Welcome to the final DeversiFi community update before the launch of our scalable trustless DeversiFi 2.0 exchange in partnership with StarkWare. We publish updates that focus on project development, KPIs and DeversiFi news.

COVID-19 Update

First and foremost, as a team, we hope that you and your family are staying safe, healthy and well during these challenging times. Like most, we are vigilantly keeping track of developments and where possible, playing our role, as individuals, in supporting our respective communities.

As a distributed company, DeversiFi is well positioned to ride out the coming months as the physical movement of people is impaired by COVID-19 related lockdowns. If anything, our productivity and focus has increased as a result of less conferences and travelling for meetings over the past few weeks.

Having said that we are preparing for a worst case scenario where crypto markets go sidewards (or down) for the next 12 months. To clarify, this isn’t our base case scenario, but are planning to ensure that DeversiFi continues to grow regardless of what happens in the outside world.

All DeversiFi founders already work for either zero salary or a very small salary. This has been something that we have committed to doing ever since DeversiFi was launched in 2019 and it ensures that all capital is focused on the front line (development, marketing, product management etc). We have taken the opportunity to raise some more capital for the business via SAFE notes and have trimmed non essential spending to make our already lean operation even leaner. As a result we have extended our runaway to c.12-15 months in a worst case scenario where DeversiFi earns zero revenue and we raise no further funding – a highly unlikely scenario as we have set about building something highly valuable for the DeFi and trading community.

We would like to take this new opportunity to thank all investors, new and old as well as the community of Nectar ($NEC) holders, some of who have been instrumental during the fundraising process.

Key Performance Indicators (KPIs) – Q1 2019

Over the past several weeks we have run several small scale advertising campaigns and trading competitions to explore new marketing and communication channels, which are now ready to scale for the DeversiFi 2.0 launch.

The total trading volume over the final 30 day trading competition period was US $5.5m This was mainly due to a small number of new large traders primarily trading the ETH/USDT market

Q1 Highlights:

