Welcome to the November 2019 DeversiFi monthly community update. In order to maintain a high standard of transparency we publish a monthly update about product development, KPIs and news from the DeversiFi ecosystem. Please reach out to the team if you would like to see anything else included.

DeversiFi is driven by a mission to become the world’s most complete decentralised trading experience. We want to bring traders the features and experience that they would expect from any large exchange, but with the added control and flexibility that decentralised custody brings.

If you haven’t noticed already, an updated Nectar ($NEC) 2.0 Whitepaper has been published (October) for community review that details a proposed new roadmap for the Nectar token.

KPIs

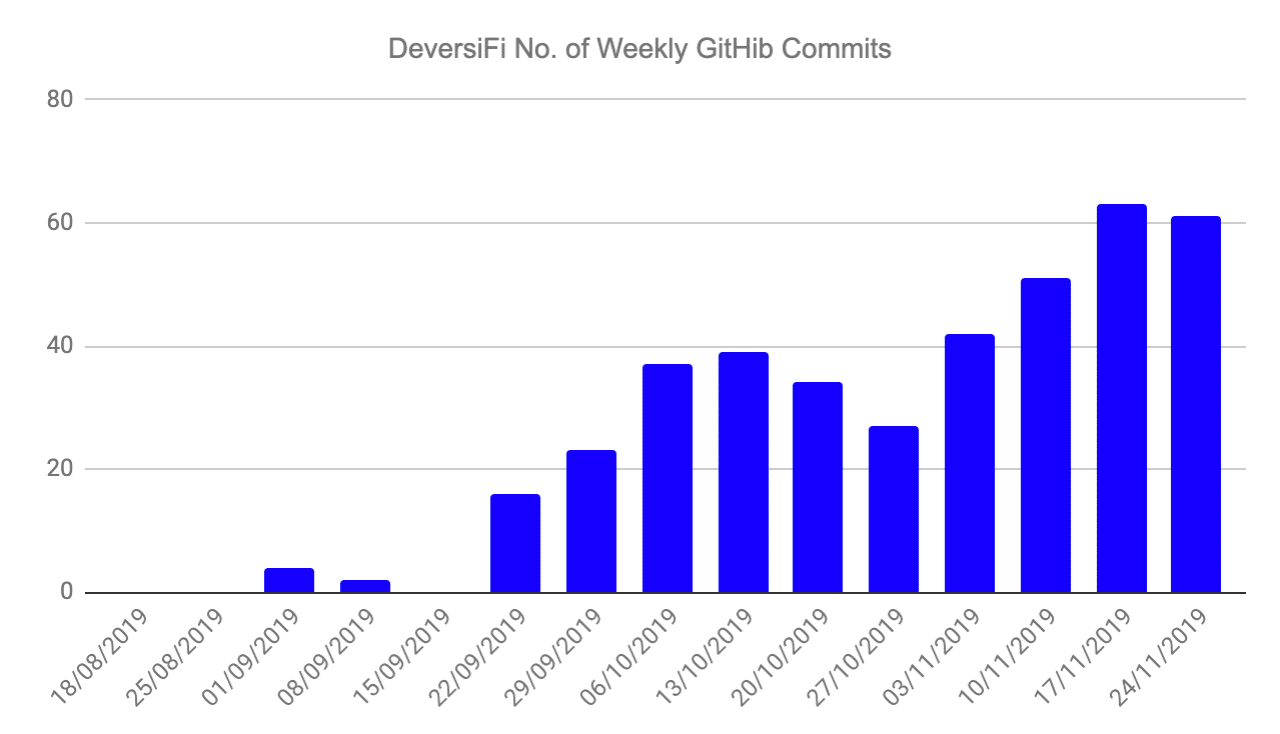

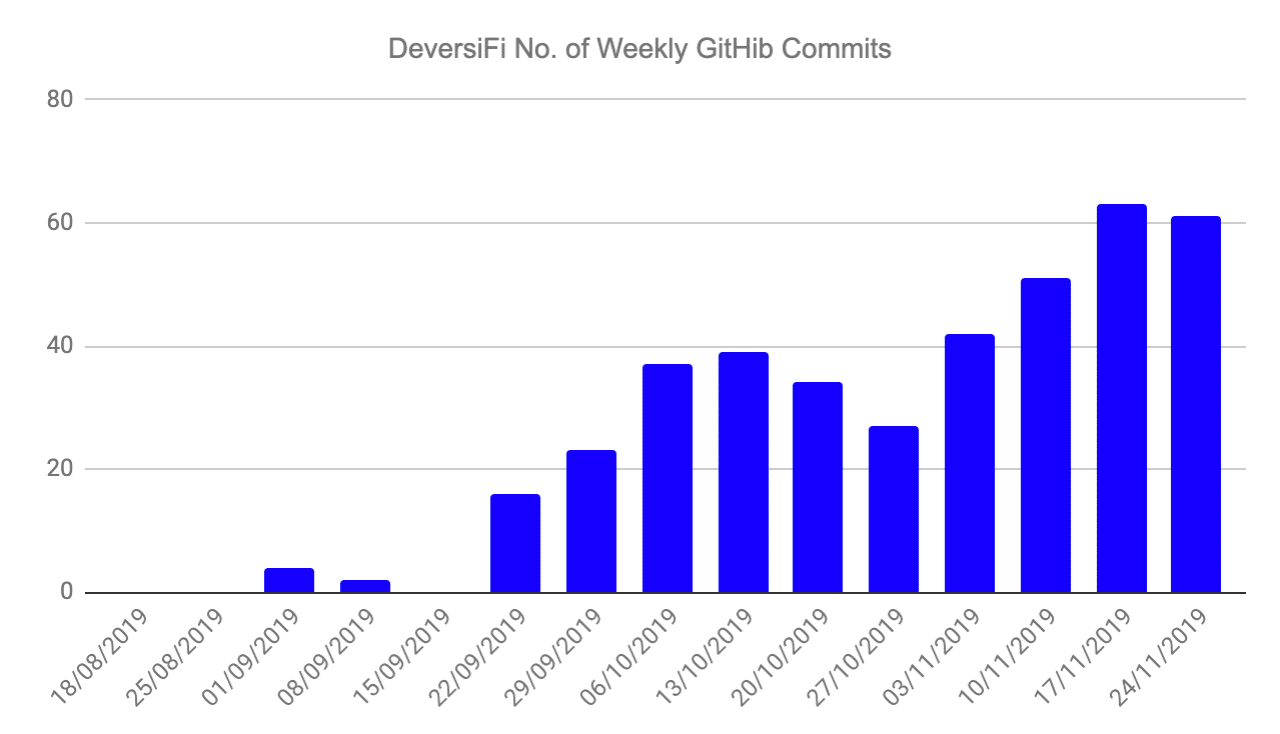

Our short term priority remains to increase our development capacity ahead of the Starkware integration and DeversiFi re-launch in February/March 2020. As detailed later in this blog, we made three new developer hires last month and are continuing the search for new talent. Our GitHub activity is starting to reflect the change in pace and we expect it to continue growing rapidly as new developers are on-boarded.

