Some names in crypto are complex and confusing. But not this one.

Stablecoins are stable. They’re pegged 1:1 to other currencies and commodities, notably the U.S. dollar, so traders can treat them as digital versions of the assets they’ve traded forever.

These assets provide a best-of-both-worlds solution: the democracy of crypto and the solidity of old-world currencies. And while they provide all the immediate benefits of other crypto assets (they can be swapped, traded and invested in yield opportunities) they also provide a long-term store of value, meaning users can HODL them in confidence that their value won’t deviate.

There’s actually a lot more to stablecoins beneath this top-line pitch, so let’s pull open that hood and get into it.

First of all: what problems are stablecoins supposed to solve?

All currencies, whether fiat or crypto, are controlled by the basic law of supply and demand.

Currencies are traded for one another on the open market. The more demand there is for a particular currency, the more its value goes up.

However, traditional fiat currencies do not exist in isolation: they are intrinsically linked to the countries that issue them.

When deciding whether to buy and sell currencies, traders will consider the issuing country’s economic performance, its resources and its political stability. This was seen in 2016, when traders rushed to sell their pounds because they thought Brexit would dent Britain’s future trading prospects.

What’s more, central banks can pull certain levers to manipulate the supply-demand balance of their currencies. The U.S. Federal Reserve, for example, can manipulate the value of the dollar by printing more money (which causes its value to drop) or raising interest rates (which causes its value to rise).

Crypto doesn’t have these backstops. Coins and tokens aren’t underpinned by countries or central banks: the only thing that matters is the reputation of the currency itself. This is supply and demand in its purest form.

However, this brings challenges. Traders’ perception of a particular currency can change in an instant, due to the emergence of alternative ‘flavour of the month’ currencies, panic whipped up by negative media coverage, or hype on social media.

What’s more, there’s far less crypto floating around than old-world fiat currency. Right now, there are around 19 million bitcoins in circulation, but around 1.2 trillion US dollars. So if people rush to sell bitcoin, it will have a far bigger effect than a sell-off of dollars.

This combination of a ‘pure’ supply-demand model and relatively low trading volumes has seen the value of crypto currencies oscillate wildly.

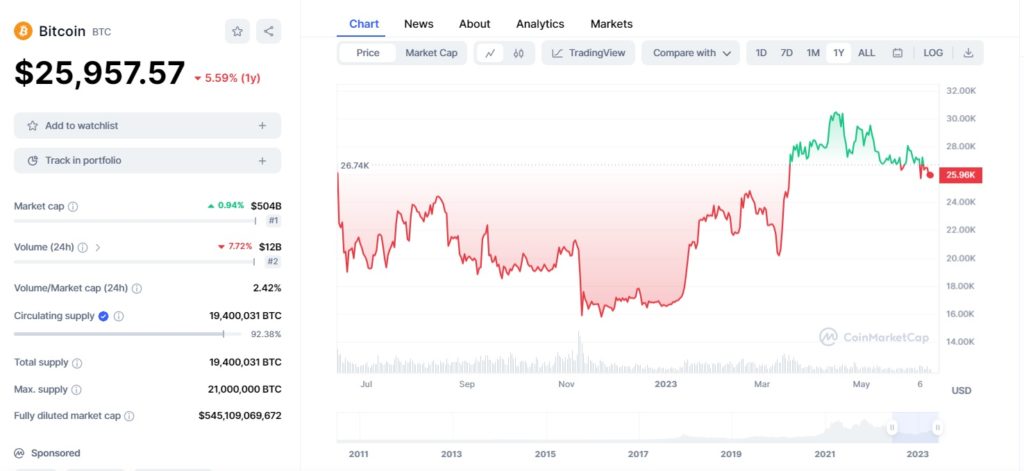

Again, we can look at bitcoin for an example. As you can see in this table from CoinMarketCap, the value of the currency has fluctuated between $15,700 and $30,500 in the 12 months to June 11, 2023.

In other words, its value has fluctuated by more than 100%.

This places limits on what crypto can be used for. Sure, we can trade coins and tokens on crypto exchanges, but many people are reluctant to use them as a store of value because they don’t know how much each asset is really worth.

And it’s practically impossible to use crypto as a means of exchange in the real world, because neither buyer or seller has faith in the currency.

So, crypto came up with stablecoins.

This same tactic has been witnessed in the real world. In the olden days, countries would tie their currency to gold, a policy known as the ‘gold standard’, and many emerging countries have since pegged their money to the U.S. Dollar.

The idea was to give traders reassurance that the currency has tangible value, without losing the fundamental values of crypto: freedom, openness and constant connectivity.

This model has a number of advantages:

- ‘Always-on’ tradeability. Because stablecoins live on the internet, they are always available, unlike their fiat anchors, which are limited by the opening hours of banks an currency trading platforms.

- High-speed trading. Another advantage of the internet, and specifically blockchains, is speed. Stablecoins can be bought and sold in seconds, and the advent of AMMs and liquidity pools means you don’t even need a partner on the other side of the trade. Imagine a ForEx trade reduced to the speed of sending an email, and you get the idea.

- Versatility. Many stablecoins are available on several different blockchains, so you can acquire them from loads of different decentralised applications (dApps).

- New financial possibilities. The DeFi multiverse allows you to put your currencies to work in loads of different ways – buying NFTs, investing in derivatives and, crucially, pursuing yield opportunities. And the emergence of multi-chain, multi-opportunity platforms like rhino.fi means you can pursue all these possibilities from one place.