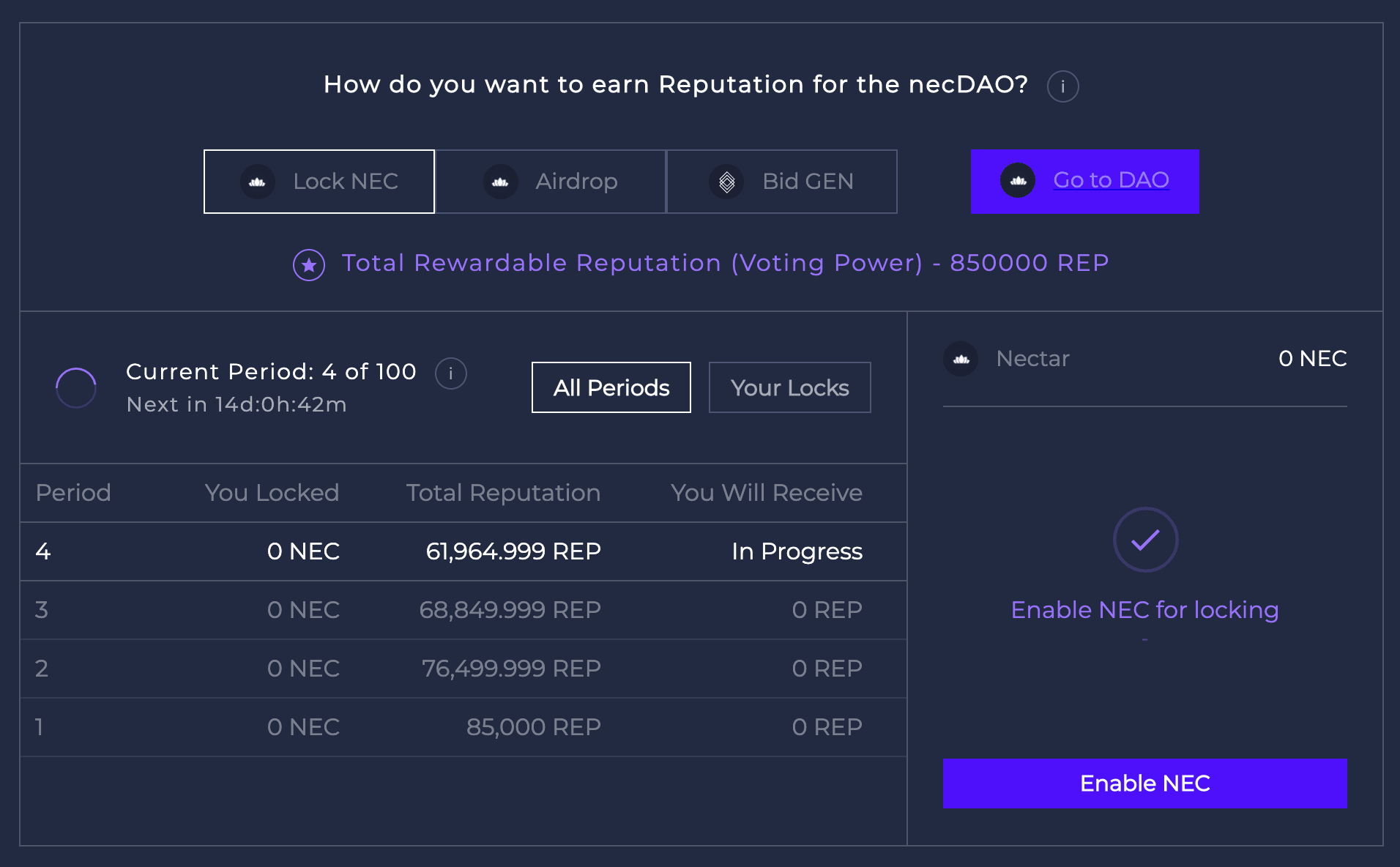

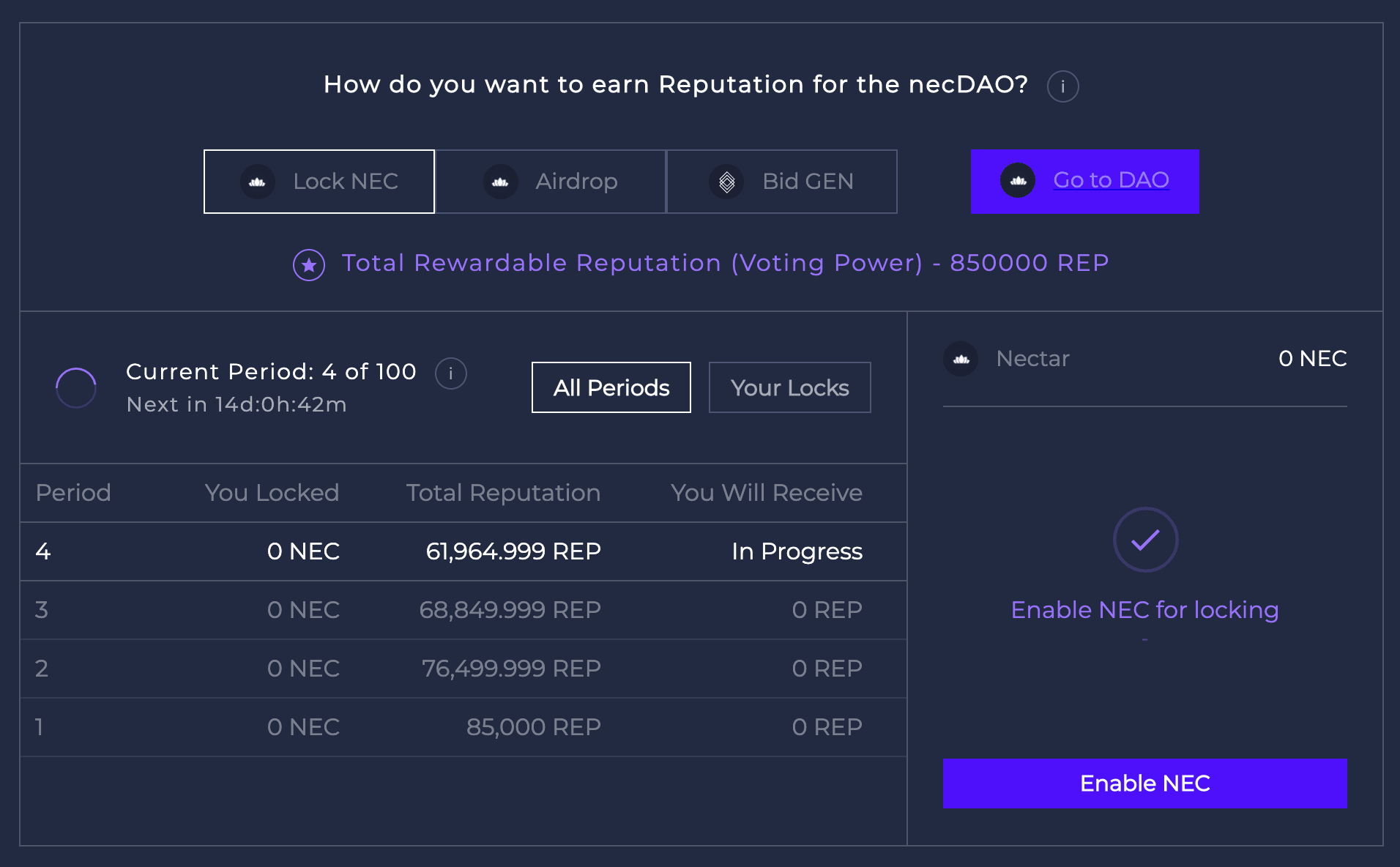

necDAO Bootstrapping and Launch

The bootstrapping phase of the Nectar ($NEC) DAO was completed, initial reputation was distributed and the first proposals were submitted for voting. There are now over 100 reputation holders in the necDAO and over 100m NEC tokens (US $5.5m) were staked by the community. At the same time, the Nectar token was upgraded so that it can now only be changed by the necDAO, marking its move to full community ownership.

When the necDAO is funded with 17k ETH over the next few weeks, it will be the largest assets under management by a DAO in existence and a very exciting community experiment.

To find out more about the necDAO, claim Reputation by staking NEC, or vote & submit on proposals, see the dedicated section on nectar.community/dao, the home of the Nectar ecosystem.