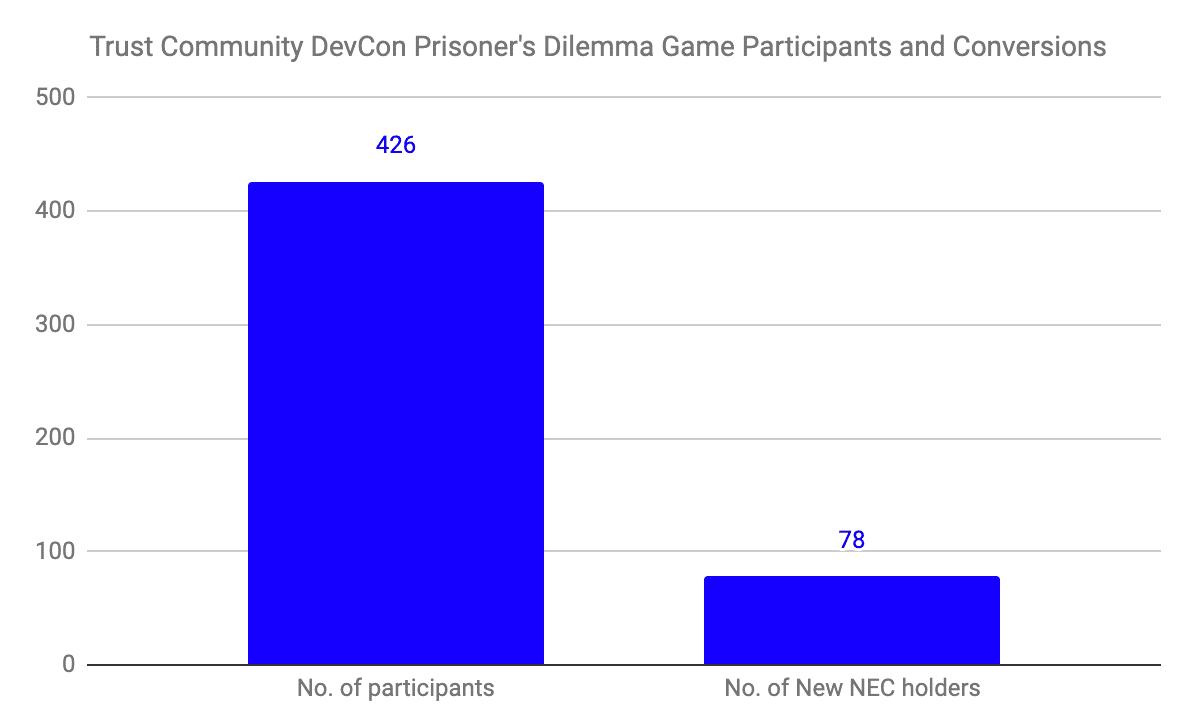

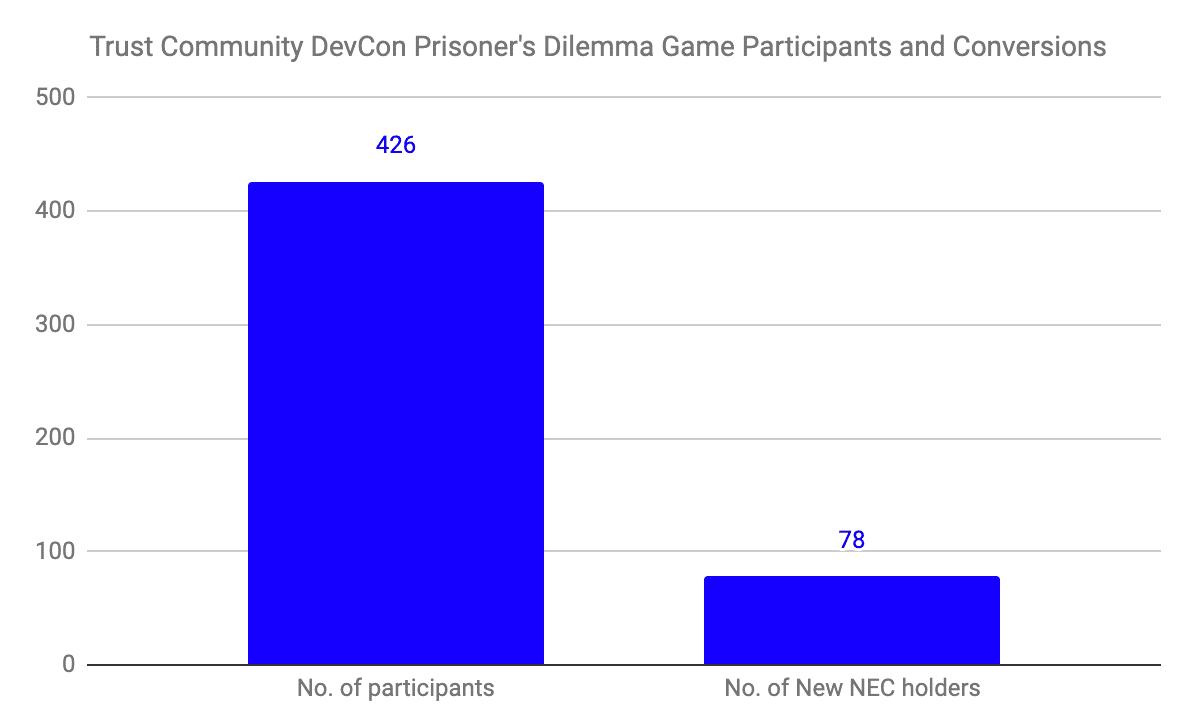

We are experimenting with different ways to attract new users to DeversiFi as we prepare for re-launch with the updated Starkware tech stack. One of the most innovative and memorable experiments was the Prisoner’s Dilemma game that we launched with Trust Community at DevCon in order to test their proof-of-concept ZK identity verification (something which we are hoping to incorporate into DeversiFi). There was 426 game participants at DevCon, with 78 of those so far going on to claiming their NEC token rewards. Some of those 78 new users are now an integral part of DeversiFi and are helping with user research and outreach. We hope to increase the number of conversions to closer to 200 as we approach February. There are still 297,005 NEC reward tokens left in the prize pool so if you were a DevCon game participant then make sure you open your Trust Community app and follow the instructions to claim your prize.

Short Term Plans

Backend Migration Complete

The short term tech focus over the past three months has been to upgrade the whole DeversiFi platform stack from what was, essentially, an innovative MVP (as Ethfinex Trustless) and turn it into a high performing and stable product. This upgrade is nearing completion and is live in our staging environment ready to be pushed into production shortly.

If you have been a long term user of DeversiFi you will notice instant improvements in performance when the update goes live (via both the API and UI), along with several bug fixes. From a trading experience perspective, limit orders that have been partially filled will now remain on the order book until they are filled, instead of being canceled automatically (a hangover from our legacy liquidity partner integration)

