push adoption of L2 scaling technologies in the DeFi space. What I would like to ask (and it’s currently the only thing holding me back from buying some NEC) is what are you doing about the relatively low volume and small number of tokens listed on your exchange? How do you plan on attracting more users to the exchange and what are your unique selling points?

Some good questions there! Glad to hear you’re looking into NEC in more detail. Regarding the relatively low volume: Our approach/position is to target professional traders, i.e. algo, quat, arb or frequent day traders. This group in particular is cautious before adopting new technology and it may take time to change behaviour/attract these traders over from CeFi to DeFi. In order to do that, we have focussed on a) signalling the tigh level of security on DeversiFi (heavily audited contracts as well as now our Nexus Mutual insurance) and b) targeting users through selective DeFi integrations, new features and marketing campaigns. Regarding token listings, we are preparing to add a range of popular DeFi pairs which will come once we have finalised the creation of our native matching engine as well as integrating with additional liquidity sources (both DEX & CEX).

Selling points:

- Speed (instantaneous execution and clearing), over 9K TPS

- Control – trade from your private wallet or custodian

- Security – funds are held by smart contracts, DeversiFi never takes custody of your funds, the security of the exchange is underpinned by the Ethereum network and the Data Availability Committee. Insurance from Nexus Mutual

- Deep, High-Speed Liquidity – aggregated CEX liquidity for large pairs. The deepest markets for wBTC/usdt and ETH/usdt

- Low fees – fees start at 0.15% maker and 0.2% taker

- Privacy – keep your trading activity private

- Certainty – instant trade finality and withdrawal certainty

Currently DiversiFi is not available to U.S. residents. Can you explain why that is? Will this change in the near future and if so how?

Unfortunately DeversiFi is not available to USA residents as per our term’s and conditions. We are looking for ways to address this in the medium term but unfortunately we have to be extra careful with USA regulatory risk and believe that our resources are better used in the short term to improve the core product before expanding to other jurisdictions.

A large part of traditional finance trading volume is high frequency trading. Are there any plans to capture any of this HFT market and if so how?

DeversiFi is a self-custodial exchange, however, contrary to popular belief that doesnt mean it is slow. Our APIs already allow for high speed connectivity for complete algorithmic trading.

Find out more: https://docs.rhino.fi/

Which upcoming feature or upgrade are you most excited about or proud of?

One of the biggest challenges for L2 is the friction between it and L1, one of the most exciting and interesting updates we are working on is a mechanism to drastically reduce that friction and increase the efficiency of the process!

Personally, I am very proud of the fact that we have delivered a high performance, high speed self-custodial exchange to mainnet. Every time I place and order that clears instantly and the tokens appear with my wallet I still have a moment when I dont quite believe it. We have come a long way from the days of terrible UX and confusing entirely on-chain DEXs from 2017

In terms of upcoming features, I am personally excited about our plans to enable ‘better’ withdrawals. Apologies for not being able to go into more detail now but watch this space.

Our latest community update is a good place to check all the latest developments plus outook for the next few months https://rhino.fi/blog/deversifi-community-update-05-q2-2020/

Is there a plan to post the availability proof for those that want to pay for it?

Having the choice what data to put on and off chain is something that the StarkWare team is working on for the future version of StarkEx. You can find out more about that here – https://medium.com/starkware/volition-and-the-emerging-data-availability-spectrum-87e8bfa09bb. Implementing it into DeversiFi when it is available will be dictated by user feedback. However, trading privacy is something we believe will be more and more important as DeFi grows.

What are the plans to allow market makers to move funds in and out of the diversify, providing liquidity? Do diversify, as operator, plans to provide this liquidity?

DeversiFi is unique in this regard as we (as a company) aggregate CEX liquidity to give DeversiFi traders deep order books for major pairs such as ETH/USDt and wBTC/USDt. A market maker is free to provide liquidity by connecting via the DeversiFi API and we hope that over the next few months more and more liquidity providers will connect to DeversiFi.

It is worth adding that we speak to lots of traders, funds and market makers on a daily basis, therefore have a reasonable understanding of the current friction points that they face when trading on DeversiFi at the moment. Our plan for the next six months is to overcome some of those pain points.

How did you integrate L2 solutions and would you advise other projects to do the same? What pitfalls should a project avoid by implementing L2?