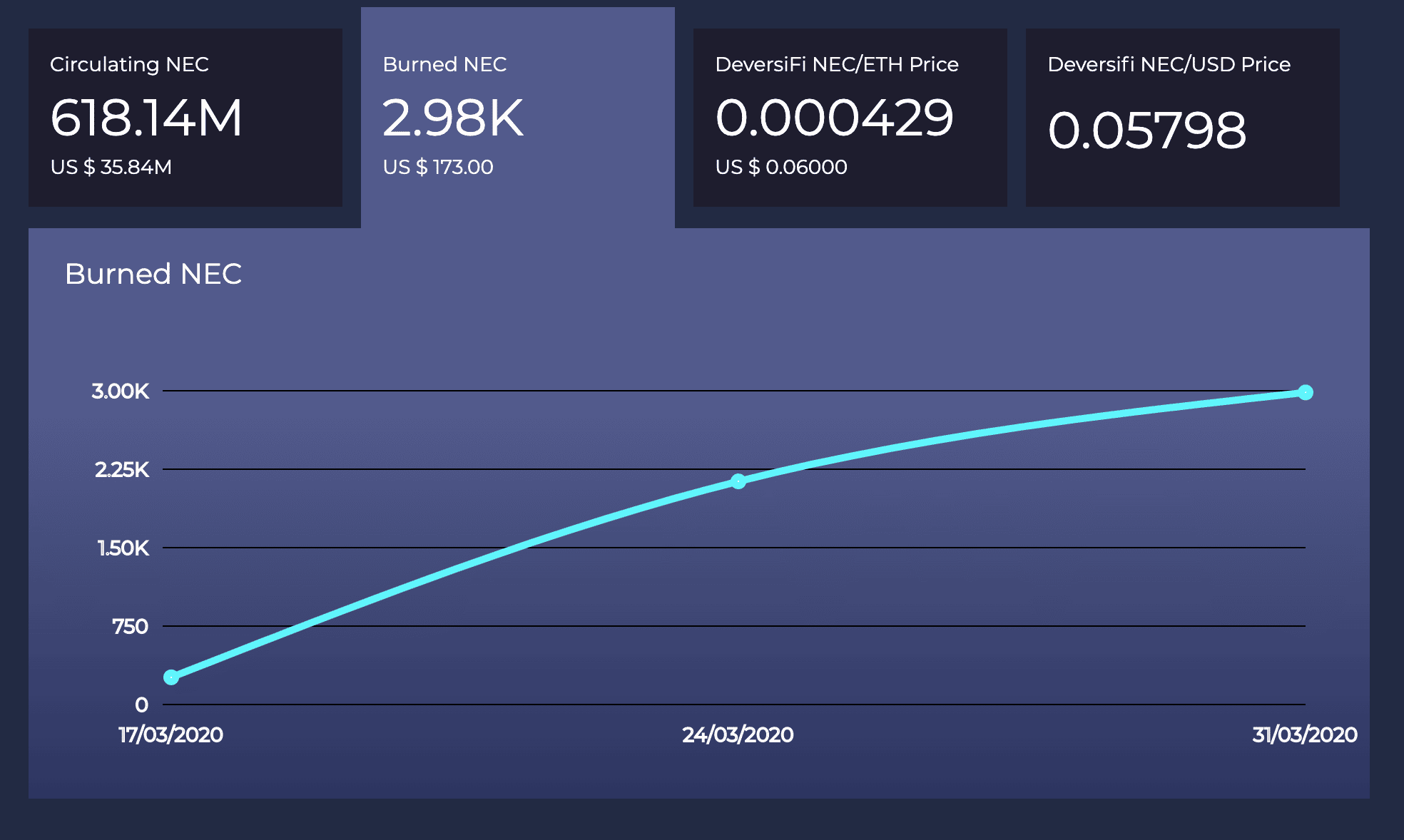

400m NEC Token Burning and the Start of Weekly Burning Auctions

400m NEC tokens (US $20m) were burned in a one-off burning event, removing them from total supply.

Furthermore, weekly auctions have now started where DeversiFi pledges up to 50% of of trading fee revenue (determined by exchange volume) to buy-back and burn NEC tokens from holders.

These two events mark Nectar’s shift from inflationary (Nectar 1.0) to deflationary (Nectar 2.0) tokenomics.

The total amount of Nectar tokens now stands at 618.14m . More details can be found on the NEC Ownership and Distribution support pages

New Token Listings

There were a number of new DeversiFi token listings during Q1. There are a number of considerations that have to be taken into account when adding new tokens to DeversiFi, with one of the primary concerns being liquidity. The DeversiFi team aims to ensure that there are deep order books from the moment tokens are listed. This may be via linking up to specific sources of existing liquidity, aggregating various centralised & decentralised order books, or working with external liquidity providers to directly provide liquidity. The new token listings in Q1 were:

- Tether Gold (XAUt)

- Ampleforth (AMPL)

- 0x Protocol (ZRX)

- BTC (wBTC)

Several more tokens will be added over the coming weeks in the lead up to the DeversiFi 2.0 launch.

Bitcoin Trading Without The Exchange Risk

The Bitcoin (wBTC) DeversiFi listing is something that we are particularly excited about as for the first time in the industry, Ethereum traders can gain direct exposure to some of the most liquid Bitcoin order books in the industry, directly from their privately owned cryptocurrency wallet. This is the missing bridge between Bitcoin and DeFi markets and we are excited to see it take off as we move to the high speed DeversiFi 2.0.