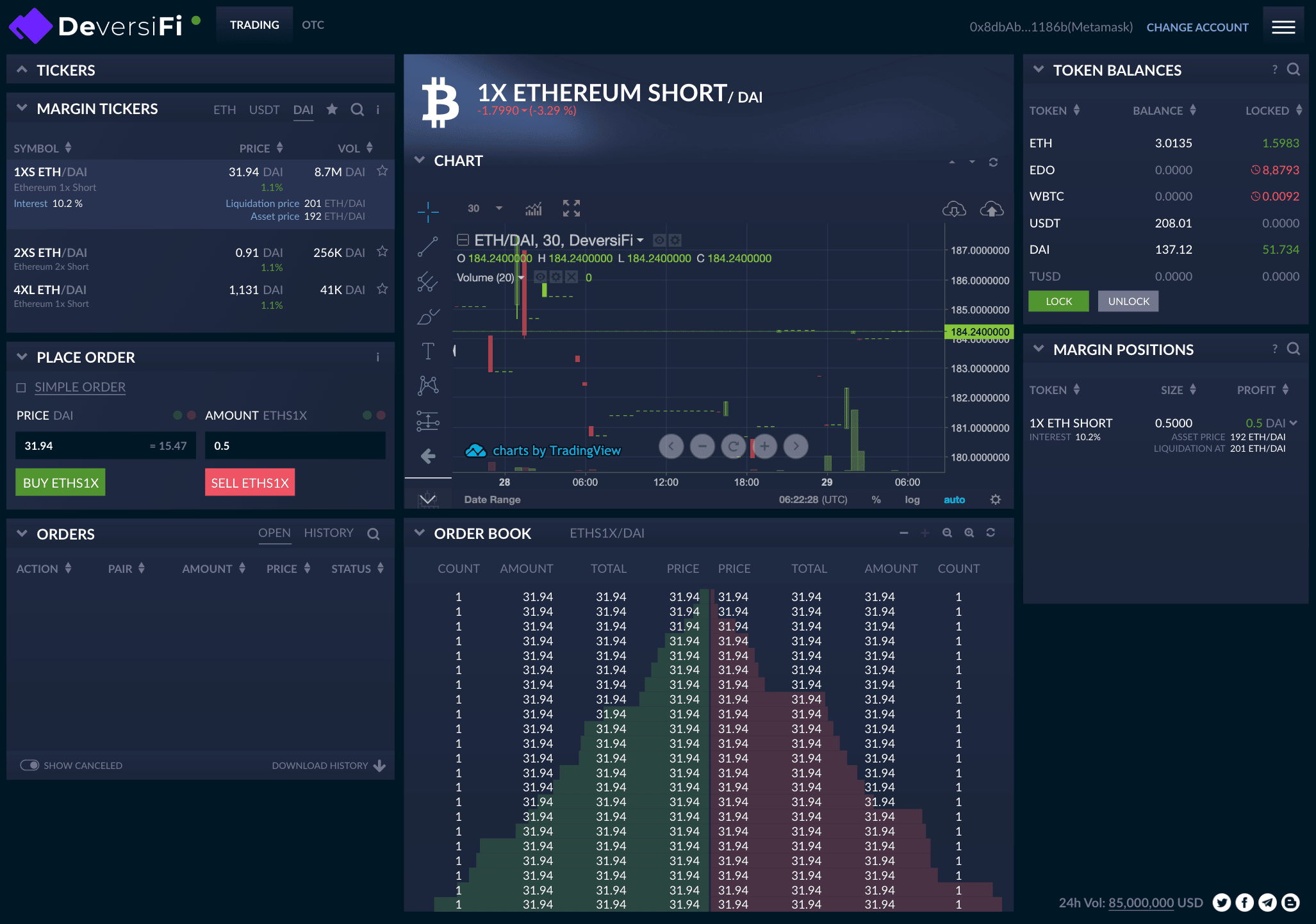

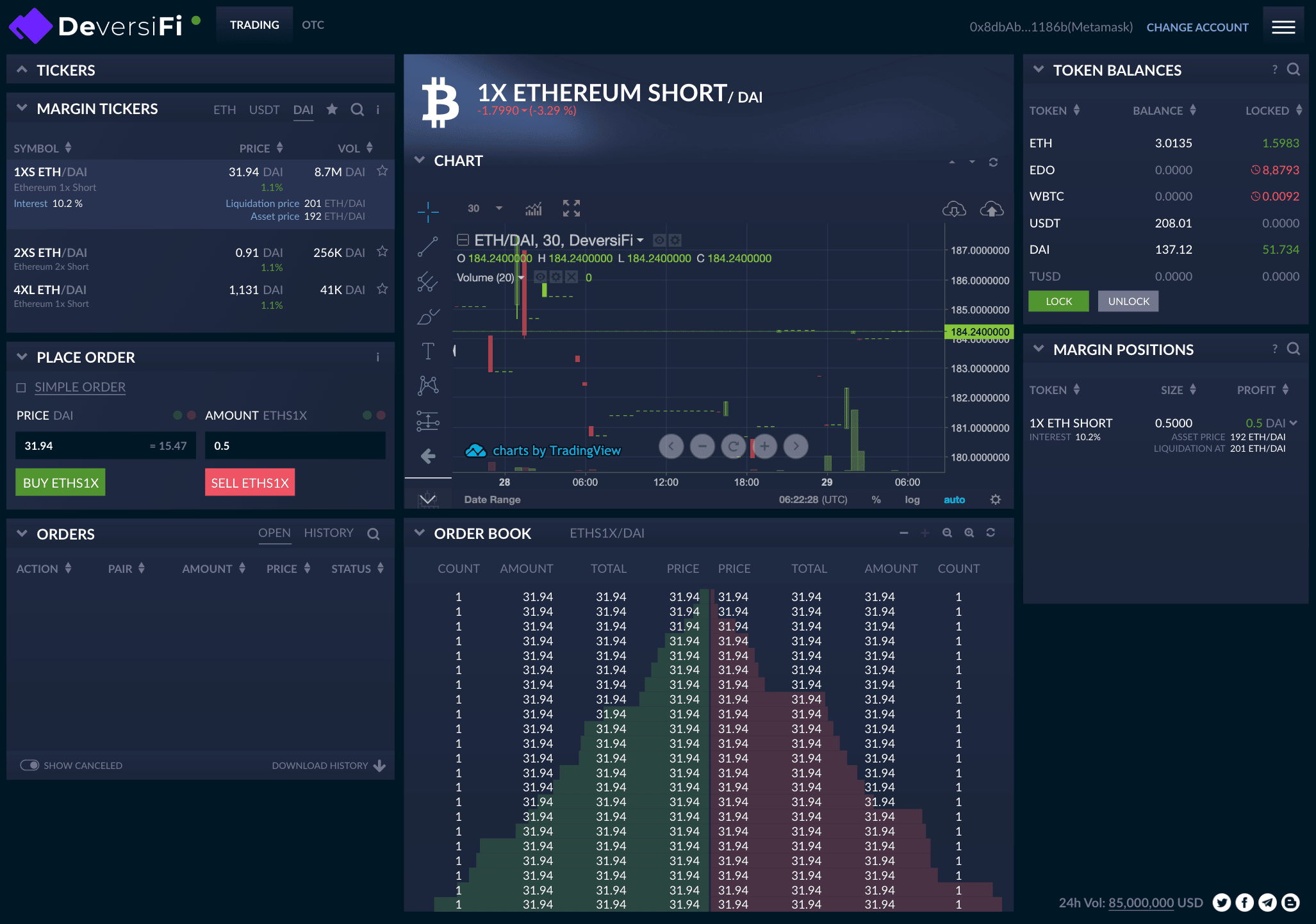

Margin Trading

We are integrating the BZX margin pTokens (exposure tokens) into DeversiFi so that traders will be able to instantly execute orders against a pre-populated order book inventory of tokens. Along with the token listings themselves, there will also be significant changes made to the UI to give more information about the underlying asset price, liquidation price and P&L (hopefully more of the P and less of the L!)

We are rolling the different margin trading and token inventory components out over the next few weeks to make sure that we can take on-board user feedback and action any urgent changes if needed. We have already run two rounds of user testing and actioned subsequent UI changes to improve the end-to-end trading experience. You can see a sneak peek of the UI components below, but they are likely to change significantly before the final releases.

The main pain-point for margin traders at the moment revolves around the ‘ETF’ style of the product instead of what they may be used to on centralized exchanges. Once a trader realises that in order to short an asset, they need to buy a pToken, the rest of the user journey falls into place very quickly. As a result, our focus is on improving the user-onboarding and educational content at the very start of the user journey.

necDAO

DeversiFi is launching the world’s largest DAO in two weeks time. For some background, it was Ethfinex who first developed Nectar $NEC – a utility token designed to serve the Nectar ecosystem. They built pioneering governance tools and pledged 50% of exchange fees to traders of the exchange. In August 2019, Ethfinex closed their doors for good, coinciding with the launch of a brand new entity – DeversiFi. It is the guiding raison d’etre of DeversiFi to build infrastructure facilitating the emergent transition to a new, open and decentralized world. In that light, DeversiFi assigned the remaining 17,000 ETH to Nectar holders. It is this legacy, and these funds that launch the largest DAO to date – necDAO.