This is a great question. Quite early on in our research we realised that supporting both an exchange and L2 settlement technology takes completely different skill sets and organisational setup. DeversiFi actually built our own L2 scaling technology in-house but about 18 months ago we encountered StarkWare and the rest is history.

Working with a company such as StarkWare who has a huge amount of expertise, not only on the cryptography side of things but on the business side of things made the integration much easier.

On Nectar DAO

Useful links: Website 🟣 Alchemy page 🟣 Knowledge Base

Q. u/CyprusHills:

Having read some of your website, tokens have to be voted on by the DAO. Imo this is kind of an issue, in order to gain adoption you guys need to very quickly list as many tokens as possible (even though gaining liquidity for them is an issue in itself I guess). What do you think?

A. u/ben_efx:

I agree with your point here. To be crystal clear, we do not currently use necDAO as a way to list tokens. Tokens are listed as decided by the leadership team, so we do have scope to list popular DEFI tokens with minimal friction and this is something we’re exploring at the moment. The possibility of using the necDAO is a yet-to-be-defined process that will place control in the hands of NEC holders (similar to what the Ethfinex Token Vote was), however, this is some time in the future.

We are working on some changes over the next 3 months to give us a lot more freedom over the tokens we list. Our aim is to add markets which are interesting for and desired by our users. However, new listings are still reviewed from a regulatory perspective.

On Nectar ($NEC)

Useful links: Website 🟣 CoinGecko 🟣 Knowledge Base

Q. u/yeadave4:

According to the whitepaper, Bitfinex has 54% of the token supply while the DiversiFi team only has 18%. Why is there such a disparity? While both are said to have “5 year vesting”, are all tokens locked for 5 years or is there a gradual/continued “release” of tokens? Can Bitfinex use any of their 54% to vote before the end of the 5 year period? If so, how would they be prevented from having a disproportionate/controlling influence on DiversiFi?

A. u/rossmidd:

The best place to find all the most up-to-date information regarding NEC token allocation is the support article here:

https://support.rhino.fi/en/article/deversifi-nectar-token-nec-z5rq16/

As you can see from the wallet that contains the Bitfinex tokens, none of the tokens have moved since the minting of NEC three years ago, apart from some NEC tokens that were used as bounties & community incentives. Bitfinex have not staked any of their tokens into the necDAO, but in theory could stake up to 20% per year if they wished.

Q. u/econoar:

Are you guys planning any type of “liquidity mining” for NEC like some other competitors?

NEC was actually one of the original liquidity mining tokens! Back in 2018 & 2019, NEC was earned by traders on the old Ethfinex exchange, it was never sold as part of an IEO or ICO – it was only ever earned or given to shareholders.

We are examining ways in which we can utilise NEC for a liquidity mining program on DeversiFi but want to make sure that the core product is at a fairly advanced stage before we ‘turn on the taps’ so to speak. Our focus for the next few months at least is building all the exciting new features and integrations that the DeversiFi community of traders has requested.

Can you describe NEC’s token model- how does it work and what are the expected value drivers for it?

I’ll chime in for this one:

NEC is a pretty cool token (of course we’d say that!) but it has been on an interesting journey over the last couple of years. It began life as the first liquidity mining token that reward traders of Ethfinex for the liquidity they provided while also empowering holders by allowing them to vote on, for e.g., which tokens they wanted to see listed next.

Since Ethfinex closed down, NEC was partially adopted by DeversiFi (but the two projects are separate) and now NEC (2.0) is a deflationary token (50% of trading fee revenue is used to buy and burn NEC, this burn rate is likely to by supplemented by other burn events, for example, a recent proposal in necDAO will earn profit from seeding Uniswap liquidity and use 50% of that to speed up the burn rate, as well as other upcoming plans) that also offers trader up to 20% trading fee discounts and membership in one of the largest DAO’s in the industry (necDAO) with 17,000 ETH pledged.

So in sum, it is a perpetually deflationary token which offers incentives in the form of discounts as well as utility in the form of governance. Seeing the growing success of liquiditing mining, we may yet see NEC’s utility expand to re-encompasse this in the future but whether we bring back LM or not, we are looking at novel and value-driving ways to improve NEC’s utility with the goal of driving volume and increasing value. Can’t say too much on that at the moment but are very excited to make some announcement in the near future!

Also, why only 149M/618M NEC are in circulation? Is it not a dumping risk by the issuer?