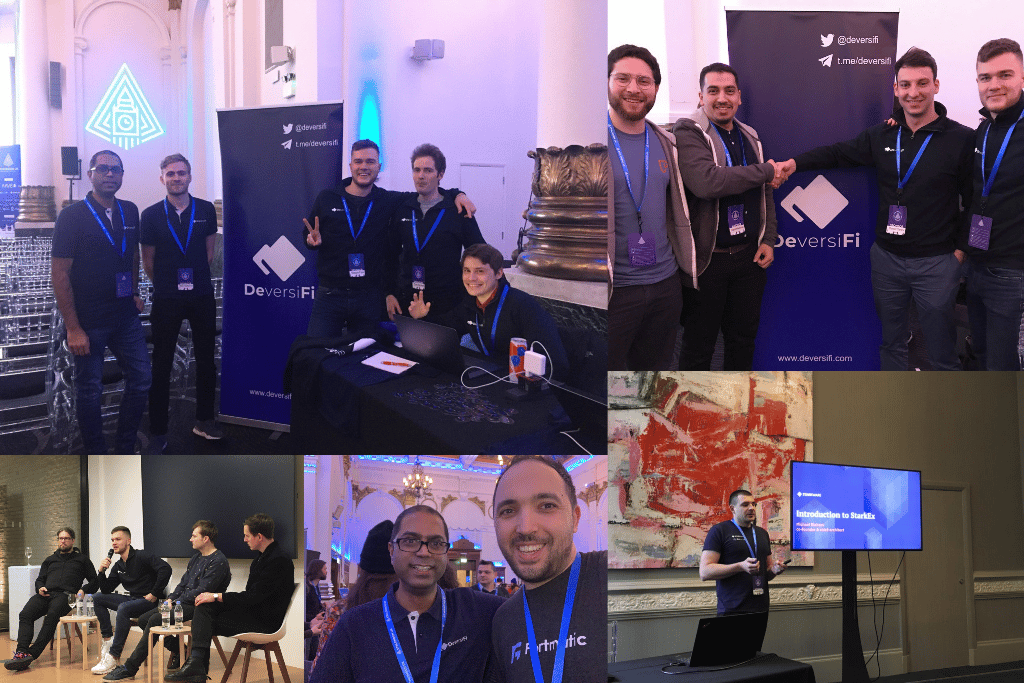

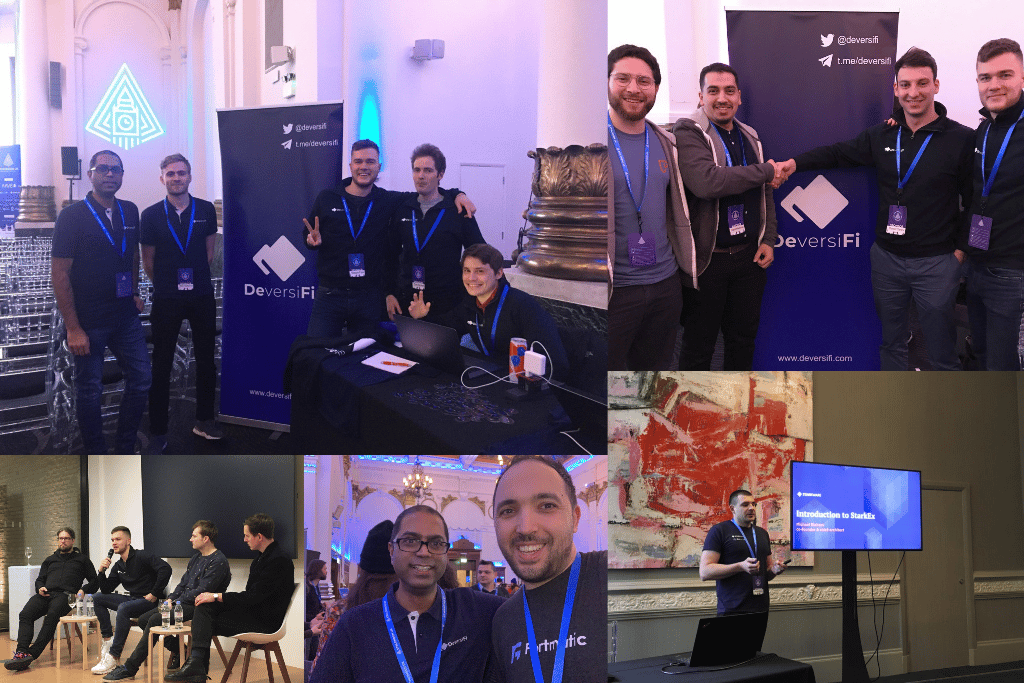

Showcasing DeversiFi 2.0 and Sponsoring ETHLondon Hackathon

A few short days before London was placed into coronavirus related Lockdown, the DeversiFi team attended and sponsored the ETHLondon hackathon. 300+ Ethereum developers from around the world descended on Embankment to learn, hack and develop some exciting new concepts.

The DeversiFi and StarkWare teams worked around the clock during the week prior to the hackathon to have a testnet version of the high speed DeversiFi 2.0 platform up and running for the event. At the conference, DeversiFi and StarkWare were able to ‘break cover’ and talk about some of the innovations that have been happening behind the scenes as the two teams have been integrating their tech stacks over the past nine months.

Four developer teams engaged with our API and built on the DeversiFi 2.0 testnet. Congratulations to Nabil Makhout & Osamah Bukraa who stole first prize ($2,500) by using our new API to build a Telegram trading bot. Something that we are excited to see developed into a full scale product when DeversiFi 2.0 is launched.