- Low fees. When you buy fiat currencies, banks and trading platforms can gobble up huge amounts of money in fees. DeFi platforms, particularly those built on Layer 2 (away from the congestion of Ethereum and other layer 1 blockchains) keep these fees to a minimum.

- Universal access. Unlike banks, DeFi doesn’t need (or want) to know your location, demographic background or financial circumstances. So it’s open to everyone – even those who don’t have a bank account.

That’s great, but how do stablecoins actually work?

In other words, how is their value controlled?

This is an important question. To remain in sync with its underlying asset, the stablecoin requires a mechanism that will adjust its value quickly and efficiently.

Each asset has its own mechanism, and this varies according to the stabilisation mechanism and the assets that underpin it.

- Some stablecoins are based on centralised controls, while others are based on decentralised methods, primarily smart contracts.

- Some stablecoins are are backed by fiat, while others are backed by crypto (some stablecoins even have no backing at all, although many of these projects have disappeared).

In many cases, there’s a correlation between these two factors. Centralised stablecoins are often backed by fiat, while decentralised stablecoins may also be backed by crypto (either in addition to or instead of fiat).

USDT (Tether) and USDC (Circle) are examples of the first group. Both are centralised stablecoins and are backed by fiat. In both cases, the issuer will mint or burn tokens to keep the price in check. If the value of one of these stablecoins goes above $1, then the issuer can use real-world dollars to mint the stablecoin, causing the supply to increase (and thus create inflation). If the value goes below $1, the issuer use their dollars to buy the stablecoin, then burn it to receive fiat greenbacks.

DAI, on the other hand, is a decentralised stablecoin. It uses smart contracts to handle the mint-and-burn process, and while it is pegged to the U.S. dollar, it is backed by Ethereum and various other tokens.

There are advantages and disadvantages to both methods.

– Decentralised stablecoins avoid the need for traditional intermediaries and are closer to the fundamental principles of DeFi, which replaces human bias and exclusivity with universal, incorruptible code.

Centralised stablecoins always have a store of old-world currency to fall back on, and are less vulnerable to hacks, exploits and cynical trading activity than their centralised counterparts. This was illustrated during the demise of UST, a dollar-backed stablecoin. In May 2022 UST’s value was drastically distorted by a series of large trades, causing it to lose its dollar peg.

Do stablecoins usually work, though?

Yes. UST aside, most stablecoins have proved steady and resilient.

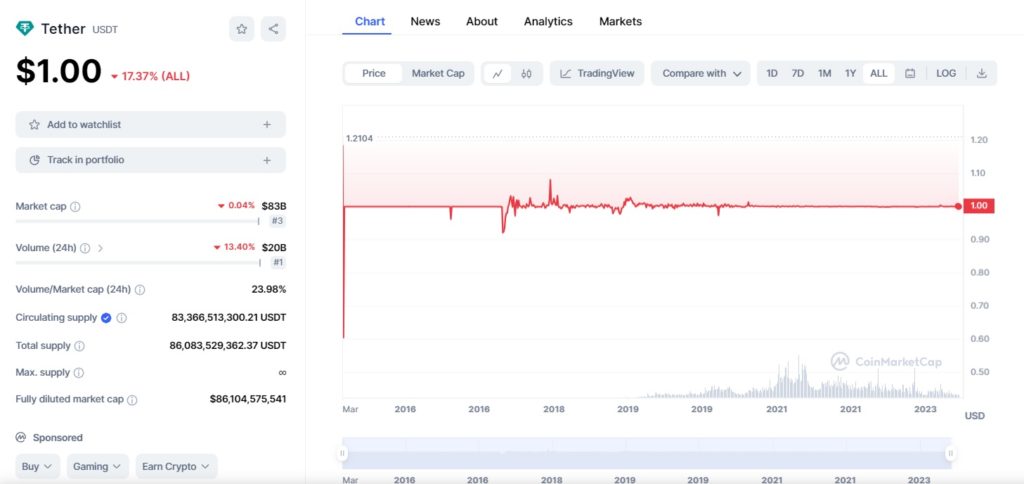

If you look at a chart showing the value of USDT since it was created in 2016, its value has remained within a range of $0.9 and $1.1, and usually within a much tighter band (again, thanks to CoinMarketCap for this one).

So well as providing a tradeable asset, currencies like USDT can serve as both a store of value and a means of exchange in the real world. In other words, they can fulfil all the functions crypto was meant to deliver.

So, are stablecoins a good investment?

We can’t really answer this one, as 1) we can’t give trading advice and 2) it really depends on what you’re investing for.

As we’ve mentioned above, stablecoins can do all the things other coins can do. In other words, you can use them to trade, swap, pursue yield opportunities and everything else DeFi has to offer.

Some people will prefer the gains made possible by higher-volatility assets, while others will want the security and reliability of an asset that’s pegged to something they already know and use.

We can’t advise you either way, but if you want more detailed info on stablecoins, please hit us up on Twitter or Discord and we’ll give you our best take.

And if you’ve enjoyed this explainer, why not check out some of the other content in our Learn section? We think you might like:

A beginner’s guide to trades and swaps.

How cross-chain yield farming works.

How to convert fiat into crypto.

Click below to get lending, and get earning.