The remaining non-circulating NEC is locked up in 4 year vesting contracts which protects against the threat of large holders dumping on the market.

Additionally, a large portion (78m) of the circulating supply is itself locked up in the necDAO, in some cases for up to 12months (this cannot be unstaked until the time has elapsed).

https://support.rhino.fi/en/article/deversifi-nectar-token-nec-z5rq16/

There is an outline of the token distribution in their whitepaper. I believe that Bitfinex owns a significant portion but they are vested and can’t sell for 5 years.

DeversiFi and Bitfinex have a linear vesting schedule for 4 years since the first portion (20% was unlocked), we have added some extra information on this in the answer above but let us know if you have any more questions! A more detailed distribution of the NEC token is available at the below link:

https://support.rhino.fi/en/article/deversifi-nectar-token-nec-z5rq16/

After the past several weeks, it seems clear that the next growth rally for our industry may be the result of DEFI incentives. I.e. yield farming, liquidity mining, rebates and other methods value providers have for earning funds by participating.

How do you plan to ensure that your platform and specifically the NEC token is meaningfully included in this basket of DEFI tokens and provides the right incentives to attract new users in the same way other tokens are?

Hey there!

- This is an exciting line of thought for us and one we’re looking at very closely at the moment. As mentioned in previous answers, liquidating mining, in particular, was a feature in NEC 1.0 and maybe something we bring back considering its evident success at the moment, however, we want to ensure long-term value and want traders to use DeversiFi for more than just NEC rebates so are considering every possible utility.

- As things stand, however, NEC already is well-poised to be included in this basket as it gives holders voting rights in one of the largest DAOs in the game (necDAO) which holds 17,000 ETH, gives holders trading fee discounts and is also burnt on a perpetual basis. That said, what I think will most add extra value would be the integration of cherry-picked DEFI protocol into DeversiFi. We are talking to a number of high profile DEFI teams and are working on this at the moment but cannot yet provide any ‘news’ im afraid but image earning interest on your trading account, for example! Loads we’re considering!

Can you explain what exactly the significance of the DAO holding 17,000 ETH is? What can be done with that ETH? Can the DAO theoretically vote to pay out the ETH to NEC holders?

A great question! 😀

The answer is actually yes. NEC holders have the power to vote on whatever gets proposed, so in theory, they could decide that yes, they’d rather distribute the ETH between themselves or to subsidise their own trading on DeversiFi.

However, the necDAO is purposed to govern the Nectar token ecosystem while serving an advisory role regarding sensitive DeversiFi aspect and much of the larger NEC holders are in support of the project and the value in seeing DeversiFi volume grow as well as Nectar volume and adoption is ultimately a better choice.

How can the 17k ETH be put to work to further DeversiFi then? Are there any concrete ideas or proposals floating around? Because that’s a lot of money.

Agree. It is a considerable amount and as such, its transferal to the necDAO has not occurred in one go but rather will be sent periodically based on a linear schedule (at the moment, a total of 800 has been sent).

Regarding examples, you can check out the alchemy interface here which shows proposal history: https://alchemy.daostack.io/dao/0xe56b4d8d42b1c9ea7dda8a6950e3699755943de7/history/

Some notable ones include the DeversiFi marketing proposal, large customer integration fund, and one that is yet to pass but is well on its way is NEC Auto-Buy and Burn Liquidity Provider Scheme: Phase 1 which will make the DAO profitable while speeding up the rate of NEC deflation through burning.

Admittedly, necDAO is yet to have a comprehensive list of proposal examples but we expect this to steadily grow, similar to other DAOs. Proposals could span anything from marketing initiatives, events, the developing of new interfaces catering to specific traders (that may help onboard them or provide added value) etc etc.

About DeversiFi

DeversiFi gives traders the edge in fast moving decentralised finance (DeFi) markets by allowing them to trade at lightning speed and with deep aggregated liquidity, directly from their privately owned cryptocurrency wallet.

Traders can take advantage of more trading opportunities while always preserving control of their assets for when they need to move fast. DeversiFi’s order-books are off-chain, but settlement occurs on the Ethereum blockchain. This means that traders benefit from fast moving order books and instant execution, without having to trust the exchange and whilst always maintaining control of their assets at all times.

For the first time, traders can enjoy all the benefits that they would expect from a legacy large centralised exchange, but with no exchange or counter-party risk.