The necDAO is being built in conjunction with DAOStack, based on feedback from a test DAO that has been running for the past four months, powered by some willing community members. We are pleased to report that a bug bounty that has been running for the past three weeks has only found two minor smart contract vulnerabilities. The DAO ‘bootstrapping phase’ will launch in two weeks time and will allow early adopters to claim their share of a Reputation airdrop. Reputation is the native non-transferable currency of the necDAO and is used to vote on proposals.

Watch this space as more on the necDAO is coming this week.

StarkWare Integration

We are incredibly excited that DeversiFi will be the first non-custodial exchange to launch using the StarkWare settlement layer. StarkWare is a ZK scaling solution that batches transactions on the Ethereum blockchain, increasing throughput and privacy without compromising on security (the security model is linked to the Ethereum blockchain instead of using a separate side chain).

We have made three new developer hires to accelerate the StarkWare integration and are targeting a February/March re-launch date. The StarkWare team flew to meet us two weeks ago and are continuing to be in daily contact with our technical team.

On the commercial side of things, we have designed a new low fee schedule that is only possible once the cost of settlement on-chain is reduced using a second-layer scaling solution, such as StarkWare. DEXs that offer zero fees are misleading as they are either a) not sustainable (being subsidised in the short term) b) don’t include gas costs, or c) have and implied cost due to a worse bid/offer spread and complex routing system. The StarkWare settlement layer has allowed us to design a fee schedule that will be both competitive and still provide a significant revenue share for buying-back $NEC tokens, as detailed in the NEC 2.0 Whitepaper from October.

Our planned upgrade has generated a lot of buzz since its announcement at Devcon in Osaka and a large number of traders are itching to give it a try for a number of reasons:

- DeversiFi as a non-custodial bridge for deep centralised exchange liquidity

- Instant deposit/withdrawals (locking/unlocking tokens)

- No minimum order sizes

- High throughput and low fees

- Private trading

- No counterparty risk

- No front running (a problem with on-chain DEXs)

- Native private wallet support. Ie you can connect with your metamask without having to download yet another wallet

- Deep liquidity

It goes without saying that we are all very excited to launch a professional self-custody exchange and will be running a series of mainnet tests for high-volume and lead users in February. If you would like to be part of this feedback group , please email [email protected] or message @rossmidd on Telegram

Matching Engine & API Critical Path

In parallel to the StarkWare integration, Jeff Lozier, our CTO has started work reengineering the critical path for order placement to make it ‘enterprise grade’. We were already using a best-in-class API framework, inherited from our incubation within Bitfinex, but due to the extra steps that are involved in signing orders compared to a centralised exchange, it is even more important that the matching engine and supporting framework is even faster.

Jeff’s background in high frequency equities trading and matching engine technology makes him perfectly positioned to lead this overhaul. Depending on progress, we will either launch the new hot-patch and matching engine at the same time as the StarkWare integration in February/March, or slightly afterwards.

DeversiFi Team Week

As a distributed growing company we make sure that we have regular physical meet-ups with the wider team to welcome new joiners, work on any particularly tricky technical problems, run workshops and make sure we are all aware of the rapidly evolving roadmap. Last week we welcomed 14 of the team to London for four intense and productive days, largely focusing around the StarkWare integration, hot-patch re-engineering and marketing plans for the February exchange re-launch.

We will be scaling the team quickly in the first half of next year so please keep an eye on the DeversiFi careers page. Currently we are hiring for a senior back-end developer and a senior-front end developer – if you are a passionate, free thinking and entrepreneurial developer who shares our vision for a decentralised and open finance system then please each out.

We are thrilled to bring back our monthly community updates. This serves as the second in a recurring series highlighting and deep diving all DeversiFi happenings over the past month, so that you are always in the know as we build out the decentralised future, together.

Get involved with, play your role and join us together as we fan the flames of the financial evolution.