EthCC and Trust Community

DeversiFi and IDEN3’s Trust Community Project joined forces to showcase the Nectar ($NEC) token and Trust Community’s Zero Knowledge identity technology at the EthCC conference in Paris. EthCC attendees were given a bracelet in their swag-bag upon entering the conference and then downloaded the Trust Community app to connect with other attendees in order to win NEC.

As a direct result of the Trust Community game, we welcomed 400 new NEC holders to the Nectar ecosystem and introduced them to DeversiFi. As an additional, unexpected benefit, this allowed the TrustCommunity app to display a social graph of who people connected with during the event which unfortunately had a significant number of later-diagnosed Coronavirus attendees. If you were diagnosed with COVID, you could mark yourself so others would know and get tested.

For more background, Trust Community is a company that is focused on Zero Knowledge scaling solutions for identity. We hope to be able to use their technology for KYC on DeversiFi if KYC becomes a requirement of the exchange in the future.

Short Term Plans:

StarkWare-Powered DeversiFi 2.0 PROGRESS

The main focus remains the launch of DeversiFi 2.0, powered by StarkWare zkSTARK technology. After a successful demo of the core technology on testnet at EthLondon, the team is now taking a few extra weeks to fine tune and test the production release. A high level overview of some of the Q1 highlights are as follows:

- Completed full integration with StarkWare and launched on the Ropsten test network.

- Created the first version of the DeversiFi API Documentation portal, built to be user-friendly for developers – Beta DeversiFi API documents are here

- Open-sourced the first version of our client library, which wraps all API calls, signing and cryptographic functions, and interaction with the blockchain to remove the need for traders to interact with these directly.

- Began optimisation of order placement and management to maximise speed and performance on our API.

- Kicked off stress testing with StarkWare to verify interaction points, including ensuring that our state tree remains in-sync at all times. End-to-end testing is expected to continue until mainnet launch.

- Launched the Data Availability Committee (DAC) on test-network with all of the future committee members participating. The DAC is a consortium of some of the most well known and neutral ethereum ecosystem participants who are responsible for providing the ‘escape hatch’ if DeversiFi and StarkWare were to go offline. More on the DAC will be revealed shortly

We will be hosting a closed showcase day for key supporters of the exchange who would like to try out the new platform before anyone else. If you would like to take part, then please email [email protected]

DeversiFi 2.0 will be able to offer traders the same experience that they would expect from a large centralised exchange, but without giving up control of their assets. In testing earlier this quarter, the StarkWare settlement technology was metered at 8000 transactions-per second, meaning DeversiFi 2.0 will be able to offer lightning fast and trustless trading to professional and algorithmic traders.

Unlike other exchanges, the trustless zkSTARKS setup allows for incredibly high speeds without opening up a large amount of additional attack vectors, as is often the case with exchanges that are striving to use optimistic rollup technology. Our implementation of the StarkWare also enables private trading, something that we (and our customers) feel is a key missing component of the decentralised Ethereum trading ecosphere today.

With every passing day we are more confident that the StarkWare settlement system is the best-in-class technology for our specific user base of professional traders who expect zero compromise and we are excited to share more details on the core technology and launch soon.

Margin Trading & Enterprise Grade Matching Engine

Adding margin trading functionality to DeversiFi is a key priority as it enables traders to gain exposure to leveraged markets (for capital efficiency purposes) as well as entering into short positions. This piece of work is tied into the development of a new matching engine and smart order routing system.

Our CTO (Jeff) has a background in high frequency trading, derivatives products and has built several high performance matching engines previously. Therefore he is ideally positioned to lead on the matching engine project and is making good progress. His focus is not just on building a functioning engine, but building something that can scale to beyond anything that is currently deployed on any large crypto exchange today.

We explored using a third party matching engine service but after speaking to nine different providers, the combined cost, setup time and ongoing fees meant that doubling down on our own matching engine technology was the clear route forward.

We have also been watching the recent BZX & flash loan exploits closely over the past few months. As fellow DeFi builders, they have our full support and we know that they will come back stronger and more resilient than before.

Other Projects

There are dozens of other key pieces of work underway but the whole team is currently focused on the DeversiFI 2.0 platform and everything required for a new product launch.

We work around the clock on the development of DeversiFi as the home of decentralised token trading, offering the most innovative solutions putting our users in control of their trading experience without sacrificing on speed, liquidity, choice or trust.

Get involved with, play your role and join us together as we fan the flames of the financial evolution.